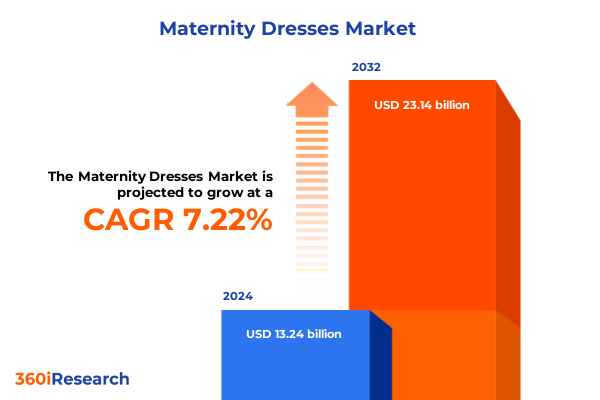

The Maternity Dresses Market size was estimated at USD 14.02 billion in 2025 and expected to reach USD 14.85 billion in 2026, at a CAGR of 7.41% to reach USD 23.14 billion by 2032.

Unveiling the Dynamics of the Maternity Dresses Market Through Emerging Consumer Preferences, Technological Innovations, and Industry Transformation

In today’s rapidly evolving retail landscape, the maternity dresses segment has emerged as a focal point for brands and retailers striving to address the nuanced needs of expectant consumers. This introduction outlines the convergence of demographic shifts, consumer empowerment, and technological advancements that collectively define the modern maternity apparel ecosystem. As birth rates fluctuate and purchasing patterns evolve, understanding the factors shaping maternity dress preferences becomes critical for stakeholders intent on fostering brand loyalty and driving revenue growth.

Moreover, heightened awareness surrounding maternal well-being and the desire for comfortable yet fashionable attire have expanded the market’s scope beyond traditional designs. Health considerations now intersect with style aspirations, prompting designers to integrate adjustable silhouettes, breathable fabrics, and adaptive features. Concurrently, the digitization of shopping experiences has accelerated omnichannel engagement, enabling expectant mothers to research, compare, and purchase maternity dresses across a variety of touchpoints. This introductory section establishes the foundational themes of innovation, consumer-centric design, and strategic agility that permeate the subsequent analysis.

By setting the stage with these critical dynamics, readers will gain clarity on the essential drivers influencing market actors-from emerging startups to established apparel manufacturers-while appreciating the transformative potential of marrying comfort, style, and functionality in maternity dress offerings.

Examining the Landmark Shifts Reshaping the Maternity Dresses Landscape from Digital Transformation to Sustainability Imperatives

The landscape of maternity dresses has undergone transformative shifts as brands integrate digital technologies, sustainable practices, and data-driven design processes. Influencers and social media platforms now shape style narratives, enabling expectant mothers to discover new trends and designers that resonate with personal values and lifestyles. Virtual fitting rooms and augmented reality applications have further bridged the gap between online and offline shopping, ensuring greater confidence in purchase decisions while reducing return rates.

Sustainability initiatives have concurrently gained traction, with manufacturers exploring eco-friendly fibers, low-impact dyeing techniques, and transparent supply chains to meet the demand for responsible fashion. These green credentials not only differentiate brands in a crowded market but also foster deeper emotional connections with environmentally conscious consumers.

Furthermore, strategic collaborations between maternity wear labels and mainstream fashion houses have blurred traditional category boundaries, introducing capsule collections that elevate maternity dresses from functional garments to style statements. Data analytics tools now enable brands to refine size grading, forecast popular silhouettes, and personalize marketing campaigns, driving more precise inventory management and higher conversion rates.

These transformative trends underscore the necessity for industry participants to reimagine product development cycles and consumer engagement strategies. By adapting to evolving expectations around digital convenience, sustainability, and personalized experiences, brands can secure a competitive edge in the dynamic maternity dresses market.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on Supply Chains Pricing and Competitive Positioning in Maternity Apparel

In 2025, the cumulative impact of newly enacted United States tariffs has reverberated throughout the maternity dresses supply chain, compelling manufacturers and retailers to reassess sourcing strategies and pricing structures. Duties on imported fabrics and finished apparel have elevated landed costs, prompting some brands to seek alternative suppliers in tariff-exempt countries or to invest in domestic production capabilities to mitigate financial pressure and secure supply continuity.

