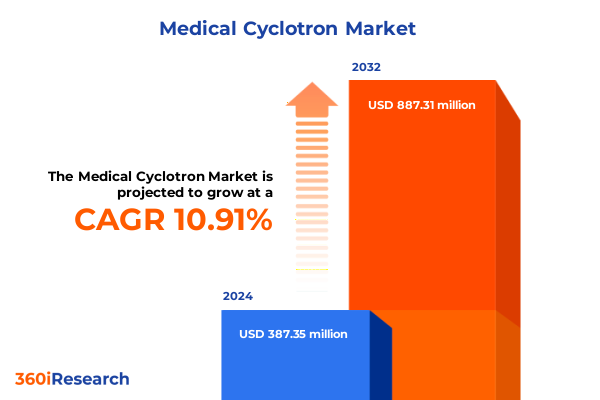

The Medical Cyclotron Market size was estimated at USD 427.56 million in 2025 and expected to reach USD 476.62 million in 2026, at a CAGR of 10.99% to reach USD 887.31 million by 2032.

Pioneering the Evolution of Medical Cyclotron Technology to Empower Radiopharmaceutical Innovation and Clinical Diagnostics Worldwide

The medical cyclotron has emerged as an indispensable tool at the intersection of nuclear physics and clinical medicine, fueling advancements in the production of radiopharmaceuticals and the enhancement of diagnostic imaging. As healthcare systems around the globe continue to prioritize early disease detection and targeted therapies, the precision and reliability offered by modern cyclotrons have become essential. This introduction provides a concise yet comprehensive overview of the technologies, market dynamics, and clinical applications underpinning the current state of medical cyclotron utilization.

From small research-focused units to high-energy industrial models, cyclotron installations serve a dual role in both routine tracer production and pioneering investigative studies. Alongside evolving regulatory frameworks and stringent safety mandates, these machines are rapidly integrating advanced automation and digital control systems. Consequently, stakeholders in healthcare, pharmaceutical manufacturing, and academic research must remain abreast of these developments to capitalize on emerging opportunities in radiopharmaceutical synthesis, therapeutic isotope generation, and preclinical experimentation.

Unveiling Pivotal Technological Advances and Strategic Trends Reshaping the Medical Cyclotron Landscape for the Next Generation of Healthcare Solutions

Over the past decade, the medical cyclotron landscape has undergone a profound transformation driven by rapid technological breakthroughs. Innovations in targetry materials and beam modulation have significantly enhanced isotope yield and purity, enabling the reliable production of both diagnostic tracers and therapeutic radioisotopes. With these advancements, cyclotron manufacturers are now integrating artificial intelligence–driven maintenance protocols and remote monitoring capabilities, reducing downtime and optimizing operational efficiency.

Regulatory authorities have also adapted, instituting clearer guidelines for cyclotron installation, radiation safety, and waste management. This has encouraged broader adoption in emerging markets, where government incentives aim to bolster domestic production of critical isotopes. Meanwhile, strategic collaborations between academic institutions and industry players are fostering translational research, paving the way for novel diagnostic agents. As the convergence of digital tools, automation, and regulatory harmonization accelerates, the cyclotron market is poised for continued innovation and wider clinical integration.

Analyzing the Far-Reaching Consequences of United States Tariffs Imposed in 2025 on Cyclotron Manufacturing Supply Chains and Market Dynamics

In early 2025, the United States implemented a series of tariffs specifically targeting imported cyclotron components and finished units. These measures were introduced to incentivize local manufacturing, protect domestic suppliers, and address national security concerns related to critical isotope production. While the tariffs have led to higher purchase and operational costs for end users relying on overseas equipment, they have also stimulated increased investment in domestic production capacity and supply chain diversification.

Manufacturers have responded by expanding partnerships with American fabrication facilities and investing in modular production lines capable of local assembly. Simultaneously, research institutes and hospitals are exploring lease and service-based models to mitigate upfront capital requirements. Although short-term procurement challenges have emerged, the broader effect has been a renewed focus on supply chain resilience and strategic stockpiling. In the medium to long term, these shifts are expected to strengthen the domestic cyclotron ecosystem, resulting in more reliable access to isotopes essential for both diagnostic imaging and targeted radiotherapy.

