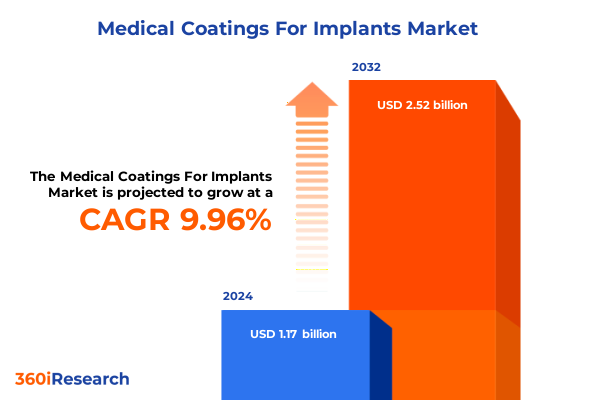

The Medical Coatings For Implants Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.41 billion in 2026, at a CAGR of 10.05% to reach USD 2.52 billion by 2032.

Unveiling the Critical Role of Advanced Medical Coating Innovations in Enhancing Implant Performance Patient Safety and Long-Term Healthcare Outcomes

The evolution of medical implants has been intrinsically linked to the innovations in surface coatings that safeguard patient welfare and enhance device longevity. Over the past decade, coatings have evolved from simple barrier layers to multifunctional platforms that combat infection, promote tissue integration, and deliver therapeutic agents at the implant interface. By mitigating risks such as biofilm formation and adverse immune responses, these advanced solutions are redefining post-implantation outcomes and elevating standards of care across disciplines ranging from orthopedics to cardiovascular surgery.

Moreover, the intersection of materials science and biomedical engineering has produced a diverse palette of coating chemistries tailored to specific clinical challenges. Antimicrobial strategies harness silver-based and antibiotic-embedded formulations to address the persistent threat of surgical-site infections, while bioactive compositions based on calcium phosphate and hydroxyapatite foster osteointegration in load-bearing applications. Concurrently, drug-eluting approaches are emerging as a means to provide localized anticoagulant and antimicrobial therapy, reducing systemic side effects and improving patient compliance.

As the healthcare landscape grows ever more complex, stakeholders require a nuanced understanding of how these technologies converge with regulatory frameworks, supply chain dynamics, and market demands. This executive summary offers a holistic overview of the key drivers, challenges, and strategic imperatives that will shape the trajectory of medical coatings for implantable devices, enabling decision-makers to navigate this rapidly advancing domain with clarity and confidence.

Mapping the Key Technological Disruptions Supply Chain Evolutions and Regulatory Reforms Redefining the Future of Medical Coatings for Implantable Devices

The medical coatings arena is currently experiencing a wave of transformative shifts that extend well beyond incremental refinements. At the heart of this transition lies the advent of nanocoating techniques, such as layered nanocoating and sol-gel nanocoating, which enable unprecedented control over surface topography and functional group presentation. These approaches are coupled with plasma spraying variations, including thermal and cold spray processes, that permit the deposition of bioactive ceramics alongside metals and polymers, significantly broadening the application spectrum for both load-bearing and soft tissue implants.

Simultaneously, supply chains are being reengineered to emphasize regional resilience and vertical integration, as manufacturers seek to shorten lead times and mitigate dependencies on single-source suppliers. Electrochemical deposition methods, including electrodeposition and electrophoretic techniques, are being optimized through agile manufacturing principles, while atomic layer deposition offers a layer-by-layer precision that aligns with emerging regulatory expectations for traceability and quality control. These technological evolutions are catalyzed by intensified collaboration among academic institutions, contract development organizations, and implant producers, fostering an ecosystem in which knowledge-sharing accelerates time to market.

From a regulatory standpoint, authorities are revising guidance to accommodate combination products and co-engineered interfaces, incentivizing developers to pursue coatings that demonstrate clear clinical benefits. As a result, stakeholders must adapt to evolving standards around biocompatibility testing, accelerated approval pathways, and post-market surveillance. Taken together, these technological disruptions, supply chain realignments, and regulatory reforms are fundamentally redefining how medical coatings are conceived, developed, and deployed across the implant lifecycle.

