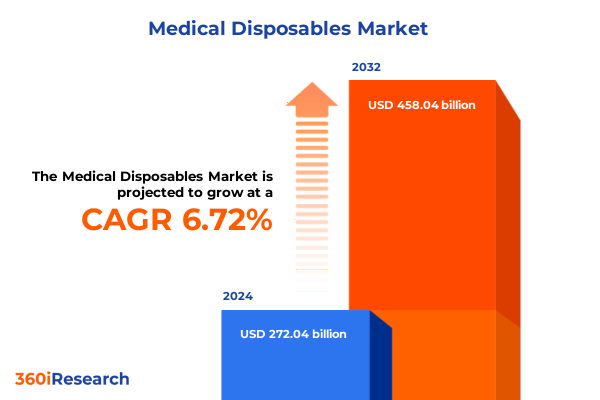

The Medical Disposables Market size was estimated at USD 287.57 billion in 2025 and expected to reach USD 303.99 billion in 2026, at a CAGR of 6.87% to reach USD 458.04 billion by 2032.

Unveiling the Driving Forces Behind the Rapid Adoption of Medical Disposables in Healthcare Delivery and Patient Safety Protocols

Single-use medical disposables have become indispensable in modern healthcare environments where stringent infection control measures are paramount. By replacing reusable equipment with disposable alternatives, healthcare institutions can dramatically reduce the risk of cross-contamination and surgical-site infections, thereby safeguarding both patients and clinical staff. The COVID-19 pandemic underscored the critical importance of reliable disposable supplies such as gloves, masks, syringes, drapes, and gowns, driving unprecedented demand across acute-care hospitals, ambulatory centers, and home healthcare settings.

Beyond infection prevention, the operational efficiencies afforded by disposables-eliminating the need for reprocessing and sterilization-allow clinical teams to focus on patient care rather than instrument turnaround times. This shift has gained momentum not only in high-volume surgical suites but also in diagnostics and chronic-care management, where point-of-care testing and infusion therapies rely on reliable single-use consumables. As hospitals and outpatient facilities strive to enhance patient throughput while maintaining high safety standards, disposables have solidified their role as core enablers of efficient, high-quality healthcare delivery.

Charting the Pivotal Transformations Reshaping the Medical Disposables Landscape Amidst Technological Innovation and Evolving Clinical Practices

The medical disposables sector is experiencing transformative shifts driven by rapid technological innovation and the integration of advanced materials. Manufacturers are deploying antimicrobial coatings and biodegradable polymers to address environmental and infection-control concerns simultaneously, ensuring product safety while reducing waste management burdens. Additionally, digital enhancements such as RFID-enabled inventory tracking and smart packaging are streamlining procurement and usage monitoring, increasing traceability and operational transparency across healthcare supply chains. These technological advancements are setting new benchmarks for product performance and sustainability in the medical disposables marketplace.

Parallel to material and digital innovation, evolving clinical practices and regulatory frameworks are reshaping demand patterns. The pandemic fast-tracked the adoption of telehealth and home-based care, prompting the development of disposable test kits and infusion sets tailored for patient self-administration. At the same time, regulatory bodies are tightening quality and traceability requirements, mandating more rigorous standards for single-use items. Healthcare systems are responding by forging strategic partnerships with domestic manufacturers to bolster supply resilience and align with new guidelines aimed at mitigating future public health crises. This confluence of clinical, regulatory, and technological drivers is redefining the medical disposables landscape and setting the stage for sustained evolution in product design and distribution models.

Assessing the Broad Economic and Operational Consequences of the 2025 United States Tariff Policies on Medical Disposables Supply Chains and Costs

The 2025 tariff policies enacted by the United States have introduced new cost pressures across the medical disposables supply chain. Tariffs of up to 25% on diagnostic equipment and surgical instruments, coupled with 20% duties on essential consumables such as syringes, bandages, and gloves, have driven procurement costs higher for hospitals and clinics. Raw materials used in device manufacturing, including polymers, steel, and aluminum, are similarly affected by tariffs of 15% or more, compounding production expenses for domestic and international suppliers alike. These measures, aimed at strengthening domestic manufacturing, have inadvertently heightened operational costs within healthcare ecosystems.

