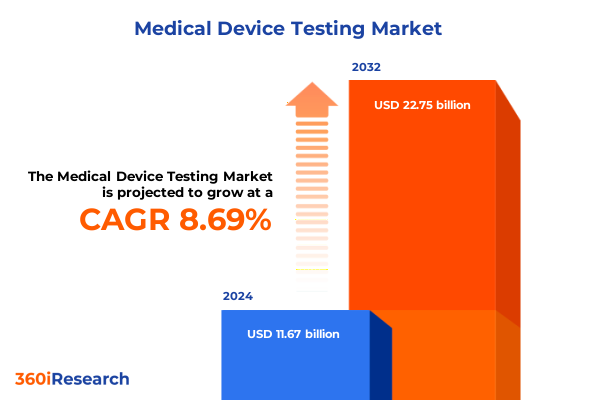

The Medical Device Testing Market size was estimated at USD 12.64 billion in 2025 and expected to reach USD 13.69 billion in 2026, at a CAGR of 8.75% to reach USD 22.75 billion by 2032.

Setting the Stage for Comprehensive Medical Device Testing: An Overview of Current Trends, Challenges, and Market Dynamics Impacting Quality and Compliance

The ever-evolving landscape of medical device development has underscored the critical importance of rigorous testing protocols that assure patient safety and regulatory compliance. As devices grow more sophisticated-integrating digital health components, advanced biomaterials, and complex electronic systems-testing laboratories must adapt by embracing cutting-edge methodologies and maintaining robust quality management frameworks. This introductory overview contextualizes the pivotal drivers shaping the medical device testing environment, including heightened regulatory scrutiny, intensifying market competition, and accelerating technological innovation.

Against a backdrop of global regulatory harmonization efforts, laboratories and original equipment manufacturers (OEMs) are navigating intricate requirements, from the European Union’s Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) to the U.S. Food and Drug Administration’s Quality in 21st Century initiative. Simultaneously, stakeholders are contending with supply chain resilience challenges and geopolitical pressures that influence sourcing and operational continuity. Within this dynamic context, testing providers are compelled to offer end-to-end solutions that span biocompatibility assessments, chemical analysis, performance validation, and sterilization qualification. In doing so, they not only facilitate product market entry but also help innovators reduce development timelines and mitigate risk.

Subsequent sections of this executive summary delve into transformative shifts in testing technologies and practices, the implications of recent U.S. tariff measures, nuanced segmentation insights, and regional dynamics. By presenting comprehensive analyses of corporate strategies and practical recommendations, we aim to furnish decision-makers with the intelligence required to capitalize on emerging opportunities and confront pressing challenges.

Emerging Paradigms in Medical Device Testing Driven by Technological Breakthroughs, Regulatory Overhauls, and Evolving Stakeholder Expectations

Innovation in medical device testing is reshaping traditional paradigms by leveraging advanced instrumentation, digitalization, and integrated data analytics. Laboratories are moving beyond conventional wet lab techniques to deploy high-throughput screening platforms and real-time monitoring solutions that accelerate testing cycles and enhance reproducibility. Artificial intelligence and machine learning algorithms are now being applied to interpret complex spectral data, predict material interactions, and optimize test protocols, engendering a shift toward predictive validation models.

In parallel, virtual and in silico testing methodologies are gaining traction as complementary approaches to reduce reliance on animal models and lower development costs. Computational fluid dynamics and finite element analysis enable imperceptible insights into device performance under physiological conditions, streamlining design refinements before physical prototypes are manufactured. These digital tools are increasingly endorsed by regulatory authorities as part of risk-based submission strategies, prompting service providers to build capabilities in simulation and model-informed engineering.

Meanwhile, the global regulatory landscape is undergoing transformative revisions. The rollout of the EU MDR and IVDR has compelled manufacturers to reassess their compliance roadmaps, spurring demand for re‐certification and gap analyses. Simultaneously, the FDA’s efforts to modernize Quality System Regulation are creating synergies between premarket and postmarket surveillance activities. These converging forces are fostering a new era of quality assurance where continuous compliance, data transparency, and cross‐functional collaboration are paramount.

