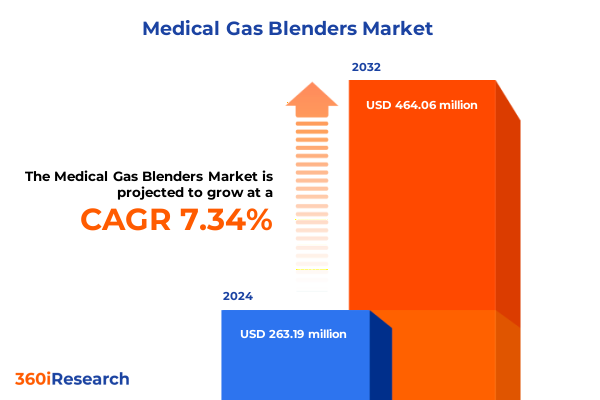

The Medical Gas Blenders Market size was estimated at USD 282.96 million in 2025 and expected to reach USD 303.88 million in 2026, at a CAGR of 7.32% to reach USD 464.06 million by 2032.

Setting the Stage for Medical Gas Blender Market Dynamics as Innovation, Regulation, and Clinical Demand Converge in a Shifting Healthcare Environment

The global landscape for medical gas blenders has evolved into a complex arena shaped by technological innovation, stringent regulatory requirements, and shifting clinical practices. These devices, which precisely mix oxygen, air, and anesthetic gases for patient care, sit at the nexus of engineering precision and life-critical performance. In recent years, supply chain constraints and the imperative for digital connectivity have heightened the urgency for advanced blending solutions that can seamlessly integrate with hospital information systems and support remote monitoring. Consequently, manufacturers and healthcare providers alike are seeking platforms that deliver user-friendly interfaces, robust safety features, and streamlined maintenance protocols.

Moreover, demographic shifts underscore an increasing prevalence of chronic respiratory conditions and a growing demand for neonatal and ambulatory care services. As care delivery migrates beyond the traditional hospital setting, the need for portable, proportional flow, and fixed ratio gas blending systems has intensified. The confluence of these trends underscores the critical role of medical gas blenders in enhancing clinical outcomes and reducing operational risk. By establishing a clear understanding of market drivers, regulatory dynamics, and emerging innovations, stakeholders can make informed investment and development decisions that align with long-term strategic goals.

Navigating the Evolution of Medical Gas Blenders Through Digital Integration, Point-of-Care Innovation, and Enhanced Patient Safety Protocols

Over the past five years, the medical gas blender sector has undergone a profound transformation driven by digitization, point-of-care decentralization, and a renewed focus on patient safety. Digital integration now enables real-time monitoring of gas concentrations through networked dashboards, reducing human error while facilitating preventive maintenance. Simultaneously, proportional flow systems have witnessed significant enhancements in microprocessor control, ensuring smoother transitions between mixing ratios and optimizing gas usage efficiency. These technological leaps are complemented by embedded alarms and fail-safe mechanisms that adhere to the latest ISO standards, further elevating device reliability.

Concurrently, the expansion of outpatient surgical centers and multispecialty clinics has ushered in demand for compact, portable blenders capable of delivering both invasive and noninvasive ventilation support. In response, manufacturers are developing modular platforms that cater to a diverse spectrum of clinical applications-from regional anesthesia procedures to neonatal respiratory therapy. This shift toward flexible, multi-purpose devices reflects a broader industry trend toward resource optimization and cost containment, all while maintaining rigorous safety and performance benchmarks.

Assessing the Combined Effects of 2025 United States Tariff Measures on Medical Gas Blender Supply Chains, Cost Structures, and Market Access Strategies

The introduction of new United States tariffs in early 2025 has exerted multifaceted pressure on the medical gas blender market, amplifying costs at several critical junctures. Import duties on key electronic components and precision fittings have compelled original equipment manufacturers to revisit their procurement strategies, often redirecting sourcing to domestic suppliers or lower-tariff trading partners. This strategic pivot, however, can introduce longer lead times and increased logistics complexity, placing additional strain on production schedules and inventory management.

Moreover, the cumulative tariff burden has accelerated conversations around vertical integration and localized manufacturing. Several leading producers have begun evaluating the establishment of North American assembly operations to mitigate the financial impact of import levies. While this approach promises enhanced supply chain resilience, it also requires substantial upfront capital investment and a recalibration of existing quality assurance protocols. As a result, stakeholders must balance near-term cost volatility with the potential long-term benefits of regionalized production ecosystems.

