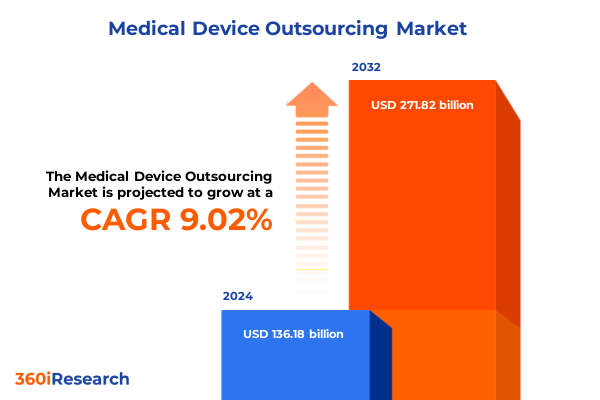

The Medical Device Outsourcing Market size was estimated at USD 146.50 billion in 2025 and expected to reach USD 157.60 billion in 2026, at a CAGR of 9.23% to reach USD 271.82 billion by 2032.

Establishing a Comprehensive Introduction to Medical Device Outsourcing by Unveiling Core Market Drivers and Emerging Challenges Shaping the Future of Healthcare Delivery and Stakeholder Expectations

Outsourcing in the medical device sector has evolved from a peripheral strategy to a central pillar of competitive differentiation. Rising development costs, increased regulatory scrutiny, and accelerating innovation cycles have prompted original equipment manufacturers to engage specialized partners for a broad range of activities. From early-stage clinical trials and design and development services to manufacturing, sterilization, and quality validation, outsourcing providers bring deep expertise and economies of scale that enable agile responses to market demands.

As the complexity of medical technologies grows-driven by miniaturization, digital integration, and advanced materials-OEMs are collaborating with third-party specialists to access cutting-edge capabilities without committing to in-house capital expenditures. This shift frees internal teams to concentrate on core competencies such as product ideation and strategic planning. Concurrently, service providers are investing in state-of-the-art infrastructure, regulatory frameworks, and cross-functional talent pools to offer end-to-end solutions that support rapid time to market.

Moreover, globalization and supply chain diversification have encouraged partnerships spanning multiple geographies. Nearshoring strategies, enhanced logistical networks, and digital platforms for remote project management are enabling seamless coordination of design, manufacturing, and distribution across continents. This introduction sets the stage for a deeper examination of transformative shifts, tariff impacts, segmentation insights, regional dynamics, key players, and actionable recommendations essential to navigating this dynamic landscape.

Understanding the Transformative Shifts Redefining Medical Device Outsourcing through Technological Innovations Regulatory Harmonization and Data-Driven Collaborative Strategies for Enhanced Efficiency and Supply Chain Resilience

Medical device outsourcing has entered a new era defined by rapid technological advancement and increasing regulatory harmonization. Artificial intelligence and machine learning are being embedded in design and validation workflows, accelerating iteration cycles while ensuring robust risk management. Robotics and automation in manufacturing lines are elevating precision and throughput, even as digital twins and predictive maintenance models enhance operational reliability.

Simultaneously, regulatory agencies across key markets are aligning requirements to facilitate faster approvals for novel technologies. Harmonized standards from bodies such as the US Food and Drug Administration and the European Medicines Agency are reducing duplicative testing and enabling service providers to optimize their compliance frameworks. This regulatory convergence has encouraged companies to pursue cross-border partnerships, leveraging expertise from multiple jurisdictions to streamline product launches.

Patient-centric innovation is also reshaping outsourcing models. Rising demand for personalized therapies and connected devices has driven service firms to develop tailored solutions, integrating digital health platforms and software-as-a-service offerings alongside traditional engineering services. This shift underscores the importance of data-driven collaboration and interoperability standards, which are critical for delivering end-to-end value in a market that rewards patient outcomes and real-world evidence.

Analyzing the Cumulative Impact of United States Tariffs Implemented in 2025 on Medical Device Outsourcing Costs Supply Chain Strategies and Global Partnerships

In 2025, a series of tariff measures targeting imported medical device components and assemblies began to reshape outsourcing economics. These duties, ranging from intermediate inputs to finished modules, have increased landed costs and created pressure on profit margins across the value chain. As a response, many OEMs have accelerated nearshoring initiatives, relocating production closer to end markets to mitigate tariff exposure and reduce logistical complexities.

This strategic pivot has led to a reconfiguration of supplier networks and stimulated investments in domestic contract manufacturing facilities. While higher local labor and real estate costs partially offset tariff savings, the benefits of reduced transit times and greater supply chain resilience have been compelling. Outsourcing service providers offering flexible, on-demand capacities in North America have experienced strong demand, particularly for high-value device components where compliance traceability is critical.

At the same time, global partnerships continue to evolve toward hybrid models. Firms are blending overseas low-cost manufacturing for standardized modules with regional assembly and quality testing to comply with local content regulations and avoid punitive duties. This approach requires sophisticated coordination across multiple tiers of subcontractors and a proactive tariff mitigation strategy, underscoring the importance of agile logistics, advanced trade advisory services, and dynamic cost modeling.

