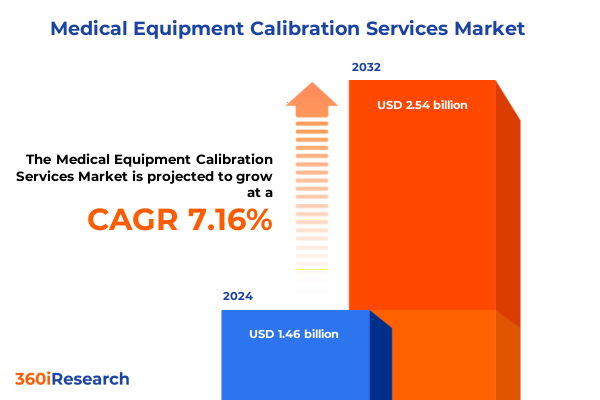

The Medical Equipment Calibration Services Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.62 billion in 2026, at a CAGR of 7.39% to reach USD 2.54 billion by 2032.

Unveiling the Critical Role of Calibration Services in Ensuring the Accuracy and Reliability of Complex Medical Instruments

The calibration of medical equipment ensures the accuracy and reliability of instruments across healthcare facilities, directly impacting patient safety and clinical outcomes. In an environment where stringent regulatory bodies and quality standards govern every aspect of device performance, calibration services have become a cornerstone of compliance and risk management. As devices grow more complex, from imaging systems to surgical tools, the necessity for specialized calibration methodologies intensifies, making these services indispensable for healthcare providers aiming to uphold the highest levels of operational excellence.

Embracing Technology-Driven Evolution as Calibration Services Transition to Automated, Connected, and Predictive Platforms

The landscape of medical equipment calibration services is undergoing a profound transformation driven by a convergence of technological advancements and evolving industry demands. The proliferation of Internet of Things (IoT) connectivity and cloud-based platforms has enabled remote calibration capabilities, allowing technicians to monitor and adjust critical care equipment without physical site visits. This shift not only reduces downtime and logistical burdens but also aligns with healthcare facilities’ increasing focus on operational efficiency and uninterrupted patient care.

Analyzing How Renewed Section 301 Tariffs on Medical Devices Are Amplifying Cost Pressures and Driving Supply Chain Realignments

In 2025, the reinstatement of Section 301 tariffs by the U.S. Trade Representative introduced a 25% duty on Class I and II medical devices imported from China, encompassing a broad spectrum of products from orthopedic instruments to basic monitoring devices. Industry leaders warn that these tariffs amplify cost pressures, compel supply chain diversification, and potentially delay the deployment of essential equipment within U.S. hospitals. Concurrent global tensions have further fueled strategic initiatives to regionalize manufacturing and source components domestically, as healthcare systems prioritize resilience amid trade uncertainties.

Delving into Instrument, Service Model, End-User, Service Type, and Application Dynamics That Define Calibration Market Segmentation

Instrument type segmentation reveals that calibration services for imaging equipment-such as CT scanners, MRI units, ultrasound systems, and X-ray machines-demand rigorous precision due to stringent imaging standards, while laboratory equipment calibration for analytical instruments, blood analyzers, pH meters, and thermal cyclers is guided by exacting clinical chemistry and microbiology protocols. Patient monitoring devices, including blood pressure monitors, ECG monitors, pulse oximeters, and temperature probes, require specialized traceable calibration to ensure continuous accuracy, and calibration of surgical instruments like endoscopes, scalpels, and surgical microscopes underpins the exacting tolerances necessary for operative procedures. The service model segmentation highlights differences in logistics and turnaround, with offsite calibration centers leveraging centralized expertise and economies of scale, whereas onsite calibration services deliver immediate response and tailored support within facility environments. End users, ranging from diagnostic centers and hospitals to pharmaceutical companies and research laboratories, exhibit distinct calibration priorities: diagnostic centers emphasize throughput and uptime, hospitals prioritize patient safety and regulatory adherence, pharmaceutical companies focus on GMP and analytical traceability, and research laboratories require custom protocols for experimental setups. Service type segmentation across corrective, predictive, and preventive offerings underscores how reactive maintenance addresses immediate out-of-tolerance events, predictive approaches leverage data analytics to forecast calibration needs, and preventive strategies schedule regular interventions to minimize deviations. Application segmentation spans laboratory testing-encompassing clinical chemistry analyzers, hematology instruments, immunoassay analyzers, and microbiology systems-to medical imaging, patient monitoring, and surgery, each with unique calibration frequencies and documentation requirements.

This comprehensive research report categorizes the Medical Equipment Calibration Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Service Model

- Service Type

- End User

- Application

Comparing How Americas, EMEA, and Asia-Pacific Regions Are Shaping Distinct Calibration Service Requirements and Growth Patterns

Across the Americas, robust healthcare infrastructures and stringent accreditation standards underpin a mature calibration services ecosystem characterized by high outsourcing rates and regular compliance audits. In the Europe, Middle East & Africa region, harmonized regulations such as the European Union’s Medical Device Regulation (MDR) drive uniform calibration protocols, while diverse healthcare models in the Middle East and Africa create differentiated demand for both offsite expertise and localized onsite services. Asia-Pacific is experiencing rapid growth in calibration demand fueled by expanding hospital networks in China and India, increasing regulatory alignment in Japan and Australia, and heightened investments in medical technology across Southeast Asia. Regional dynamics also reflect evolving supply chain strategies: Americas actors respond to tariff-induced cost increases by diversifying suppliers, EMEA participants prioritize consistency under unified regulatory frameworks, and Asia-Pacific stakeholders optimize local service delivery to support burgeoning healthcare modernization initiatives.

