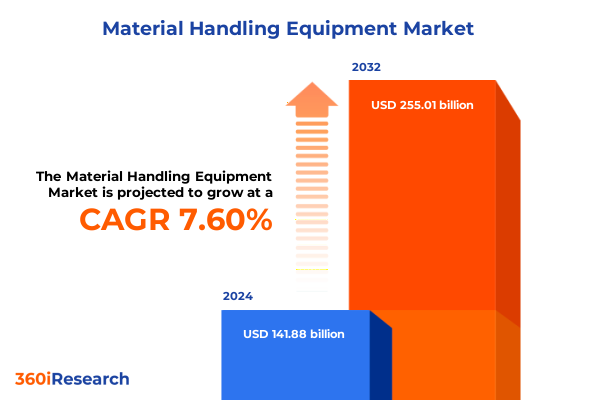

The Material Handling Equipment Market size was estimated at USD 151.96 billion in 2025 and expected to reach USD 163.04 billion in 2026, at a CAGR of 7.67% to reach USD 255.01 billion by 2032.

An Unprecedented Era of Material Handling Innovation and Digital Transformation Is Reshaping Logistics and Industrial Operations Worldwide

The material handling sector is undergoing a profound metamorphosis as industrial, warehouse, and logistics operators seek greater agility and resilience. Fueled by supply chain disruptions over recent years, businesses have accelerated the adoption of digital solutions designed to optimize throughput and minimize downtime. Enhanced data collection capabilities embedded into automated equipment are enabling real-time visibility across complex operations, empowering decision-makers to recalibrate workflows and preempt bottlenecks with unprecedented precision.

Meanwhile, labor market constraints have compounded pressure on enterprises to rethink traditional manual processes. With millions of unfilled positions across manufacturing and distribution centers, organizations are turning to robotics and automation to address persistent worker shortages. The integration of autonomous mobile robots (AMRs) and advanced guiding systems not only mitigates workforce gaps but also promotes safer and more ergonomic environments for remaining personnel.

Moreover, sustainability objectives have emerged as an equally powerful catalyst for innovation in material handling. As environmental regulations tighten and corporate responsibility initiatives gain momentum, energy-efficient conveyors and green forklift technologies are being prioritized. Industry surveys show a significant uptick in executive commitment to broad sustainability roadmaps, with over two-thirds of manufacturers pledging extensive eco-friendly measures in 2025. By harmonizing productivity gains with environmental stewardship, the sector is charting a new paradigm of operational excellence and long-term competitiveness.

The Convergence of Robotics, AI, and Sustainable Technologies Is Driving Transformative Shifts in Material Handling Across Sectors

A convergence of robotics, artificial intelligence, and modular design philosophies is driving transformative shifts across material handling landscapes. Autonomous mobile robots are rapidly displacing fixed guided vehicles by leveraging AI-powered mapping and sensor fusion to dynamically navigate facility layouts. Their ability to adapt to changing environments not only accelerates order processing rates but also unlocks previously untapped efficiencies in multi-zone distribution hubs.

In tandem, electrification and alternative energy sources are redefining forklift operations. Advanced lithium-ion battery systems are extending cycle times while slashing thermal management needs, and hydrogen-powered models have demonstrated fast-refueling capabilities with zero tailpipe emissions. Such innovations are imperative for companies seeking to align their operations with stringent emissions targets and minimize total cost of ownership in high-intensity use cases.

Conveyor architectures themselves are undergoing a metamorphosis as well. Traditional static layouts are giving way to plug-and-play modules that can be quickly reconfigured to accommodate seasonal peaks or shifts in product mix. Enhanced by integrated IoT sensors and smart controls, these flexible conveyor ecosystems enable seamless load balancing, predictive maintenance alerts, and real-time throughput optimization-all without significant capital expenditure on permanent infrastructure.