Uncovering How Diverse Application Demands End-User Segments Cyclotron Energy Levels Product Solutions and Distribution Models Influence Market Behavior

When examining the market through the lens of application, it becomes clear that cyclotron utilization bifurcates into radiopharmaceutical production and research applications. Within production, the focus on diagnostic tracers and therapeutic radioisotopes highlights the growing demand for precision oncology tools and neurology imaging agents. This duality underscores the need for flexible cyclotron configurations that can switch quickly between production modes without compromising yield.

Shifting the perspective to end users, diagnostic imaging centers and hospitals drive steady demand for routine tracer generation, while pharmaceutical companies and research institutes seek high-throughput systems capable of novel isotope development. End-user requirements vary significantly, from compact low-energy units for decentralized tracer delivery to high-energy cyclotrons supporting advanced therapeutic isotope research.

Energy classification further delineates the market, with high-energy cyclotrons catering to a broad spectrum of isotopes for both diagnosis and therapy, while low-energy and medium-energy models serve more specialized clinical and research roles. Product distinctions between dual cyclotrons and single cyclotrons reveal opportunities for institutions balancing diverse production needs against capital constraints. Lastly, distribution approaches via channel partners or direct sales shape procurement timelines and service agreements, influencing how quickly new installations come online and how maintenance support is structured.

This comprehensive research report categorizes the Medical Cyclotron market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Cyclotron Type

- Application

- End User

- Distribution Channel

Decoding Regional Dynamics to Showcase How Americas Europe Middle East Africa and Asia-Pacific Markets Are Shaping the Global Cyclotron Industry

Across the Americas, strong government funding for nuclear medicine and the presence of established cyclotron manufacturers have fostered robust adoption of both research-grade and clinical units. The region’s mature healthcare infrastructure and reimbursement frameworks further support steady expansion of PET and SPECT imaging programs, driving continuous upgrades of existing cyclotron facilities.

In Europe, the Middle East, and Africa, regulatory harmonization efforts are enabling cross-border collaborations and streamlining approvals for cyclotron installations. Western Europe remains a hotbed for high-energy cyclotron deployments, while the Middle East is investing heavily in oncology centers requiring in-house isotope production. In parts of Africa, pilot programs demonstrate the potential for low-energy systems to address critical diagnostic gaps, paving the way for broader clinical uptake as infrastructure and training improve.

Asia-Pacific stands out for rapid growth fueled by expanding healthcare access, rising cancer incidence, and national initiatives to develop domestic isotope production capabilities. Major economies in the region are prioritizing local manufacturing and research partnerships, while Southeast Asian and Oceanic markets show increasing interest in compact, low-cost cyclotron solutions designed for decentralized healthcare settings.

This comprehensive research report examines key regions that drive the evolution of the Medical Cyclotron market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Innovations from Leading Cyclotron Manufacturers Driving Industry Competition Collaborations and Next-Gen Solutions

Leading cyclotron manufacturers are executing a range of strategic initiatives to solidify their market positions. Key players have invested in advanced target systems that improve isotope yield while reducing waste, responding to end-user demands for cost-effective production. Collaborative research agreements between equipment suppliers and pharmaceutical companies are accelerating the development of novel radiopharmaceuticals, deepening customer relationships and enhancing value propositions.

Several organizations have expanded their global footprint through selective acquisitions of regional service providers, ensuring local maintenance capabilities and faster response times for troubleshooting. Others are partnering with automation and artificial intelligence firms to introduce remote diagnostics platforms, minimizing operational disruptions and optimizing preventative maintenance schedules. By tailoring product portfolios to address both high-volume clinical requirements and specialized research applications, industry leaders are differentiating themselves through flexibility, reliability, and technological excellence.

Moreover, ongoing investments in modular cyclotron architectures are enabling faster deployment timelines, critical for emerging markets. These comprehensive strategies signal a shift toward integrated service offerings, encompassing everything from site planning and regulatory support to training and long-term performance monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Cyclotron market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&D Radiation Technologies

- ACCEL Instruments GmbH

- Accuray, Inc.

- Advanced Cyclotron Systems Inc.

- Alcen

- Best Theratronics Limited

- EBARA Corporation

- Eckert & Ziegler AG

- Hitachi High‑Tech Corporation

- Huayi Isotope Co., Ltd.

- IBA Molecular

- Ion Beam Applications S.A.

- IsoDAR

- IsoSolution, Inc.

- Isotope Sciences

- Niowave, Inc.

