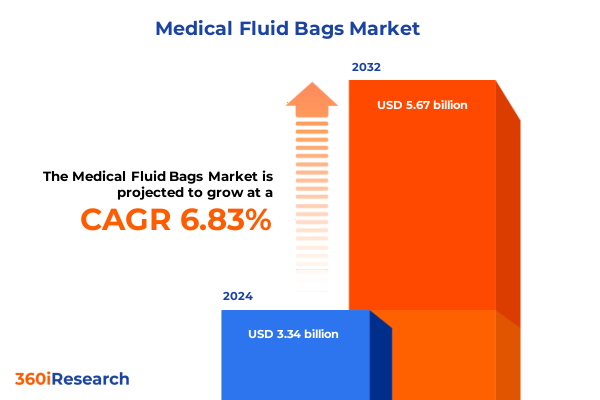

The Medical Fluid Bags Market size was estimated at USD 3.55 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 6.90% to reach USD 5.67 billion by 2032.

Discover the evolving realm of medical fluid bags where innovation and patient care converge to redefine safety and performance in clinical settings

In recent years, the realm of medical fluid bags has witnessed a profound convergence of technological innovation and clinical necessity, elevating these once-basic disposables into sophisticated devices integral to patient care. Driven by heightened safety standards and demand for efficient administration, manufacturers have re-engineered core materials, designs, and production processes. This evolution underscores how fluid containment solutions now extend far beyond simple storage, embedding features that safeguard sterility and ease of use within high-pressure environments. In this context, the introduction presents a panoramic view of the critical role these devices play in modern healthcare.

As regulatory authorities worldwide intensify scrutiny over biocompatibility and infection control, the medical fluid bag sector stands at the forefront of rigorous quality demands. The adoption of advanced polymers and refined sterilization protocols has become not only a differentiator but a requirement for market participation. Simultaneously, rising awareness among clinicians and patients alike has amplified expectations for product transparency, traceability, and environmental responsibility. This dynamic interplay of heightened regulation and user-driven standards sets the stage for a deeper exploration of how medical fluid bag solutions continue to adapt, innovate, and deliver unmatched reliability in clinical settings.

Uncover the seismic shifts reshaping medical fluid bag development as material science breakthroughs and digital integration drive unprecedented transformation

The medical fluid bag sector is undergoing transformative shifts fueled by breakthroughs in polymer science and digital integration capabilities. Novel non-PVC formulations now offer reduced leachables and improved environmental profiles, appealing to healthcare providers seeking safer and greener options. Concurrently, the rise of smart sensors and connected infusion systems is enabling real-time monitoring of flow rates and bag integrity, marking a departure from traditional gravity-fed approaches. These advancements collectively signal an era where form and function intertwine to meet escalating clinical demands.

Beyond materials and connectivity, supply chain reshaping has emerged as a pivotal force in the landscape. Strategic partnerships between raw material innovators and device manufacturers have fostered vertical integration, accelerating time to market and enhancing quality control. In parallel, digital platforms that facilitate remote training and technical support have enhanced product adoption, particularly in decentralized environments such as home care settings. As a result, the stability and adaptability of the medical fluid bag ecosystem have strengthened, reflecting an industry poised for sustained modernization.

Examine how the 2025 United States tariff adjustments on key raw materials have cumulatively influenced manufacturing economics and supply resilience

The policy environment of 2025 introduced new tariff measures on essential raw materials, most notably PVC resin and specialized polymer additives crucial for medical fluid bag production. As a result, manufacturers have navigated elevated input costs, prompting many to reassess supplier diversification and cost-containment strategies. These cumulative tariff impacts have not only altered procurement practices but also reinforced the importance of localized manufacturing hubs to mitigate cross-border sensitivities and ensure uninterrupted supply to healthcare facilities.

In response, leading producers have accelerated investments in alternative compounds and recyclability initiatives to counterbalance cost pressures. Some have leveraged collaborative agreements with domestic material suppliers to secure preferential pricing and volume flexibility. Moreover, contract negotiations now routinely include tariff adjustment clauses, embedding greater financial protection for both buyers and sellers. Through these collective adaptations, the sector demonstrates resilience, strategically absorbing external shocks to uphold continuity and safeguard patient care.

