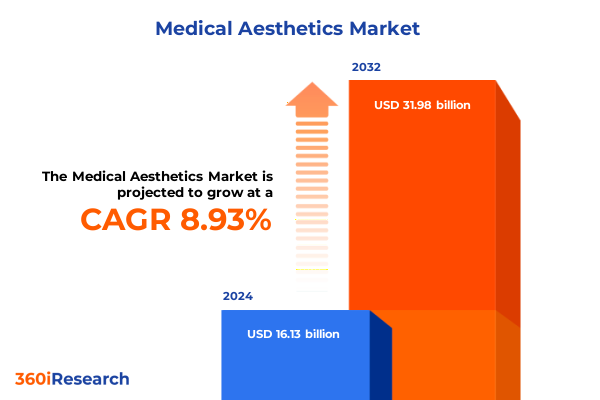

The Medical Aesthetics Market size was estimated at USD 17.53 billion in 2025 and expected to reach USD 19.05 billion in 2026, at a CAGR of 8.96% to reach USD 31.98 billion by 2032.

Unveiling the Rising Demand and Innovations Driving the Future Growth Trajectory of the U.S. Medical Aesthetics Industry in a Transformative Era

The U.S. medical aesthetics industry has evolved from a niche segment into a mainstream healthcare and beauty convergence, fueled by advancements in technology, shifting demographics, and a cultural emphasis on wellness. In recent years, minimally invasive treatments have surged in popularity as patients seek effective, low-downtime procedures to enhance appearance and confidence. Meanwhile, innovations in devices and formulations have expanded the range of available treatments, enabling providers to tailor solutions that meet diverse aesthetic goals.

Against this dynamic backdrop, providers and manufacturers are challenged to stay ahead of rapid technological change, evolving regulations, and consumer expectations for safety and efficacy. At the same time, emerging tools in digital health and data analytics empower practitioners to refine treatment protocols and measure outcomes more precisely. As we navigate this transformative era, stakeholders must adopt a strategic perspective that balances product innovation, patient experience, and operational efficiency. This executive summary serves as a foundational overview, setting the stage for deeper analysis across evolving market segments, regulatory impacts, and strategic imperatives.

How Rapid Technological Breakthroughs Combined with Shifting Consumer Preferences Are Dramatically Reshaping the Modern Medical Aesthetics Landscape Today

In recent years, the medical aesthetics landscape has undergone profound transformation driven by rapid technological breakthroughs and evolving consumer mindsets. Laser resurfacing equipment has become more precise, while non-invasive skin tightening devices integrate real-time feedback systems that enhance treatment safety and outcomes. Simultaneously, the integration with artificial intelligence and machine learning has enabled customized treatment algorithms, ushering in a new era of predictive aesthetic protocols.

Concurrently, consumers are increasingly informed and discerning, seeking solutions that align with their values and lifestyles. Younger generations such as Gen Z and Millennials expect minimally invasive devices and home-based treatments that offer convenience without compromising efficacy, while Baby Boomers and Gen X continue to prioritize proven formulations and injectable toxin subtypes for wrinkle reduction and facial volume enhancement. As a result, providers are prioritizing cross-disciplinary collaborations that blend dermatology, plastic surgery, and wellness principles to deliver comprehensive patient journeys.

This shift is further accelerated by the rise of portable and wearable smart devices, which empower patients to adhere to treatment protocols beyond the clinical setting. With providers adapting to these expectations, the industry is witnessing an unprecedented convergence of digital health, personalized medicine, and aesthetic science, fundamentally reshaping the competitive landscape.

Assessing the Far-Reaching Ramifications of Recent U.S. Trade Tariffs on Import Dynamics and Cost Structures Across Medical Aesthetics

Recent tariff measures imposed on medical devices, cosmeceuticals, and injectable products have introduced cost pressures across the U.S. value chain. Import duties on lasers and energy devices have raised procurement expenses for clinics, often necessitating price adjustments or strategic sourcing from domestic manufacturers. Similarly, additional tariffs on hyaluronic acid fillers and calcium hydroxylapatite fillers have increased input costs, prompting providers to optimize treatment protocols to maintain margins without compromising patient outcomes.