As a result, healthcare providers are beginning to experience budgetary strains and potential supply disruptions. Although widespread shortages have not yet materialized, some hospitals have reported delaying non-critical equipment purchases and freezing discretionary spending to buffer against tariff-driven price increases. Long-term procurement contracts and inventory reserves have temporarily shielded many institutions, but the prospect of extended tariffs raises concerns about sustained price escalation and diminished purchasing power, particularly in smaller ambulatory centers and rural clinics.

In response, industry stakeholders are intensifying efforts to mitigate adverse effects through advocacy and strategic initiatives. Major healthcare associations are lobbying for exemptions on critical medical supplies, arguing that healthcare goods should remain tariff-free due to their essential nature. Simultaneously, device manufacturers are exploring reshoring key production processes and diversifying raw material sourcing to reduce dependence on high-tariff imports. These actions, combined with increasing public and private investments into domestic supply infrastructure, are crucial to preserving supply chain resilience and ensuring continuity of care amid ongoing trade policy uncertainties.

Illuminating Critical Market Segmentation Dimensions That Define Product Type, Raw Material Composition, End User Applications, and Distribution Channels in Medical Disposables

The medical disposables market is defined by distinct segmentation dimensions that capture variation in product design, material composition, application settings, and sales channels. Within product typologies, offerings range from diagnostic and laboratory disposables through drug delivery systems and infusion-related materials to nonwoven surgical drapes and wound management products. Each category exhibits unique performance requirements and cost structures, reflecting differences in use protocols and regulatory scrutiny levels. Simultaneously, raw material segmentation-spanning nonwoven fabrics, plastics, paper and paperboard, and rubber and latex-shapes both functional attributes such as barrier performance and production economics tied to feedstock availability and price volatility. These segmentation layers collectively determine provider buying patterns and inform supplier investment strategies in research, manufacturing capacity, and material innovation to address evolving clinical and environmental demands.

Equally critical are the distinctions in end user and distribution channel segmentation. Disposables deployed in hospitals, ambulatory surgical centers, and diagnostic laboratories face different procurement cycles, regulatory requirements, and usage intensities compared with those used in home healthcare or clinic settings. Furthermore, distribution channels-including direct procurement agreements, online platforms, and retail pharmacies-offer varying cost efficiencies and inventory management models, influencing how products are positioned for rapid delivery or bulk purchasing. Together, these segmentation insights enable manufacturers and distributors to tailor product portfolios, pricing strategies, and go-to-market approaches to meet diverse customer needs and optimize resource allocation across the complex medical disposables ecosystem.

This comprehensive research report categorizes the Medical Disposables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- End User

- Distribution Channel

Unveiling Distinct Regional Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific That Shape Demand for Medical Disposables Globally

In the Americas, the United States and Canada dominate due to sophisticated healthcare infrastructure, high per-capita healthcare spending, and established channels for procurement and waste management. North America alone holds a significant share of global medical disposables consumption, driven by advanced hospital networks and outpatient facilities that continuously seek innovations to enhance patient care and operational efficiency. Latin America, while smaller in absolute terms, is experiencing rising demand for disposables as expanding public health initiatives and private sector investments improve access to surgical and diagnostic services. This regional dynamic underscores the importance of broad product adaptability and cost-effective manufacturing models to serve markets spanning from high-resource urban centers to resource-constrained rural clinics.