Unveiling Critical Segmentation Insights Across Product Variants, End User Channels, Clinical Applications, and Gas Type Configurations for Targeted Growth

A nuanced understanding of market segmentation reveals distinct growth vectors and competitive dynamics within each category. Continuous flow devices, which are analyzed across analog and digital architectures, continue to dominate applications where simplicity and reliability are paramount. Analog continuous flow systems offer proven performance for basic respiratory support, whereas digital continuous flow configurations deliver advanced user controls, data logging, and integrated safety interlocks. In parallel, the proportional flow segment encompasses adjustable ratio and fixed ratio solutions, catering to scenarios where precise anesthetic delivery is critical; adjustable ratio platforms grant clinicians on-the-fly modulation capabilities, while fixed ratio devices ensure consistency for standardized procedures.

End user channels further underscore the importance of tailored strategies. Ambulatory surgical centers, whether hospital affiliated or standalone facilities, demand compact portable models that optimize procedure turnover rates and minimize maintenance downtime. Clinics, spanning multispecialty and pulmonary focus, require versatile blenders that support both routine respiratory therapy and emergency interventions. Hospitals, from government-funded to private institutions, pursue scalable solutions with comprehensive service agreements and advanced analytics for operational oversight.

Clinical applications reinforce these distinctions. Anesthesia blenders, supporting both general and regional methods, prioritize integration with electronic health record systems and automated logging for compliance. Neonatal units differentiate between invasive and noninvasive ventilation modules, emphasizing gentle flow profiles and low dead-space considerations. Meanwhile, respiratory therapy deployments, in both adult and pediatric contexts, benefit from user-friendly interfaces and portable form factors for crisis response.

Gas type configurations complete the segmentation matrix. Oxygen-air blenders, offered in both adjustable and fixed ratio variants, dominate conventional respiratory support, whereas oxygen-nitrous oxide units, available as adjustable or fixed systems, remain indispensable in anesthesia departments where pain management and sedation control are critical.

This comprehensive research report categorizes the Medical Gas Blenders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Application

- Gas Type

Exploring Regional Market Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific to Guide Strategic Investments and Partnership Decisions

Regional analysis elucidates how geographic and regulatory contexts shape adoption curves and competitive positioning. In the Americas, cost containment initiatives within public healthcare systems have spurred procurement of devices with proven total cost of ownership benefits. Manufacturers with localized service networks and flexible financing options have gained favor, while outpatient centers in North America increasingly adopt portable proportional flow blenders to support ambulatory surgeries and mobile respiratory units.

Within Europe, the Middle East, and Africa, stringent CE marking requirements and evolving reimbursement frameworks present both challenges and incentives for market entrants. Western European nations emphasize integration with clinical IT infrastructures and sustainability goals, prompting investments in digital continuous flow systems with remote monitoring capabilities. Meanwhile, emerging economies across the Middle East and Africa exhibit strong growth potential driven by infrastructure expansion and international aid programs focused on neonatal care.

Asia-Pacific markets display diverse trajectories. In developed regions such as Japan and Australia, precision blending platforms aligned with rigorous clinical guidelines are in high demand, and partnerships with local distributors are critical for market access. Conversely, Southeast Asian and South Asian nations prioritize affordability and ease of maintenance, prompting introductions of cost-effective analog continuous flow models. This heterogeneity underscores the importance of adaptive go-to-market strategies that align product offerings with country-specific regulatory, economic, and clinical imperatives.

This comprehensive research report examines key regions that drive the evolution of the Medical Gas Blenders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Medical Gas Blender Manufacturers’ Strategic Moves, R&D Innovations, and Collaborations Shaping the Competitive Landscape

Leading companies have adopted multifaceted strategies to reinforce their market positions and stimulate innovation. One prominent manufacturer has expanded its digital continuous flow portfolio by integrating advanced sensor arrays and cloud-based analytics, enabling predictive maintenance and real-time performance dashboards. This approach enhances lifecycle management and reduces unplanned downtime in critical care units.

Another key player has pursued targeted acquisitions of niche proportional flow technology firms, thereby broadening its product suite to include adjustable ratio and fixed ratio configurations optimized for anesthesia delivery. Such consolidation efforts not only strengthen distribution networks but also foster synergies in research and development, accelerating new feature roll-outs.

Collaborative partnerships between OEMs and hospital systems have also emerged as a cornerstone of competitive differentiation. By co-developing customized blending solutions and service protocols, these alliances address unique clinical workflows and support compliance with localized regulatory standards. Additionally, several companies have formed joint ventures with component suppliers to secure priority access to high-precision flow sensors and printed circuit technologies, insulating their supply chains against tariff-induced disruptions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Gas Blenders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Armstrong Medical Ltd.

- Becton, Dickinson and Company

- Bio‑Med Devices, Inc.