Moreover, the levies applied to microdermabrasion and chemical peels have rippled through supply contracts, as providers evaluate the trade‐off between established exfoliation-based treatments and emerging alternatives. Threads for lifting, particularly polydioxanone and polycaprolactone variants sourced from overseas suppliers, have seen longer lead times and higher freight expenses, creating an incentive to stockpile inventory or explore local production partnerships. Meanwhile, home-based treatment kits incorporating brightening agents or anti-aging formulations face regulatory scrutiny and cost recalibrations aligned with new tariff classifications.

Collectively, these developments are catalyzing a strategic reevaluation of global supply chains. Stakeholders are actively renegotiating contracts, diversifying supplier bases, and investing in domestic manufacturing capabilities. As the industry adapts, aligned strategies around procurement, inventory management, and pricing will become critical to sustaining competitive advantage amid rising trade-related costs.

Unlocking Deep Market Dynamics by Examining Product Types Application Areas and Consumer Profiles That Define Industry Growth Patterns

The market’s heterogeneity is underscored by diverse product types that span from injectable toxin subtypes to home-based treatment kits, each responding to distinct clinical demands and patient preferences. Botulinum toxin offerings have expanded beyond traditional variants as providers leverage novel injectable toxin subtypes for targeted wrinkle reduction and hyperhidrosis treatments. Cosmeceuticals have bifurcated into anti-aging formulations and brightening agents, reflecting patient-driven demand for skin quality enhancement and pigment correction. In parallel, the dermal fillers space is characterized by calcium hydroxylapatite and hyaluronic acid formulations, each delivering unique viscoelastic properties for facial volume enhancement.

Treatment protocols integrate laser resurfacing equipment-both ablative lasers and non-invasive skin tightening devices-alongside exfoliation-based treatments such as microdermabrasion and chemical peels. Simultaneously, threads for lifting have evolved from polydioxanone to longer-lasting polycaprolactone threads, while standalone portable devices and wearable smart wearables expand the modality spectrum. Application areas further segment into body contouring that addresses cellulite removal and stretch mark treatment, facial aesthetics centered on volume enhancement and wrinkle reduction, as well as hair restoration through follicular unit extraction and platelet-rich plasma therapy. The end-user landscape captures medical day spas, aesthetic dermatology practices, and plastic surgery clinics, each demanding tailored device modalities and treatment protocols.

Patient demographics reveal generational divides; baby boomers often gravitate toward restorative approaches that emphasize subtle rejuvenation, whereas Gen Z and Millennials embrace minimally invasive and technology-driven experiences. Gender-specific formulations and device settings further refine segmentation, as providers customize regimens for female and male patients. Collectively, these multifaceted segments shape targeted R&D efforts, marketing strategies, and service delivery models.

This comprehensive research report categorizes the Medical Aesthetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Procedure Type

- Product Type

- Device Modality

- Gender

- Application Area

- End-User

Drawing Strategic Regional Perspectives by Analyzing Growth Drivers and Market Nuances Across the Americas Europe Middle East Africa and Asia Pacific

Geographic nuances play a pivotal role in shaping market dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, North America leads with advanced regulatory frameworks that support rapid adoption of AI-driven and minimally invasive devices, while Latin American markets are gaining momentum through medical tourism and cost-competitive service offerings. Providers in the region are leveraging cross-border collaborations to tap into emerging patient pools seeking accessible body contouring, hair restoration, and breast enhancement procedures.

Across Europe Middle East and Africa, the regulatory landscape is characterized by stringent safety standards in Western Europe, fostering innovation in cosmeceuticals and laser-based treatments. Meanwhile, the Middle East embraces high-end luxury clinics that cater to affluent clientele, driving demand for bespoke protocols and cutting-edge threads for lifting. In Africa, select urban centers are emerging as hubs for dermatology clinics offering platelet-rich plasma therapy and microdermabrasion services at competitive price points.

