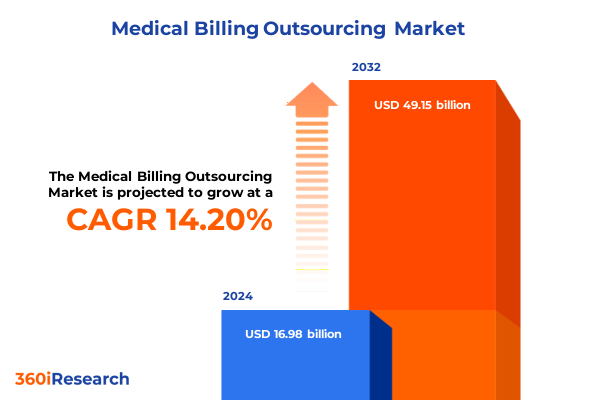

The Medical Billing Outsourcing Market size was estimated at USD 15.75 billion in 2025 and expected to reach USD 16.73 billion in 2026, at a CAGR of 7.26% to reach USD 25.73 billion by 2032.

Shaping Healthcare Financial Excellence through Strategic Medical Billing Innovations Elevating Operational Efficiency and Patient Experience

Healthcare providers today confront an increasingly complex matrix of administrative burdens, billing regulations, and revenue cycle demands that threaten both operational stability and patient care quality. In this dynamic environment, outsourcing medical billing has evolved beyond a mere cost-containment strategy into a critical enabler of streamlined financial management and enhanced patient engagement. As hospitals, ambulatory surgical centers, and private practices strive to reconcile escalating compliance requirements with the imperative to reduce claim denials, strategic partnerships with specialized billing entities emerge as a central pillar of sustainable growth.

Against this backdrop, this executive summary provides a concise yet comprehensive overview of the transformative trends shaping the medical billing outsourcing market. By examining the shifting contours of service delivery models, technological integration, and market segmentation, this section sets the stage for deeper understanding of tariff impacts and regional nuances. Through a synthesis of qualitative expertise and quantitative analysis, decision-makers will gain clarity on key drivers, segmentation insights, and actionable strategies that can be tailored to diverse healthcare settings.

Furthermore, the infusion of advanced automation, artificial intelligence, and cloud-based platforms into billing workflows has ushered in unprecedented efficiency gains and accuracy improvements. This technological shift not only accelerates claim processing but also empowers providers with real-time analytics to anticipate and resolve revenue cycle bottlenecks. As the sector continues to embrace digital transformation, the role of outsourcing partners extends to delivering bespoke technology stacks and compliance advisory services, reflecting a holistic approach to revenue integrity.

Navigating Paradigm Shifts Impacting Medical Billing Ecosystems with Technology Integration Compliance Adaptation and Workforce Evolution Strategies

Medical billing outsourcing is undergoing a remarkable metamorphosis, driven by the convergence of regulatory complexity, digital innovation, and evolving care delivery models. The proliferation of value-based care frameworks has compelled providers and their outsourcing partners to shift focus from volume-driven claims submission toward outcomes-oriented revenue cycle management. Consequently, service portfolios are expanding to encompass end-to-end solutions that integrate denial management, patient billing support, and predictive analytics into a cohesive financial ecosystem.

Simultaneously, regulatory headwinds such as the No Surprises Act and increasingly granular coding standards demand swift adaptation. Organizations that once relied on manual processes are now gravitating toward robotic process automation and artificial intelligence to ensure coding accuracy, optimize claim adjudication, and reduce compliance risks. This technological acceleration is complemented by talent models that leverage remote and hybrid frameworks, enabling specialized billing teams to operate with greater flexibility and resilience.

Moreover, the emergence of strategic alliances between traditional business process outsourcers and innovative technology vendors reflects a broader ecosystem realignment. By combining deep domain expertise with scalable cloud infrastructures, such partnerships are unlocking new opportunities for real-time revenue insights, seamless interoperability with electronic health record systems, and agile response to market fluctuations. These transformative shifts underscore a future where holistic financial management is defined by collaboration, data-driven decision-making, and continuous process refinement.

Assessing the Ripple Effects of Recent Tariff Policies on Medical Billing Outsourcing Cost Structures Regulatory Compliance and Competitive Positioning

Recent trade policy adjustments in 2025 have introduced a new dimension of cost considerations for medical billing outsourcing operations. While services themselves remain largely tariff-exempt, the ancillary impact on hardware procurement, cloud infrastructure deployment, and cross-border data center management has begun to influence total cost of ownership. Outsourcing firms that rely on imported servers, specialized networking equipment, and third-party coding software have encountered upward pricing pressure, prompting repricing of nearshore and offshore service packages.

Beyond immediate cost adjustments, these trade measures have spurred a reconfiguration of data hosting architectures. Several providers have evaluated onshore expansion strategies to mitigate exposure to additional duties on imported components, resulting in a gradual shift toward domestic data warehouses and private cloud environments. This reorientation, however, carries its own set of compliance and operational challenges, including higher labor rates and the need for expanded local support teams.

