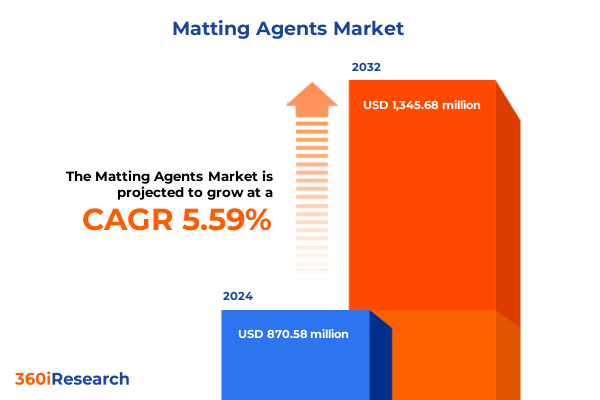

The Matting Agents Market size was estimated at USD 916.37 million in 2025 and expected to reach USD 967.81 million in 2026, at a CAGR of 5.64% to reach USD 1,345.67 million by 2032.

Unveiling the Crucial Role and Evolutionary Journey of Matting Agents in Transforming Coating Performance and Aesthetic Outcomes

Matting agents have evolved from niche additives to indispensable components within modern coating formulations, driving both functional and aesthetic performance across diverse industries. Initially developed to reduce surface gloss and eliminate unwanted reflections, these agents now play a pivotal role in tailoring visual finishes to consumer preferences and regulatory standards. As coatings manufacturers pursue differentiated product lines and brand owners seek premium matte textures, matting agents have become central to achieving consistent, high-quality results on a broad spectrum of substrates.

The scope of matting agents has broadened alongside advances in polymer science and inorganic chemistry, enabling formulators to address challenges such as scratch resistance, abrasion durability, and tactile sensation. Concurrently, rising consumer demand for sophisticated matte finishes in architectural applications, automotive coatings, and consumer goods has propelled innovation in particle design, surface modification, and dispersant technologies. This convergence of performance expectations and creative ambition underscores the strategic significance of matting agents in shaping product identity and market positioning.

Looking ahead, the intersection of sustainability objectives and digital manufacturing trends promises to further redefine how matting agents integrate into complex formulations. By optimizing particle morphology and surface treatments, formulators can deliver enhanced matte aesthetics without compromising on environmental compliance or production efficiency. As industry stakeholders collaborate across the value chain, the evolutionary journey of matting agents continues to unlock new possibilities in coatings differentiation and functional performance.

Assessing the Seamless Integration of Sustainability, Technological Advancements, and Regulatory Shifts Reshaping the Matting Agents Landscape

The matting agents landscape has undergone transformative shifts driven by heightened sustainability mandates, rapid technological advancements, and evolving regulatory frameworks. Over recent years, formulators have transitioned from solventborne systems to waterborne and UV-curable platforms, reflecting a broader industry imperative to minimize volatile organic compound emissions and reduce carbon footprints. This shift has required the development of novel particle chemistries compatible with low-VOC environments while maintaining the optical and tactile properties essential to matte finishes.

Simultaneously, digital manufacturing processes and precision application methods have elevated the need for consistent rheology and dispersion stability in matting agent technologies. The increasing adoption of advanced dispersion techniques, including high-shear mixing and ultrasonic treatments, has enabled more uniform particle distribution, translating to smoother surface finishes and predictable gloss levels. Regulatory landscapes have also tightened, with stricter emissions limits and trade compliance standards reshaping supply chain strategies.

These cumulative forces have catalyzed closer collaboration between pigment specialists, dispersant suppliers, and coating formulators, fostering innovation in surface functionalization and hybrid chemistries. As formulations become more complex, cross-functional teams leverage predictive modeling and real-time monitoring to optimize matting agent integration. In turn, these transformative shifts are positioning matting agents not merely as gloss modifiers but as enablers of advanced performance attributes across multiple end-use segments.

