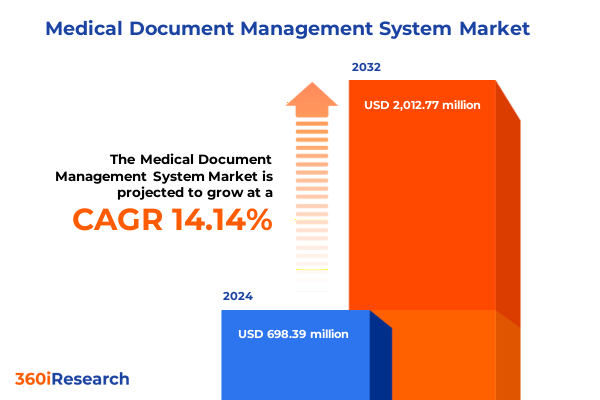

The Medical Document Management System Market size was estimated at USD 786.46 million in 2025 and expected to reach USD 888.17 million in 2026, at a CAGR of 14.36% to reach USD 2,012.76 million by 2032.

Crafting a Comprehensive Vision for Medical Document Management Excellence to Enhance Operational Efficiency and Accelerate Clinical Outcomes Across Healthcare Organizations

The healthcare sector is undergoing a pivotal transformation driven by the imperative to manage documentation more efficiently and securely. As clinical workflows become increasingly digitized, the demand for robust medical document management solutions has intensified. These solutions are not merely tools for storing and retrieving patient records; they are central to enhancing interoperability, ensuring regulatory compliance, and supporting data-driven decision making. In today’s environment, healthcare providers face mounting pressures to reduce administrative burdens while simultaneously improving the quality of care, making the strategic implementation of document management systems a critical organizational priority.

Against this backdrop, stakeholders ranging from hospitals and clinics to diagnostic centers and ambulatory care networks are seeking integrated platforms that can seamlessly bridge administrative, billing, and clinical documentation. These platforms must not only capture and archive diverse document types but also enable real-time analytics, automated workflows, and secure collaboration across care teams. With the advent of cloud architectures and advanced software services, organizations can now deploy scalable solutions that adapt to evolving regulatory landscapes and patient expectations. This section establishes the foundational context for our executive summary by outlining the significance of medical document management systems and the key drivers that are reshaping healthcare operations globally.

Analyzing the Shift from Traditional Paper-Based Records to Intelligent Digital Platforms and Key Drivers Shaping the Medical Document Management Ecosystem

Over the past decade, the transition from paper-based archives to intelligent digital repositories has accelerated, reshaping the medical document management landscape. The convergence of cloud-native architectures, machine learning-enhanced capture capabilities, and integrated analytics has liberated healthcare organizations from the constraints of physical storage and manual indexing. This digital evolution has been fueled by an increased regulatory focus on data security, patient privacy mandates such as HIPAA, and the growing expectation for seamless interoperability among electronic health record (EHR) systems.

Moreover, the rise of remote care models and telehealth has underscored the necessity for cloud-enabled access to documentation from any location. Today’s solutions are no longer passive repositories; they actively streamline document workflows through intelligent routing, optical character recognition, and natural language processing. In turn, clinicians can devote more time to patient care, administrative overheads are reduced, and compliance processes are automated. As we explore transformative shifts in this section, it becomes clear that the medical document management ecosystem is evolving from static record-keeping to dynamic, insights-driven frameworks that underpin value-based care initiatives.

Evaluating the Financial and Operational Consequences of New United States Tariffs in 2025 on Healthcare Document Management Technologies

In 2025, the United States implemented a series of tariffs targeting imported technology components and software subscriptions, exerting upward pressure on the cost of deploying medical document management infrastructures. Hardware components such as specialized scanners, network appliances, and storage arrays have experienced increased duties, while software-as-a-service agreements linked to offshore providers have faced import classifications that levy additional fees. These policy measures have led organizations to reevaluate total cost of ownership and consider hybrid deployment models that optimize on-premise investments against cloud service expenditures.

Consequently, healthcare providers are wrestling with inflationary budgetary impacts, prompting longer procurement cycles and increased demand for vendor cost transparency. Some regional hospital systems have responded by consolidating supplier relationships and negotiating multi-year contracts that include tariff escalation clauses. Others are embracing open-source capture tools and leveraging domestic software development partners to mitigate exposure to import duties. This section examines how the cumulative impact of the 2025 tariffs is reshaping procurement strategies, technology roadmaps, and vendor partnerships across the healthcare ecosystem.

