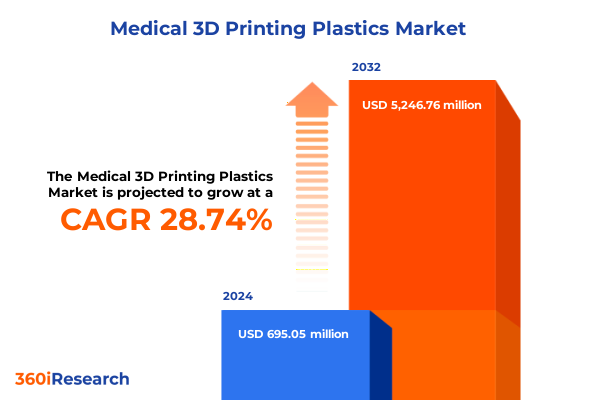

The Medical 3D Printing Plastics Market size was estimated at USD 892.86 million in 2025 and expected to reach USD 1,151.12 million in 2026, at a CAGR of 28.78% to reach USD 5,246.75 million by 2032.

Unveiling the Critical Role and Evolution of Specialty Plastics in Shaping the Future of Medical Three-Dimensional Printing and Healthcare Outcomes

Medical three-dimensional printing has rapidly evolved from a prototyping novelty to a cornerstone of modern healthcare innovation, with specialty plastics at its core. Advanced polymer formulations now enable precise fabrication of patient-specific implants, surgical guides, and prosthetic components that seamlessly integrate with human tissue. This synergy between biomaterials science and additive manufacturing technologies has unlocked unprecedented opportunities to enhance clinical outcomes, streamline surgical workflows, and reduce costs associated with bespoke medical devices. As healthcare providers and device manufacturers strive to address escalating demands for personalized care, plastic-based 3D printing solutions are emerging as indispensable tools for translating digital designs into functional, biocompatible products.

The maturation of the medical 3D printing plastics sector has been driven by breakthroughs in material science, improvements in printing resolution, and the attainment of rigorous regulatory clearances. Regulatory agencies worldwide are increasingly recognizing the safety and efficacy of specialized photopolymer resins, engineering-grade powders, and high-performance thermoplastic filaments, fostering broader adoption across dental, orthopedic, and surgical applications. Furthermore, cross-industry collaborations between polymer developers and additive manufacturing equipment suppliers are accelerating the introduction of next-generation materials engineered for enhanced mechanical strength, sterilization compatibility, and biointegration. Together, these advancements are setting the stage for a transformative shift in how medical devices are designed, manufactured, and delivered to patients.

Navigating Revolutionary Advances and Disruptive Innovations Reshaping the Medical Three-Dimensional Printing Plastics Landscape Across Processes and Materials

The landscape of medical 3D printing plastics is being reshaped by a convergence of revolutionary advances in material formulations and disruptive manufacturing processes. Emerging biocompatible resin chemistries are now offering tunable mechanical properties that mimic human tissue, while high-temperature engineering filaments such as polyether ether ketone are expanding the range of sterilizable components suitable for long-term implantation. Simultaneously, novel composite powders incorporating nanoparticles are delivering superior performance in selective laser sintering, enabling the production of lightweight yet durable orthopedic implants that meet stringent clinical requirements.

Alongside these material innovations, additive manufacturing technologies themselves are undergoing transformative shifts. Digital light processing and stereolithography systems are achieving micron-scale resolution for intricate dental guides and hearing aid shells, whereas multi jet fusion platforms are streamlining batch production of polymer parts with consistent quality. Material jetting has emerged as a versatile approach for fabricating multi-material constructs that replicate complex anatomical structures with remarkable fidelity. These technological breakthroughs, underpinned by advancements in printer hardware and process control, are fueling a paradigm shift from prototyping to end-use manufacturing. As a result, medical professionals, device makers, and research institutions are collaborating more closely to translate these cutting-edge capabilities into improved patient outcomes and operational efficiencies.

Assessing the Comprehensive Consequences of Newly Implemented United States Tariffs on Medical Three-Dimensional Printing Plastics and Supply Chains in 2025

In early 2025, the United States implemented a new tranche of tariffs targeting imported specialty plastics used in medical 3D printing, reflecting broader trade policy measures. These duties have affected a range of photopolymer resins, fine engineering powders, and high-performance filaments, elevating landed costs for manufacturers and potentially constraining supply chains. The immediate consequence has been an increased emphasis on sourcing domestically produced materials or qualifying alternate suppliers in tariff-free jurisdictions. As import-dependent companies reassess procurement strategies, some are accelerating efforts to onshore resin production or enter joint ventures with U.S.-based polymer producers to mitigate cost volatility.

This tariff landscape has also spurred innovation in material development and process optimization. Manufacturers are exploring high-yield formulations that require less raw input without compromising performance, while additive equipment providers are refining printing parameters to maximize material utilization. Additionally, compliance with new customs requirements and classification guidelines has become a critical competency for importers, driving demand for specialized logistics expertise. Despite these challenges, the reshaped trade environment represents an inflection point for the domestic medical 3D printing ecosystem, incentivizing investment in local capabilities and strengthening resilience against future policy shifts.