- Dameca A/S

- EKU Elektronik GmbH

- Farstar (Wuxi) Medical Equipment Co., Ltd.

- Flow‑Meter S.p.A.

- HERSILL S.L.

- HEYER Medical AG

- Inox Air Products Limited

- Linde plc

- Maxtec, Inc.

- Medin Medical Innovations GmbH

- Ohio Medical Corporation

- Sechrist Industries, Inc.

- SIAD S.p.A.

- Smiths Medical, Inc.

- Taiyo Nippon Sanso Corporation

Implementing Proactive Strategies for Industry Stakeholders to Capitalize on Emerging Technologies, Regulatory Changes, and Market Opportunities

Industry leaders can capitalize on emerging trends by prioritizing strategic investments in digitalization, supply chain resilience, and regulatory agility. Fostering R&D programs that accelerate the development of integrated telemonitoring features and AI-driven flow optimization algorithms will differentiate product portfolios and deliver measurable clinical benefits. Concurrently, establishing regional assembly partnerships can mitigate tariff impacts and reduce lead times, ensuring uninterrupted access to critical care equipment.

Moreover, cultivating partnerships with healthcare systems to pilot centralized blending platforms and subscription-based service models will generate recurring revenue streams while deepening customer engagement. Aligning product roadmaps with evolving standards, such as the latest ISO 80601 series for ventilator safety, is equally essential to expedite market clearance and build trust among procurement stakeholders.

Finally, a customer-centric approach that integrates comprehensive training, digital support, and predictive maintenance offerings will improve adoption rates and reinforce brand loyalty. By implementing these measures proactively, industry participants can transform market challenges into opportunities for differentiation and sustained growth.

Describing Robust Research Methodology Employed to Deliver Rigorous Analysis Through Comprehensive Data Collection and Expert Qualitative Validation

This research combines quantitative data analysis with qualitative insights to ensure a rigorous and holistic evaluation of the medical gas blender market. Primary data is collected through structured interviews with device manufacturers, clinical end users, and supply chain experts, supplemented by virtual focus groups that validate emerging hypotheses around technology adoption and regulatory impact.

Secondary sources include peer-reviewed journals, industry white papers, and publicly available regulatory filings, which are cross-referenced with internal proprietary databases to verify accuracy. Advanced analytical techniques, such as trend extrapolation and supplier mapping, are employed to identify key demand drivers and potential disruptions. Additionally, segmentation analysis leverages both top-down and bottom-up approaches to validate the relevance of product type, end user, application, and gas type categories.

Throughout the process, the research team adheres to strict quality control protocols, including data triangulation and iterative review cycles with subject matter experts. This methodology ensures that conclusions reflect the most current market realities and that insights can be confidently applied to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Gas Blenders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Gas Blenders Market, by Product Type

- Medical Gas Blenders Market, by End User

- Medical Gas Blenders Market, by Application

- Medical Gas Blenders Market, by Gas Type

- Medical Gas Blenders Market, by Region

- Medical Gas Blenders Market, by Group

- Medical Gas Blenders Market, by Country

- United States Medical Gas Blenders Market

- China Medical Gas Blenders Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Takeaways and Growth Imperatives to Guide Decision Makers in Navigating the Complex Medical Gas Blender Ecosystem

In summary, the intersection of advanced technology integration, shifting clinical care models, and evolving trade regulations defines the current state of the medical gas blender industry. Stakeholders who prioritize digital continuous flow innovations, resilient supply chain frameworks, and targeted regional strategies will be best positioned to capture emerging value. Additionally, an in-depth understanding of segmentation insights-across product variants, end users, applications, and gas types-provides a roadmap to align product development with specific market needs.

The cumulative impact of the 2025 U.S. tariffs underscores the imperative to diversify sourcing and explore regional manufacturing collaborations. Simultaneously, leading companies’ strategic M&A, R&D investments, and end user partnerships highlight pathways to maintain competitive advantage. By synthesizing these findings, decision makers can formulate actionable plans that address both immediate challenges and long-term growth imperatives in this critical segment of healthcare technology.

Engage with the Associate Director of Sales & Marketing to Unlock Comprehensive Medical Gas Blender Market Intelligence and Propel Your Strategic Initiatives

Whether you are a healthcare equipment provider or a strategic investor, securing the complete medical gas blender market report can empower your next move. You will gain access to detailed analysis of global demand drivers, granular segmentation insights, and an in-depth examination of the tariff landscape. To discuss customized licensing or bulk purchase options and to explore how this research can align with your business goals, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Act now to position your organization at the forefront of innovation in medical gas blending technology and ensure you capitalize on emerging opportunities with confidence.

- How big is the Medical Gas Blenders Market?

- What is the Medical Gas Blenders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?