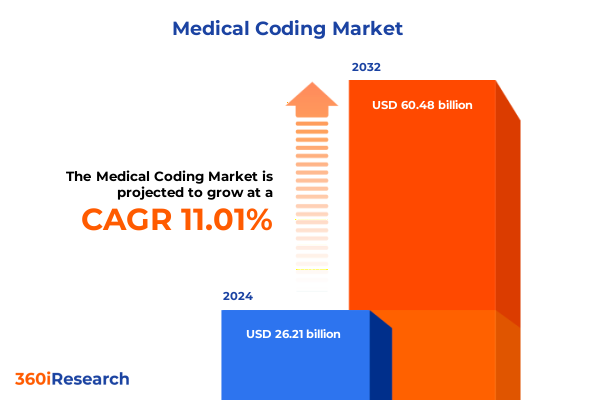

The Medical Coding Market size was estimated at USD 29.08 billion in 2025 and expected to reach USD 31.99 billion in 2026, at a CAGR of 11.02% to reach USD 60.48 billion by 2032.

Exploring the Evolving Role of Medical Coding Practices and Their Critical Importance in Streamlining Modern Healthcare Delivery Systems

The medical coding sector has emerged as a foundational pillar within healthcare operations, driving the precision and integrity of clinical documentation and billing processes. As healthcare providers worldwide increasingly prioritize accurate reimbursement, compliance, and streamlined administrative workflows, the role of coding professionals and the technologies they leverage have expanded in both complexity and criticality. This evolution has been propelled by advancing electronic health record systems, heightened regulatory scrutiny, and the digital transformation imperative, which together have reshaped the demands placed on coding methodologies.

Moreover, the integration of novel software platforms and services has begun to redefine how coding tasks are executed and managed. Stakeholders across the ecosystem now recognize that robust coding practices not only mitigate compliance risks but also enhance revenue cycle efficiency and data integrity. Consequently, organizations are investing in scalable solutions and specialized expertise to address the multifaceted challenges of accuracy, interoperability, and evolving code sets. In this context, an in-depth understanding of prevailing trends, regulatory pressures, and technological advancements is essential for stakeholders seeking to optimize operational workflows and bolster financial performance.

Identifying Pivotal Technological Innovations and Regulatory Reforms That Are Dramatically Reshaping the Global Medical Coding Landscape

The medical coding landscape is undergoing a series of transformative shifts, underpinned by rapid technological advancements and significant regulatory reforms. Artificial intelligence and machine learning-driven coding engines are now capable of interpreting complex clinical narratives, accelerating coding accuracy, and reducing manual intervention. These intelligent systems increasingly leverage natural language processing to extract pertinent details from unstructured clinical notes, thereby improving the consistency and speed of code assignment. At the same time, the widespread adoption of interoperable electronic health record platforms is facilitating seamless data exchange across healthcare networks, enabling more cohesive and efficient coding workflows.

In parallel, the transition from ICD-10 to the next generation of coding standards has compelled organizations to reassess their processes and invest in targeted training initiatives. As regulatory bodies refine guidelines and introduce new compliance requirements, coding teams are challenged to maintain up-to-date knowledge and adapt swiftly. Additionally, the rise of telehealth services has introduced novel coding considerations, necessitating new code sets and billing protocols to accurately capture remote care encounters. Taken together, these technological and regulatory shifts are driving a paradigm in which medical coding is no longer a back-office function but a strategic enabler of financial stability and clinical quality.

Assessing the Multifaceted Effects of 2025 United States Tariffs on the Medical Coding Industry's Value Chain, Costs and Provider Operations

In 2025, the imposition of updated tariffs by the United States government on imported healthcare software solutions and related technologies has had a ripple effect throughout the medical coding industry. The increased levies on cloud infrastructure components, coding software licenses, and auxiliary hardware have elevated the total cost of ownership for healthcare providers that rely on international vendors. As a result, many organizations have initiated a thorough reassessment of their vendor portfolios and contract structures to mitigate budgetary pressures while maintaining access to cutting-edge solutions.

This recalibration has prompted a growing emphasis on domestic partnerships and in-house development capabilities. Technology vendors and service providers are responding by expanding their U.S.-based data centers, establishing local support teams, and adjusting pricing models to absorb a portion of the tariff-related expenses. Meanwhile, healthcare institutions are exploring hybrid sourcing strategies that blend onshore and offshore resources, seeking to balance cost-efficiency with compliance imperatives. Despite these challenges, the industry has demonstrated resilience; stakeholders are leveraging strategic procurement practices, alternative deployment modalities, and multi-vendor architectures to navigate the tariff landscape without compromising coding accuracy or operational continuity.

