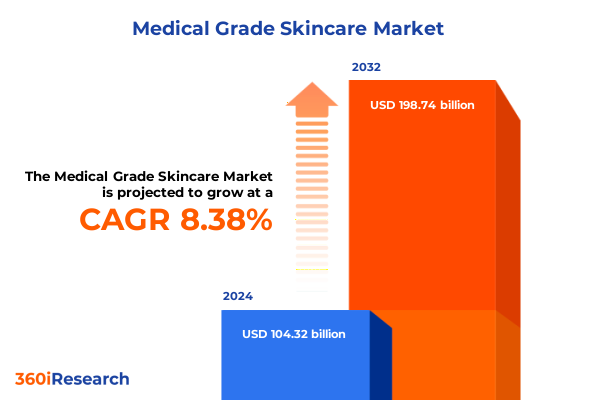

The Medical Grade Skincare Market size was estimated at USD 112.64 billion in 2025 and expected to reach USD 121.78 billion in 2026, at a CAGR of 8.44% to reach USD 198.74 billion by 2032.

A clear, strategic primer that distills clinical trends, regulatory shifts, and channel evolution to guide executive decisions in medical grade skincare

The medical grade skincare market sits at the intersection of clinical evidence, professional channels, and consumer demand for high-performance solutions. This executive summary synthesizes strategic signals, regulatory shifts, and distribution evolution that are shaping competitive advantage across product development, ingredient sourcing, and go-to-market execution. By framing developments through practical segmentation and regional lenses, the analysis highlights where investment in R&D, manufacturing resilience, and channel partnerships will produce the greatest returns.

Throughout this summary, emphasis is placed on actionable insight rather than descriptive cataloguing. Readers will find clear implications for formulation strategy, procurement decisions, and commercial models that work within tighter regulatory expectations and a more volatile trade environment. The aim is to equip senior executives and category leaders with a concise, prioritized set of observations and recommendations they can operationalize quickly.

How accelerating clinical validation requirements and hybrid channel strategies are forcing product development and commercialization to evolve rapidly across the category

Clinical validation and scientific storytelling have migrated from niche differentiators into baseline commercial requirements for medical grade skincare brands. Consumers and professional buyers increasingly demand evidence of mechanism, tolerability profiling, and reproducible outcomes, pushing formulators to prioritize clinical endpoints, standardized testing, and measurable efficacy claims. This evolution is reshaping product roadmaps and marketing approaches: technical dossiers and clinician-facing education now matter as much as consumer-oriented claims. As a result, cross-functional teams must integrate clinical development timelines and regulatory review checkpoints into product launch plans to avoid costly delays and credibility gaps.

Concurrently, distribution dynamics are changing. Medical channels such as dermatology clinics and medical spas continue to expand their influence on product adoption because they offer both procedural touchpoints and repeat-purchase opportunities through post-procedure care. At the same time, direct-to-consumer online models remain critical for brand building and broader reach; digital platforms now serve as primary education vehicles where clinical data and user outcomes must be clearly translated for lay audiences. These simultaneous pressures - elevated scientific standards and hybrid channel strategies - are the most transformative force in the category, forcing brands to adopt integrated development, evidence-generation, and omnichannel commercialization playbooks. For organizations that align product, clinical, and commercial teams, the opportunity lies in converting clinical rigor into clear, trust-building narratives that scale across both medical and consumer channels.

How the 2025 U.S. tariff landscape has reshaped procurement, formulation choices, and supplier resilience strategies for clinical skincare companies

Recent U.S. trade actions and reciprocal tariff measures introduced in 2025 have materially altered the cost calculus for imported raw materials, packaging components, and finished goods used by medical grade skincare manufacturers. These policy changes have increased the burden on procurement teams to rapidly validate alternative suppliers, re-code tariffs into landed-cost models, and evaluate nearshoring or regional sourcing strategies to mitigate margin pressure. In practice, many brands and contract manufacturers are auditing bill-of-materials exposure by supplier country, prioritizing substitutes for high-tariff items, and redesigning package specifications to avoid tariff classifications that attract higher duties. These tactical responses require close collaboration between procurement, regulatory, and product teams to ensure that substitutions meet clinical performance and safety requirements while also minimizing time-to-market disruptions. Evidence of exemptions and carve-outs for certain active ingredients has provided strategic relief for some formula categories, but exemptions are specific and must be verified against applicable tariff schedules and product classifications before they can be relied upon in commercial planning.

