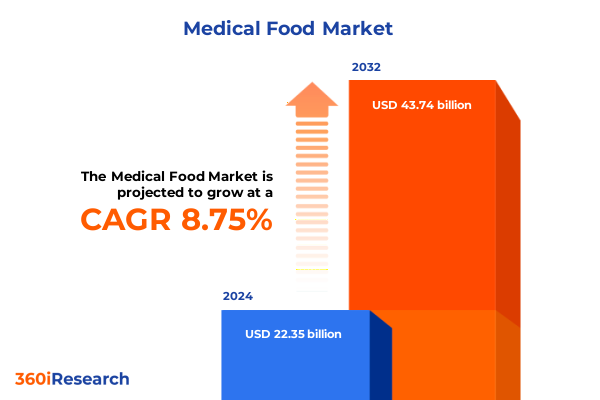

The Medical Food Market size was estimated at USD 24.12 billion in 2025 and expected to reach USD 26.03 billion in 2026, at a CAGR of 8.87% to reach USD 43.74 billion by 2032.

Understanding the Vital Role of Medical Foods in Modern Healthcare Paradigms and Patient-Centered Clinical Nutrition Strategies to Enhance Quality of Life Outcomes

Medical foods have emerged as a critical bridge between conventional dietary supplements and prescription therapies, addressing unique nutritional requirements for patients with chronic and acute medical conditions. Defined by stringent regulatory guidelines and designed to be administered under medical supervision, these specialized formulations encompass nutrient-dense compositions tailored to support metabolic functions, gut health, and neurological balance. By integrating clinical evidence with advanced nutritional science, medical foods empower clinicians to deliver targeted interventions that enhance patient outcomes, reduce hospital readmissions, and improve quality of life. As healthcare systems worldwide shift toward value-based care, the importance of precision nutrition has become increasingly recognized as a key driver of both clinical efficacy and cost-effectiveness. Furthermore, advancements in formulation technology and diagnostic tools now enable the development of highly customized interventions that adapt to individual patient profiles, reflecting an overarching trend toward personalized medicine.

In recent years, the integration of digital health platforms and telemedicine has accelerated the adoption of medical foods as an essential component of comprehensive treatment pathways. Remote monitoring tools allow clinicians to track patient compliance, nutritional biomarkers, and clinical endpoints in real time, facilitating prompt adjustments to nutritional regimens. This symbiotic relationship between technology and nutrition science has catalyzed new opportunities for collaboration across multidisciplinary care teams, including dietitians, gastroenterologists, neurologists, and endocrinologists. As a result, medical foods continue to evolve from niche therapeutic adjuncts into mainstream clinical solutions, underscoring the sector’s strategic significance within modern healthcare delivery models.

Unveiling the Pivotal Technological and Regulatory Transformations Shaping the Medical Food Industry Landscape in 2025 and Beyond

The medical food landscape is undergoing seismic shifts driven by regulatory refinements, technological breakthroughs, and evolving patient expectations. Regulatory authorities have introduced more robust frameworks for product classification, labeling standards, and evidence requirements, heightening transparency and bolstering clinician confidence. Concurrently, the rise of digital nutraceutical platforms and AI-powered formulation tools is redefining product development cycles, enabling rapid prototyping of bespoke nutrient blends informed by genomic, metabolomic, and microbiome data. As a result, companies are investing heavily in digital twins and predictive modeling to forecast clinical responses, streamline R&D processes, and accelerate time-to-market.

Beyond technology, transformative shifts in reimbursement models are reshaping stakeholder incentives. Payers are increasingly recognizing the long-term cost savings associated with improved nutritional outcomes and reduced hospital utilization. Value-based contracting pilots now incorporate nutritional adherence metrics and patient-reported outcomes, aligning manufacturer reimbursement with clinical performance. This confluence of regulatory rigor, technological innovation, and value-driven reimbursement is catalyzing a new era of collaboration across healthcare ecosystems, where medical foods are positioned not merely as adjunctive interventions but as integral components of holistic care pathways.

Evaluating the Aggregate Effect of 2025 United States Tariff Adjustments on Medical Food Supply Chains, Pricing Dynamics, and Market Accessibility

The introduction of revised United States tariffs in 2025 has imparted far-reaching consequences for medical food manufacturers, distributors, and end users alike. Elevated duties on key micronutrients and specialty ingredients, along with increased levies on imported packaging materials, have intensified cost pressures throughout the supply chain. In turn, companies have faced the challenge of reconciling margin compression with the imperative to maintain price accessibility for vulnerable patient populations. Moreover, extended lead times resulting from customs inspections and administrative complexities have amplified the risk of stockouts, particularly for products reliant on niche ingredient sources.