- Norisys

- NorthStar Medical Radioisotopes (or related cyclotron operations)

- Nuclear Medicine Equipment Engineering

- Pro‑Nova Solutions, LLC

- Shimadzu Corporation

- Shinva Medical Instrument Co., Ltd.

- Siemens Healthineers AG

- Sumitomo Heavy Industries, Ltd.

- Ultra‑compact Cyclotron, Inc.

- Varian Medical Systems, Inc.

Delivering Pragmatic Recommendations for Industry Leaders to Enhance Cyclotron Capabilities Mitigate Supply Risks and Capitalize on Emerging Opportunities

Industry participants should prioritize the development of modular cyclotron platforms capable of rapid reconfiguration to meet evolving clinical and research demands. By investing in standardized component interfaces and scalable production modules, equipment suppliers can reduce installation lead times and lower total cost of ownership. At the same time, establishing local assembly and fabrication partnerships will mitigate tariff-related challenges and reinforce supply chain resilience.

Healthcare organizations and research institutes can explore service-based procurement models, such as equipment leasing or pay-per-use agreements, to alleviate capital expenditure pressures. Collaboration with pharmaceutical partners on co-development projects for novel isotopes can unlock new revenue streams and foster deeper stakeholder engagement. In parallel, integrating predictive maintenance solutions powered by machine learning will enhance uptime and extend equipment lifecycles, ultimately improving return on investment.

Finally, stakeholders should engage proactively with regulatory bodies and industry associations to shape guidelines that balance safety, operational flexibility, and innovation. Through these tactical and strategic actions, industry leaders can secure a competitive edge while contributing to the sustainable growth of the medical cyclotron ecosystem.

Presenting a Robust Research Methodology Integrating Expert Consultations Multisource Data Collection and Validation for Cyclotron Market Understanding

This report’s findings are grounded in a multifaceted research approach combining primary interviews with cyclotron manufacturers, healthcare providers, and regulatory experts. In-depth consultations provided firsthand perspectives on installation challenges, isotope production workflows, and maintenance protocols. These qualitative insights were supplemented by extensive analysis of patent filings and technical literature to track technological innovations and emerging design trends.

Secondary data sources included regulatory agency publications, scientific journals, and company white papers, ensuring a holistic view of safety standards, throughput requirements, and end-user expectations. Quantitative validation was achieved through cross-referencing shipment records, import–export datasets, and public financial reports, reinforcing the robustness of the conclusions drawn. This meticulous methodology ensures that the strategic insights presented herein rest on a solid foundation of empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Cyclotron market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Cyclotron Market, by Product

- Medical Cyclotron Market, by Cyclotron Type

- Medical Cyclotron Market, by Application

- Medical Cyclotron Market, by End User

- Medical Cyclotron Market, by Distribution Channel

- Medical Cyclotron Market, by Region

- Medical Cyclotron Market, by Group

- Medical Cyclotron Market, by Country

- United States Medical Cyclotron Market

- China Medical Cyclotron Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Key Insights and Projecting Future Trajectories for the Medical Cyclotron Industry Amid Evolving Clinical Research and Therapeutic Applications

The medical cyclotron sector stands at a pivotal juncture where technological innovation, regulatory evolution, and strategic supply chain realignment converge. As the demand for advanced diagnostic tracers and therapeutic isotopes intensifies, stakeholders must navigate both opportunities and challenges shaped by shifting tariff landscapes and regional dynamics. The analysis highlights the importance of flexible cyclotron platforms, diversified procurement models, and collaborative research frameworks in driving sustainable growth.

By embracing modular designs, fostering partnerships across the value chain, and leveraging data-driven maintenance strategies, the industry is well-positioned to deliver enhanced clinical outcomes and accelerate radiopharmaceutical innovation. The insights presented in this executive summary underscore the critical role of strategic foresight and operational agility in shaping the future trajectory of the medical cyclotron market.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Exclusive Cyclotron Market Research Insights and Obtain Your Comprehensive Report Today

To learn more about the comprehensive cyclotron market research analysis and how it can inform your strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the detailed findings, answer any tailored inquiries, and ensure you gain the actionable insights needed to advance your organization’s position in this evolving landscape. Reach out to secure your copy of the full report and embark on a data-driven journey toward enhanced radiopharmaceutical innovation and clinical excellence.

- How big is the Medical Cyclotron Market?

- What is the Medical Cyclotron Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?