Beyond cost, the tariff environment has accelerated structural shifts in the supply chain. Brands that previously relied on single-source suppliers have had to fast-track dual-sourcing, qualify regional partners, and in some cases, re-evaluate in-house manufacturing to secure continuity. These shifts are increasing near-term operating complexity but are also creating durable advantages for organizations that build supplier resilience and faster reformulation pathways. Importantly, the tariff landscape remains dynamic; policy updates, exemptions, and bilateral negotiations can change cost exposures on short notice, so ongoing scenario planning and regulatory monitoring must become routine elements of commercial planning.

Actionable segmentation insights that align product portfolios, clinical evidence needs, and channel strategies across ingredient sources, formulation types, and end-user settings

Segmentation provides a practical blueprint for prioritizing product development and channel strategies. When product type segmentation highlights categories such as acne treatments, anti-aging interventions, cleansers, masks and serums, moisturizers, skin brightening, and sun protection, it reveals distinct clinical and regulatory expectations for efficacy data, tolerability, and post-procedure use profiles. Some product families demand robust dermatologic validation and tolerance data because they sit adjacent to procedural care, while others compete more on daily-use safety and sensory attributes, which influences formulation trade-offs and packaging choices.

Ingredient source segmentation - between natural and synthetic inputs and the further differentiation of plant-based versus animal-derived sources - shapes sourcing complexity, stability considerations, and claims language. Natural plant extracts may appeal to a subset of practitioners and consumers focused on sustainability, but synthetic actives often deliver more consistent potency and stability, which is critical for clinical outcomes. Skin type segmentation, encompassing combination, dry, oily, and sensitive skin and subcategories such as allergic or reactive skin, requires brands to map product portfolios to real-world patient cohorts seen in dermatology clinics. Similarly, formulation segmentation across cream, gel, liquid, patch, and powder formats drives manufacturing and regulatory pathways; for instance, patch-based delivery raises device considerations that necessitate cross-disciplinary regulatory review.

Function-based segmentation clarifies therapeutic positioning, where acne-prone, aging, dehydration, hyperpigmentation, rosacea, and sun-damage categories each demand differentiated claims and educational resources. Within acne-prone segments, understanding bacterial, cystic, and hormonal variants influences both active selection and clinician partnership strategies. Application-based segmentation across body, eye area, face, hands, lips, and neck frames dosing, packaging, and clinical-advice implications. Distribution channel segmentation that separates offline and online operations - with offline comprising beauty retail, pharmacies, and supermarkets and online including brand websites and eCommerce platforms - highlights how merchandising, physician recommendation, and patient adherence touchpoints differ by channel. Finally, end-user segmentation across dermatology clinics, home use, hospitals, medical spas, and plastic surgery clinics indicates where clinical training, product bundling, and post-procedure recommendations can influence lifetime value and repurchase patterns. Collectively, these segmentation lenses should guide prioritization of clinical trials, labeling language, and commercial investments so that product profiles align with the expectations of both clinicians and consumers.

This comprehensive research report categorizes the Medical Grade Skincare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Source

- Skin Type

- Formulation

- Active Ingredient Class

- Price Tier

- Packaging Type

- Function

- Application

- Distribution Channel

- End User

Regional strategy imperatives that reconcile sourcing resilience, regulatory complexity, and channel preference across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics materially affect sourcing, regulatory interplay, and route-to-market strategies. In the Americas, proximity to manufacturing hubs in North America, Mexico, and parts of Latin America can be leveraged to mitigate tariff exposure and compress lead times; North American clinical channels remain influential in shaping product credibility and adoption pathways. In Europe, Middle East & Africa, regulatory fragmentation and strong consumer interest in sustainability and ingredient transparency require brands to modularize dossiers and tailor communication to regional regulatory norms and practitioner expectations. In Asia-Pacific, rapid innovation cycles, strong domestic ingredient ecosystems, and a thriving professional channel landscape in several markets create both competition and opportunities for partnerships focused on localized formulation and co-development.