Analyzing the Ripple Effects of Recent United States Tariffs on Chemical Imports and Their Complex Implications for Matting Agent Supply Chains

The imposition of tariffs on chemical imports into the United States, particularly those targeting specialty additives and raw material precursors, has introduced new complexities into matting agent supply chains. Since the tariff adjustments implemented in early 2025, coatings manufacturers have experienced increased costs for certain polymeric and inorganic particles, necessitating strategic reevaluation of sourcing practices. These trade measures have influenced domestic production capacities, with several North American suppliers accelerating investment in local manufacturing to offset elevated import duties.

In practice, the added costs attributed to applied duties have prompted formulators to explore alternative chemistries, such as transitioning from certain silica-based matting agents to polymer-based or wax-based solutions that emerge from unaffected domestic feedstocks. While this agility has helped maintain continuity of supply, it has also driven innovation in material efficiency, encouraging development of lower-load matting systems that deliver comparable matte effects with reduced additive levels.

Furthermore, the ripple effects of these tariffs extend beyond raw material sourcing to impact logistics and inventory management strategies. Companies have broadened their distributor networks and diversified supplier portfolios to hedge against escalating freight charges and potential trade policy shifts. As the industry adapts to the ongoing tariff environment, stakeholders are leveraging closer partnerships with regional producers and embracing integrated supply chain models to safeguard formulation consistency and mitigate cost volatility.

Unlocking In-Depth Insights into Market Dynamics Through Comprehensive Segmentation Based on Type, Formulation, Application, and End-Use Industries

Segmenting the matting agents market by type reveals distinct performance and application advantages associated with polymer-based matting agents, silica-based matting agents, and wax-based matting agents. Polymer-based solutions excel in waterborne formulations by offering flexible particle architecture, whereas silica-based options deliver high refractive index contrasts ideal for industrial coatings applications. Wax-based matting agents continue to serve cost-sensitive markets due to their simplicity and compatibility with solventborne systems.

Examining formulation modalities highlights that in powdered form, matting agents provide long shelf life and transport efficiency, while solventborne dispersions facilitate easy integration into established industrial processes. UV/EB curable systems benefit from specialized particle surface chemistries that promote rapid crosslinking, and waterborne formulations underscore growing green chemistry initiatives by reducing VOC output without compromising matte aesthetics.

When analyzed through the lens of application areas, the architectural coatings segment prizes UV-resistant silica-based materials for exterior durability, industrial coatings employ polymer-based varieties to achieve precise gloss control under harsh conditions, leather coating applications demand wax-based formulations for smooth tactile finishes, printing inks require finely milled particles for uniform print gloss, and wood coatings leverage hybrid chemistries to balance transparency and surface protection.

By end-use industry, aerospace manufacturers value lightweight polymeric agents that maintain aerodynamic smoothness; the automotive sector demands low-distortion solutions for consistent appearance; construction applications favor robust silica-based matte finishes for building facades; and textile coatings utilize wax-infused particles to enhance fabric hand and washfastness.

This comprehensive research report categorizes the Matting Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Application Area

- End-Use Industry

Mapping Regional Variations in Demand, Technological Maturity, and Regulatory Frameworks Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Across the Americas, robust infrastructure investment and stringent environmental regulations have accelerated adoption of waterborne and low-VOC matting agent technologies, with formulators emphasizing domestic production to mitigate recent tariff impacts. Latin American markets, in particular, show increasing interest in hybrid solutions that blend polymeric and inorganic functionalities to address both performance and sustainability priorities, driven by urbanization and growth in construction sectors.

In Europe, Middle East & Africa, the regulatory landscape remains the most rigorous globally, with REACH standards guiding the selection of eco-friendly matting agents. This region exhibits strong demand for advanced silica-based materials in automotive OEM coatings, where high durability and aesthetic consistency are critical. Meanwhile, emerging economies across the Middle East are investing in industrial coatings applications that leverage wax-based agents for cost-efficient finishes in infrastructure projects.