Elevated Tariff Regimes and Trade Policy Overhauls Are Exerting a Cumulative Impact on United States Material Handling Costs and Supply Chains

The cumulative impact of recent United States tariff measures has markedly increased input costs for material handling equipment manufacturers and end-users. In June 2025, Section 232 steel and aluminum tariffs were elevated from 25 percent to 50 percent, a significant escalation aimed at strengthening domestic metal production but one that also intensified supply chain pressures for downstream industries. Analysts estimate that these heightened duties will impose over $50 billion in additional annual expenses across U.S. manufacturers of equipment and components dependent on imported metals.

Vehicle supplier industries, which rely heavily on robust steel frameworks for cranes, hoists, and chassis for handling vehicles, reported substantial ramifications from these policies. A prominent survey among light and commercial vehicle suppliers indicated that nearly eight out of ten firms experienced material cost surges and disrupted supply agreements in the wake of renewed tariff enforcement. This strain has forced many operators to either absorb elevated procurement expenses or pass them on through higher service rates, thereby reshaping pricing dynamics across warehousing and distribution services.

As a result of these trade policy shifts, manufacturers are reevaluating supplier portfolios, seeking alternative sources in allied nations, and accelerating near-shoring initiatives. While such strategic realignments have begun to mitigate some of the tariff-driven cost pressures, the ongoing volatility in trade relations underscores the need for agile sourcing strategies and robust risk management frameworks to safeguard continuity of material handling operations.

Unveiling Key Market Segmentation Insights to Guide Strategic Deployment of Material Handling Equipment Across Diverse Operational Needs

Market segmentation by equipment type underscores divergent growth trajectories across core solutions. Automated storage and retrieval systems, split between mini-load and unit-load configurations, are increasingly favored in high-density storage applications where rapid vertical retrieval is paramount. Conveyors, ranging from belt to roller variants and inclusive of overhead and pallet-specific models, continue to be the backbone of linear throughput, with innovations focusing on energy recapture and modular reconfiguration. Cranes and hoists-encompassing bridge, gantry, and jib crane formats-remain indispensable for heavy lifting tasks, particularly in manufacturing and port logistics. Industrial trucks, including counterbalance and reach-truck forklifts alongside order pickers and pallet jacks, round out the portfolio by addressing versatile point-to-point transport needs across diverse floor footprints.

Beyond equipment taxonomy, functional segmentation reveals that positioning solutions are vital for precise alignment of loads, storage systems are critical for capacity optimization, transportation modules facilitate horizontal and vertical movement, and unit load formation mechanisms ensure that items are correctly packaged and stabilized for onward handling. When viewed through a technology lens, fully automated systems lead for high-throughput, manual systems retain niche utility in low-volume or irregular task scenarios, and semi-automated offerings strike a balance particularly appealing to mid-sized facilities. Similarly, bulk load handling configurations serve industries with large, homogeneous product streams, while unit-load systems cater to discrete, SKU-driven operations. End-user verticals from construction, segmented into commercial and residential projects, to manufacturing sectors like automotive and electronics, as well as warehouse and distribution networks including 3PL providers and e-commerce operators, each leverage tailored equipment combinations. The application spectrum spans assembly integrations where synchronized line-side delivery is crucial, general handling of finished goods or raw materials, and sorting processes that demand speed and accuracy for order fulfillment.

This comprehensive research report categorizes the Material Handling Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- System Type

- Product Flow

- Mobility

- Facility Type

- Application

- End-User Industry

- Enterprise Size

Regional Dynamics Highlight Varied Growth Trajectories and Technology Adoption Patterns Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics are shaping distinct pathways for material handling adoption and innovation. In the Americas, a mature industrial ecosystem and extensive e-commerce infrastructure have driven rapid uptake of advanced automation, particularly in fulfillment centers servicing retail and grocery verticals. North American operators are at the forefront of integrating AI-driven robotics to tackle labor challenges and meet increasingly granular delivery windows, thereby maintaining a robust growth trajectory supported by domestic manufacturing incentives and recalibrated supply chains.