Taken together, regional strategy must be nuanced: nearshoring or regional contract manufacturing can reduce tariff risk and improve speed, but it also necessitates investment in local quality systems and regulatory knowledge. Moreover, channel mix should be adapted regionally; for example, partnerships with dermatology clinics and medical spas may drive initial credibility in markets where professional endorsement is a primary adoption vector, whereas direct-to-consumer digital channels may accelerate awareness and trial in markets with high online penetration. Trade policies and tariff exposures vary by region and product classification, so regional procurement strategies that incorporate tariff schedules, exemption lists, and logistics routing will be essential for maintaining cost competitiveness while preserving clinical integrity.

This comprehensive research report examines key regions that drive the evolution of the Medical Grade Skincare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How incumbent and emerging players are reshaping product, supply-chain, and clinician engagement strategies to maintain clinical credibility while navigating commercial headwinds

Leading companies are responding to the combined pressures of clinical expectations, tariff volatility, and changing distribution by doubling down on three strategic imperatives: evidence generation, supply-chain diversification, and clinician partnerships. Evidence generation includes investing in rigorous tolerance and efficacy studies that can be communicated clearly to clinicians and consumers. Supply-chain diversification focuses on qualifying multiple suppliers, exploring nearshore manufacturing, and redesigning packaging to reduce exposure to tariff-sensitive components. Clinician partnerships center on building educational programs, post-procedure product bundles, and loyalty frameworks that integrate products into the patient journey.

Some major players have publicly shifted sourcing and packaging strategies in response to trade actions, re-evaluating supplier footprints and making tactical moves toward regional procurement hubs. These adjustments demonstrate how incumbent brands are balancing operational cost pressures with the need to protect brand trust and clinical performance. For smaller innovators and contract manufacturers, agility in reformulation and supplier qualification is a competitive advantage: the ability to test alternative actives, validate equivalence in tolerability, and accelerate clinician pilots can open distribution pathways in both medical and retail channels. The most durable competitive positions will combine clinical credibility with supply-chain agility and a channel strategy that synchronizes clinician endorsement with consumer accessibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Grade Skincare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Advanced Skin Technology

- Alkem Laboratories Ltd.

- Alpyn Beauty

- AlumierMD Labs, Inc.

- AMP Medical, LLC

- Audaja Inc.

- Augustinus Bader

- Beiersdorf AG

- Cipla Limited

- Colgate-Palmolive Company

- CosMedical Technologies, LLC

- DefenAge by Progenitor Biologics, LLC

- DERMAdoctor

- Environ Skin Care (Pty) Ltd.

- Epicutis

- Episciences, Inc.

- ESK Care Pty Limited

- Estée Lauder Companies Inc.

- Evolve Med Spa

- Galderma SA

- Glenmark Pharmaceuticals Limited

- Haleon PLC

- Honasa Consumer Ltd.

- Image Skincare

- INSKIN Cosmedics Group Pty Ltd.

- Inspira Skin

- iS CLINICAL

- Kenvue Inc.

- L'Oréal S.A.

- Marini SkinSolutions

- NAOS

- NEOCUTIS by Merz North America, Inc.

- Obagi Cosmeceuticals LLC

- Pierre Fabre S.A

- Piramal Pharma Limited

- Revision Skincare

- Sebapharma GmbH & CO. KG

- Sente, Inc.

- Shiseido Company, Limited

- Skin + Me

- The Skincare Company

- Topix Pharmaceuticals, Inc.

- Trilogy Laboratories, LLC

- Unilever PLC

- USRx LLC

- ZO Skin Health, Inc.

Practical, prioritized actions for leaders to lock in clinical credibility, supplier resilience, and clinician-driven commercial pathways in a volatile trade environment

Industry leaders should prioritize three pragmatic actions that translate insight into measurable advantage. First, formalize integrated clinical-commercial roadmaps so that product development timelines explicitly incorporate clinical study design, tolerability testing, and regulatory checkpoints. This alignment reduces launch uncertainty and accelerates clinician adoption. Second, implement a supplier resilience program that classifies materials by tariff exposure, clinical criticality, and substitute feasibility; this should include dual-sourcing strategies, regional qualification plans, and a rapid reformulation protocol to preserve performance while addressing cost shocks. Third, expand clinician engagement beyond traditional sampling to structured education, co-developed patient protocols, and bundled care pathways that embed products into procedural and post-procedure regimens.