Within Europe, Middle East & Africa (EMEA), market drivers vary substantially between mature Western European health systems and rapidly evolving healthcare landscapes in the Middle East and parts of Africa. In Western Europe, stringent environmental regulations and cost-containment measures are prompting a shift towards sustainable disposable solutions and competitive tender frameworks for large-volume contracts. Conversely, in the Middle East and Africa, improving healthcare infrastructure and growing healthcare workforce capacities are fueling robust demand growth for basic disposable products, particularly in areas aiming to enhance infection control standards. Across EMEA, manufacturers must navigate diverse regulatory regimes and logistical challenges, adapting supply chain strategies to local market conditions and evolving public health priorities.

Across the Asia-Pacific region, rapid expansion of healthcare spending and infrastructure development in markets such as China, India, and Southeast Asia is propelling one of the fastest growth trajectories globally. Government initiatives to modernize healthcare facilities, coupled with rising awareness of infection prevention, are driving substantial procurement of disposables in both public and private sectors. Countries with advanced manufacturing bases are also emerging as global exporters of medical disposables, leveraging technological innovation and cost-competitive production to capture international market share. As a result, Asia-Pacific has become a critical focal point for capacity expansion and product localization efforts among leading global suppliers.

This comprehensive research report examines key regions that drive the evolution of the Medical Disposables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positions and Innovation Portfolios of Leading Manufacturers Driving the Medical Disposables Sector Forward

The competitive landscape of medical disposables is anchored by multinational corporations with extensive product portfolios and global distribution networks. Medtronic leads with its diversified offerings across cardiovascular, diabetes, and surgical segments, continuously investing in R&D to introduce advanced single-use catheters and precision delivery systems. Johnson & Johnson commands a broad presence in wound care, surgical mesh, and diagnostic disposables, driven by its scale and innovation pipeline. Stryker has established a strong position in nonwoven surgical products and orthobiologics, capitalizing on its reputation for quality and reliability. Abbott and Boston Scientific further enhance the market’s expertise with specialized diagnostic and interventional disposables, respectively, demonstrating how focused innovation can carve out leadership positions within high-growth niches. Together, these companies set performance benchmarks and influence industry standards on safety and efficacy for disposable medical products.

Alongside the global titans, specialist manufacturers such as Becton Dickinson and Company (BD), 3M Company, Cardinal Health, and B. Braun have secured critical roles through targeted portfolios in syringes, infection prevention solutions, and fluid management products. BD’s leadership in needle safety and prefilled syringes underscores the intersection of product innovation and regulatory compliance. 3M’s broad infection control suite, including high-performance surgical drapes and sterilization wraps, exemplifies sustained investment in material science advancements. Cardinal Health and B. Braun leverage integrated distribution channels and service offerings to reinforce their positions as key partners to healthcare providers, reflecting the strategic importance of logistics and value-added support in the disposables market. Emerging companies such as Molnlycke Health Care continue to challenge incumbents by focusing on sustainability and specialty wound care, illustrating the competitive diversity shaping sector evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Disposables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Ansell Limited

- Asahi Kasei Corporation

- Becton, Dickinson and Company

- Berry Global Group, Inc.

- Cardinal Health, Inc.

- Coloplast A/S

- Georgia-Pacific LLC

- Halyard Health, Inc.

- Johnson & Johnson Services, Inc.

- Kimberly-Clark Corporation

- Medline Industries, Inc.

- Medtronic plc

- Mölnlycke Health Care AB

- Nipro Corporation

- Owens & Minor, Inc.

- Paul Hartmann AG

- Terumo Corporation

- Unicharm Corporation

Delivering Targeted Strategic Recommendations to Enhance Resilience Agility and Sustainability for Medical Disposables Industry Stakeholders

Industry leaders must prioritize investments in domestic and nearshore production facilities to mitigate the risks associated with global trade uncertainties and tariffs. By expanding local manufacturing capabilities, suppliers can shorten lead times, reduce freight costs, and respond more swiftly to fluctuations in demand. Collaborative ventures with government agencies and public-private partnerships can further secure incentives for capacity expansion, ensuring a resilient supply base that aligns with evolving regulatory requirements and national health security objectives.