Deriving Key Insights from Market Segmentation Based on Service Type Device Type End User and Outsourcing Model to Guide Strategic Decision-Making

An in-depth review of outsourcing activity reveals that service type segmentation drives distinct strategic priorities. Clinical trials partners are racing to integrate decentralized protocols and virtual patient engagement tools, while design and development specialists focus on modular architectures for IoT-enabled devices. Logistics providers are investing in real-time tracking and temperature-controlled solutions, and manufacturing partners differentiate through contract manufacturing, custom manufacturing, and original equipment manufacturing offerings. Packaging experts are emphasizing sustainable materials and serialization to meet anti-counterfeiting mandates, whereas regulatory affairs consultants are enhancing software solutions to streamline submissions. Repair and maintenance divisions refine predictive maintenance, and sterilization firms expand capacity for novel sterilants and low-temperature processes. Testing and validation units adopt digital inspection technologies and automation to handle growing throughput demands.

Device type segmentation has also shaped outsourcing trends. Providers servicing cardiovascular devices must navigate stringent biocompatibility testing for cardiac monitoring devices, catheters, heart valves, and stents. Diagnostic imaging outsourcing covers computed tomography scanner calibration, magnetic resonance imaging throughput enhancement, nuclear imaging systems validation, ultrasound systems optimization, and X-ray systems safety checks. Orthopedic and ophthalmic device developers rely on specialized tooling and additive manufacturing for complex geometries, while dental and ENT outsourcing emphasizes rapid turnaround for precision components. In vitro diagnostic workflows integrate sample-to-answer platforms and microfluidics testing to reduce time to result.

End user segmentation underscores varied service requirements. Ambulatory surgical centers demand rapid setup and certification of sterile devices, clinics prioritize modular device kits for point-of-care applications, diagnostic laboratories require high-throughput validation, home healthcare providers seek compact and user-friendly designs, hospitals engage full-service outsourcing for scale and compliance, and research institutes collaborate on advanced prototyping. Outsourcing models range from co-sourced engagements for shared risk and control to fully outsourced arrangements for turnkey capabilities and insourced approaches that supplement internal teams with select expertise.

This comprehensive research report categorizes the Medical Device Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Device Type

- Outsourcing Model

- End User

Uncovering Regional Dynamics in Medical Device Outsourcing across the Americas Europe Middle East and Africa and Asia-Pacific Markets Shaping Growth Patterns

Regional nuances continue to influence outsourcing strategies and service provider specialization. In the Americas, strong demand in the United States has spurred nearshoring partnerships with Mexico and Canada. Providers in these regions emphasize just-in-time inventory, stringent quality certifications, and rapid regulatory consultation services to support cross-border supply chains. Latin American markets are emerging as sites for clinical trial diversification, with cost-effective patient recruitment and growing regulatory capacity.

In Europe, Middle East & Africa, outsourcing dynamics are characterized by a balance of established Western European hubs and emerging Eastern markets. Germany, France, and the United Kingdom lead in advanced manufacturing and regulatory consultancy, while Central and Eastern Europe offer cost advantages for assembly and packaging. The Middle East is investing in local sterilization and logistics infrastructure to reduce import dependency, and Africa is gradually building capacity for basic device testing and validation.

Asia-Pacific remains a critical engine of growth for large-scale manufacturing and innovation. China continues to mature its outsourcing ecosystem, targeting higher-value segments such as cardiac monitoring and diagnostic imaging, while India leverages its clinical research capabilities and skilled engineering workforce. Southeast Asian nations are emerging as alternative centers for contract manufacturing and component supply, emphasizing operational efficiency and compliance with global quality standards.

This comprehensive research report examines key regions that drive the evolution of the Medical Device Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Impacting Medical Device Outsourcing with Innovative Service Offerings Strategic Collaborations and Competitive Differentiation Initiatives and Operational Excellence

Leading service providers are differentiating through specialization, scale, and digital integration. Jabil Healthcare has expanded its contract manufacturing footprint by integrating robotic assembly lines and implementing digital quality management systems. Flex’s medical solutions unit leverages global design and development centers, offering end-to-end capabilities from concept prototyping to high-volume production. Sanmina has enhanced its value proposition with regulatory affairs hubs and validation labs in strategic markets, enabling faster submissions and localized compliance support.

Companies such as Parexel and ICON are innovating in clinical trial outsourcing by deploying decentralized trial platforms and harnessing real-world data analytics. Sterigenics has invested in advanced sterilization equipment and novel low-temperature processes, while TÜV SÜD and UL Solutions have broadened their service portfolios to include digital testing and cybersecurity certification. Packaging specialists like Amcor LifeSciences are focusing on sustainable films and serialization technologies to meet global anti-counterfeiting and environmental standards.

Emerging entrants, including specialized niche players, are also gaining traction. Firms offering additive manufacturing for complex orthopedic and dental implants are partnering with research institutes to accelerate validation workflows. Regulatory technology start-ups are developing AI-driven submission tools that promise to reduce approval timelines, underscoring the competitive imperative for traditional providers to enhance digital competence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Device Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Plastics, LLC

- Angiplast Private Limited

- Benchmark Electronics, Inc.

