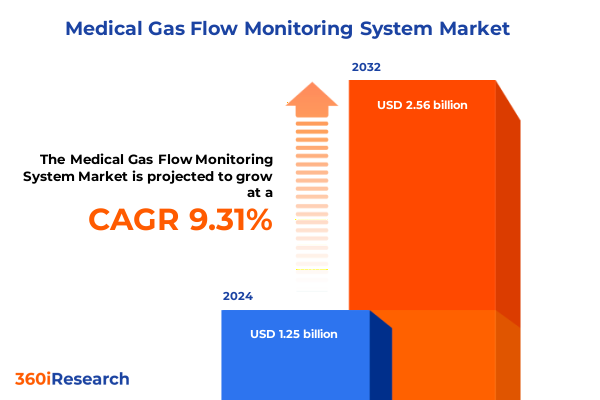

The Medical Gas Flow Monitoring System Market size was estimated at USD 1.36 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 9.47% to reach USD 2.56 billion by 2032.

Understanding the Vital Role of Advanced Medical Gas Flow Monitoring Systems in Elevating Patient Safety and Operational Efficiency in Healthcare Facilities

In today’s healthcare environment, precision and safety are paramount. Medical gas flow monitoring systems play an indispensable role in delivering life-sustaining gases-such as oxygen, nitrous oxide, and anesthetic mixtures-with exacting accuracy to patients across diverse clinical settings. These systems bridge the gap between supply infrastructure and bedside delivery, ensuring that clinicians can administer gases at prescribed flow rates reliably and without interruption, a critical determinant of patient outcomes and operational efficiency.

As hospitals and ambulatory care facilities strive to enhance quality of care while managing costs, the adoption of advanced flow monitoring solutions has accelerated. Real-time measurement capabilities, integrated alarms, and remote monitoring functionalities now form the backbone of contemporary gas delivery networks. This shift not only addresses regulatory mandates for patient safety and device traceability but also supports broader digital initiatives aimed at optimizing clinical workflows and reducing resource waste. In this context, our analysis delves into the transformative trends, policy influences, segmentation dynamics, and regional nuances shaping the market’s trajectory, providing a comprehensive foundation for strategic decision-making.

How Digital Transformation and Smart Connectivity Are Reshaping Medical Gas Flow Monitoring Practices for Enhanced Clinical Oversight and Efficiency

The convergence of digital transformation and healthcare delivery has ushered in a new era for medical gas flow monitoring. Leaders in the field are integrating smart connectivity features-such as Internet of Things (IoT) platforms and wireless telemetry-to enable centralized oversight of gas delivery networks. By linking flow sensors to hospital information systems, clinical engineers gain instantaneous visibility into performance metrics, facilitating predictive maintenance and rapid response to anomalies. This integrated approach not only reduces downtime but also enhances patient safety by minimizing the risk of undetected leaks or flow deviations.

Simultaneously, advancements in sensor technology have expanded the range of monitoring modalities. Ultrasonic and thermal mass flow devices now deliver high-resolution data while offering non-intrusive, clamp-on installation options that reduce operational disruptions. Augmented analytics powered by machine learning algorithms further refine alarm thresholds and support diagnostic workflows by distinguishing between transient fluctuations and critical events. These capabilities enable care teams to make proactive adjustments, strengthening adherence to strict regulatory standards and promoting continuous improvement. Ultimately, these transformative shifts underscore a broader industry movement toward data-driven, interoperable, and resilient gas delivery ecosystems.

Evaluating the Far-Reaching Impacts of 2025 United States Trade Tariffs on Medical Gas Flow Monitoring Supply Chains and Cost Structures

The United States’ decision to escalate tariffs on key medical device imports in 2025 has sent ripples throughout the medical gas flow monitoring supply chain. Components such as precision orifice plates, venturi tubes, and specialized sensor elements sourced from China and other exporting regions now face levies that can exceed conventional duties, translating into higher landed costs for original equipment manufacturers and distributors. This new tariff landscape has compelled many stakeholders to reexamine procurement strategies and explore alternative sourcing models to maintain competitive pricing and protect margin integrity.

In response to mounting cost pressures, industry participants are adopting a multifaceted approach to supply chain resilience. Some leading manufacturers are accelerating nearshoring initiatives, investing in domestic machining and assembly facilities to circumvent tariff exposure. Others are diversifying vendor portfolios by partnering with suppliers in tariff-free jurisdictions across Europe and the Middle East & Africa. Concurrently, the integration of value-added services-such as remote commissioning, subscription-based analytics, and predictive maintenance contracts-has emerged as a strategic lever to offset hardware price increases, unlocking new revenue streams and reinforcing customer loyalty. As the tariff environment remains fluid, firms that embrace both localized production and service-driven models will be best positioned to navigate these headwinds and sustain growth.