Deriving Actionable Insights from Component Document Type Deployment Mode Application Organization Size and End User Segmentation in Medical Document Management

Segmentation insights reveal that the medical document management market’s evolution is intricately tied to its component mix, document typologies, deployment preferences, application areas, organizational scales, and varied end-user requirements. In terms of component, growth is driven by the convergence of comprehensive software suites and outsourced services that facilitate seamless integration with existing IT infrastructure. When considering document type, the differential needs of administrative memos, billing statements, and clinical notes have prompted vendors to develop modular solutions that can be tailored to each workflow, ensuring compliance and audit readiness.

Deployment modes vary significantly, with cloud deployments offering rapid scalability and remote accessibility, while on-premise models continue to appeal to entities with stringent security policies or limited internet connectivity. Application-driven innovation spans advanced analytics for population health, high-fidelity document capture engines, resilient storage and retrieval frameworks, automated workflow orchestration tools, and deep integration with electronic health record systems. Furthermore, large enterprises deploy enterprise-grade platforms with complex governance controls, whereas small and medium enterprises often opt for modular implementations that align with constrained IT budgets. Finally, end users ranging from ambulatory centers and outpatient clinics to specialized diagnostic facilities and large hospital networks each demand tailored interfaces and functionality that reflect their unique operational rhythms and regulatory obligations.

This comprehensive research report categorizes the Medical Document Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Document Type

- Deployment Mode

- Application

- Organization Size

- End User

Uncovering Regional Dynamics and Growth Opportunities in the Americas Europe Middle East Africa and Asia-Pacific Medical Document Management Landscape

Regional dynamics in the medical document management market underscore distinct growth vectors across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, healthcare providers are rapidly adopting cloud-centric document workflows to support large-scale electronic health record modernization efforts and value-based reimbursement models. The regulatory environment in North America, with its stringent data privacy rules, has catalyzed investments in secure access controls and audit trail capabilities.

Meanwhile, Europe, the Middle East, and Africa present a heterogeneous landscape where varying levels of digital maturity exist among established healthcare systems and emerging markets. In Western Europe, harmonization efforts around GDPR and cross-border health information exchange have spurred demand for interoperable platforms and advanced encryption standards. In contrast, regions within the Middle East and Africa are investing in foundational digital infrastructure, prioritizing core document storage and capture functionalities before adding analytics and workflow automation. In the Asia-Pacific region, growth is being led by rapid digitization initiatives, government-sponsored smart hospital programs, and ambitious public health record digitization projects. Collectively, these regional trends shape differentiated solution requirements and strategic entry models for vendors aiming to capture market share across diverse regulatory and technological landscapes.

This comprehensive research report examines key regions that drive the evolution of the Medical Document Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Competitors Driving Technological Advancement and Market Penetration in Medical Document Management Solutions

The competitive landscape is marked by a diverse set of innovators ranging from established enterprise software providers to specialized document management firms and emerging technology startups. Leading players are distinguished by their ability to deliver end-to-end platforms that integrate capture, storage, and workflow orchestration with advanced analytics and EHR interoperability. Strategic partnerships and mergers have accelerated the development of AI-driven capabilities, while investments in user experience are enhancing clinician adoption rates.

Several companies have prioritized building ecosystems through open APIs, enabling third-party developers to extend functionality in areas such as population health reporting and patient engagement portals. Others are expanding their global footprint via localized deployment teams and value-added services that address regulatory compliance in multiple jurisdictions. Competitive differentiation increasingly hinges on offering modular, subscription-based pricing models that allow organizations to scale features according to evolving needs. As a result, market leaders are focusing on cultivating long-term customer relationships through continuous platform enhancements, managed services offerings, and comprehensive training initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Document Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- Cerner Corporation

- Epic Systems Corporation

- General Electric Company

- Hyland Software, Inc.

- Koninklijke Philips N.V.

- McKesson Corporation

- Medical Information Technology, Inc.

- NextGen Healthcare, Inc.

- OpenText Corporation

Delivering Strategic Recommendations to Propel Healthcare Organizations toward Optimized Document Management and Sustained Competitive Advantage

To navigate the complexities of the medical document management landscape and maintain a competitive edge, industry leaders should adopt a multifaceted strategy that balances technological innovation with operational pragmatism. First, healthcare organizations must prioritize cloud-native architectures with hybrid deployment capabilities to leverage elastic scalability while retaining control over sensitive data. Next, forging strategic alliances with API-driven platform providers will enable seamless integration of analytics and AI-driven modules, thereby accelerating insights into patient populations and administrative efficiency.