Assessing the Cumulative Effects of United States 2025 Import Tariffs on Supply Dynamics Manufacturing Costs and Strategic Sourcing in Medical Coating Markets

The implementation of 2025 import tariffs by the United States has introduced a complex layer of cost considerations and strategic recalibrations for medical coating manufacturers. By imposing additional duties on key raw materials and intermediate components sourced through major trade corridors, these measures have elevated the urgency to reassess global procurement strategies. Consequently, firms are prioritizing alternative sourcing hubs and enhancing inventory buffering to shield production schedules from volatility in raw material pricing.

Furthermore, the tariff landscape has prompted a resurgence of domestic manufacturing initiatives, with several specialized coating producers investing in localized capacity expansions. These onshore efforts not only address import cost pressures but also align with broader policy incentives for reshoring critical healthcare supply chains. While initial capital outlays for facility upgrades and qualification processes have introduced short-term financial strain, the long-term payoff manifests in more transparent cost structures and improved responsiveness to fluctuating demand across implant applications.

In parallel, downstream partners, including contract applicators and implant OEMs, are adapting their commercial models to navigate the altered cost base. Collaborative agreements and value-sharing frameworks are emerging, enabling stakeholders to distribute the burden of additional tariffs while preserving competitive pricing. As industry participants digest the cumulative effects of the 2025 tariffs, those who proactively integrate tariff forecasting into their strategic planning are positioned to maintain supply continuity and drive margin resilience amid an evolving trade environment.

Uncovering Critical Segmentation Insights Across Diverse Coating Types Implants Materials Applications and Emerging Technologies Shaping Market Dynamics

A nuanced understanding of market segmentation is essential for identifying high-impact opportunities and tailoring value propositions. When examining coating types, companies must recognize the differentiated performance attributes of antimicrobial solutions, which encompass both antibiotic-embedded and silver-based variants, alongside bioactive formulations leveraging calcium phosphate and hydroxyapatite chemistries. Meanwhile, ceramic coatings such as alumina and zirconia deliver superior wear resistance for joint replacement devices, in contrast with drug-eluting platforms that offer localized antibiotic- or anticoagulant-release profiles. Metallic nitrides, including titanium and zirconium options, provide a versatile interface for cardiovascular stents, whereas natural and synthetic polymers facilitate flexibility in spinal and neurological implants.

Implant type segmentation further refines strategic focus by aligning coating functionalities with clinical demands. In cardiovascular applications, surface treatments that reduce thrombogenicity and platelet adhesion are paramount, whereas dental implants benefit from bioactive compositions that promote osseointegration and soft tissue adhesion. Neurological devices demand ultrathin conformal layers to preserve electrode sensitivity, while orthopedic and spinal implants leverage both mechanical reinforcement and localized drug delivery to enhance postoperative recovery.

Material composition also drives selective adoption, as manufacturers choose between ceramic, composite, metal, and polymer substrates based on implant biomechanics and longevity requirements. Composite systems, differentiated by fiber-reinforced or particulate reinforcements, are gaining traction in complex reconstructive procedures. Application-focused segmentation-spanning bone screws, cardiac valves, joint replacements, plates, and stents-further informs prioritization, with each use case demanding bespoke surface engineering. Technology-based clustering, from electrodeposition and atomic layer deposition through layered nanocoating and cold spray techniques, underscores the importance of matching deposition methodologies to performance specifications and production throughput targets.

This comprehensive research report categorizes the Medical Coatings For Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Implant Type

- Material Composition

- Technology

- End User

Comparative Regional Perspectives Highlighting Unique Opportunities and Challenges Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a profound influence on the trajectory of medical coatings innovation and adoption. In the Americas, established healthcare infrastructure and a robust manufacturing base create fertile ground for high-value antimicrobial and drug-eluting coatings. Policy frameworks that incentivize domestic production have catalyzed investment in second-generation nanocoating facilities, while collaborative ecosystems spanning leading research universities and contract coating services drive applied research and commercialization.

Across Europe, the Middle East, and Africa, the market is characterized by a dual trend of regulatory harmonization and localized capacity building. European Union medical device regulations have raised the bar for biocompatibility and post-market monitoring, prompting suppliers to refine quality management systems and align validation protocols. Concurrently, strategic partnerships in the Middle East and North Africa are fostering transfer of coating expertise, enabling regional OEMs to accelerate product launches tailored to local patient demographics and environmental conditions.