In Asia-Pacific, rapid industrialization and expanding consumer goods production have created significant demand for versatile matting solutions. Waterborne polymer-based agents dominate in architectural and decorative coatings across China and Southeast Asia, while Japan and South Korea prioritize UV/EB curable systems in electronics and specialty applications. The region’s dynamic growth is further supported by expanding local manufacturing capacities, reducing dependency on imports and fostering innovation through regional R&D collaborations.

This comprehensive research report examines key regions that drive the evolution of the Matting Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Driving Innovation, Strategic Collaborations, and Competitive Positioning within the Global Matting Agent Ecosystem

Several key companies stand at the forefront of matting agent innovation, leveraging extensive R&D capabilities to introduce next-generation particle designs. One leading specialty chemicals provider has invested in surface modification platforms that enable tunable gloss levels and enhanced scratch resistance, cementing its position as a go-to supplier for premium automotive coatings. Another global material science group has expanded its waterborne dispersions portfolio with polymer-based microspheres optimized for architectural markets.

Additionally, a diversified chemical conglomerate has pursued strategic collaborations with pigment and resin manufacturers to co-develop hybrid matting systems that address both aesthetic and performance requirements in industrial coatings. Through targeted acquisitions, a multinational specialty coatings firm has strengthened its wax-based and silica-based offerings, enabling formulators to access integrated solutions under a unified supply chain.

In parallel, an emerging specialty materials company has gained traction by focusing on sustainable feedstocks, introducing bio-derived polymer matting agents compatible with UV-curable formulations. These competitive dynamics underscore an industry trend toward cross-segment partnerships, as suppliers seek to broaden application-specific offerings while adhering to evolving regulatory and environmental standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Matting Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aalborz Chemical, LLC

- Akzo Nobel N.V.

- Anhui Kingcham New Materials Co., Ltd.

- Arkema S.A.

- Axalta Coating Systems, LLC

- BASF SE

- BCD Chemie GmbH

- BioPowder by Schilling Ltd.

- BYK-Chemie GmbH

- Cabot Corporation

- CHT Germany GmbH

- Deuteron GmbH

- Estron Chemical, Inc.

- Evonik Industries AG

- Fine Cause Co.,Ltd.

- Goyen Chemical

- Henan Minmetals East Industrial Co., Ltd.

- Honeywell International Inc.

- Hubei Hoyonn Chemical Industry Co., Ltd

- Imerys S.A.

- ISF Group Limited

- ISHIHARA SANGYO KAISHA, LTD.

- J.M. Huber Corporation

- Jinsha Precipitated Silica Manufacturing Co., Ltd.

- Jinwei Chemical Co., Ltd.

- Mitsubishi Chemical Group Corporation

- MÜNZING Chemie GmbH

- PPG Industries, Inc.

- PQ Corporation

- SINO SUNMAN INTERNATIONAL

- Stahl Holdings B.V.

- The Lubrizol Corporation

- Thomas Swan & Co. Ltd.

- W. R. Grace & Co.

- Yantai Sunychem Int'l Co., Ltd.

- Zhejiang Shuangcai New Materials Co., Ltd.

Formulating Actionable Strategies and Best Practices to Empower Stakeholders in Navigating Market Challenges and Capitalizing on Emerging Opportunities

To navigate the evolving matting agents market successfully, industry leaders should prioritize strategic partnerships that accelerate access to advanced particle chemistries and surface functionalization expertise. Collaborating with pigment and resin innovators can yield integrated systems that deliver consistent matte finishes while addressing broader formulation challenges such as durability and environmental compliance. In tandem, investing in pilot-scale trials and real-time process analytics will de-risk scale-up of new matting solutions across solventborne, waterborne, and UV-curable platforms.

Moreover, companies should actively monitor trade policy developments and diversify supply networks by establishing local manufacturing or distribution alliances. This approach not only hedges against tariff fluctuations but also reduces lead times and strengthens regulatory compliance efforts. Embracing a modular R&D structure that leverages digital simulation tools will accelerate formulation optimization, enabling faster time-to-market for differentiated matte finishes.