In the Asia Pacific, markets such as South Korea, Japan, and China stand at the forefront of aesthetic innovation, propelled by strong cultural emphasis on skin aesthetics and early adoption of smart wearables. Providers in these markets are pioneering customized treatment algorithms and portable standalone devices that align with high-frequency usage patterns. Cross-regional knowledge transfer continues to accelerate, enabling global providers to integrate best practices and localized service models across diverse patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Medical Aesthetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Market Players Revealing Strategic Partnerships Innovations and Competitive Approaches That Define Market Leadership

Market leadership is defined by a combination of product innovation, strategic partnerships, and global footprint. Leading injectable toxin and filler manufacturers have intensified R&D investments to differentiate their pipelines, focusing on next-generation biocompatible formulations and longer-lasting effects. Laser and energy device companies are forging alliances with AI technology firms to introduce predictive maintenance platforms and real-time treatment customization.

Simultaneously, cosmeceutical brands are expanding their portfolios through collaborations with dermatology clinics, integrating advanced brightening agents and anti-aging formulations into clinical protocols. Device modality specialists are pursuing targeted acquisitions of portable device startups and smart wearable innovators to enhance their digital health capabilities. Channel diversification is another hallmark of success, as companies align with beauty and wellness centers, dermatology clinics, and plastic surgery practices to ensure seamless product integration and end-user training.

The competitive landscape is further shaped by emerging players that offer niche solutions-such as home-based treatment kits and polycaprolactone thread innovations-challenging incumbents to accelerate their own product roadmaps. Additionally, alliances between hospitals, specialty clinics, and device manufacturers are fostering multidisciplinary treatment suites that span facial aesthetics, body contouring, and hair restoration, underscoring the value of integrated service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Aesthetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AbbVie Inc.

- Alma Lasers, Ltd.

- Alpha Aesthetics, Inc.

- Anthony Products Inc.

- Arion Laboratories

- Avinent Implant System, S.L.U.

- Bausch Health Companies Inc.

- Candela Corporation

- Cutera, Inc.

- Cynosure, LLC

- Galderma S.A.

- Global Consolidated Aesthetics Limited

- Groupe Sebbin SAS

- Guangzhou Wanhe Plastic Material Co., Ltd.

- Hanson Medical, Inc.

- Implantech Associates Inc.

- Institut Straumann AG

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- KLS Martin Group

- Lattice Medical SAS

- Medytox, Inc.

- Merz Aesthetics, Inc.

- Nobel Biocare Services AG

- Quanta System S.p.A.

- Sientra, Inc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Implementing Strategic Roadmaps to Navigate Evolving Regulatory Technological and Consumer Trends for Sustainable Market Advantage

To capitalize on emerging opportunities, industry leaders should prioritize a multi-pronged strategy that aligns innovation with operational agility. First, investing in AI-driven customization platforms will enable providers to deliver predictive and outcome-based therapies, enhancing patient satisfaction and strengthening brand differentiation. Concurrently, diversifying the supply chain through local manufacturing partnerships and alternate sourcing for critical components will mitigate tariff-driven cost pressures and reduce lead-time volatility.

Next, fostering cross-disciplinary collaborations between aesthetic dermatology practices, medical day spas, and plastic surgery clinics can unlock new patient segments by bundling complementary treatment protocols-ranging from minimally invasive injectables to non-invasive contouring devices. Incorporating wearable and portable modalities into service offerings will also support patient adherence and generate valuable real-world data to refine treatment algorithms. Moreover, tailoring marketing and product development efforts to generational and gender-specific preferences ensures relevancy across diverse patient demographics, from Baby Boomers seeking subtle rejuvenation to Gen Z embracing at-home maintenance kits.