This comprehensive research report examines key regions that drive the evolution of the Medical Equipment Calibration Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Recognizing How Established Global Leaders and Agile Specialists Are Competing Through Certification, Technology, and Strategic Partnerships

The competitive landscape features global leaders such as Fluke Biomedical, Tektronix, Transcat, Trescal, and NS Medical Systems, each distinguished by comprehensive service portfolios and certification credentials. These organizations have invested in advanced calibration laboratories, digital platforms for certificate management, and comprehensive training programs to uphold quality standards internationally. Emerging specialists are carving niches in remote calibration and IoT-enabled monitoring, while regional calibration providers are deepening service networks to support localized regulatory compliance. Strategic alliances between calibration laboratories and original equipment manufacturers (OEMs) are further enhancing service differentiation, enabling integrated maintenance solutions that streamline workflows and reinforce vendor relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Equipment Calibration Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALS Limited

- Applus+ Servicios Tecnológicos, S.A.

- Biomedical Technologies, Inc.

- Bureau Veritas SA

- DEKRA SE

- Endress+Hauser AG

- Eurofins Scientific SE

- Fluke Biomedical

- Intertek Group PLC

- SGS SA

- Tektronix, Inc.

- Transcat, Inc.

- TÜV Rheinland AG

- UL LLC

Implementing Strategic Digital, Operational, and Collaborative Initiatives to Enhance Calibration Reliability, Agility, and Regulatory Alignment

Industry leaders should prioritize the integration of remote and automated calibration platforms to reduce turnaround times and enhance service scalability. By leveraging IoT-enabled devices and predictive maintenance analytics, organizations can optimize calibration intervals and allocate resources more efficiently. Diversifying supply chains by establishing regional calibration hubs can mitigate tariff-induced cost volatility and bolster resilience. Collaborations with OEMs focused on digital certificate integration and blockchain-backed traceability can streamline compliance workflows and reinforce trust. Investing in workforce development through specialized certification programs will ensure that technicians remain adept at servicing increasingly complex medical technologies. Finally, engaging proactively with regulatory bodies to advocate for harmonized calibration standards can lower barriers to cross-border service delivery and foster industry alignment.

Outlining a Robust, Triangulated Research Framework Combining Primary Interviews and Secondary Data to Ensure Analytical Rigor

This analysis synthesizes primary research consisting of in-depth interviews with calibration service executives, regulatory experts, and healthcare facility managers, alongside secondary research sourced from industry white papers, regulatory filings, and peer-reviewed journals. We employed a rigorous triangulation methodology to cross-verify data points, ensuring that qualitative insights align with documented trends. Key segmentation frameworks were developed based on service attributes, end-user needs, and application contexts, while regional and competitive analyses were informed by publicly available tariffs data and corporate disclosures. The resulting report delivers a robust foundation for strategic planning, risk assessment, and market entry decisions within the calibration services domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Equipment Calibration Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Equipment Calibration Services Market, by Instrument Type

- Medical Equipment Calibration Services Market, by Service Model

- Medical Equipment Calibration Services Market, by Service Type

- Medical Equipment Calibration Services Market, by End User

- Medical Equipment Calibration Services Market, by Application

- Medical Equipment Calibration Services Market, by Region

- Medical Equipment Calibration Services Market, by Group

- Medical Equipment Calibration Services Market, by Country

- United States Medical Equipment Calibration Services Market

- China Medical Equipment Calibration Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing How Technological, Regulatory, and Operational Forces Converge to Elevate Calibration Services as a Critical Healthcare Imperative

As medical devices become increasingly sophisticated and regulatory landscapes grow more stringent, calibration services stand at the nexus of quality assurance, patient safety, and operational efficiency. The intersection of digital transformation, supply chain realignment, and evolving service models presents both challenges and opportunities for service providers and healthcare systems alike. Organizations that embrace technology-enabled workflows, diversify service delivery models, and cultivate strategic partnerships will be well positioned to meet the demands of a dynamic healthcare environment. By adopting the actionable recommendations outlined, industry participants can navigate trade uncertainties, enhance compliance, and drive superior clinical outcomes through meticulous calibration practices.

Unlock Comprehensive Market Insights and Strategic Recommendations by Connecting with Our Senior Sales Executive for a Customized Research Proposal

To explore the comprehensive analysis of the medical equipment calibration services landscape, secure your copy of the full market research report by reaching out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with our team to gain immediate access to in-depth insights, supportive data appendices, and strategic recommendations tailored to equip your organization for success. Elevate your competitive positioning by leveraging this authoritative resource-contact Ketan Rohom today to receive a personalized proposal and begin harnessing actionable intelligence that drives informed decision-making.

- How big is the Medical Equipment Calibration Services Market?

- What is the Medical Equipment Calibration Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?