Furthermore, implementing robust change management programs is essential for driving clinician adoption and minimizing workflow disruptions. Leaders should invest in role-based training tailored to the diverse needs of administrative staff, billing specialists, and clinicians. Additionally, executive sponsorship coupled with clear performance metrics will ensure accountability and continuous improvement. Lastly, conducting regular tariff impact assessments and renegotiating supply contracts can mitigate cost pressures, while exploring domestic software development partnerships can provide additional agility. By following these recommendations, organizations can orchestrate a holistic document management strategy that delivers operational resilience and fosters innovation across care delivery.

Detailing a Robust Research Methodology Combining Primary Engagements Secondary Analysis and Quantitative Modeling to Ensure Data Integrity

Our research approach combines primary qualitative engagements with key stakeholders, secondary data analysis, and quantitative modeling to ensure comprehensive coverage and data integrity. Initially, in-depth interviews were conducted with C-suite executives, IT directors, and health information managers across various healthcare settings, including ambulatory clinics, diagnostic centers, and tertiary hospitals. These discussions provided firsthand perspectives on deployment challenges, cost structures, and emerging functional requirements. Subsequently, secondary sources such as regulatory publications, peer-reviewed journals, and industry white papers were systematically reviewed to validate and contextualize the primary insights.

Quantitative analyses incorporated anonymized procurement data and vendor financial disclosures to model component cost trends, tariff impacts, and adoption rates across segments. Scenario-based forecasting techniques were applied to assess the resilience of deployment strategies under varying economic and policy conditions. Finally, all findings underwent a multi-tiered validation process, including cross-verification with subject matter experts and iterative rounds of feedback from end users, to guarantee accuracy and relevance. This methodology underpins the rigor and credibility of our market intelligence, ensuring that strategic recommendations are grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Document Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Document Management System Market, by Component

- Medical Document Management System Market, by Document Type

- Medical Document Management System Market, by Deployment Mode

- Medical Document Management System Market, by Application

- Medical Document Management System Market, by Organization Size

- Medical Document Management System Market, by End User

- Medical Document Management System Market, by Region

- Medical Document Management System Market, by Group

- Medical Document Management System Market, by Country

- United States Medical Document Management System Market

- China Medical Document Management System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Findings Highlighting Industry Trends Challenges and Pivotal Takeaways Shaping the Future of Medical Document Management

In conclusion, the medical document management market is at an inflection point where technology innovation, regulatory evolution, and geopolitical factors are converging to redefine operational paradigms. The transition to intelligent digital platforms, amplified by artificial intelligence and cloud capabilities, promises unprecedented efficiency gains and enhanced patient care coordination. However, the introduction of United States tariffs in 2025 adds a layer of complexity, compelling stakeholders to reevaluate procurement strategies and consider hybrid deployment architectures.

Segmentation insights highlight that while services and software are co-driving market growth, the specific requirements of administrative, billing, and clinical documentation necessitate tailored solutions. Similarly, deployment preferences between cloud and on-premise models, coupled with application-specific needs such as analytics and EHR integration, underscore the importance of modular, scalable architectures. Regional dynamics further reinforce the need for localized strategies, whether addressing GDPR compliance in Europe, infrastructure build-outs in the Middle East & Africa, or digitization initiatives in Asia-Pacific. By synthesizing these findings, this executive summary equips decision-makers with a holistic understanding of current trends and actionable pathways to secure competitive advantage in the evolving landscape of medical document management.

Engage Directly with Ketan Rohom Associate Director Sales & Marketing to Acquire the Complete Market Research Report and Elevate Your Strategic Document Management Initiatives

Act now to unlock unparalleled insights and strategic guidance by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing whose expertise can tailor the report to your organizational goals. This comprehensive medical document management market research report provides a deep dive into evolving industry trends, enabling you to benchmark performance, anticipate regulatory shifts, and enhance operational resilience. By partnering with Ketan, you gain access to customized data visualizations, scenario analyses, and deployment roadmaps that align with your growth trajectories and technology priorities.

Seize this opportunity to transform document workflows, reduce administrative burdens, and accelerate clinical decision support across the entire care continuum. Reach out to Ketan Rohom to discuss enterprise licensing, volume discounts, and bespoke use-case modules that address your unique challenges in services and software, administrative, billing, clinical, cloud, on-premise, analytics, capture, storage, workflow, EHR integration, and more. Empower your organization with the actionable intelligence needed to outperform competitors, navigate tariff-induced pricing pressures, and drive sustainable innovation. Secure your copy of the report today and start translating market intelligence into strategic advantage.

- How big is the Medical Document Management System Market?

- What is the Medical Document Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?