Unlock detailed insights into how variations in product types, materials, end users, delivery modes, and sterilization methods shape market dynamics

The medical fluid bag industry manifests intricate nuances when examined through the lens of product type, material composition, end-user specialization, delivery mode, and sterilization approach. Across product lines such as blood bags, chemotherapy bags, parenteral nutrition bags, and saline bags, each variant demands tailored design considerations-from layering technologies that enhance barrier properties to infusion dynamics calibrated for specific therapies. These distinctions drive development priorities and quality benchmarks across manufacturing processes.

Material selection further delineates market preferences, with non-PVC alternatives gaining traction due to regulatory incentives and environmental considerations, while PVC remains a mainstay for its proven performance and cost profile. End-user environments also wield significant influence; ambulatory centers and clinics often prioritize compact, user-friendly formats, whereas home care applications demand robust, patient-centric features. Hospital procurement cycles, by contrast, emphasize interoperability with high-volume infusion pumps and compliance with stringent sterility standards.

Delivery mode bifurcates into gravity systems and pump-based administrations, the latter subdivided into elastomeric, syringe, and volumetric pumps, each offering unique advantages for flow control and portability. Meanwhile, sterilization methods such as ethylene oxide and gamma irradiation shape product lifecycle and validation pathways. Collectively, these segmentation dimensions reveal a tapestry of specialized requirements that manufacturers must navigate to tailor offerings that resonate across diverse clinical settings.

This comprehensive research report categorizes the Medical Fluid Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Delivery Mode

- Sterilization Method

- End User

Explore critical regional perspectives highlighting distinct regulatory landscapes, infrastructure maturity, and healthcare demands across global markets

Regional nuances in medical fluid bag adoption underscore how healthcare infrastructure maturity, regulatory frameworks, and patient demographics converge to shape demand. In the Americas, emphasis on cost-efficiency and robust reimbursement schemes has spurred demand for both traditional PVC infusion systems and next-generation non-PVC formats. Fragmented distribution networks have, however, compelled suppliers to refine logistics capabilities and expand service offerings to remote facilities.

Across Europe, the Middle East, and Africa, diverse regulatory regimes coexist, driving manufacturers to harmonize quality protocols while tailoring packaging and labeling to local requirements. Advanced healthcare markets in Western Europe lead in embracing integrated infusion monitoring platforms, whereas emerging economies in the region are increasingly seeking scalable, no-frills solutions to expand basic care access. Meanwhile, stringent environmental directives have accelerated the phase-out of certain plasticizers, elevating the profile of green materials.

The Asia-Pacific landscape reflects its own set of contrasts. Rapid infrastructure development and growing home care demand have catalyzed adoption of portable pump systems, while large centralized hospitals in metropolitan centers commission high-capacity, automated fluid management solutions. Regional investments in domestic manufacturing have also intensified, as governments incentivize onshore production to bolster supply security and reduce dependency on imports.

This comprehensive research report examines key regions that drive the evolution of the Medical Fluid Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delve into the strategic maneuvers and innovation pipelines of leading stakeholders propelling advancements in medical fluid bag solutions worldwide

Key industry participants have strategically aligned their innovation pipelines, mergers and acquisitions, and production footprints to maintain competitive advantage. Several multinational corporations have prioritized the development of advanced polymer blends that enhance bag transparency and reduce contamination risk, while simultaneously establishing joint ventures with raw material suppliers to lock in high-purity polymer streams. These alliances not only bolster supply reliability but also underpin research programs aimed at next-generation formulations.

Meanwhile, forward-looking enterprises have integrated digital modules within infusion pumps, facilitating predictive maintenance and remote troubleshooting. Such value-added services have become critical differentiators in tender evaluations and long-term service contracts. In parallel, a subset of agile, specialized firms has carved niches by focusing exclusively on home care solutions, leveraging lightweight elastomeric pump designs and subscription-based delivery models to capture emerging patient-centric markets.

Across the board, capital allocation toward scalable, automated production lines has intensified, reflecting a consensus that operational agility and cost discipline are indispensable amid ongoing tariff fluctuations and raw material volatility. As a result, leading providers continue to refine global footprint strategies, synchronizing capacity expansions with regional demand forecasts and regulatory milestones.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Fluid Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Becton, Dickinson and Company

- Fresenius Kabi AG

- Grifols, S.A.

- ICU Medical, Inc.

- Macopharma S.A.S.

- Nipro Corporation

- Pfizer Inc.

- Poly Medicure Ltd.