Uncovering Key Insights from Material Types, Technology Platforms, Application Areas, and End Users Shaping Medical Three-Dimensional Printing Plastics

A nuanced examination of segmentation insights reveals how each dimension of the medical 3D printing plastics market is evolving. When viewed through the lens of material type, photopolymer resin emerges as a dynamic category, with biocompatible resin driving growth in patient-contact applications and dental resin leading adoption within orthodontics and prosthodontics. Conversely, powders such as polyamide and polyether imide continue to gain traction for their strength and chemical resistance in load-bearing implants, while the thermoplastic filament segment sees acrylonitrile butadiene styrene and polyether ether ketone commanding attention for their sterilization compatibility and mechanical robustness.

From the technology perspective, fused deposition modeling stands out for its accessibility and diverse material compatibility, catalyzing use cases in rapid prototyping and low-volume production of custom medical devices. Selective laser sintering technologies are increasingly leveraged to produce intricate polymeric components, whereas stereolithography platforms, powered by dental and biocompatible resins, are optimizing workflows in dental laboratories and hearing aid manufacturing. Across application segments, dental solutions remain the largest driver of demand, with surgical guides and aligners at the forefront, while orthopedic implants and surgical planning models are establishing three-dimensional printing as a critical clinical support tool. Finally, when considering end users, hospital and clinic environments are intensifying investment in on-site printing capabilities to accelerate patient-specific care, and medical device manufacturers are pursuing strategic partnerships to internalize additive workflows and deliver differentiated product offerings.

This comprehensive research report categorizes the Medical 3D Printing Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology

- Application

- End User

Exploring Regional Market Variations and Growth Drivers Across the Americas, EMEA, and Asia-Pacific in Medical Three-Dimensional Printing Plastics

Regional dynamics of the medical 3D printing plastics market illustrate clear variations in adoption, regulatory alignment, and supply chain maturity. In the Americas, the United States leads with robust infrastructure for on-site hospital printing facilities and a vibrant network of polymer specialists collaborating with additive equipment vendors. Canada and Mexico are following suit by developing localized resin synthesis capabilities and leveraging cross-border manufacturing synergies to optimize material availability and cost structures.

Europe, Middle East & Africa (EMEA) presents a mosaic of highly regulated healthcare systems paired with strong academic and research institutions driving material innovation. Germany and the United Kingdom are pioneering standards for medical-grade plastics, while smaller markets in the Middle East are rapidly scaling dental and hearing aid applications through public–private partnerships. Africa, though in an earlier adoption phase, is witnessing pilot initiatives focused on low-cost, bioresorbable polymers to address critical care shortages.

In Asia-Pacific, countries such as Japan and South Korea are advancing production of ultra-high-performance filaments and resins, bolstered by governmental R&D incentives. China’s growing additive ecosystem is supported by domestic polymer manufacturers offering cost-competitive powders, whereas Australia and India are integrating three-dimensional printing in dental laboratories and research institutions at an accelerating pace. Collectively, these regional insights underscore the importance of tailored strategies, local material qualification, and regulatory collaboration to unlock market potential across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Medical 3D Printing Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Key Industry Participants Driving Innovation and Competitive Positioning in the Medical Three-Dimensional Printing Plastics Landscape

Leading players in the medical 3D printing plastics space are differentiating through targeted material innovation, strategic partnerships, and expanded service offerings. Several polymer specialists have launched proprietary biocompatible photopolymer portfolios engineered for specific clinical applications, while others are collaborating with additive equipment manufacturers to co-develop integrated hardware–material solutions. Key companies have also expanded geographically, establishing regional mixing facilities to support localized material formulations and compliance with evolving chemical regulatory standards.

Strategic acquisitions and joint ventures have become commonplace, as device manufacturers seek to internalize material development capabilities and reduce dependency on external suppliers. Investment in pilot production lines for advanced powder bed fusion powders has enabled select firms to offer qualifying lot traceability and quality certifications required for medical device manufacturing. Additionally, service bureaus are differentiating through end-to-end value propositions that encompass material qualification, part design optimization, post-processing validation, and regulatory submission support. Collectively, these strategic initiatives reflect a maturing competitive landscape in which collaboration across the value chain is essential to capture emerging opportunities and drive long-term differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical 3D Printing Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- Arkema SA

- Asiga

- BASF SE

- BEGO GmbH & Co. KG

- Carbon, Inc.

- Covestro AG

- DENTSPLY SIRONA Inc.

- Desktop Metal, Inc.

- Detax GmbH

- DWS S.r.l.

- EOS GmbH

- Evonik Industries AG

- FormLabs Inc.

- Henkel AG & Co. KGaA

- HP Inc.

- Keystone Industries

- Koninklijke DSM N.V.

