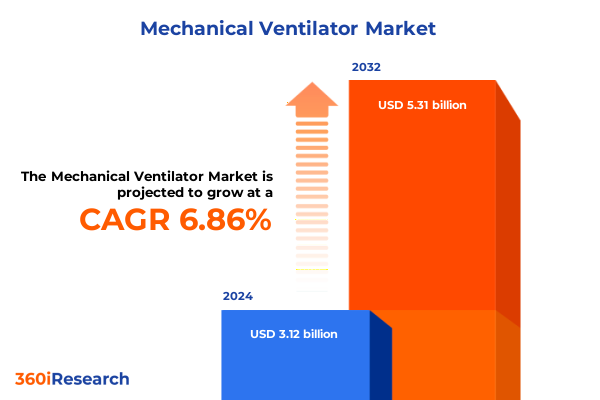

The Mechanical Ventilator Market size was estimated at USD 3.33 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 6.89% to reach USD 5.31 billion by 2032.

Unveiling the Role of Mechanical Ventilators as Cornerstones of Critical Care Delivery and Their Strategic Importance in Global Health Crisis Management

Mechanical ventilators are at the heart of modern critical care, providing life-sustaining respiratory support for patients with impaired lung function. These devices employ computer-controlled mechanisms to deliver precise volumes of oxygen and remove carbon dioxide, ensuring optimal gas exchange in intensive care units worldwide. From their origins in 18th-century bellows adapted for artificial respiration to today’s microprocessor-driven platforms, ventilators have evolved through significant milestones such as the iron lung era and the advent of positive pressure ventilation systems that form the cornerstone of today’s respiratory therapy.

The COVID-19 pandemic brought unprecedented attention to ventilator capacity and capability, as acute respiratory distress syndrome (ARDS) became a defining challenge for critical care teams internationally. The rapid scaling of production and deployment underscored systemic vulnerabilities in supply chains and the critical importance of scalable manufacturing frameworks to address surges in demand. This period also catalyzed collaboration among engineers, clinicians, and regulatory bodies to refine protocols, expand device versatility, and develop emergency-use adaptations that alleviated equipment shortages.

Today’s ventilator solutions integrate advanced monitoring features and data analytics, enabling clinicians to access real-time respiratory parameters and trend analyses. The seamless connectivity with electronic health records (EHR) and hospital information systems enhances decision-making, reducing the risk of ventilation-induced lung injury through adaptive algorithm-based adjustments. Moreover, predictive maintenance alerts built into these platforms ensure higher device uptime and reliability, a critical factor for intensive care environments.

In parallel, the growing emphasis on telehealth and home-based care has driven innovation in portable and lightweight ventilator systems. These devices support patient mobility and enable remote monitoring, extending the continuum of care beyond hospital walls. This shift aligns with healthcare’s broader goals of improving patient quality of life and reducing hospital readmissions by offering controlled respiratory support in ambulatory and home settings.

Exploring How Digital Integration Artificial Intelligence and Remote Care Models Are Redefining the Next Generation of Mechanical Ventilation Technologies

The landscape of mechanical ventilation is undergoing a profound digital transformation, driven by the integration of artificial intelligence (AI) and Internet of Medical Things (IoMT) technologies. Edge AI, which processes clinical data directly on ventilator devices, reduces response latency and bandwidth requirements while enhancing decision support in real time. These intelligent capabilities empower ventilators to autonomously detect patient-ventilator asynchronies, predict potential complications, and adjust parameters to individual physiology, markedly improving patient outcomes.

Concurrently, healthcare providers are embracing tele-ICU and remote care models, where critical care expertise can be extended across distributed hospital networks. Cloud-based platforms now aggregate ventilator data with other vital signs, enabling remote clinicians to monitor multiple patients simultaneously and intervene proactively. Partnership models between med-tech manufacturers and cloud service giants have accelerated this shift, resulting in scalable and interoperable telehealth frameworks that support both hospital and home-based ventilation scenarios.

Another notable shift is the rise of hybrid ventilator architectures that blend traditional pressure and volume control modes with dynamic, software-driven customizations. These systems offer clinicians a spectrum of tailored ventilation strategies, from high-frequency oscillatory ventilation to bilevel positive airway pressure, through modular hardware-software interfaces that can be updated remotely. The convergence of user-centric design, adaptive control algorithms, and predictive maintenance features is setting the stage for next-generation ventilators that prioritize clinical flexibility and operational resilience in diverse care settings.

