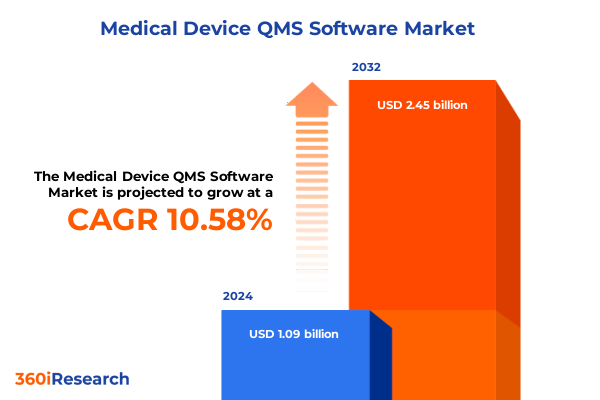

The Medical Device QMS Software Market size was estimated at USD 1.21 billion in 2025 and expected to reach USD 1.33 billion in 2026, at a CAGR of 10.61% to reach USD 2.45 billion by 2032.

Establishing the Imperative for Advanced Medical Device Quality Management Software Amidst Heightened Regulatory and Digital Transformation Pressures

The accelerating convergence of regulatory complexity, digital transformation imperatives, and heightened quality expectations has elevated the role of medical device quality management software from a back-office compliance tool into a strategic enabler of operational excellence. As healthcare organizations and medical device manufacturers navigate evolving standards and patient safety mandates, QMS platforms have become central to integrating cross-functional processes, standardizing workflows, and ensuring real-time visibility into quality metrics.

Moreover, the proliferation of connected medical devices and the shift toward software-as-a-medical-device (SaMD) models have intensified demands for robust traceability, risk management, and continuous monitoring capabilities. These developments underscore the imperative for software solutions that not only codify regulatory requirements but also drive proactive quality controls and data-driven decision making.

Consequently, stakeholders require an authoritative synthesis of the market’s technological drivers, segmentation dynamics, regional nuances, and competitive landscape. This executive summary distills key insights and strategic considerations to inform leadership decisions, validate investment priorities, and shape software deployment roadmaps in the rapidly evolving medical device QMS ecosystem.

Navigating Transformative Technological Advancements and Strategic Process Shifts Redefining the Medical Device Quality Management Software Landscape in 2025

The medical device quality management software landscape is undergoing transformative shifts propelled by advanced analytics, modular cloud architectures, and integrated risk-based frameworks. As organizations seek to anticipate compliance deviations rather than react post-facto, analytics-driven insights have emerged as a core differentiator, guiding corrective and preventive actions (CAPA) more swiftly and accurately.

In parallel, the adoption of hybrid cloud models, complemented by private and public cloud variants, is reshaping deployment strategies. This flexible approach balances the scalability and remote access of cloud environments with the control and customization afforded by on-premise integrated or standalone systems. Consequently, software providers are realigning roadmaps to deliver seamless data synchronization, fortified security protocols, and optimized total cost of ownership.

Furthermore, the integration of mobile platforms, Internet of Things (IoT) connectivity, and artificial intelligence has amplified the potential of QMS solutions. Real-time monitoring of device performance, predictive risk scoring, and automated document control workflows are transitioning quality management from a compliance necessity into a source of competitive advantage. These shifts demand that decision-makers reevaluate legacy systems and accelerate adoption of next-generation platforms capable of sustaining innovation and regulatory agility.

Assessing the Cumulative Impact of Newly Imposed 2025 United States Tariffs on Medical Device Quality Management Software Imports and Operations

In early 2025, newly imposed United States tariffs on imported software services and data processing modules have reverberated across the medical device quality management software market. By increasing the cost of offshore data storage and third-party cloud services, these tariffs have prompted organizations to reassess sourcing strategies and prioritize cost containment in quality management operations.

Notably, the tariffs have catalyzed a shift toward onshore and domestic cloud deployments, as manufacturers and service providers seek to mitigate exposure to import levies. This reorientation has led to strategic partnerships between QMS vendors and domestic infrastructure providers, enabling localized data residency and tighter alignment with evolving customs and compliance requirements.

Consequently, pricing models have undergone recalibration, with vendors adjusting subscription fees and service level agreements to distribute tariff costs more evenly over multi-year contracts. In addition, development roadmaps now emphasize tariff-resilient architectures, including containerized and edge-compute solutions that reduce reliance on centralized offshore data centers. Looking ahead, these cumulative impacts underscore the need for agile financial planning and proactive vendor collaboration to ensure uninterrupted access to critical quality management capabilities.

Unveiling Key Market Segmentation Insights Across Deployment Models, Organizational Sizes, Applications, End Users, and Service Offerings in Medical Device QMS

An in-depth examination of deployment models reveals that medical device quality management software is evaluated across two primary delivery frameworks. Cloud-based offerings, spanning hybrid cloud configurations alongside private and public cloud variants, cater to organizations prioritizing scalability and remote accessibility. In contrast, on-premise installations, available as integrated suites or standalone modules, attract stakeholders focused on bespoke customization and direct infrastructure control. Consequently, decision-makers are increasingly adopting a blended strategy, leveraging cloud agility for core quality functions while retaining on-premise deployments for sensitive document control and legacy process integration.