Assessing the Cumulative Economic and Operational Consequences of 2025 U.S. Tariff Measures on Medical Device Testing and Supply Chains

The United States’ newest tariff measures, announced in early 2025, have introduced additional layers of complexity for medical device testing providers and OEMs that rely on finely tuned global supply chains. Most notably, a proposed 15% tariff on European imports-pending finalization of the U.S.–EU trade agreement-would apply to a broad array of medical devices and testing equipment, from diagnostic imaging components to sterilization instrumentation. Market participants are closely monitoring negotiations, as the deal’s exemptions or carve-outs for critical goods remain under discussion; reports suggest that negotiators intend to safeguard essential medical technologies, but full details are yet to be codified.

Concurrently, recent U.S. tariffs on Chinese, Mexican, and Canadian imports have reinstated duties on testing consumables and laboratory essentials that were previously exempted. The American medical technology association has lobbied for comprehensive exclusions, warning that higher input costs would translate into elevated testing fees and delayed product launches. In the interim, many laboratories are evaluating strategic relocation of component sourcing to regions with lower duties, yet such supply chain reconfiguration demands time-intensive qualification processes and may lead to interim shortages or bottlenecks. A survey of industry executives indicates that procurement lead times have extended by several weeks in the wake of tariff announcements, with notable backlogs in surgical instrument validation kits and chromatography reagents.

The financial ramifications of these tariffs extend to healthcare providers, which allocate substantial budgets to testing services and equipment expenditures. Hospital systems report that medical supply costs already represent over 10% of operational budgets, and the cumulative effect of stepped-up tariff rates could exacerbate fiscal pressures on care delivery organizations. As a result, stakeholders across the value chain must proactively engage policymakers to advocate for narrowly tailored exemptions, while simultaneously exploring nearshoring strategies, renegotiating supplier contracts, and leveraging collaborative purchasing consortia to mitigate cost inflation.

Unlocking Hidden Market Opportunities Through a Detailed Exploration of Test Types, Technologies, End Users, and Device Categories in Medical Device Testing

A nuanced understanding of market segmentation is essential to uncover growth pockets and anticipate shifting demand patterns in medical device testing. In terms of test types, biocompatibility remains a cornerstone of safety evaluation, encompassing cytotoxicity assays, irritation and sensitization assessments, as well as toxicokinetic profiling. Equally critical are chemical analyses that verify material composition and leachable profiles, electrical safety tests that assure proper device function under varied voltage conditions, and mechanical examinations that evaluate structural integrity. Performance validation assesses device functionality under simulated use cases, while sterilization validation spans dry heat, ethylene oxide, radiation, and steam modalities.

Beyond test modalities, technological segmentation reveals that chromatography techniques-GC, HPLC, and ion chromatography-provide high-resolution separation capabilities for complex mixtures, whereas flow cytometry excels at cellular characterization and immunophenotyping. Microscopy platforms deliver morphological insights across scales, and spectroscopy methods such as FTIR, mass spectrometry, NMR, and UV-Vis underpin molecular fingerprinting and contaminant detection. Each technology subset commands unique infrastructure requirements and specialist expertise, influencing capital investment decisions and lab service offerings.

End users of testing services range from academic institutions conducting foundational research to contract research organizations that facilitate outsourced development, hospitals and clinical laboratories operating diagnostic centers and specialty clinics, and device manufacturers both large and small. Academic researchers often demand flexible scheduling and exploratory test designs, while large OEMs prioritize high-throughput capacity and standardized protocols. Small and medium enterprises seek agile partnerships capable of scaling with prototype iterations, and diagnostic laboratories emphasize rapid turnaround times to support clinical decision-making.

Finally, device type segmentation highlights diverging testing imperatives across therapeutic areas. Cardiovascular devices-including heart valves, pacemakers, and stents-undergo extensive fatigue and durability testing. Dental instruments face rigorous sterility and material compatibility requirements, diagnostic imaging equipment necessitates precise electrical and radiation assessments, and orthopedic implants must demonstrate biomechanical performance under load. Neurological and ophthalmic devices each present specialized validation protocols, reflecting their unique physiological interfaces.