Amid these headwinds, stakeholders have explored strategic mitigation strategies to preserve continuity of supply and safeguard patient care. Manufacturers have diversified sourcing networks by forging alliances with domestic producers and alternative overseas suppliers situated in tariff-exempt jurisdictions. Distribution partners have implemented advanced inventory management systems and demand-forecasting algorithms to optimize stock buffers and reduce obsolescence. Simultaneously, advocacy groups and industry associations have engaged policymakers to seek targeted relief measures, emphasizing the societal cost burdens of nutritional interruption in medically fragile cohorts. Looking ahead, the cumulative impact of tariff realignments underscores the need for resilient supply chain architectures and agile pricing frameworks capable of absorbing macroeconomic fluctuations while sustaining patient-centric access.

Deriving Comprehensive Insights from Multifaceted Segmentation Including Product Type, Nutrient Composition, Indications, Demographics, End-User, and Formulation Type

Deep analysis of the market through multiple segmentation lenses reveals nuanced growth trajectories across product formulations, nutrient compositions, clinical indications, demographic cohorts, end-user settings, and formulation customization. Liquid formulas-both concentrated blends and ready-to-drink preparations-demonstrate high adoption rates in acute care settings, whereas solid formats such as bars, granules, and tablets cater to outpatient and home-based management. In parallel, the demand for fiber-rich profiles featuring both soluble and insoluble fibers addresses gastrointestinal disorders, while high-protein variants drawing on plant-based and animal-derived proteins support metabolic disorders and muscle-wasting conditions. Low-carbohydrate formulas, optimized for keto-friendly and diabetic-safe protocols, further illustrate the diversification across nutrient composition.

Indication-based segmentation underscores gastrointestinal health needs in Crohn’s disease and irritable bowel syndrome, alongside metabolic disorder applications for glycogen storage diseases and phenylketonuria, and emerging neurological formulations targeting Alzheimer’s disease and epilepsy. Demographically, adult populations drive baseline market volumes, with pediatric and geriatric subpopulations exhibiting specialized requirements for tailored nutrient concentrations and dosage forms. The end-user milieu spans home healthcare environments to hospitals and clinics, where in-patient and out-patient services dictate distribution channels and formulation preferences. Finally, the dichotomy between standardized formulas and customized patient solutions -including allergen-free and vegan-friendly options-highlights the industry’s pivot toward personalization and adherence maximization.

This comprehensive research report categorizes the Medical Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Nutrient Composition

- Formulation Type

- Indication

- Demographics

- End-User

Analyzing Regional Nuances Across Americas, Europe, Middle East and Africa, and Asia-Pacific to Illuminate Diverse Medical Food Market Dynamics

Regional dynamics imbue the global medical food market with distinct regulatory, economic, and cultural textures. In the Americas, progressive reimbursement landscapes and consolidated distribution networks bolster the uptake of advanced formulations, while a strong emphasis on digital health integration accelerates tele-nutrition initiatives. Contrastingly, the Europe, Middle East & Africa region presents a tapestry of fragmented regulatory regimes, each with unique classification criteria for medical foods, prompting companies to tailor market entry strategies on a country-by-country basis. In many EMEA markets, collaborative frameworks between public health agencies and private payers are emerging to subsidize critical nutritional interventions, particularly for rare metabolic disorders.

Across Asia-Pacific, rapid urbanization and rising healthcare expenditure underpin robust growth in both developed and emerging markets. Evolving clinician awareness and increasing patient engagement with preventive care fuel demand for targeted nutritional therapies. However, challenges such as inconsistent regulatory harmonization and variable cold-chain infrastructure necessitate localized supply chain adaptations. Taken together, these regional insights underscore the imperative for market participants to calibrate product portfolios, pricing models, and stakeholder partnerships in alignment with diverse regional imperatives and growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Medical Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Driving Competitive Differentiation in the Medical Food Sector Through Strategic Initiatives

The competitive architecture of the medical food sector is defined by both global conglomerates and specialized innovators pursuing differentiated strategies. Leading nutrition and healthcare corporations leverage extensive R&D capabilities and existing distribution footprints to expand their medical food pipelines, while smaller niche players focus on pioneering proprietary formulations, strategic licensing partnerships, and licensing collaborations with academic centers. Some companies have harnessed digital platforms to create end-to-end patient engagement ecosystems, integrating remote monitoring, adherence tracking, and clinician dashboards that reinforce value propositions.

Collaborative ventures between manufacturers, contract research organizations, and clinical institutions are accelerating the validation of novel clinical applications and biomarker-driven formula customizations. Meanwhile, mergers, acquisitions, and joint ventures continue to reshape competitive positioning, as firms seek to bolster geographic reach, enhance manufacturing capacities, and enrich their product portfolios. The confluence of scale-driven synergies and focused innovation underscores a market in which agility and scientific credibility are critical determinants of success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Ajinomoto Cambrooke, Inc.

- Alfasigma USA, Inc.