Finally, integrating sustainability metrics into product road maps will resonate with end users and regulatory bodies alike. By setting clear performance and environmental targets-such as reducing additive concentrations and employing renewable feedstocks-companies can demonstrate leadership in green chemistry and capture growing demand for eco-friendly matte coatings.

Detailing a Rigorous Research Framework Integrating Qualitative and Quantitative Techniques to Ensure Comprehensive and Reliable Market Intelligence

A rigorous research framework underpins the analysis of the matting agents market by combining qualitative perspectives with quantitative validation to ensure comprehensive insights. The methodology begins with extensive secondary research, drawing on industry publications, regulatory databases, and technical white papers to map innovation trajectories and compliance requirements. This foundation informs the development of a detailed segmentation matrix based on type, formulation, application, and end-use industries.

Primary research complements secondary findings through structured interviews with formulating experts, coatings manufacturers, and supply chain stakeholders, enabling nuanced understanding of technology adoption drivers and market dynamics. These interviews uncover real-world challenges related to dispersion stability, gloss uniformity, and regulatory adherence. Data triangulation follows, integrating feedback from multiple sources to validate thematic trends and identify potential data gaps.

The quantitative component leverages a bottom-up approach to assess production capacities, material flows, and adoption rates across global regions. Geographic analysis incorporates regional trade data and tariff schedules to capture the impact of policy shifts on supply chains. Finally, all insights undergo rigorous cross-review by an internal panel of industry specialists to ensure analytical accuracy and strategic relevance, resulting in a research output that supports informed decision making without reliance on speculative forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Matting Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Matting Agents Market, by Type

- Matting Agents Market, by Formulation

- Matting Agents Market, by Application Area

- Matting Agents Market, by End-Use Industry

- Matting Agents Market, by Region

- Matting Agents Market, by Group

- Matting Agents Market, by Country

- United States Matting Agents Market

- China Matting Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Takeaways and Strategic Insights to Illuminate the Current Matting Agent Market and Its Trajectory for Industry Leaders and Decision Makers

The matting agents market exhibits a dynamic interplay of innovation, regulatory influence, and supply chain optimization, with clear patterns emerging across segmentation and regional landscapes. Polymer-based and silica-based agents maintain strong positions in waterborne and industrial coatings, while wax-based solutions continue to address niche requirements in leather and wood applications. Formulation trends underscore a shift toward low-VOC waterborne and UV-curable systems, reflecting industry commitments to environmental stewardship.

Trade policies in the United States have introduced cost pressures that are reshuffling supplier relationships and accelerating domestic production of specialty additives. Meanwhile, regional markets display divergent maturity levels, with the Americas prioritizing sustainability, EMEA enforcing strict regulations, and Asia-Pacific driving volume growth through local innovation. Competitive dynamics center on collaborative R&D models and strategic acquisitions, suggesting that future market leadership will favor agile companies capable of balancing performance with compliance.

These insights highlight the importance of a coordinated approach that bridges technical expertise, regulatory foresight, and logistical resilience. Stakeholders who adopt robust research methodologies, engage in targeted partnerships, and align product road maps with emerging market demands will be best positioned to capture value and shape the next phase of matting agents innovation.

Reach Out to Ketan Rohom to Secure the Definitive Matting Agents Market Report and Unlock Strategic Insights for Informed Business Growth

By engaging directly with Ketan Rohom in his capacity as Associate Director of Sales & Marketing, readers can secure comprehensive market research that delivers actionable intelligence on the matting agents sector. A personalized consultation ensures decision makers will gain clarity on technological developments, competitive dynamics, and regulatory considerations influencing matting agent strategies. This direct interaction simplifies the procurement process and expedites access to in-depth analysis, enabling stakeholders to align product road maps with market expectations seamlessly. Reach out to Ketan Rohom today to transform insights into competitive advantage and drive forward-looking business growth.

- How big is the Matting Agents Market?

- What is the Matting Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?