This comprehensive research report categorizes the Medical Device Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Device Type

- Device Class

- Test Phase

- Sourcing Model

- Testing Method

- End User

Comparative Regional Dynamics Shaping the Medical Device Testing Industry Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping opportunity landscapes and competitive positioning within the medical device testing sector. In the Americas, the United States remains the largest single market, driven by a confluence of rigorous FDA oversight, robust R&D investment, and a dense network of contract laboratories. Canada is following suit with regulatory modernization under Health Canada’s emerging guidance, while Latin American markets are witnessing gradual harmonization with international standards, presenting nascent growth avenues for laboratories offering cross-border testing solutions.

Across Europe, Middle East, and Africa, the implementation of the EU Medical Device Regulation has spurred demand for retesting and recertification services among EU-based and global manufacturers aiming to maintain market access. At the same time, the U.K.’s post-Brexit regulatory framework continues to evolve, prompting laboratories to develop UK-specific compliance capabilities. In the Gulf Cooperation Council and North Africa, initiatives to localize testing infrastructure and reduce dependency on European and Asian labs have gained momentum, supported by government incentives for domestic life-science hubs.

In the Asia-Pacific region, countries such as China, Japan, and South Korea are scaling up life-science investments, leading to significant expansion of in-country testing capacity and the emergence of local competitors. Regulatory reforms in China, including accelerated review pathways for novel devices, are fostering partnerships between domestic OEMs and international service providers. Southeast Asian nations like Singapore and Malaysia are positioning themselves as regional centers of excellence by offering streamlined market entry processes and state-of-the-art laboratory infrastructure. Collectively, these regional variances underscore the importance of tailored market entry and partnership strategies.

This comprehensive research report examines key regions that drive the evolution of the Medical Device Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Competitive Movements and Service Portfolio Expansions Among Leading Medical Device Testing Service Providers Worldwide

Leading service providers are pursuing diverse strategies to differentiate their offerings, scale capacity, and capture emerging market segments. SGS, for instance, has broadened its North American footprint by securing ISO 17025 accreditation for its Mississauga laboratory to deliver extractables and leachables testing, thereby enhancing its ability to serve biopharmaceutical and medical device clients with localized expertise. Simultaneously, Eurofins Scientific has invested in expanding its Swiss testing facility to address European MDR re-certification demand, enabling extended microbiology and toxicology throughput.

WuXi AppTec’s acquisition of Frontage Labs’ medical device testing division in late 2024 has fortified its analytical and microbiological service portfolio across North American and Asian markets, reflecting a broader industry trend toward consolidation and end-to-end solution bundling. Intertek Group’s introduction of a cloud-based test results monitoring platform underscores the growing emphasis on digital transformation to accelerate compliance workflows and foster real-time collaboration with clients. Meanwhile, Pace Analytical’s strategic partnership with a leading U.S. orthopedic device manufacturer to provide long-term biocompatibility and package validation services illustrates how targeted alliances can secure recurring revenue streams and strengthen customer loyalty.

In addition, boutique laboratories specializing in niche areas-such as DNV GL’s focus on electrical safety for neuromodulation devices and NAMSA’s expertise in preclinical biocompatibility-are differentiating through deep domain know-how and tailored client support. Collectively, these competitive moves highlight the criticality of geographic expansion, service diversification, and digital enablement in sustaining market relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Device Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BSI Group UK Limited

- Bureau Veritas SA

- Charles River Laboratories International, Inc.

- CSA Group

- DEKRA SE

- Eurofins Scientific SE

- GE HealthCare Technologies Inc.

- Intertek Group plc

- Labcorp Holdings Inc.

- NSF International

- Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- TÜV SÜD AG

- UL LLC

- WuXi AppTec Co., Ltd.

Strategic Imperatives for Industry Leaders to Navigate Disruptive Trends, Policy Shifts, and Technological Innovations in Medical Device Testing

To navigate the evolving terrain of medical device testing, industry leaders must prioritize strategic investments in digital platforms that streamline data capture, analysis, and remote collaboration. Embracing cloud-based quality management systems can reduce administrative overhead, enhance traceability, and support agile response to regulatory audits. Furthermore, forging strategic alliances with upstream suppliers-particularly for critical testing reagents and materials-can mitigate the operational risks posed by tariff fluctuations and supply chain disruptions.