In response, leading outsourcing partners are recalibrating their pricing models and service level agreements to balance cost recovery with competitive positioning. By adopting flexible deployment options-spanning onshore, nearshore, and offshore modalities-and renegotiating vendor contracts for hardware and software licensing, these firms are working to preserve margin stability while maintaining service excellence. As tariffs continue to evolve, organizational readiness and strategic procurement will be key determinants of resilience in the medical billing outsourcing market.

Unlocking Deep Segmentation Insights to Shape Customized Medical Billing Services across Diverse Service Types End User Categories Deployment Modes and Pricing

The medical billing outsourcing market can be understood through a multi-layered segmentation framework that illuminates unique client needs and service delivery imperatives. Based on service type, clients can access dedicated medical billing services encompassing claims submission, denial management, patient billing support, and payment posting. Parallel to this, medical coding services focus on CPT coding, HCPCS coding, and ICD coding, ensuring precise documentation, while revenue cycle management offerings extend into AR follow-up and insurance verification.

When considering end users, the market serves ambulatory surgical centers-both freestanding and hospital-affiliated facilities-academic, general, and specialty hospitals, as well as private practice environments including multi-specialty and single specialty clinics. These diverse care settings demand adaptable workflows that align with internal billing teams and technology stacks. Deployment mode further differentiates offerings, with nearshore, offshore, and onshore models tailored to provider priorities around cost, compliance, and proximity.

Service provider types range from traditional BPOs and knowledge process outsourcing firms to IT vendors and specialized billing agencies, each bringing distinct strengths in scalability, technical integration, or niche expertise. Pricing models encompass fixed fee arrangements, subscription-based structures, and transaction-based agreements, providing the flexibility to synchronize costs with revenue cycle performance. Additionally, application platforms span cloud-based solutions-including private and public clouds-hospital information systems, on-premise deployments with licensed or perpetual models, and comprehensive practice management systems.

This comprehensive research report categorizes the Medical Billing Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Mode

- Pricing Model

- End User

- Application

Exploring Regional Dynamics Shaping Medical Billing Outsourcing Trends across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a profound influence on the trajectory of medical billing outsourcing growth and strategic adoption rates. In the Americas, market maturity is characterized by stringent regulatory frameworks, sophisticated payer ecosystems, and a heightened focus on value-based care initiatives. This environment has catalyzed demand for advanced analytics dashboards, denial avoidance protocols, and patient engagement platforms, with U.S. providers leading the charge in comprehensive outsourcing partnerships.

Conversely, Europe, the Middle East, and Africa present a heterogeneous landscape where GDPR compliance, cross-border data privacy considerations, and disparate reimbursement models shape service design. Providers operating in these territories are investing in localized compliance expertise, multi-language coding teams, and hybrid deployment architectures to accommodate both centralized billing hubs and decentralized care networks.

In Asia-Pacific, cost arbitrage and expanding healthcare access drive rapid outsourcing uptake. Emerging economies leverage robust talent pools in India, the Philippines, and Southeast Asia to manage high-volume claim processing and coding services. At the same time, regional players are ascending as competitive threats, deploying next-generation automation and specialized expertise to capture market share. Across each region, providers and payers alike must adapt their strategies to local regulatory climates, technology infrastructure availability, and evolving patient expectations.

This comprehensive research report examines key regions that drive the evolution of the Medical Billing Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Strengths of Leading Medical Billing Outsourcing Providers Shaping the Industry’s Technological Advancement

A review of prominent service providers highlights a competitive field defined by technological investment, strategic partnerships, and value-added service expansion. Leading firms have integrated artificial intelligence into coding workflows to reduce error rates and accelerate submission cycles, while others have forged alliances with electronic health record vendors to deliver seamless interoperability and unified reporting interfaces. Several organizations are deepening their consulting practices, advising clients on revenue integrity assessments, denial prevention strategies, and payer mix optimization.

In parallel, a subset of specialized billing agencies has emerged with a focus on niche therapeutic areas, leveraging coders with advanced clinical backgrounds to navigate complex cases in oncology, orthopedics, and mental health. This specialization underscores a broader trend toward vertical integration, where service providers position themselves as domain experts rather than pure transaction processors. Technology incumbents and newer entrants alike are differentiating through cloud-native platforms, real-time performance analytics, and customizable workflow engines that cater to the nuanced billing requirements of diverse care settings.

As competitive pressures intensify, successful vendors balance scale economies with specialized capabilities, ensuring that their service portfolios can evolve in step with regulatory updates, payer program changes, and shifting provider priorities. Those that excel will continue to invest in talent development, strategic technology roadmaps, and client-centric service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Billing Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGS Health Services Private Limited

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- Change Healthcare LLC

- Ciox Health, LLC

- Conifer Health Solutions, LLC

- GeBBS Healthcare Solutions, Inc.

- Genpact Limited

- HCL Technologies Limited

- Infosys Limited

- Optum360, LLC

- Oracle Cerner Corporation

- R1 RCM Inc.