Uncovering Deep Insights Across Component Services Software Deployment Types and End User Dynamics Driving the Medical Coding Market

The segmentation of the medical coding market across components, deployment modes, and end users reveals nuanced patterns of adoption and service preferences. When examining components, services continue to play a pivotal role, spanning consulting engagements that guide organizational readiness, implementation projects that integrate specialized coding platforms, ongoing support and maintenance agreements that ensure system reliability, and comprehensive training and education programs that upskill coding professionals. Conversely, software solutions are evolving rapidly, with categories such as electronic health records serving as the central repository for patient data, dedicated medical coding software enhancing automation and decision support, practice management tools optimizing appointment and billing workflows, and revenue cycle management platforms providing end-to-end financial performance monitoring.

Turning to deployment mode, an increasing proportion of healthcare providers are embracing cloud-based environments, drawn by the flexibility, scalability, and reduced upfront capital requirements they offer. Nevertheless, some institutions with stringent data residency and compliance mandates continue to rely on on-premise installations, valuing the direct control over infrastructure and enhanced customization potential. Finally, within the end-user segment, the diversity of care settings-from ambulatory surgical centers that demand rapid coding turnarounds for outpatient procedures to clinics and physician practices focused on high-volume preventive care, as well as hospitals that manage intricate inpatient coding scenarios-highlights the critical need for adaptable, context-specific solutions.

This comprehensive research report categorizes the Medical Coding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User

Revealing Distinct Regional Dynamics and Strategic Growth Drivers Across the Americas Europe Middle East and Africa and Asia-Pacific Medical Coding Markets

Regional dynamics within the medical coding market present a tapestry of opportunities and challenges shaped by regulatory frameworks, healthcare infrastructure maturity, and technological readiness. In the Americas, the market is characterized by advanced electronic health record penetration and robust revenue cycle management practices, driven by stringent billing regulations and an emphasis on value-based care. This environment has fostered a demand for integrated coding platforms that support complex reimbursement models and seamless interoperability across provider networks.

By comparison, the Europe, Middle East and Africa region is navigating a diverse regulatory landscape, with some markets rapidly adopting international coding standards and others emphasizing locally tailored solutions. Government initiatives aimed at enhancing cross-border data sharing have accelerated interest in cloud-based coding services, while training programs are bridging skill gaps among coding professionals. Meanwhile, Asia-Pacific is witnessing rapid modernization of healthcare systems, underpinned by significant public and private investments in digital health infrastructure. Market players are forging strategic alliances to localize software capabilities, addressing language-specific coding requirements and compliance nuances unique to each jurisdiction.

This comprehensive research report examines key regions that drive the evolution of the Medical Coding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Strategies Partnerships and Innovation Highlights of Leading Players Shaping the Medical Coding Industry

Leading organizations in the medical coding domain are differentiating themselves through targeted partnerships, strategic acquisitions, and relentless innovation. Some prominent players have forged collaborations with major electronic health record vendors to embed advanced coding modules directly within clinical workflows, streamlining data handoffs and minimizing manual entry. Others have expanded their service portfolios through the acquisition of niche training firms, augmenting their ability to deliver customized educational content that addresses evolving code sets and regulatory shifts.

Innovation remains a key battleground, with companies investing heavily in artificial intelligence capabilities that enhance coding accuracy and reduce turnaround times. These investments are complemented by robust data analytics offerings that provide clients with actionable insights into coding patterns, denial reasons, and revenue recovery opportunities. Additionally, several market participants have established regional delivery centers to support local language requirements, regulatory compliance, and round-the-clock coding operations, thereby reinforcing their value propositions in an increasingly competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Coding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Access Healthcare

- AGS Health Pvt. Ltd.

- Allscripts Healthcare Solutions Inc.

- Aviacode Inc.

- Cerner Corporation

- Change Healthcare Holdings Inc.

- Conifer Health Solutions LLC

- Epic Systems Corporation

- ExlService Holdings Inc.

- GeBBS Healthcare Solutions

- Himagine Solutions Inc.

- Maxim Healthcare Services

- McKesson Corporation

- MiraMed Global Services Inc.

- MRA Health Information Services

- Omega Healthcare Management Services Pvt. Ltd.