Analyzing the Complex Effects of the 2025 US Tariff Policies on Global Supply Chains and Accessibility of Critical Medical Devices

In April 2025, the U.S. administration’s "Liberation Day" tariff announcement introduced a two-tier structure comprising a universal 10% import duty on all goods-excluding Canada and Mexico-and reciprocal tariffs on approximately 60 countries deemed to have unfair trade practices. This policy extended to medical devices, including mechanical ventilators, removing longstanding duty-free treatments and triggering significant cost pressures across the healthcare supply chain.

The immediate impact on medtech manufacturers and healthcare providers was pronounced, as industry groups warned of rising device costs and potential supply disruptions. Stock indices for companies such as Boston Scientific and Masimo experienced early declines in reaction to tariff details, while groups like the Advanced Medical Technology Association (AdvaMed) criticized the move as a de facto excise tax on life-saving equipment. Hospitals, already grappling with inflationary pressures, confronted the risk of higher capital expenditure for ventilators and ancillary supplies.

Faced with escalating duties, manufacturers accelerated efforts to reconfigure supply chains, seeking production shifts to lower-tariff jurisdictions or negotiating tariff exemptions. However, legal challenges culminated in a landmark ruling by the United States Court of International Trade on May 28, 2025, which deemed the emergency tariff orders beyond the authority granted under the IEEPA. The injunction against tariff enforcement introduced fresh uncertainty, compelling industry leaders to balance compliance strategies with long-term sourcing resilience in a rapidly evolving trade environment.

Deriving Strategic Insights from Multifaceted Market Segmentation to Uncover Diverse Mechanical Ventilation Opportunities Across Clinical and Home Care Settings

The product type segmentation of the mechanical ventilator market distinguishes between invasive and non-invasive systems, each reflecting distinct clinical workflows. Invasive ventilators, traditionally rooted in ICU care, deliver controlled breaths via endotracheal intubation or tracheostomy, serving patients with severe respiratory failure. Conversely, non-invasive devices cater to a broader range of respiratory conditions, offering bilevel positive airway pressure, continuous positive airway pressure, negative pressure, and positive pressure modalities that support patient comfort and reduce the risks associated with invasive interventions.

Mode of ventilation is another critical lens, dividing devices into negative and positive pressure categories. While positive pressure ventilation remains the predominant modality in acute care due to its precision and adaptability, negative pressure ventilation is experiencing niche resurgence in certain neurological and rehabilitation use cases, driven by its non-invasive nature and patient-centric benefits.

Mobility-based segmentation contrasts portable ventilators, designed for transport and home care settings with compact form factors and battery operation, against stationary units optimized for hospital ICUs with extensive monitoring and connectivity features. The proliferation of portable systems has been instrumental in enabling decentralization of respiratory care, reducing hospital readmissions by streamlining post-acute and palliative treatment pathways.

Patient type segmentation further refines market dynamics, as adult, geriatric, and pediatric cohorts demand tailored ventilatory support. Manufacturers incorporate adaptive algorithms and customizable interfaces to accommodate age-specific lung mechanics, targeting improved synchrony and minimizing the risk of ventilation-induced injury across the lifespan.

Application segmentation underscores the diverse clinical contexts in which ventilators operate, from emergency resuscitation and post-surgical recovery to management of chronic respiratory diseases and neurological conditions. Devices increasingly feature rapid-start modes and disease-specific protocols, enabling clinicians to swiftly adapt ventilation strategies to emergent scenarios and long-term care objectives.

Finally, end-use segmentation reveals distinct procurement and usage patterns in ambulatory surgical centers, emergency transport services, home care settings, and hospitals and clinics. Each channel influences product design, service delivery models, and aftermarket support strategies, shaping the competitive landscape and informing manufacturers’ go-to-market frameworks.