- Liqcreate

- Lithoz GmbH

- PHROZEN TECH CO., LTD.

- Planmeca Oy

- Solvay S.A.

- Stratasys Ltd.

Offering Actionable Recommendations for Industry Leaders to Seize Opportunities and Mitigate Risks in Medical Three-Dimensional Printing Plastics

For stakeholders aiming to capitalize on the momentum within medical 3D printing plastics, a multi-pronged strategic roadmap is imperative. First, investing in advanced material research and forging partnerships with polymer chemists can enable the development of next-generation resin and filament formulations tailored for specific clinical applications. Building flexible supply chains that incorporate both domestic and international raw material sources will mitigate risks associated with tariff fluctuations and logistical disruptions.

Moreover, proactive engagement with regulatory bodies to streamline material certification and biocompatibility testing processes can accelerate time-to-market and foster trust among healthcare providers. Cross-functional collaboration between R&D, clinical, and manufacturing teams will optimize translation of laboratory breakthroughs into scalable production workflows. Finally, pursuing strategic alliances with equipment vendors and service bureaus can augment in-house capabilities, offering turnkey solutions that integrate material, machine, and software expertise. By adopting these actionable recommendations, industry leaders can navigate the evolving landscape, capture new revenue streams, and deliver superior patient-centric solutions.

Detailing a Robust Mixed-Methods Research Methodology Ensuring Accuracy and Reliability for In-Depth Analysis of Medical Three-Dimensional Printing Plastics

This analysis draws on a mixed-methods research approach designed to ensure comprehensive coverage and data integrity. The initial phase involved systematic secondary research, encompassing peer-reviewed journals, patent filings, regulatory agency databases, and industry white papers, to construct a foundational understanding of material properties and regulatory frameworks. Concurrently, quantitative market segmentation data were sourced from customs records, trade associations, and corporate disclosures to map tariff impacts and regional adoption trends.

In the second phase, primary research was conducted through in-depth interviews with polymer scientists, additive manufacturing experts, clinical practitioners, and regulatory consultants, providing qualitative insights into emerging material innovations and operational challenges. These findings were triangulated with data from survey-based studies of end users-including dental laboratories, hospitals, and device manufacturers-to validate market drivers and investment priorities. Finally, data synthesis and expert working sessions were employed to refine key themes, ensuring that the resulting insights are actionable and reflective of real-world dynamics. This rigorous methodology balances breadth of analysis with depth of expert validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical 3D Printing Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical 3D Printing Plastics Market, by Material Type

- Medical 3D Printing Plastics Market, by Technology

- Medical 3D Printing Plastics Market, by Application

- Medical 3D Printing Plastics Market, by End User

- Medical 3D Printing Plastics Market, by Region

- Medical 3D Printing Plastics Market, by Group

- Medical 3D Printing Plastics Market, by Country

- United States Medical 3D Printing Plastics Market

- China Medical 3D Printing Plastics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Insights Emphasizing the Strategic Importance and Future Directions Driving Growth in Medical Three-Dimensional Printing Plastics Innovation

The medical 3D printing plastics sector stands at an inflection point where technological innovation, regulatory evolution, and supply chain reconfiguration converge to redefine healthcare manufacturing. Specialty plastics have transcended the prototyping phase to become core enablers of patient-specific solutions, supported by a growing portfolio of biocompatible resins, engineering-grade powders, and high-performance filaments. Meanwhile, evolving trade policies and domestic production incentives are reshaping sourcing strategies, prompting greater investment in local material capabilities.

As the market continues to mature, stakeholders who align strategic objectives with segmentation-specific dynamics, regional nuances, and competitive benchmarks will be best positioned to capture value. Material and technology synergies, backed by rigorous compliance and strategic partnerships, will differentiate leaders from followers. Ultimately, the integration of advanced polymers into medical additive manufacturing workflows promises to elevate clinical outcomes, accelerate device innovation, and unlock new paradigms in personalized healthcare delivery.

Compelling Call to Action Urging Stakeholders to Connect with Ketan Rohom for Access to a Comprehensive Medical Three-Dimensional Printing Plastics Report

The complexities of the medical 3D printing plastics market demand specialized insights that only a dedicated research report can provide. Stakeholders seeking to leverage the latest innovations, navigate evolving regulations, and anticipate emerging trends will find invaluable guidance through a one-on-one consultation. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, organizations can secure immediate access to in-depth analysis covering material performance characteristics, tariff implications, segmentation nuances, and competitive benchmarking. This direct engagement ensures tailored support in interpreting data, aligning strategic objectives with market realities, and accelerating time-to-value. Initiating this dialogue empowers decision-makers to make informed investments and secure a competitive edge in an increasingly dynamic and technology-driven healthcare landscape. Reach out today to transform data into actionable strategies and capitalize on the full potential of medical three-dimensional printing plastics.

- How big is the Medical 3D Printing Plastics Market?

- What is the Medical 3D Printing Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?