Organization size further influences platform selection and implementation cadence, as large enterprises demand extensive integration capabilities, robust analytics, and dedicated support mechanisms. Meanwhile, small and medium enterprises, bifurcated into medium and small business segments, seek streamlined deployments with flexible pricing, minimal IT overhead, and rapid time to value. This duality necessitates tiered product roadmaps and modular service portfolios that enable scalability in alignment with organizational maturity.

Across application domains, software adoption spans audit management, change control, complaint management, corrective and preventive action, document control, nonconformance management, risk management, supplier management, and training management. Within these, action tracking and root cause analysis elevate CAPA effectiveness, while access management, record archiving, and version control ensure document integrity. Concurrently, risk assessment and risk mitigation functionalities are gaining traction as enterprises transition toward proactive quality assurance.

End-user profiles underscore further diversity, encompassing contract manufacturing organizations, contract research organizations, original equipment manufacturers, and service providers. To address this spectrum, QMS vendors are expanding service offerings-ranging from process consulting and regulatory consulting to customization, implementation, integration, system upgrades, technical support, online training, and onsite training-to support end-to-end deployment and ongoing optimization.

This comprehensive research report categorizes the Medical Device QMS Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Pricing Model

- Licensing

- Application

- End User

- Deployment Model

- Organization Size

Gleaning Critical Regional Dynamics Influencing Medical Device Quality Management Software Adoption in the Americas, EMEA, and Asia-Pacific

Regional dynamics are redefining adoption trajectories for quality management software, with the Americas leading a robust shift toward cloud-first implementations supported by stringent Food and Drug Administration (FDA) requirements. North American stakeholders place premium value on real-time risk management and comprehensive audit trails, often partnering with vendors that provide localized support and dedicated U.S.-based hosting.

Meanwhile, the Europe, Middle East & Africa landscape demands multifaceted compliance pathways to reconcile Medical Device Regulation (MDR) in Europe, the Saudi Food and Drug Authority guidelines, and diverse African regulatory frameworks. As a result, software platforms that seamlessly integrate multi-jurisdictional regulatory templates and multilingual interfaces are gaining traction, empowering organizations to harmonize quality processes across disparate markets.

Asia-Pacific is emerging as a fast-growing segment, propelled by investment in healthcare infrastructure and accelerating digital health initiatives. Regulatory bodies across Japan, China, Australia, and Southeast Asian nations are increasingly mandating electronic quality management, fostering demand for modular, cloud-enabled solutions that accommodate localized data privacy mandates. This region’s rapid evolution underscores the importance of flexible deployment models and scalable service support to address heterogeneous regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Medical Device QMS Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Medical Device Quality Management Software Providers

Leading software vendors are deploying a range of strategic initiatives to solidify market positions and cultivate differentiation. Investments in artificial intelligence–driven risk analytics and predictive compliance modules enable these companies to anticipate quality deviations and deliver actionable alerts before critical events arise. Moreover, partnerships with major cloud infrastructure providers facilitate hybrid deployment options that marry global uptime guarantees with region-specific data residency.

In addition, the expansion of professional services arms-encompassing customization, integration, and continuous system upgrades-enhances vendor value propositions by reducing implementation timelines and accelerating user onboarding. Concurrently, the integration of mobile-native workflows and IoT connectivity demonstrates a commitment to supporting frontline quality checks and device performance monitoring.

Competitive positioning is further strengthened through mergers and acquisitions, as established players incorporate niche point solutions to broaden functional coverage. These transactions underscore a trend toward unified platforms that eliminate integration complexity and deliver a single source of truth for quality and compliance data. Collectively, these initiatives signal a maturing marketplace where innovation, service depth, and deployment flexibility serve as primary differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Device QMS Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AmpleLogic

- AssurX, Inc.

- ComplianceQuest, Inc.

- Dot Compliance Ltd.

- Ennov SAS

- Epicor Software Corporation

- Greenlight Guru, Inc.

- Hexagon AB

- Honeywell International Inc.

- Ideagen

- Intelex Technologies ULC

- Intellect, Inc.

- IQVIA Holdings Inc.

- MasterControl Solutions, Inc.

- Matrix Requirements GmbH

- Oracle Corporation

- Orcanos Ltd.

- PTC Inc.

- Qualio, Inc

- Qualityze Inc.

- Siemens AG

- TecWork Global Business Solutions Pvt. Ltd.

- Veeva Systems Inc.