- Wipro Limited

Formulating Actionable Strategies for Leaders to Accelerate Growth Enhance Compliance and Leverage Emerging Technologies in Medical Billing Outsourcing

To thrive in the evolving medical billing outsourcing landscape, industry leaders should prioritize a proactive alignment of technology, processes, and compliance. First, investing in artificial intelligence and robotic process automation can expedite claim adjudication, minimize coding inaccuracies, and free up human capital for complex exception management. Complementing this, leaders must deepen partnerships with platform providers to ensure seamless data exchange with electronic health record systems and payer interfaces.

Second, strengthening compliance frameworks through regular audits and targeted training programs will mitigate risks associated with coding denials, regulatory penalties, and data privacy breaches. Building a cross-functional center of excellence that brings together coding specialists, compliance officers, and data analysts can foster a continuous improvement culture and enable rapid response to policy shifts such as coding guideline updates or tariff adjustments.

Finally, embracing flexible deployment strategies-leveraging a calibrated mix of onshore, nearshore, and offshore resources-will optimize cost synergies while maintaining service quality. Coupled with adaptable pricing structures that tie fees to key performance indicators, these approaches position organizations to withstand economic fluctuations and competitive pressures. By implementing these recommendations, leaders can fortify their revenue cycles, enhance patient satisfaction, and secure sustainable growth in a dynamic market.

Employing Robust Research Methodology Leaning on Expert Qualitative Insights and Comprehensive Quantitative Data Analysis for Medical Billing Market Clarity

The research methodology underpinning this report integrates both qualitative and quantitative techniques for a robust market assessment. Secondary research commenced with an exhaustive review of industry literature, regulatory filings, and financial disclosures to map macroeconomic factors, trade policy changes, and technology adoption trends. This desk-based analysis provided a foundational context for identifying key market segments and competitive landscapes.

Primary research involved in-depth interviews with senior executives, domain experts, and operational leaders from healthcare providers, outsourcing firms, and technology vendors. These discussions yielded nuanced perspectives on service delivery challenges, client priorities, and innovation roadmaps. Quantitative data was subsequently validated through statistical modeling, triangulating insights from proprietary databases, public financial data, and third-party analytics.

Finally, the findings were subjected to a multi-stage verification process involving peer review by independent advisors and cross-comparison against historical benchmarks. This systematic approach ensures that the conclusions drawn and recommendations proposed are both data-driven and grounded in real-world practice, offering stakeholders a high-integrity resource for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Billing Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Billing Outsourcing Market, by Service Type

- Medical Billing Outsourcing Market, by Deployment Mode

- Medical Billing Outsourcing Market, by Pricing Model

- Medical Billing Outsourcing Market, by End User

- Medical Billing Outsourcing Market, by Application

- Medical Billing Outsourcing Market, by Region

- Medical Billing Outsourcing Market, by Group

- Medical Billing Outsourcing Market, by Country

- United States Medical Billing Outsourcing Market

- China Medical Billing Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Delivering Transformative Healthcare Finance Results through Strategic Medical Billing Approaches Informed by Data Trends Segmentation and Regulatory Insights

By synthesizing emerging trends in technology, regulation, and market segmentation, this report underscores the imperative for healthcare organizations to adopt strategic outsourcing models that deliver both financial resilience and operational agility. Advanced automation, intelligent coding tools, and holistic revenue cycle management frameworks are redefining the scope of partnering arrangements, shifting the focus from transactional processing toward collaborative, value-driven engagements.

Market segmentation insights reveal that success hinges on understanding the unique billing requirements of diverse care settings-from freestanding and hospital-affiliated surgical centers to specialty hospitals and single specialty practices. Likewise, deployment flexibility and pricing models that align supplier incentives with provider performance are essential for sustaining competitive differentiation.

As trade policies and geopolitical dynamics continue to influence cost structures, industry participants must remain vigilant, refining procurement strategies and enhancing compliance capabilities. Ultimately, the most resilient organizations will be those that seamlessly blend technological innovation with deep domain expertise, forging partnerships that drive continuous improvement and long-term financial health.

Elevate Your Strategic Decisions by Securing the Comprehensive Medical Billing Outsourcing Report with Support from Expert Associate Director Ketan Rohom

If you are ready to equip your organization with the strategic insights and detailed market intelligence necessary to transform your financial operations, reach out to Associate Director, Sales & Marketing Ketan Rohom to secure your copy of the comprehensive medical billing outsourcing market research report. Ketan Rohom will provide you with personalized guidance on licensing options, answer any questions about data scope, and discuss how the findings can be aligned with your organization’s unique requirements. Whether you represent a hospital network, an ambulatory surgical center, or a private practice group, this report offers a wealth of actionable intelligence that can inform decisions at the boardroom level and drive sustained revenue cycle excellence. Engage directly with Ketan Rohom today to explore special bundle offers, in-depth briefing sessions, and priority access to updates that will keep you ahead of evolving market dynamics and competitive challenges.

- How big is the Medical Billing Outsourcing Market?

- What is the Medical Billing Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?