In Asia Pacific, rapid expansion of elective procedures and rising healthcare expenditure are fueling demand for innovative surface solutions. Market participants are leveraging lower-cost manufacturing clusters in Southeast Asia and India to scale production of ceramic and polymer-based coatings. At the same time, emerging hubs in East Asia are investing heavily in advanced coating equipment and training programs to service a growing network of implant developers. Taken together, these regional profiles reveal a mosaic of opportunity and challenge that stakeholders must navigate through targeted strategies and strategic alliances.

This comprehensive research report examines key regions that drive the evolution of the Medical Coatings For Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives Partnerships and Innovation Pipelines Among Leading Medical Coating Providers Driving Competitive Differentiation

Leading medical coating providers are distinguishing themselves through strategic partnerships, targeted investment in next-generation technologies, and the cultivation of integrated solution offerings. Key industry actors have forged alliances with universities and contract manufacturing organizations to accelerate development of multifunctional coatings that combine antimicrobial, bioactive, and drug-eluting capabilities on a single implant. Such collaborations not only expand the innovation pipeline but also facilitate shared access to advanced characterization tools and clinical validation networks.

In addition, several companies have diversified their portfolios through acquisition of specialized niche players, enhancing their ability to offer end-to-end coating services. These transactions are complemented by investments in in-house R&D centers focused on emerging deposition methods, including plasma spraying variations and atomic layer deposition for ultra-thin conformal layers. By integrating intellectual property portfolios related to nanocoating processes and novel biopolymer formulations, leading providers are positioning themselves as vital partners for OEMs seeking comprehensive surface engineering solutions.

Moreover, an increasing number of coating manufacturers are establishing direct customer engagement platforms, offering digital portals for real-time process monitoring, quality assurance data, and collaborative project management. This integration of digital capabilities with traditional coating expertise enhances transparency, reduces time to market, and fosters deeper customer relationships. As competition intensifies, providers that deliver both technical excellence and seamless user experiences are set to capture the greatest share of emerging implant surface opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Coatings For Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aap Implantate AG

- AST Products, Inc.

- Biocoat, Inc.

- BioInteractions Limited

- Covalon Technologies Ltd.

- Danaher Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Harland Medical Systems, Inc.

- IHI Ionbond AG

- Johnson & Johnson

- Johnson & Johnson Services, Inc.

- Koninklijke DSM N.V.

- Medtronic plc

- Precision Coating Co., Inc.

- Sciessent LLC

- Smith & Nephew plc

- Stryker Corporation

- Surface Solutions Group, Ltd.

- SurModics, Inc.

- Thermal Spray Technologies, Inc.

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Roadmap for Industry Leaders to Capitalize on Technological Advances Regulatory Trends and Supply Chain Resilience in Medical Coatings

Industry leaders must adopt a proactive stance to capture value from the complex interplay of innovation, regulation, and supply chain pressures in the medical coatings sector. A strategic roadmap should begin with increased allocation of R&D resources toward nanocoating technologies, given their capacity to deliver multifunctional surfaces with minimal thickness and high precision. Simultaneously, firms should diversify their supply networks by qualifying alternative raw material suppliers in geopolitically stable regions, thereby mitigating risks associated with import tariffs and transportation disruptions.

Equally important is the development of collaborative frameworks with regulatory bodies to co-create guidance pathways for combination products. By engaging early in dialogue around validation protocols and clinical endpoints, manufacturers can streamline approval processes and reduce time to market. Partnerships with leading academic institutions and clinical centers will further support robust post-market surveillance programs and strengthen evidence generation for value-based contracting.

To reinforce competitive positioning, organizations should explore integrated digital platforms that connect R&D, manufacturing, and quality teams, enabling real-time analytics and predictive maintenance for coating equipment. Such digital integration will enhance throughput, reduce waste, and support compliance with evolving data integrity requirements. Ultimately, companies that align technological investment, supply chain resilience, and regulatory collaboration will be best positioned to thrive in a rapidly advancing medical coatings landscape.

Transparent Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis and Rigorous Validation Processes Ensuring Analytical Robustness

The insights presented in this summary are grounded in a rigorous, transparent methodology designed to ensure analytical validity and practical relevance. Primary research involved in-depth interviews with a cross-section of stakeholders, including implant OEM decision-makers, surface engineering specialists, regulatory affairs experts, and clinical key opinion leaders. This direct engagement yielded nuanced perspectives on performance criteria, validation challenges, and emerging application areas.