As cost bases adjust, design teams are optimizing material utilization by refining pattern efficiencies and reducing waste, while procurement specialists negotiate long-term contracts to stabilize prices. Retailers have responded by revising promotional calendars and reconfiguring assortment mixes to protect margins and maintain competitive retail price points. Simultaneously, some high-end labels have leveraged the tariff environment as an opportunity to emphasize “Made in USA” credentials, appealing to consumers with an affinity for locally produced garments.

The new tariff regime has also spurred innovation in alternative fabric formulations, with research and development teams exploring recycled blends and plant-based fibers that circumvent punitive import duties. This strategic pivot not only addresses cost considerations but also aligns with consumer demand for sustainable clothing options. Collectively, the 2025 tariff measures have catalyzed a reconfiguration of supply networks and cost-management practices, underscoring the importance of agile sourcing and continuous operational improvement in navigating regulatory headwinds.

Revealing Key Segmentation Insights That Illuminate Consumer Behaviors Preferences and Strategic Opportunities in the Maternity Dresses Market

Analysis of market segmentation reveals nuanced consumer behaviors across product categories, fabric preferences, maternity stages, age demographics, and sales channels. Casual dresses remain the most versatile segment, prized for daily wear and adaptability, while formal dresses cater to special occasions such as baby showers and maternity photoshoots. Nursing dresses, designed with functional elements for postpartum convenience, exhibit strong loyalty among repeat buyers, and party dresses appeal to expectant mothers seeking trend-driven silhouettes. Workwear dresses combine professional aesthetics with ergonomic features, reflecting growing demand from career-oriented consumers.

Fabric type further differentiates consumer choices. Cotton and blended fabrics balance comfort and durability, linen attracts buyers seeking natural textures and breathability, and polyester maintains cost-effectiveness and easy-care attributes. Across maternity stages, demand intensifies during the second trimester as body shape stabilizes, while first-trimester purchases often focus on transitional sizing and third-trimester acquisitions prioritize extra flexibility and support.

Demographic analysis shows adult consumers dominate spending, yet growing influence from young adults and occasional teen shoppers underscores the importance of tailored messaging and social media engagement strategies. Offline channels, including brand stores, specialty boutiques, and supermarket hypermarkets, continue to serve shoppers who value tactile experiences and immediate gratification. Conversely, brand websites and e-commerce marketplaces have expanded reach through curated digital storefronts and personalized recommendations. These segmentation insights highlight opportunities for brands to craft targeted assortments, optimize channel investments, and design marketing approaches that resonate with distinct consumer cohorts.

This comprehensive research report categorizes the Maternity Dresses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Fabric Type

- Maternity Stage

- Customer Age

- Sales Channel

Unpacking Essential Regional Insights That Highlight Growth Drivers Challenges and Opportunities Across Global Markets for Maternity Dresses

Regional analysis uncovers distinct growth drivers and market characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust retail infrastructure and high consumer spending power support premium and mid-tier maternity dress offerings, while cultural emphasis on comfort and wellness drives demand for functionally superior designs. Digital penetration continues to enhance e-commerce adoption, especially in urban centers.

In Europe Middle East & Africa, fragmented markets present both challenges and opportunities. Western European nations exhibit stringent sustainability regulations and a preference for ethically sourced materials, incentivizing brands to prioritize transparent supply chains. In contrast, markets in the Middle East show a growing appetite for modest maternity activewear and occasion wear, and North African countries benefit from proximity to textile manufacturing hubs, enabling hybrid models of nearshoring and export-oriented production.