Finally, maintaining proactive engagement with key regulatory bodies and professional societies will facilitate smoother product approvals and elevate practice standards. By balancing these strategic imperatives, industry leaders can build resilient business models that thrive amid evolving market dynamics and regulatory landscapes.

Employing Rigorous Data Collection Analytical Frameworks and Expert Validation to Ensure Comprehensive Market Intelligence and Credibility

This research employs a rigorous, hybrid methodology that integrates primary interviews with aesthetic dermatologists plastic surgeons device manufacturers and regulatory experts alongside secondary data from peer-reviewed journals industry whitepapers and trade publications. Quantitative data on device shipments treatment adoption rates and tariff classifications were corroborated through public customs databases and proprietary industry surveys, ensuring accuracy in capturing trade-driven cost dynamics.

Qualitative insights were derived from in-depth consultations with clinical advisory boards, technology partners, and end-user focus groups, providing nuanced perspectives on treatment preferences and emerging modality adoption. Segmentation frameworks were validated through stakeholder workshops to align on product type definitions application area categorizations and patient demographic nuances. Additionally, device modality typologies, including AI integration and wearable technologies, were mapped against regulatory approval timelines and reimbursement landscapes.

Throughout the process, data triangulation and iterative expert reviews were conducted to enhance credibility and minimize bias. This comprehensive approach delivers a holistic view of the medical aesthetics ecosystem, offering decision-makers robust, actionable insights that are grounded in both quantitative metrics and practitioner expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Aesthetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Aesthetics Market, by Procedure Type

- Medical Aesthetics Market, by Product Type

- Medical Aesthetics Market, by Device Modality

- Medical Aesthetics Market, by Gender

- Medical Aesthetics Market, by Application Area

- Medical Aesthetics Market, by End-User

- Medical Aesthetics Market, by Region

- Medical Aesthetics Market, by Group

- Medical Aesthetics Market, by Country

- United States Medical Aesthetics Market

- China Medical Aesthetics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Market Insights to Highlight Critical Trends Emerging Opportunities and Strategic Imperatives for Stakeholder Success

The U.S. medical aesthetics market stands at a pivotal juncture, where technological innovation, evolving consumer expectations, and regulatory changes converge to shape future trajectories. Key themes-such as AI-driven customization, diversified supply chains, and cross-disciplinary service integration-underscore the imperative for stakeholders to adapt strategically. Meanwhile, regional variations and tariff impacts emphasize the need for geographically nuanced approaches and resilient procurement frameworks.

Segmentation analysis reveals that success will hinge on the ability to deliver tailored experiences across a broad spectrum of product types, application areas, and patient demographics. Leading companies are those that marry cutting-edge formulations and devices with holistic treatment protocols, delivering measurable outcomes while optimizing operational efficiency. Simultaneously, providers that cultivate partnerships across the beauty, dermatology, and surgical domains will unlock synergies that drive both patient acquisition and retention.

Looking ahead, the industry’s evolution will be guided by continuous innovation in device modalities, deeper integration of data analytics, and responsive regulatory strategies. By embracing these imperatives and leveraging comprehensive market intelligence, stakeholders can position themselves to capitalize on growth opportunities and navigate emerging challenges with confidence.

Seize Advanced Market Research Opportunities by Partnering with Our Expert To Unlock Strategic Insights and Drive Informed Decision Making

Engaging with this comprehensive market research report unlocks unparalleled strategic insights and competitive intelligence tailored to your organization’s unique needs. By collaborating directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, you will gain personalized guidance on leveraging these findings to optimize product portfolios, refine go-to-market approaches, and navigate evolving regulatory landscapes. Reach out today to discuss customized data packages, deeper regional analyses, or bespoke workshops designed to translate research into actionable growth opportunities. Position your business at the forefront of innovation by partnering with our expert to secure the intelligence necessary for confident decision-making and sustained market leadership.

- How big is the Medical Aesthetics Market?

- What is the Medical Aesthetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?