Deciphering Market Dynamics Through In-Depth Evaluation of Product Lines, Applications, End Users, Technologies, and Sales Channels for Medical Gas Flow Monitoring

A comprehensive understanding of the medical gas flow monitoring market requires an appreciation of how demand drivers vary by product type, application, end user, technology, and sales channel. Within product categories, differential pressure flow meters-including variants such as orifice plates, Venturi tubes, and averaging Pitot tubes-continue to be favored for their robustness in traditional pipeline systems. Mechanical flow meters, typified by rotameters and turbine meters, remain entrenched in legacy installations, while thermal mass flow meters-both fixed and portable configurations-are rising in prominence for applications where temperature and viscosity compensations are critical. Ultrasonic flow meters, leveraging either Doppler or transit-time technologies, are increasingly adopted for non-contact measurements and scenarios that demand minimal pressure drop.

Application segmentation further reveals distinct patterns of adoption. Ambulatory surgery centers, covering general, ophthalmology, and orthopedic procedures, prioritize compact, transportable devices that facilitate rapid deployment across versatile clinical environments. Emergency departments and operating rooms require systems with instant-on capabilities and stringent alarm protocols, whereas radiology departments often integrate flow monitoring with imaging workflows to optimize patient throughput. In adult and pediatric intensive care units, the precision of flow delivery is paramount, with specialized units designed to address the unique respiratory support requirements of each patient cohort.

End users such as ambulatory surgical centers, diagnostic clinics, and research laboratories underscore the market’s breadth, illustrating the need for both standardized solutions and highly customized offerings. Technological preferences divide along lines of connectivity: IoT-enabled platforms deliver data-rich dashboards for centralized monitoring, while standalone devices appeal to facilities seeking point-of-use simplicity. Wired systems serve legacy infrastructures, whereas wireless configurations pave the way for future-proofed, mobile deployment. Finally, direct sales relationships continue to dominate in enterprise-level hospital procurement, distributors play a crucial role in supporting regional service networks, and online channels are carving out a niche by offering rapid access and competitive pricing for smaller end users.

This comprehensive research report categorizes the Medical Gas Flow Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Sales Channel

Uncovering Divergent Regional Trends in Healthcare Infrastructure, Regulatory Compliance, and Technological Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional landscapes diverge significantly in their adoption patterns and growth trajectories. In the Americas, robust healthcare budgets and well-established infrastructure underpin high penetration of advanced gas flow monitoring solutions. The United States, in particular, leverages regulatory incentives and capital spending programs to drive system upgrades, while Brazil and Mexico show steady modernization efforts fueled by private-public partnerships and hospital expansions.

Europe, the Middle East & Africa present a mosaic of regulatory stringency and investment priorities. Western European countries enforce rigorous safety standards that mandate regular calibration and alarm integration, incentivizing replacement of aged technology. Emerging markets in the Middle East & Africa are witnessing projects that combine capacity building with knowledge transfer, often supported by international health organizations seeking to elevate clinical capabilities.

In Asia-Pacific, the pace of urbanization and rising healthcare expenditures are catalyzing rapid uptake of IoT-enabled and wireless flow monitoring platforms. Countries such as China and India are bolstering local manufacturing to reduce dependency on imports, while Southeast Asian nations focus on digital hospital initiatives to streamline patient care pathways. Each region’s distinct regulatory framework, reimbursement mechanisms, and infrastructure maturity level shape the selection of products, technologies, and deployment models.

This comprehensive research report examines key regions that drive the evolution of the Medical Gas Flow Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Driving Innovation and Competitive Differentiation in the Medical Gas Flow Monitoring Sector Through Strategic Advancements

The competitive landscape of medical gas flow monitoring is defined by a cohort of established device manufacturers and innovative technology providers. Drägerwerk AG Co. KGaA has reinforced its leadership through product launches that integrate real-time data analytics and modular architectures, appealing to tertiary care centers seeking scalable solutions. ResMed, historically known for respiratory care, has diversified its portfolio to encompass precision flow measurement devices, leveraging its global distribution network to gain market share. ZOLL Medical Corporation has focused on developing ruggedized, point-of-care flow meters designed for emergency and field use, addressing the needs of trauma and military applications.

Air Liquide and Smiths Medical distinguish themselves through end-to-end service offerings that couple pipeline installation expertise with flow monitoring hardware, streamlining vendor management and ensuring system interoperability. Philips Healthcare and Allied Healthcare Products invest heavily in R&D, exploring sensor miniaturization and enhanced alarm capabilities for neonatal and pediatric units. Meanwhile, GE Healthcare, Puritan Bennett, Mindray Medical International, and Hamilton Medical are expanding their domestic manufacturing footprints to mitigate tariff exposure and accelerate time to market. Across this competitive set, differentiation arises from product performance, service integration, regulatory compliance support, and the ability to deliver turnkey solutions tailored to specialized clinical environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Gas Flow Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide Medical Systems

- Becton, Dickinson and Company

- DESCO Medical

- Drägerwerk AG & Co. KGaA

- General Electric Company

- Koninklijke Philips N.V.