This comprehensive research report categorizes the Mechanical Ventilator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ventilation Interface

- Mode of Ventilation

- Ventilation Mode

- Ventilation Technology

- Humidification Type

- Patient Type

- Application

- End Use

- Sales Channel

Presenting Key Regional Perspectives on Adoption Trends Infrastructure Developments and Regulatory Landscapes Shaping Mechanical Ventilator Markets Worldwide

In the Americas, the United States and Canada lead in the adoption of advanced ventilator technologies, bolstered by substantial R&D investments and well-established critical care infrastructure. The region’s emphasis on tele-ICU networks and integrated healthcare systems has accelerated deployments of intelligent ventilation platforms, creating a robust environment for continuous innovation and strategic partnerships with technology providers.

Europe, the Middle East, and Africa (EMEA) exhibit heterogeneous dynamics shaped by regulatory harmonization under the EU Medical Device Regulation, alongside evolving healthcare priorities in emerging markets. Western Europe’s high reimbursement rates and commitment to interoperability have fostered early uptake of next-generation ventilators, while Middle Eastern countries are investing in local manufacturing initiatives. In Africa, limited ICU capacity and infrastructure challenges are driving demand for portable and low-complexity devices that can be deployed in resource-constrained settings.

Asia-Pacific stands out for its rapid market expansion, propelled by rising healthcare expenditures, growing domestic manufacturing capabilities, and lessons learned from the pandemic. Countries such as China and India are emphasizing self-reliance through localization strategies, while Australia, Japan, and South Korea continue to adopt premium ventilator solutions. The region’s sharp focus on portable units and hybrid digital platforms reflects a desire to enhance home care models and emergency preparedness, contributing to a diversified and resilient market landscape.

This comprehensive research report examines key regions that drive the evolution of the Mechanical Ventilator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovations Partnerships and Competitive Strategies of Leading Medical Device Manufacturers Dominating the Mechanical Ventilator Arena

Global med-tech leaders have made strategic alliances to harness cloud computing and AI for ventilator management. Philips Healthcare expanded its partnership with a leading cloud services provider in late 2024 to integrate advanced analytics into its HealthSuite platform, enabling real-time performance monitoring, predictive maintenance, and seamless EHR interoperability across hospital networks. This collaboration underscores a broader industry trend of converging medical device expertise with digital technology capabilities to enhance care delivery.

Medtronic followed suit with its own cloud-driven telehealth framework launched in mid-2024, embedding AI-powered decision support into its ventilator portfolio. By leveraging scalable infrastructure, the company has improved remote patient monitoring and streamlined device provisioning for home care settings, reflecting a shift toward subscription-based models and ongoing service engagements with healthcare providers.

Other key players, including GE Healthcare, Dräger, and Fisher & Paykel, are directing investments toward modular platform designs and intuitive user interfaces. GE Healthcare has acquired specialized tele-ICU software firms to bolster cross-platform compatibility, whereas Dräger and Fisher & Paykel focus their R&D efforts on customizable non-invasive ventilation solutions and portable devices that meet the evolving demands of emergency response and home-based therapy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mechanical Ventilator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeonmed Co., Ltd.

- Air Liquide Medical Systems S.A.

- Allied Medical, LLC

- Avasarala Technologies Limited

- Bio-Med Devices, Inc.

- Bunnell Incorporated

- CorVent Medical Inc.

- Drägerwerk AG & Co. KGaA

- Event Medical

- Fisher & Paykel Healthcare Corporation Limited

- Fritz Stephan GmbH

- GE HealthCare Technologies Inc.

- Getinge AB

- Hamilton Medical AG

- Hayek Medical

- Heyer Medical AG

- Inspiration Healthcare Group plc.

- Kare Medical and Analytical Devices Ltd. Co.

- Koninklijke Philips N.V.

- Magnamed Tecnologia Médica S/A

- Medtronic plc

- Mindray Medical India Pvt. Ltd.

- Nihon Kohden Corporation

- ResMed Inc.

- Schiller AG

- Shenzhen Comen Medical Instruments Co., Ltd.

- Siare Engineering International Group S.r.l.

- Smiths Group plc

- Vapotherm, Inc.

- VentMed Medical Technology Co., Ltd.