- Arla Foods Ingredients Group P/S

- Bayer AG

- Cerecin Inc.

- Danone S.A.

- Dutch Medical Food BV.

- EBM Medical

- ExeGi Pharma, LLC

- Fresenius SE & Co. KGaA

- FrieslandCampina

- Mead Johnson & Company, LLC

Formulating Pragmatic and Forward-Looking Recommendations to Empower Industry Leaders in Navigating the Evolving Medical Food Landscape

To navigate the complexity of the evolving medical food environment, industry leaders should prioritize supply chain resilience by establishing multi-tiered sourcing frameworks and investing in advanced inventory optimization technologies. Concurrently, proactive engagement with regulatory stakeholders will be vital to anticipate classification shifts, influence evidence requirements, and secure expedited pathways for novel formulations. Companies should also accelerate their digital health roadmaps by incorporating tele-nutrition services, AI-driven adherence monitoring, and predictive analytics to support patient outcomes and differentiate their value propositions.

In parallel, expanding collaborative research partnerships with academic institutions and specialty clinics can de-risk clinical development pathways and generate robust real-world evidence. Leaders must explore flexible financing models with payers, aligning reimbursement with outcome-based metrics to unlock broader market access. Furthermore, cultivating patient and caregiver communities through educational initiatives and support programs will enhance adherence, brand loyalty, and clinical impact. By executing this multi-pronged strategy, organizations can reinforce their market positions while delivering sustained value to patients, providers, and payers.

Clarifying the Research Framework, Data Sources, and Analytical Techniques Underpinning the Medical Food Market Study with Rigorous Methodology

This study integrates a hybrid research design combining comprehensive secondary data collection with targeted primary research. Secondary sources, including peer-reviewed journals, regulatory filings, clinical trial registries, and industry white papers, provided a foundational understanding of regulatory frameworks, formulation technologies, and competitive landscapes. Primary research comprised in-depth interviews with key opinion leaders-ranging from clinical nutritionists, gastroenterologists, and metabolic specialists to supply chain executives and payers-to validate market dynamics and uncover unmet clinical needs. Quantitative analyses, including cross-validation of distributor shipment data and prescription volume trends, enriched the contextual insights.

The segmentation schema was developed through iterative consultations and triangulated across multiple data sets to ensure representativeness. Rigorous data quality controls, including consistency checks, outlier analyses, and peer reviews, underpinned the integrity of the findings. Furthermore, scenario modeling techniques were employed to assess the potential implications of regulatory permutations and macroeconomic variables, while geographic sub-analyses elucidated region-specific considerations. Collectively, this methodological framework provides a robust lens through which stakeholders can interpret the complex forces shaping the medical food market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Food Market, by Product Type

- Medical Food Market, by Nutrient Composition

- Medical Food Market, by Formulation Type

- Medical Food Market, by Indication

- Medical Food Market, by Demographics

- Medical Food Market, by End-User

- Medical Food Market, by Region

- Medical Food Market, by Group

- Medical Food Market, by Country

- United States Medical Food Market

- China Medical Food Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Summarizing Key Findings, Strategic Implications, and Forward Momentum for Stakeholders in the Medical Food Ecosystem

The findings of this executive summary underscore the transformative potential of medical foods within contemporary healthcare ecosystems. From the granular shifts in ingredient sourcing and tariff regimes to the strategic implications of emerging digital platforms, the market is poised for sustained evolution driven by patient needs and value-based imperatives. Segmentation analyses reveal fertile opportunities across diverse formulation types, clinical indications, and demographic cohorts, while regional nuances call for tailored approaches to regulation, distribution, and stakeholder engagement. Competitive intensity is escalating as both global leaders and specialized innovators vie for differentiation through scientific rigor, digital integration, and strategic alliances.

In light of these insights, stakeholders are advised to adopt a multifaceted strategy that synchronizes supply chain resilience, regulatory foresight, digital health enablement, and collaborative research. By doing so, they can effectively navigate the complexities of the medical food landscape, enhance patient outcomes, and capture growth in an increasingly value-driven market. As healthcare systems worldwide continue to prioritize precision nutrition as a cornerstone of therapeutic regimens, the imperatives outlined herein will serve as a guiding framework for driving innovation and delivering tangible clinical and economic value.

Engage with Ketan Rohom to Access the Definitive Medical Food Market Research Report and Unlock Actionable Insights for Strategic Growth

To secure your copy of this definitive market research report, please connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in tailoring strategic insights to stakeholder needs will ensure you obtain the data and analysis required to inform high-impact decisions. Engaging with Ketan will not only grant you access to comprehensive market intelligence but also facilitate customized briefings and ongoing support for implementation. Reach out today to take the next step toward driving growth, optimizing operations, and strengthening competitive advantage in the rapidly evolving medical food sector.

- How big is the Medical Food Market?

- What is the Medical Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?