- Sichuan Kelun Pharmaceutical Co., Ltd.

- SSY Group Limited

- Terumo Corporation

- Vetter Pharma-Fertigung GmbH & Co. KG

Empower industry frontrunners with actionable strategies to fortify supply chains, foster innovation, and navigate regulatory complexities effectively

To navigate the evolving landscape, industry leaders must embed supply chain agility at the core of their operational ethos. Prioritizing dual sourcing strategies for critical polymers and additives will buffer against geopolitical and tariff disruptions. Concurrently, fostering collaborative research alliances with material scientists and clinical partners can accelerate the introduction of greener, patient-friendly formulations.

Innovation investment should extend beyond materials to encompass digital connectivity and data analytics. By integrating smart infusion monitoring within bag assemblies or pump interfaces, organizations can unlock service-based revenue streams and deepen customer engagement. At the same time, streamlined regulatory pathways can be achieved by engaging proactively with health authorities, submitting comprehensive validation data that expedites review timelines and ensures compliance continuity.

Finally, enhancing after-sales support-through remote diagnostics, training platforms, and outcome-based contracting-will differentiate offerings and reinforce long-term customer loyalty. By coupling technological excellence with robust service delivery, industry frontrunners can secure sustainable growth and substantive value creation in an increasingly competitive arena.

Reveal the comprehensive research framework integrating primary interviews, rigorous secondary analysis, and expert validation for robust findings

Our research framework integrates a multi-tiered approach designed to ensure depth, accuracy, and strategic relevance. Initially, a series of in-depth interviews was conducted with senior executives from leading polymer suppliers, device manufacturers, and clinical end users to capture firsthand perspectives on emerging needs and technology adoption curves. These primary insights were supplemented by rigorous secondary analysis of peer-reviewed journals, patent filings, and regulatory submissions to validate thematic trends and technical benchmarks.

To enhance the robustness of findings, a cross-functional panel comprising materials scientists, regulatory specialists, and healthcare practitioners convened periodically to critique draft conclusions and identify blind spots. Quantitative data streams-sourced from government databases on healthcare facility inventories and import-export records-provided contextual grounding for supply chain and regional adoption analyses. Finally, all data sets were triangulated through a structured validation process, ensuring that each strategic insight withstands rigorous scrutiny and reflects actionable guidance for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Fluid Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Fluid Bags Market, by Product Type

- Medical Fluid Bags Market, by Material

- Medical Fluid Bags Market, by Delivery Mode

- Medical Fluid Bags Market, by Sterilization Method

- Medical Fluid Bags Market, by End User

- Medical Fluid Bags Market, by Region

- Medical Fluid Bags Market, by Group

- Medical Fluid Bags Market, by Country

- United States Medical Fluid Bags Market

- China Medical Fluid Bags Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesize key takeaways and strategic implications underscoring the future trajectory of medical fluid bag technologies and market evolution

In summary, the medical fluid bag sector stands at an inflection point where material innovation, digital enhancement, and geopolitical realities collectively redefine competitive imperatives. Advanced non-PVC formulations and integrated monitoring solutions are no longer ancillary features but core requirements that distinguish market leaders. At the same time, tariff-induced cost pressures and evolving regional regulations underscore the importance of supply chain resilience and adaptive commercialization strategies.

Ultimately, organizations that blend technological foresight with operational flexibility will be best positioned to address dynamic end-user needs across ambulatory centers, clinics, home care environments, and hospitals. By leveraging the detailed segmentation and regional insights presented, stakeholders can prioritize investments, streamline compliance pathways, and forge partnerships that drive sustained value. The path forward demands a balanced commitment to innovation, quality, and strategic responsiveness, ensuring that the next generation of medical fluid bag solutions continues to advance patient safety and clinical efficacy.

Take decisive action now to secure unparalleled insights by engaging directly with Ketan Rohom for your customized medical fluid bag market intelligence

If you’re seeking comprehensive insights that drive strategic action, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your personalized copy of the market research report. By engaging with Ketan, you gain tailored guidance on how these findings apply to your unique operational context, with streamlined access to further expert analysis and data customization. Don’t let competitors outpace you in adopting the next wave of advancements: connect with Ketan Rohom today to transform understanding into advantage and ensure your organization leads in the evolving medical fluid bags landscape.

- How big is the Medical Fluid Bags Market?

- What is the Medical Fluid Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?