- WILAmed GmbH

- ZOLL Medical Corporation

Actionable Strategies and Pragmatic Recommendations for Industry Leaders to Navigate Tariff Volatility Technological Disruption and Evolving Clinical Demands

Industry leaders are advised to prioritize investment in AI-driven control systems and edge analytics to differentiate their ventilator offerings. Embedding adaptive algorithms that personalize ventilation profiles based on real-time physiological data will not only improve patient outcomes but also create new service revenue streams through predictive maintenance and performance-based contracts.

To mitigate trade policy risks, companies must diversify manufacturing footprints and consider nearshoring or regional assembly hubs to reduce exposure to tariffs and logistical disruptions. Engaging proactively with policymakers and industry associations can facilitate targeted exemptions for critical medical devices, preserving affordability and ensuring uninterrupted patient care.

Forging strategic partnerships across healthcare and technology sectors will be vital. Collaborations with telehealth providers, software developers, and EHR vendors can accelerate product development cycles and enhance interoperability. By aligning device roadmaps with evolving care models-such as remote monitoring and home ventilation-manufacturers can strengthen their competitive position and increase market penetration in high-growth segments.

Outlining the Comprehensive Research Design Combining Primary Interviews Secondary Data Sources and Rigorous Validation Techniques to Ensure Data Integrity

The research methodology underpinning this analysis integrates a multi-tiered approach to ensure comprehensive and reliable insights. Primary research comprised in-depth interviews with key stakeholders, including critical care physicians, respiratory therapists, hospital procurement directors, and supply chain specialists. These discussions provided qualitative perspectives on clinical priorities, adoption barriers, and emerging demand drivers.

Secondary research involved systematic collection of data from regulatory filings, company annual reports, clinical trial registries, and peer-reviewed journals. Market intelligence platforms and government databases were consulted to capture recent tariff developments, regional regulatory updates, and competitive landscaping. Data triangulation techniques were employed to validate findings, while statistical tools facilitated the identification of trend patterns and correlation analyses. The combined framework of primary validation and secondary corroboration underpins the robustness and accuracy of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mechanical Ventilator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mechanical Ventilator Market, by Product Type

- Mechanical Ventilator Market, by Ventilation Interface

- Mechanical Ventilator Market, by Mode of Ventilation

- Mechanical Ventilator Market, by Ventilation Mode

- Mechanical Ventilator Market, by Ventilation Technology

- Mechanical Ventilator Market, by Humidification Type

- Mechanical Ventilator Market, by Patient Type

- Mechanical Ventilator Market, by Application

- Mechanical Ventilator Market, by End Use

- Mechanical Ventilator Market, by Sales Channel

- Mechanical Ventilator Market, by Region

- Mechanical Ventilator Market, by Group

- Mechanical Ventilator Market, by Country

- United States Mechanical Ventilator Market

- China Mechanical Ventilator Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 4134 ]

Synthesizing Critical Insights and Strategic Imperatives to Illuminate the Future Path for Mechanical Ventilation Technologies and Market Stakeholders

This executive summary synthesizes how digital innovation, evolving clinical demands, and policy environments are converging to reshape the mechanical ventilator market. From AI-assisted parameter optimization and edge computing to the challenges posed by 2025 tariff measures and regional regulatory landscapes, stakeholders must adapt strategically to thrive. The insights captured herein underscore the imperative for manufacturers to diversify supply chains, forge cross-sector partnerships, and embed intelligence at the device level to meet the needs of critical care settings and decentralized care models alike.

As healthcare systems worldwide prioritize resilience and patient-centricity, the path forward for mechanical ventilation lies in modular, interoperable platforms that deliver precision therapy, support remote management, and sustain operational uptime. Navigating this dynamic market demands a balance of technological foresight, regulatory agility, and clinician-centric design thinking.

Secure a Comprehensive Mechanical Ventilator Market Research Report by Connecting with Ketan Rohom to Drive Strategic Decisions and Gain Competitive Advantage

Don't miss the opportunity to leverage in-depth market intelligence and gain a competitive edge by securing a comprehensive mechanical ventilator market research report. Connecting with Ketan Rohom, Associate Director, Sales & Marketing will provide you with tailored insights, exclusive data compilations, and strategic guidance to inform your next steps. Reach out today to discuss how this report can empower your organization to navigate complex industry dynamics and optimize growth trajectories.

- How big is the Mechanical Ventilator Market?

- What is the Mechanical Ventilator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?