The Asia-Pacific region stands out for rapid urbanization and rising disposable incomes, which have fueled a shift towards branded and premium maternity dress lines. Local manufacturers in China and India are increasingly competing on quality and design innovation, while Southeast Asian economies demonstrate potential for growth driven by young populations and expanding e-commerce ecosystems. Cross-border trade agreements and regional trade blocs continue to shape cost structures and market accessibility, underscoring the importance of localized strategies tailored to each subregion’s regulatory environment, consumer preferences, and competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Maternity Dresses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Strategies and Innovations Driving Competitive Differentiation in the Maternity Dresses Sector

Leading companies in the maternity dresses sector are distinguished by their ability to marry design innovation with operational excellence. Market frontrunners have invested in advanced design studios, leveraging three-dimensional prototyping and body-scanning technologies to refine fit and streamline development timelines. Strategic partnerships with textile innovators have enabled exclusive access to performance fabrics that combine stretch recovery with moisture-wicking properties, elevating comfort for expectant mothers.

In retail execution, top players employ omnichannel integration to deliver seamless experiences, from in-store styling consultations to mobile-driven flash sales. Loyalty programs with personalized rewards and subscription options for wardrobe updates reinforce customer retention and generate recurring revenue streams. On the marketing front, influential collaborations with maternal wellness experts and lifestyle influencers amplify brand credibility and drive engagement across digital channels.

Operationally, supply chain resilience has become a competitive differentiator, with successful organizations diversifying supplier bases and maintaining buffer stock of critical fabrics to mitigate the impact of logistical disruptions. Corporate responsibility initiatives, including charitable partnerships supporting maternal health and environmentally conscious packaging, further differentiate leading brands by resonating with socially conscious consumers. This multifaceted strategic approach underscores how effective alignment of innovation, customer engagement, and responsible practices can elevate brand leadership in the maternity dresses marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Maternity Dresses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actoserba Active Wholesale Pvt. Ltd.

- ASOS plc

- Blush 9 Maternity Wear

- Destination Maternity Corporation

- Gap Inc.

- Hatch Collection, LLC

- Isabella Oliver Ltd.

- Kaftan Studio Pvt. Ltd.

- Mama Couture Pvt. Ltd.

- Mamma Presto

- Me N Moms Pvt. Ltd.

- Mine4Nine Maternity Wear Pvt. Ltd.

- MomToBe Maternity Wear Pvt. Ltd.

- Morph Design Studio Pvt. Ltd.

- Nejo

- Nite Flite Fashion Pvt. Ltd.

- Purple Panda Fashions Pvt. Ltd.

- Redcliffe Hygiene Pvt. Ltd.

- Sweet Dreams Apparel Pvt. Ltd.

- Ziva Maternity Wear Pvt. Ltd.

Crafting Actionable Recommendations for Industry Leaders to Harness Market Trends Elevate Customer Engagement and Optimize Growth in Maternity Apparel

Industry leaders should prioritize the integration of customer feedback loops into every stage of product development to ensure that maternity dress offerings align with evolving needs. By establishing digital communities and conducting targeted ethnographic research, brands can uncover nuanced insights on fit preferences, aesthetic aspirations, and functional requirements, enabling rapid iteration and differentiated design.

Investment in technology-driven personalization tools, such as AI-powered style recommendation engines and virtual fit advisors, can enhance the shopping experience and reduce friction in the decision-making process. Concurrently, expanding strategic alliances with sustainable textile manufacturers and exploring circular business models will not only address cost pressure from tariffs but also resonate with eco-conscious shoppers.

A balanced omnichannel strategy is essential; brands must optimize their brick-and-mortar presence by curating experiential retail formats while amplifying digital channels through immersive content, live-streamed styling sessions, and seamless checkout capabilities. Targeted marketing campaigns that celebrate diversity in maternity journeys-showcasing different ages, stages, and cultural backgrounds-will foster authentic connections and broaden market appeal.

Finally, operational agility should be reinforced through scenario planning and dynamic inventory management systems that adapt to tariff fluctuations, seasonal demand shifts, and emerging trend signals. Collectively, these actionable recommendations equip industry participants to capitalize on market opportunities and secure sustainable growth within the dynamic maternity dresses domain.

Outlining Rigorous Research Methodology Employed to Ensure Data Reliability Validity and Comprehensive Market Analysis for Maternity Dresses

This market research report employs a multi-faceted methodology to ensure data integrity, validity, and comprehensiveness. Primary research involved direct interactions with industry executives, designers, supply chain managers, and retail operations specialists through in-depth interviews and structured questionnaires. These qualitative inputs provided rich context regarding trend drivers, tariff impacts, segmentation dynamics, and regional differentiators.