Sustainability considerations must be integrated into product design and material selection to meet tightening environmental regulations and growing buyer expectations. Incorporating biodegradable polymers, reducing packaging waste, and implementing closed-loop recycling programs for disposable products can differentiate suppliers in competitive tender processes and align with healthcare systems’ ESG goals. Additionally, adopting digital supply chain solutions-such as real-time tracking, predictive analytics, and e-procurement platforms-will enhance operational agility, inventory optimization, and transparency, enabling stakeholders to make data-driven decisions in dynamic market conditions.

Furthermore, strategic segmentation of product portfolios and tailored go-to-market approaches are vital. Providers should leverage data-driven insights to align offerings with distinct end-user needs across hospitals, clinics, and home care. Customized service bundles, training programs, and value-added support can foster stronger customer relationships and drive higher adoption rates. Emphasizing modular, interoperable product ecosystems will also facilitate cross-selling opportunities and create stickier purchasing behaviors among healthcare institutions. By executing these targeted strategies, industry leaders can navigate competitive pressures, capitalize on growth pockets, and deliver sustained value across the medical disposables landscape

Describing a Rigorous Multi-Method Research Methodology Integrating Primary Insights and Secondary Data to Ensure Robust Market Analysis Validity

This research integrates a hybrid methodological framework combining extensive secondary data analysis with targeted primary interviews. Secondary inputs were drawn from authoritative sources including regulatory filings, industry publications, and peer-reviewed journals to map historical trends, policy shifts, and material innovations. Concurrently, in-depth interviews with procurement executives, clinical leaders, and supply chain experts provided qualitative context around usage patterns, pain points, and strategic priorities.

Quantitative data collection involved triangulating statistical information from healthcare databases, customs records, and financial disclosures, ensuring robust validation of segmentation and regional consumption estimates. Methodological rigor was maintained through continuous cross-verification across data sources, iterative peer reviews, and sensitivity testing of underlying assumptions. This multi-method approach ensures both analytical depth and practical relevance, delivering credible insights to inform strategic decisions within the medical disposables sector

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Disposables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Disposables Market, by Product Type

- Medical Disposables Market, by Raw Material

- Medical Disposables Market, by End User

- Medical Disposables Market, by Distribution Channel

- Medical Disposables Market, by Region

- Medical Disposables Market, by Group

- Medical Disposables Market, by Country

- United States Medical Disposables Market

- China Medical Disposables Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Insights from Market Drivers Innovations and Regulatory Factors Shaping the Future Trajectory of Medical Disposables

In summary, the medical disposables industry stands at a pivotal juncture where technological innovation, regulatory evolution, and global trade dynamics converge to reshape supply chain strategies and market demand. The continued adoption of advanced materials-from antimicrobial coatings to biodegradable polymers-offers new pathways to balance safety, performance, and environmental considerations. At the same time, shifting clinical practices, such as the proliferation of telehealth and home-based care, are broadening application settings and creating new market segments.

Regional variations in infrastructure maturity, regulatory environments, and economic conditions underscore the importance of adaptive strategies tailored to local needs. Meanwhile, tariff policies and sourcing challenges highlight the necessity of resilient manufacturing footprints and strategic partnerships. By aligning segmentation-driven product development, lean supply chain models, and value-added service offerings, stakeholders can capitalize on emerging opportunities, mitigate risks, and shape the future trajectory of medical disposables with confidence

Partner with Ketan Rohom to Unlock Actionable Market Intelligence and Secure Your Comprehensive Medical Disposables Research Report Today

To discuss how this comprehensive analysis can address your strategic needs and to secure access to the detailed report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep subject-matter expertise in medical disposables and can guide you in selecting the right research package to power your decision-making. His insights will help you navigate market complexities, capitalize on emerging opportunities, and build resilient supply-chain strategies. Connect with Ketan today to unlock the actionable intelligence your organization requires to stay ahead in the dynamic medical disposables landscape

- How big is the Medical Disposables Market?

- What is the Medical Disposables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?