It is equally imperative to cultivate regulatory intelligence capabilities, enabling proactive engagement with authorities and early identification of policy shifts. Companies should consider dedicating resources to participate in industry consortia and public consultations, advocating for balanced tariff exemptions and standardized testing frameworks. Concurrently, expanding nearshore and on-shore laboratory footprints through greenfield investments or joint ventures can bolster service continuity and shorten lead times.

Finally, leaders should accelerate adoption of predictive validation approaches by integrating machine learning into test design and outcome forecasting. This shift not only improves testing efficiency but also strengthens the evidentiary basis for regulatory submissions. By aligning technology investments with emerging global standards and fostering a culture of continuous improvement, organizations can enhance resilience, optimize resource allocation, and solidify their competitive advantage.

Robust and Transparent Research Methodology Underpinning the Comprehensive Analysis of Market Trends and Insights in the Medical Device Testing Domain

This analysis is underpinned by a rigorous, multi-tiered research methodology designed to capture a holistic view of the medical device testing market. The process commenced with an exhaustive secondary research phase, drawing upon publicly available regulatory documents, industry white papers, company press releases, and financial disclosures to map recent developments and strategic initiatives.

Complementing this desk research, primary qualitative interviews were conducted with senior executives from testing laboratories, OEM quality assurance teams, and regulatory experts. These conversations provided nuanced perspectives on operational challenges, investment priorities, and anticipated market trajectories. To ensure robust validation, survey data was collected from a representative sample of laboratory procurement managers, capturing metrics on service utilization, technology preferences, and supply chain risk perceptions.

Quantitative data points were triangulated through cross-referencing multiple sources, while key assumptions were stress-tested using scenario analysis to evaluate the potential impact of tariff fluctuations, regulatory reforms, and technological adoption rates. The research adheres to stringent quality control protocols, including peer reviews and consistency checks, to safeguard accuracy and objectivity. Any limitations-such as rapidly evolving policy environments or proprietary contract terms-are acknowledged, and readers are encouraged to interpret projections within the context of ongoing market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Device Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Device Testing Market, by Service Type

- Medical Device Testing Market, by Device Type

- Medical Device Testing Market, by Device Class

- Medical Device Testing Market, by Test Phase

- Medical Device Testing Market, by Sourcing Model

- Medical Device Testing Market, by Testing Method

- Medical Device Testing Market, by End User

- Medical Device Testing Market, by Region

- Medical Device Testing Market, by Group

- Medical Device Testing Market, by Country

- United States Medical Device Testing Market

- China Medical Device Testing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Integrating Key Findings to Forge a Forward-Looking Perspective on Opportunities, Challenges, and Strategic Pathways in Medical Device Testing

The convergence of technological advancements, regulatory evolution, and geopolitical considerations has created both challenges and opportunities for the medical device testing industry. As laboratories and OEMs adapt to digital transformation imperatives-embracing high-throughput analytics, cloud-enabled quality systems, and predictive validation models-they position themselves to deliver faster, more reliable testing services that support rapid innovation.

Simultaneously, proactive strategies to mitigate tariff impacts-such as supplier diversification, nearshoring, and collaborative advocacy for exemptions-are essential to maintaining cost competitiveness and service continuity. Regional nuances, from the U.S. market’s regulatory rigor to Europe’s recertification surge and Asia-Pacific’s capacity expansion, underscore the importance of locally attuned approaches.

Ultimately, success in this dynamic environment will hinge on the ability to integrate advanced technologies with deep regulatory insight and agile operational frameworks. By leveraging the strategic recommendations outlined herein, industry stakeholders can not only navigate current headwinds but also capitalize on emerging growth vectors, ensuring sustained value creation across the device development lifecycle.

Take the Next Step to Gain In-Depth Medical Device Testing Market Intelligence and Accelerate Your Strategic Decision-Making with Expert Support

To explore the full depth of market drivers, regulatory impacts, and competitive strategies shaping the medical device testing sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for personalized guidance. Secure early access to detailed datasets, custom analyses, and expert consultations tailored to your organization’s specific goals. Partner with us to accelerate your market entry, optimize testing investments, and stay ahead of regulatory changes. Contact Ketan today to obtain the comprehensive market research report that will empower your strategic planning and decision-making.

- How big is the Medical Device Testing Market?

- What is the Medical Device Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?