- C & J Industries, Inc.

- Cadence, Inc.

- Carclo PLC

- Celestica Inc.

- Cirtronics Corp.

- Federal Electronics, Inc.

- Flex Medical Solutions Ltd

- Forefront Medical Technologies

- Gerresheimer AG

- HDA Technology, Inc.

- Integer Holdings Corporation

- Plexus Corp.

- Poly Medicure Ltd.

- Recipharm AB

- Remington Medical, Inc.

- Sanbor Medical

- Sanmina Corporation

- SeaskyMedical

- Tessy Plastics Corp.

- West Pharmaceutical Services, Inc.

Presenting Actionable Recommendations for Industry Leaders to Enhance Outsourcing Strategies Foster Innovation and Mitigate Risks in the Evolving Medical Device Landscape

Industry leaders must prioritize investment in digital platforms that enable end-to-end visibility across outsourced workflows. Integrating artificial intelligence for predictive quality control, advanced analytics for demand forecasting, and blockchain for traceability can enhance efficiency while mitigating compliance risks. Establishing open architectures that facilitate seamless data exchange between OEMs and third-party providers will be critical to unlocking collaborative value.

To navigate the evolving tariff landscape, companies should adopt dual-sourcing strategies that balance cost optimization with supply chain resilience. Developing nearshore and onshore partnerships alongside established offshore facilities will help maintain agility in the face of policy changes. Negotiating long-term agreements with flexible volume commitments can also provide pricing stability while safeguarding quality and delivery performance.

Building strategic alliances with specialized niche firms can accelerate access to emerging technologies such as additive manufacturing, connected devices, and decentralized trial platforms. Policymakers and industry consortia are also engaging in regulatory dialogue to shape harmonized standards. Proactive participation in these initiatives can position organizations to influence regulatory pathways and reduce approval timelines for next-generation devices.

Detailing a Rigorous Research Methodology Emphasizing Data Triangulation Expert Engagement and Multi-Source Validation to Ensure Credibility of Medical Device Outsourcing Insights

The analysis underpinning this report combines extensive secondary research with rigorous primary validation. Industry publications, regulatory databases, and patent filings were reviewed to map current practices, emerging technologies, and tariff regulations. Company filings, investor presentations, and press releases were analyzed to understand strategic priorities and investment trends among leading providers.

To ensure depth and credibility, structured interviews were conducted with senior executives at OEMs, contract manufacturers, clinical research organizations, sterilization specialists, and regulatory consultants. These expert engagements provided insights into evolving service models, operational challenges, and opportunities for differentiation. Data collected from these interviews was triangulated against quantitative trade data and tariff schedules to assess the real-world impact of policy changes on cost structures and sourcing decisions.

Additionally, relevant case studies illustrating successful nearshoring, digital integration, and hybrid outsourcing approaches were reviewed to highlight best practices. A multi-source validation framework was applied to reconcile divergent perspectives and ensure that key findings accurately reflect the current state of the medical device outsourcing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Device Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Device Outsourcing Market, by Service Type

- Medical Device Outsourcing Market, by Device Type

- Medical Device Outsourcing Market, by Outsourcing Model

- Medical Device Outsourcing Market, by End User

- Medical Device Outsourcing Market, by Region

- Medical Device Outsourcing Market, by Group

- Medical Device Outsourcing Market, by Country

- United States Medical Device Outsourcing Market

- China Medical Device Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions from Key Findings to Illuminate Strategic Imperatives and Future Pathways in Medical Device Outsourcing for Decision-Makers Emphasizing Sustainable Growth

The convergence of advanced technologies, regulatory harmonization, and shifting trade policies has fundamentally reshaped medical device outsourcing strategies. Organizations that embrace digital platforms, hybrid sourcing models, and strategic partnerships are better positioned to navigate cost pressures, accelerate innovation cycles, and maintain compliance across geographies. The insights presented in this report underscore the imperative for dynamic, data-driven decision-making as the complexity of medical devices and their supply chains continues to grow.

Regional variations highlight that no single approach fits all markets; tailored strategies that leverage local strengths in manufacturing, clinical research, and regulatory expertise are essential. Leading service providers are carving out competitive advantages through specialization, operational excellence, and digital integration, creating a multi-tiered ecosystem that caters to diverse outsourcing needs.

Ultimately, the path forward involves balancing efficiency and resilience. By integrating predictive analytics, embracing modular design principles, and cultivating a network of complementary partners, industry stakeholders can transform outsourcing from a cost-containment exercise into a strategic catalyst for growth and innovation.

Contact Associate Director of Sales and Marketing to Secure the Detailed Medical Device Outsourcing Market Research Report and Gain Strategic Competitive Advantage Today

The market research report offers an in-depth exploration of the evolving medical device outsourcing ecosystem, addressing critical questions around emerging service requirements and regulatory complexities. To secure access to these valuable insights and empower your strategic planning, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engaging with this comprehensive study will provide your organization with a competitive edge, enabling you to make data-driven decisions and stay ahead of industry trends.

- How big is the Medical Device Outsourcing Market?

- What is the Medical Device Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?