Secondary research complemented these insights by systematically reviewing reputable industry publications, trade association reports, and regulatory announcements. Data from these sources informed the analysis of fabric innovations, sustainability benchmarks, and competitive strategies. Rigorous cross-validation techniques, including triangulation against publicly available financial filings and case studies, reinforced the accuracy of key findings.

Quantitative analyses were conducted using advanced statistical models to detect patterns in consumer behavior, correlate tariff changes with cost structures, and identify emerging segment growth trajectories. Geographic information systems (GIS) mapping illustrated regional concentrations of manufacturing and consumption, while network analysis tools elucidated supply chain interdependencies.

Compliance with ethical research standards was maintained throughout the process, ensuring confidentiality and unbiased representation of stakeholder perspectives. By integrating qualitative depth with quantitative rigor, the methodology provides stakeholders with a robust foundation for strategic decision-making in the maternity dresses market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Maternity Dresses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Maternity Dresses Market, by Product Category

- Maternity Dresses Market, by Fabric Type

- Maternity Dresses Market, by Maternity Stage

- Maternity Dresses Market, by Customer Age

- Maternity Dresses Market, by Sales Channel

- Maternity Dresses Market, by Region

- Maternity Dresses Market, by Group

- Maternity Dresses Market, by Country

- United States Maternity Dresses Market

- China Maternity Dresses Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Informed Conclusions on Market Trajectories Emerging Trends and Strategic Imperatives Within the Maternity Dresses Ecosystem

The maternity dresses market is characterized by a confluence of consumer-centric innovation, regulatory influences, and competitive ingenuity. Key trends-from the ascent of sustainable materials and digital shopping experiences to the strategic recalibration triggered by 2025 tariff policies-reflect a sector in dynamic evolution. Segment-specific insights reveal that product category versatility, fabric composition, maternity stage considerations, and demographic targeting collectively shape purchasing behavior and brand loyalty.

Regional distinctions underscore the importance of tailored strategies: North American consumers prioritize premium comfort and convenience, whereas European markets emphasize ethical sourcing, and Asia-Pacific growth is driven by rising incomes and e-commerce expansion. Competitive analysis demonstrates that firms excelling in agile design processes, omnichannel integration, and corporate responsibility initiatives occupy leading positions.

To thrive in this landscape, stakeholders must balance innovation with operational resilience, integrating consumer feedback into iterative development, leveraging data analytics for personalized experiences, and sustaining supply chain flexibility amid regulatory shifts. The interplay between these elements encapsulates the multifaceted nature of the maternity dresses ecosystem, highlighting strategic imperatives that will define market leadership over the coming years.

Encouraging a Strategic Dialogue with the Sales Leadership to Secure the Comprehensive Maternity Dresses Market Research Report

We invite industry stakeholders seeking in-depth understanding of the maternity dresses market to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at our research firm. Engaging with Ketan offers unparalleled access to a bespoke market research report tailored to address strategic queries and operational objectives. By establishing this dialogue, organizations can secure nuanced insights on consumer behavior, tariff implications, segmentation dynamics, regional differentiators, and competitive landscapes, empowering leaders to refine product portfolios and distribution strategies with confidence.

Ketan possesses extensive expertise in translating complex quantitative and qualitative findings into actionable business intelligence. His consultative approach ensures that each client’s unique priorities-whether optimizing fabric selection, navigating regulatory changes, or amplifying omnichannel presence-are meticulously addressed. Prospective purchasers will benefit from a comprehensive briefing session illuminating report methodologies, key takeaways, and practical applications. This engagement underscores our commitment to delivering impact-driven research that fosters innovation, resilience, and sustained growth.

To initiate the process, stakeholders can request a customized proposal that outlines the report’s scope, deliverables, and timeline. Partnering with Ketan guarantees timely access to the complete maternity dresses market research report, offering a strategic advantage in an increasingly competitive environment. Take this step today to transform data into decisive action and position your organization at the forefront of market evolution.

- How big is the Maternity Dresses Market?

- What is the Maternity Dresses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?