Across Europe, Middle East & Africa, established regulatory frameworks and a strong emphasis on environmental compliance have catalyzed investment in energy-efficient conveyors, hydrogen-fuel cell forklifts, and modular AS/RS solutions. European warehouses are pioneering digital twin implementations to simulate material flow and optimize spatial layouts, while Middle Eastern logistics hubs are capitalizing on strategic trade corridors to scale cross-border operations. African markets, though nascent, are benefiting from targeted infrastructure development programs that underscore the importance of scalable material handling platforms to support burgeoning industrial activity.

In Asia-Pacific, rapid e-commerce expansion and government-led industrialization initiatives in China, India, and Southeast Asian economies have created a fertile environment for both global OEMs and local integrators. The region’s high population density and consumer demand have translated into significant investments in micro-fulfillment centers and AMR-centric warehouses. Moreover, proactive partnerships between technology providers and national stakeholders are advancing industry-specific solutions, from semiconductor fabrication logistics in East Asia to bulk commodity handling in Australia’s mining sector.

This comprehensive research report examines key regions that drive the evolution of the Material Handling Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Leveraging Automation, Connectivity, and Sustainability to Gain Competitive Edge in Material Handling Equipment

A cadre of leading equipment manufacturers and solution integrators is consolidating their competitive positions through concerted R&D and strategic alliances. Daifuku, a global stalwart in automated systems and sortation technologies, has expanded its mini-load AS/RS portfolio with enhanced software controls that deliver sub-second retrieval cycles, catering to high-velocity distribution environments. Dematic, backed by its KION Group affiliation, continues to roll out AI-enabled robotics and machine-learning algorithms within its modular conveyor and palletizing lines, enabling predictive throughput adjustments in real time.

SSI SCHAEFER and Swisslog, subsidiaries of established industrial conglomerates, are advancing integrated solutions that unite warehouse management systems with autonomous guided vehicles, yielding unified control platforms for end-to-end visibility. Honeywell Intelligrated has focused on expanding its global footprint by forging partnerships in Asia-Pacific, thereby delivering localized support for its conveyor, sortation, and robotic deployments. Across the board, these key players are investing in energy-efficient power sources, cloud-native analytics, and digital twin frameworks to future-proof their offerings against evolving customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Material Handling Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Heli Co., Ltd.

- Beumer Group GmbH & Co. KG

- Caterpillar Inc.

- Clark Material Handling Company

- Columbus McKinnon Corporation

- Control Concepts Inc.

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Dearborn Mid-West Company

- Doosan Corporation

- EISSENMAN GmbH

- Fives Group

- Flexlink AB by Coesia S.p.A.

- Godrej & Boyce Manufacturing Company Limited

- Hangcha Group Co., Ltd.

- HD Hyundai Co., Ltd.

- Honeywell International Inc.

- Hyster-Yale Materials Handling, Inc.

- Hytrol Conveyor Company, Inc.

- Ingersoll Rand Inc.

- John Bean Technologies Corporation

- Jungheinrich AG

- Kalmar Corporation

- Kardex Holding AG

- KION Group AG

- KNAPP AG

- Komatsu Ltd.

- Liebherr-International Deutschland GmbH

- Lonking Holdings Limited

- Mitsubishi Logisnext Co., Ltd.

- SANY Group

- Siemens AG

- SSI SCHÄFER GmbH & Co KG

- Toyota Industries Corporation

- Volvo Group

- Xuzhou Construction Machinery Group Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Automation Trends and Navigate Supply Chain Challenges in Material Handling

To capitalize on the momentum behind automation, industry leaders should prioritize integration of scalable robotics platforms that can adapt to variable throughput demands. By piloting AMR deployments in controlled zones and iteratively expanding coverage, organizations can align technology adoption with measurable ROI metrics and mitigate risk exposure. Simultaneously, leveraging advanced analytics to assess equipment utilization and identify bottlenecks will enable continuous process optimization rather than one-off upgrades.