- Optum Inc.

- Parexel International Corporation

- Precyse Solutions LLC

- Quest Diagnostics Inc.

- R1 RCM Inc.

- The SSI Group LLC

- VitreosHealth

Providing Targeted Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Competitive Differentiation Opportunities

To thrive amid ongoing disruption, industry leaders should prioritize the integration of advanced automation technologies alongside targeted workforce development initiatives. By investing in artificial intelligence and natural language processing tools that complement human expertise, organizations can achieve significant gains in accuracy and throughput while mitigating coder burnout. Furthermore, establishing continuous learning frameworks that incorporate scenario-based training and certification pathways will ensure coding teams remain proficient as standards evolve.

In addition, providers should adopt a flexible deployment approach, balancing the scalability of cloud-based solutions with the data governance benefits of on-premise environments. Strategic partnerships with technology vendors and domain specialists can accelerate time to value, while diversification of sourcing models will enhance resilience against supply chain shocks. Finally, maintaining proactive engagement with regulatory bodies and industry consortia will enable stakeholders to anticipate upcoming code set changes, shape policy discourse, and secure early access to pilot programs, thereby sustaining compliance and competitive differentiation.

Detailing the Rigorous Research Framework and Analytical Techniques Employed to Derive Comprehensive Medical Coding Market Insights

The research underpinning this report was conducted through a rigorous, multi-tiered process that combined quantitative data analysis with qualitative insights. Primary research consisted of interviews with a cross-section of industry stakeholders, including coding managers, healthcare IT executives, and regulatory experts. These conversations provided first-hand perspectives on market dynamics, implementation challenges, and future readiness priorities. Complementing this, extensive secondary research leveraged reputable academic research, trade publications, and publicly available regulatory documents to validate emerging trends and corroborate stakeholder viewpoints.

Analytical methodologies included trend mapping to identify technology adoption curves, competitive benchmarking to assess vendor positioning, and triangulation techniques to reconcile discrepancies between data sources. Moreover, a dedicated expert panel reviewed preliminary findings to ensure robustness and eliminate potential bias. Throughout the research process, strict quality controls were enforced, encompassing data validation protocols, consistency checks, and iterative feedback loops. This comprehensive methodology ensures that the insights presented are both reliable and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Coding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Coding Market, by Component

- Medical Coding Market, by Deployment Mode

- Medical Coding Market, by End User

- Medical Coding Market, by Region

- Medical Coding Market, by Group

- Medical Coding Market, by Country

- United States Medical Coding Market

- China Medical Coding Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Summarizing Core Findings and Reflecting on Future Pathways to Drive Efficiency Compliance and Growth in Medical Coding Ecosystems

The analysis presented herein encapsulates the pivotal trends, regional nuances, and strategic considerations that are shaping the future of the medical coding industry. Through careful examination of technological innovations, regulatory developments, and market segmentation dynamics, stakeholders can appreciate the multifaceted drivers of change and the competitive imperatives that will define success. As the industry continues to evolve, organizations that adopt a proactive stance-embracing automation, fostering continuous learning, and cultivating agile sourcing strategies-will be best positioned to navigate uncertainty and realize sustained value.

Looking ahead, the convergence of artificial intelligence, cloud computing, and data analytics will unlock new possibilities for efficiency and insight, while emerging regulatory frameworks will demand greater transparency and adaptability. By synthesizing the core findings outlined throughout this report, industry participants can chart a path forward that balances operational excellence with strategic foresight, ensuring that medical coding remains a robust enabler of quality care and financial performance.

Engage with Ketan Rohom Today to Secure Comprehensive Medical Coding Market Insights and Empower Data-Driven Strategic Decisions

Elevate your strategic decision-making by securing a comprehensive market research report tailored specifically to decipher the evolving medical coding landscape. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled insights that will empower your organization to navigate regulatory complexities, leverage transformative technologies, and capitalize on emerging opportunities. Ketan’s expertise and personalized consultation will ensure you acquire the precise data and analysis necessary to develop winning strategies and achieve measurable growth.

Connect directly with Ketan Rohom today to discuss your organization’s unique needs and receive a customized proposal. By collaborating with his team, you will obtain timely access to in-depth research findings, expert-driven recommendations, and actionable intelligence that will sharpen your competitive edge. Do not miss the chance to turn market intelligence into a powerful tool for business success and operational excellence.

- How big is the Medical Coding Market?

- What is the Medical Coding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?