Delivering Actionable Recommendations to Empower Industry Leaders to Leverage Medical Device Quality Management Software for Compliance and Efficiency

Industry leaders should prioritize a hybrid deployment strategy that balances the agility of cloud solutions with the customization and control of on-premise systems. By tailoring deployment models to specific quality activities-such as leveraging public cloud for non-sensitive training management while reserving private or on-premise infrastructure for CAPA workflows-organizations can optimize cost structures and minimize the impact of external tariff fluctuations.

Furthermore, embedding advanced risk-based analytics and artificial intelligence into core quality processes will enable proactive identification of nonconformance trends, thereby reducing audit preparation times and accelerating corrective responses. To mitigate tariff-related headwinds, decision-makers can negotiate multi-year vendor agreements that incorporate built-in tariff escalation clauses, ensuring predictable total cost of ownership.

Collaboration with domestic infrastructure providers and strategic consulting partners will facilitate compliance with localized data residency and regulatory requirements. Simultaneously, investing in modular software architectures and open APIs will future-proof quality management ecosystems, enabling seamless integration with emerging patient-centric applications and remote monitoring devices. By embracing these recommendations, industry leaders can harness the full potential of quality management software to drive compliance, foster innovation, and sustain competitive advantage.

Detailing Comprehensive Research Methodology Framework and Analytical Approaches Underpinning the Medical Device Quality Management Software Market Study

This study’s methodology integrates a comprehensive blend of secondary research, primary interviews, and rigorous data triangulation. Initially, publicly available regulatory publications, industry white papers, and academic literature were analyzed to map the evolving compliance landscape and identify seminal quality management frameworks. In parallel, vendor product documentation and technical briefs provided insights into emerging technological capabilities and deployment architectures.

Primary research comprised structured interviews with senior quality assurance executives at medical device manufacturers, contract manufacturing organizations, and leading software providers. These discussions enriched the analysis with practical perspectives on deployment challenges, service expectations, and vendor performance metrics. Quantitative validation was achieved through cross-referencing interview inputs with secondary data sources and anonymized customer surveys.

Subsequently, a segmentation framework was developed to dissect the market by deployment models, organization size, application domains, end-user typologies, and service offerings. Each segment underwent qualitative scoring based on adoption drivers, regulatory alignment, and operational impact. Finally, findings were subjected to expert peer review to ensure analytical rigor and contextual relevance, culminating in the insights and strategic guidance presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Device QMS Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Device QMS Software Market, by Offering

- Medical Device QMS Software Market, by Pricing Model

- Medical Device QMS Software Market, by Licensing

- Medical Device QMS Software Market, by Application

- Medical Device QMS Software Market, by End User

- Medical Device QMS Software Market, by Deployment Model

- Medical Device QMS Software Market, by Organization Size

- Medical Device QMS Software Market, by Region

- Medical Device QMS Software Market, by Group

- Medical Device QMS Software Market, by Country

- United States Medical Device QMS Software Market

- China Medical Device QMS Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Concluding Insights Emphasizing Strategic Imperatives and Future-Proofing Measures for Effective Deployment of Medical Device Quality Management Software

The overarching narrative of modern medical device quality management software underscores the necessity for platforms that unify regulatory compliance, risk mitigation, and operational efficiency. The transformative shifts toward hybrid cloud models, analytics-driven risk management, and integrated IoT connectivity have redefined the benchmark for quality solutions. Concurrently, the 2025 United States tariffs have illuminated the importance of adaptable deployment strategies and resilient cost management frameworks.

Segmentation analysis reveals that nuanced requirements across organization sizes, application modules, end-user profiles, and service dimensions demand modular, scalable software architectures. Regional dynamics further accentuate the need for localization and multi-jurisdictional compliance support, from stringent FDA obligations in the Americas to diverse regulatory templates in EMEA and rapid digitalization in Asia-Pacific.

Ultimately, organizations that align strategic investments with flexible deployment models, forward-looking analytics, and robust service ecosystems will be best positioned to navigate compliance complexities and harness the full potential of quality management solutions. The recommendations outlined provide a roadmap for industry leaders to elevate quality processes, mitigate emerging risks, and unlock new efficiencies in an increasingly regulated and interconnected healthcare landscape.

Engage with Ketan Rohom to Secure Your In-Depth Medical Device Quality Management Software Market Research Report and Drive Informed Strategic Decisions

Harnessing the insights and strategic clarity presented throughout this executive summary is the first step toward strengthening your competitive positioning in the dynamic medical device quality management software domain. For a comprehensive deep dive into these market trends, segmentation analyses, competitive assessments, and tailored strategic guidance, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your in-depth market research report. This report provides the actionable intelligence and industry context necessary to refine your technology roadmap, optimize deployment strategies, and align your offerings with evolving regulatory and operational imperatives. Reach out to initiate a personalized consultation and gain immediate access to the detailed findings, expert commentary, and bespoke recommendations that will empower your organization to navigate emerging challenges and capitalize on growth opportunities in medical device quality management software.

- How big is the Medical Device QMS Software Market?

- What is the Medical Device QMS Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?