Furthermore, companies must adopt resilient sourcing strategies in light of fluctuating trade policies. Diversifying supplier networks to include both domestic fabricators and certified global partners will reduce vulnerability to tariff spikes. Coupled with near-shoring initiatives and collaborative inventory consignment models, these approaches will bolster supply chain transparency and responsiveness.

Finally, embedding sustainability into procurement and operations is no longer optional. Organizations should evaluate total life-cycle impacts of equipment acquisitions and seek partners offering end-of-life recycling and energy-management services. By demonstrating commitment to environmental governance alongside operational efficiency, industry leaders can strengthen stakeholder trust and unlock preferential terms with green financing bodies.

Robust Research Methodology Incorporates Multi-Tier Data Sources and Rigorous Validation to Ensure Accurate Market Insights

Our research framework commenced with an extensive secondary review of industry literature, trade journals, and policy documents to capture baseline trends and contextual factors. This phase included analysis of recent tariff proclamations, sustainability directives, and technology roadmaps published by leading regulatory agencies.

The secondary insights were then validated through primary interviews with senior executives, operations managers, and technical specialists across material handling OEMs and end-user organizations. These consultations provided qualitative depth, helping to quantify the influence of labor dynamics, regional regulations, and emerging technologies on equipment adoption.

Subsequently, a triangulation process was employed whereby quantitative indicators from customs data, financial disclosures of leading players, and publicly available procurement statistics were cross-referenced against primary feedback. This rigorous cross-validation ensured that our narrative and segmentation insights are grounded in verifiable evidence.

Finally, forward-looking observational analysis was used to identify forthcoming inflection points, such as anticipated tariff adjustments and the maturing of hydrogen forklift ecosystems. All findings underwent thorough internal peer review to deliver a research output characterized by both analytical rigor and operational relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Material Handling Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Material Handling Equipment Market, by Equipment Type

- Material Handling Equipment Market, by Technology

- Material Handling Equipment Market, by System Type

- Material Handling Equipment Market, by Product Flow

- Material Handling Equipment Market, by Mobility

- Material Handling Equipment Market, by Facility Type

- Material Handling Equipment Market, by Application

- Material Handling Equipment Market, by End-User Industry

- Material Handling Equipment Market, by Enterprise Size

- Material Handling Equipment Market, by Region

- Material Handling Equipment Market, by Group

- Material Handling Equipment Market, by Country

- United States Material Handling Equipment Market

- China Material Handling Equipment Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Synthesizing Market Evolution and Strategic Insights to Provide a Comprehensive Conclusion on the Future of Material Handling Equipment

Throughout this executive summary, we have highlighted how automation, sustainability, and resilient supply chains are converging to redefine material handling strategies. From the nuanced segmentation of equipment types and functional capabilities to the distinct growth patterns observable across regional markets, the landscape is marked by both opportunity and complexity.

Key players are responding to labor shortages and environmental mandates by innovating in robotics, connectivity, and energy-smart designs, while elevated tariffs underscore the imperative of agile procurement and supplier diversification. The interplay of these forces demands strategic alignment of technology roadmaps with organizational objectives, ensuring that each investment in material handling infrastructure delivers measurable outcomes.

As businesses confront evolving customer expectations, tighter regulations, and dynamic trade environments, the ability to harness data-driven insights and deploy flexible, modular solutions will be the hallmark of industry leaders. This comprehensive analysis provides the contextual awareness and actionable guidance necessary to navigate the future with confidence and precision.

Secure Your Competitive Advantage Today by Engaging with Ketan Rohom to Acquire the Definitive Material Handling Equipment Market Research Report

To seize the insights uncovered in this comprehensive research and refine your strategic roadmap, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan possesses in-depth knowledge of material handling market intricacies and can tailor the report package to your specific operational priorities, ensuring that your organization benefits from actionable data and expert guidance. Engage today to secure your competitive advantage, streamline procurement decisions, and chart a course toward sustained growth in a rapidly evolving landscape.

- How big is the Material Handling Equipment Market?

- What is the Material Handling Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?