- Medtronic plc

- Nihon Kohden Corporation

- OMEGA Engineering

- Precision Medical

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Smiths Group plc

Strategic Imperatives for Industry Leaders to Strengthen Resilience, Capitalize on Emerging Opportunities, and Navigate Regulatory Complexities

To remain at the forefront of this evolving market, industry leaders must enact a series of strategic imperatives. First, cultivating supply chain resilience through diversified sourcing and nearshoring initiatives will safeguard against tariff-driven disruptions and foster greater operational agility. This approach should be complemented by investments in localized assembly and calibration facilities to reduce lead times and strengthen customer responsiveness.

Second, accelerating the digitalization of gas delivery systems will unlock new service-based revenue models. By integrating predictive analytics, remote monitoring, and subscription-based maintenance contracts, manufacturers can enhance the lifetime value of their solutions while providing end users with data-driven insights that optimize patient care.

Third, forging strategic alliances with software providers, regulatory bodies, and clinical institutions will drive interoperability standards and streamline approval pathways. Collaborative development efforts can yield platforms that support seamless integration with electronic medical records and building management systems, amplifying the value proposition for healthcare facilities.

Finally, embedding sustainability and environmental considerations into product design-such as low-leakage components and energy-efficient sensor technologies-will align offerings with the growing emphasis on eco-friendly operations and corporate responsibility.

Detailing a Robust Multi-Modal Research Framework Combining Qualitative and Quantitative Techniques to Ensure Rigorous Analysis in Medical Gas Flow Monitoring

Our research methodology combines rigorous qualitative and quantitative techniques to deliver a holistic view of the medical gas flow monitoring market. Primary data collection encompassed in-depth interviews with key stakeholders-including device manufacturers, clinical engineers, and end-user representatives-across major regions. These conversations provided firsthand insights into purchasing drivers, operational challenges, and technology adoption patterns.

Secondary research efforts involved systematic examination of peer-reviewed journals, industry white papers, regulatory filings, and substantive company communications. Data triangulation methods were applied to reconcile information across multiple sources and validate emerging trends. Market shaping factors such as tariff developments, digital transformation trajectories, and regional policy shifts were cross-verified with trade association reports and public datasets.

Quantitative analysis leveraged historical installation and procurement figures, while expert panels assessed the impact of statutory changes and technology inflections. This dual-pronged approach ensures that our findings reflect both empirical evidence and nuanced interpretations of strategic imperatives, delivering a robust foundation for decision-making in a rapidly evolving sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Gas Flow Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Gas Flow Monitoring System Market, by Product Type

- Medical Gas Flow Monitoring System Market, by Technology

- Medical Gas Flow Monitoring System Market, by Application

- Medical Gas Flow Monitoring System Market, by End User

- Medical Gas Flow Monitoring System Market, by Sales Channel

- Medical Gas Flow Monitoring System Market, by Region

- Medical Gas Flow Monitoring System Market, by Group

- Medical Gas Flow Monitoring System Market, by Country

- United States Medical Gas Flow Monitoring System Market

- China Medical Gas Flow Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights on Market Evolution, Strategic Priorities, and the Path Forward for Medical Gas Flow Monitoring Solutions

The medical gas flow monitoring market stands at a pivotal juncture characterized by accelerating digital transformation, evolving trade policies, and shifting regional dynamics. Enhanced sensor technologies and smart connectivity features have elevated operational oversight, improving both patient safety and system reliability. Meanwhile, the 2025 tariff regime underscores the importance of supply chain resilience, driving manufacturers to adopt nearshoring strategies and diversified sourcing.

Segmentation analysis reveals that product innovation must address the requirements of distinct clinical environments, from high-throughput ambulatory surgery centers to specialized pediatric intensive care units. Regional nuances further dictate technology preferences and investment priorities, with the Americas, EMEA, and Asia-Pacific exhibiting unique regulatory and infrastructural landscapes. Leading companies are leveraging integrated service offerings and strategic partnerships to differentiate their portfolios, while actionable recommendations point toward digital service models, sustainability integration, and collaborative standards development.

Collectively, these insights chart a pathway for stakeholders to align strategic roadmaps with market realities, ensuring that investments in medical gas flow monitoring technologies yield both clinical excellence and competitive agility.

Unlock Comprehensive Market Intelligence and Expert Guidance by Engaging with Ketan Rohom for Your Medical Gas Flow Monitoring Research Needs

We invite you to gain unparalleled market insights tailored to your strategic objectives by partnering directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan leverages years of industry expertise to guide senior executives through the complexities of the medical gas flow monitoring landscape, ensuring your investment in research yields actionable intelligence and competitive advantage.

Reach out today to schedule a personalized consultation that addresses your unique business challenges and growth aspirations. Secure early access to proprietary data, in-depth analyses, and bespoke advisory support that will empower your organization to make informed decisions and drive sustained success in the evolving healthcare environment.

- How big is the Medical Gas Flow Monitoring System Market?

- What is the Medical Gas Flow Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?