Complementing the primary findings, secondary data analysis drew upon peer-reviewed literature, publicly available regulatory filings, and patent landscapes to map technology trajectories and identify competitive benchmarks. Technical white papers and conference proceedings were reviewed to capture the latest advances in deposition techniques, material science innovations, and biocompatibility testing protocols. All secondary sources were critically appraised for methodological rigor and relevance to the medical coatings domain.

Finally, a multi-tiered validation process was implemented, encompassing cross-verification of insights through stakeholder workshops and iterative feedback loops. Quantitative and qualitative data points were triangulated to ensure consistency, while key assumptions and trend extrapolations were stress-tested under varying regulatory and supply chain scenarios. This comprehensive approach guarantees a robust foundation for strategic decision-making in the development and commercialization of advanced medical coating solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Coatings For Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Coatings For Implants Market, by Coating Type

- Medical Coatings For Implants Market, by Implant Type

- Medical Coatings For Implants Market, by Material Composition

- Medical Coatings For Implants Market, by Technology

- Medical Coatings For Implants Market, by End User

- Medical Coatings For Implants Market, by Region

- Medical Coatings For Implants Market, by Group

- Medical Coatings For Implants Market, by Country

- United States Medical Coatings For Implants Market

- China Medical Coatings For Implants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights and Strategic Imperatives that Define the Trajectory of Medical Coating Innovations for Implants in an Evolving Healthcare Landscape

The convergence of material science breakthroughs, advanced deposition technologies, and dynamic regulatory landscapes is setting a new standard for implant surface engineering. Multifunctional coatings that incorporate antimicrobial, bioactive, and drug-eluting attributes are no longer aspirational but are rapidly becoming baseline expectations in high-stakes clinical applications. Moreover, the ripple effects of supply chain realignment and tariff-induced cost pressures are accelerating the shift toward localized manufacturing and vertically integrated operations.

Strategic segmentation underlines that success will hinge on the ability to match coating functionalities with specific implant requirements-whether reducing thrombogenicity in cardiovascular stents, promoting osseointegration in orthopedic devices, or preserving electrode sensitivity in neurological interfaces. Regional nuances further underscore the importance of adapting strategies to varying regulatory regimes, healthcare delivery models, and investment climates. Meanwhile, leading providers are differentiating through partnerships, digital integration, and sustained IP development.

Looking ahead, the organizations that will thrive are those that blend technological agility with collaborative regulatory engagement and resilient supply networks. By embracing an end-to-end view-from early-stage innovation through post-market performance monitoring-industry participants can drive meaningful improvements in patient outcomes while securing a competitive edge. The strategic imperatives illuminated in this report will serve as a guiding framework for navigating the complexities of the medical coatings landscape and capturing the most impactful growth opportunities.

Take Decisive Action Today to Unlock Comprehensive Strategic Insights and Customized Support for Medical Coating Innovations by Connecting with Ketan Rohom

Engaging proactively with a knowledgeable authority can be the catalyst that transforms strategic insights into measurable outcomes. I encourage you to connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored solutions that align with your organization’s goals and challenges. By initiating a conversation with Ketan Rohom, you gain direct access to in-depth expertise on advanced coating technologies, emerging regulatory requirements, and optimized sourcing strategies that can accelerate your innovation pipeline. Collaborating closely will enable you to secure customized guidance on leveraging the full suite of research findings, from segmentation nuances to regional growth levers.

Whether your priority lies in refining antimicrobial strategies, optimizing nanocoating applications, or mitigating the impact of evolving import tariffs, taking this step now ensures you harness the most actionable intelligence without delay. Reach out today to arrange a consultative briefing, where you can evaluate specific recommendations in the context of your existing projects and long-term objectives. Partnering with Ketan Rohom will empower your team to make data-driven decisions with confidence, enhancing both operational resilience and competitive positioning. Don’t miss this opportunity to translate comprehensive market insight into strategic advantage-initiate your inquiry and chart a path toward sustained leadership in the medical coatings landscape.

- How big is the Medical Coatings For Implants Market?

- What is the Medical Coatings For Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?