Moreover, commercial teams must sharpen their digital-to-clinic conversion strategies by translating clinical evidence into clear, clinician-friendly materials and consumer-facing narratives that emphasize measurable outcomes and safety. Marketing and regulatory teams should adopt standardized language templates that are pre-vetted for claims compliance in key jurisdictions to reduce time-to-market risk. Finally, prioritize capital allocation toward modular manufacturing capabilities and packaging standardization that allow quick swaps of tariff-exposed components without compromising product integrity. These recommendations are designed to be practical, sequential, and measurable so that leadership teams can monitor impact and adjust investments rapidly as trade and regulatory conditions evolve.

A practical, multi-source methodology combining clinician interviews, procurement scenarios, and regulatory analysis to generate implementable strategic recommendations

This research synthesis integrates primary and secondary intelligence to produce actionable conclusions. Primary inputs include structured interviews with industry procurement leaders, formulation scientists, and clinician stakeholders, combined with scenario workshops that mapped tariff exposures to bill-of-materials and packaging classifications. Secondary inputs involved public regulatory guidance, trade announcements, and industry reporting to validate operational implications. Analytical approaches included supplier risk scoring, channel conversion modeling, and clinical evidence gap analysis to identify where incremental study investment would unlock clinician adoption.

Wherever possible, claims have been triangulated across multiple sources to ensure robustness. Regulatory and tariff discussions were cross-checked against published government guidance and industry reporting to identify exemptions and conditional carve-outs that materially change procurement decisions. The methodology emphasizes pragmatic applicability: the resulting recommendations were stress-tested against realistic operating constraints to ensure they can be implemented with existing organizational capabilities or with clearly defined incremental investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Grade Skincare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Grade Skincare Market, by Product Type

- Medical Grade Skincare Market, by Ingredient Source

- Medical Grade Skincare Market, by Skin Type

- Medical Grade Skincare Market, by Formulation

- Medical Grade Skincare Market, by Active Ingredient Class

- Medical Grade Skincare Market, by Price Tier

- Medical Grade Skincare Market, by Packaging Type

- Medical Grade Skincare Market, by Function

- Medical Grade Skincare Market, by Application

- Medical Grade Skincare Market, by Distribution Channel

- Medical Grade Skincare Market, by End User

- Medical Grade Skincare Market, by Region

- Medical Grade Skincare Market, by Group

- Medical Grade Skincare Market, by Country

- United States Medical Grade Skincare Market

- China Medical Grade Skincare Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 3021 ]

Conclusive strategic framing that ties clinical validation, supply resilience, and channel integration into a cohesive roadmap for sustainable advantage

In summary, the medical grade skincare category is undergoing a careful recalibration: clinical evidence and clinician endorsement are becoming non-negotiable, trade actions are forcing new sourcing and packaging decisions, and channel strategies must balance medical credibility with consumer accessibility. Organizations that integrate clinical development into commercial planning, build resilient supplier networks, and invest in clinician partnerships will be better positioned to navigate the short-term disruption and capture durable growth in professional channels.

The path forward is neither purely operational nor purely strategic; it requires coordinated execution across R&D, regulatory, procurement, and commercial functions. With pragmatic scenario planning and targeted investments in evidence generation and supply-chain flexibility, leaders can convert the current period of disruption into a competitive advantage by delivering clinically validated, reliably sourced products that clinicians trust and consumers prefer.

Take decisive next steps to obtain the comprehensive medical grade skincare market report and schedule an executive briefing with our senior sales and strategy lead

For decision-makers ready to convert insight into impact, the next step is straightforward: secure the full market research report and strategic brief tailored for commercial leaders, product teams, and channel strategists. The report includes detailed segmentation analysis, regulatory and tariff scenario planning, supplier maps for alternate ingredient sources, and playbooks for medical-channel commercialization so teams can prioritize initiatives and adapt quickly to evolving trade and regulatory dynamics. To request access and arrange a tailored briefing, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who can coordinate delivery options, executive summaries, and customized workshops to align research findings with your strategic priorities.

- How big is the Medical Grade Skincare Market?

- What is the Medical Grade Skincare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?