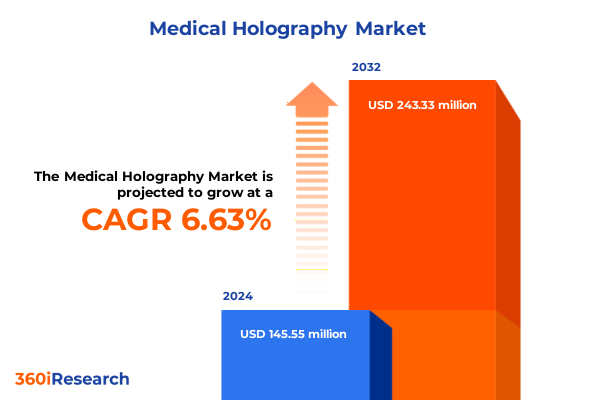

The Medical Holography Market size was estimated at USD 153.22 million in 2025 and expected to reach USD 164.80 million in 2026, at a CAGR of 6.83% to reach USD 243.33 million by 2032.

Pioneering a New Era of Medical Imaging and Patient Care through Breakthroughs in Three-Dimensional Holographic Technologies

Holographic technologies are fundamentally reshaping the foundations of medical imaging and patient care, transitioning from theoretical concepts into tangible clinical applications. Three-dimensional projections and interactive visualizations enable healthcare professionals to explore anatomy with unprecedented clarity, fostering deeper diagnostic insights and reducing reliance on invasive procedures. As advanced computational power and precision optics converge, the medical holography landscape is evolving at a pace that requires both strategic foresight and operational agility.

By integrating immersive imaging techniques into routine practice, providers can enhance collaboration across multidisciplinary teams, accelerate surgical planning, and enrich patient engagement. Recent breakthroughs in sensor miniaturization and image processing algorithms have lowered barriers to entry, allowing smaller clinics and research hospitals to adopt holographic solutions. In addition, partnerships between academic institutions and technology developers are driving iterative improvements in hardware performance and software usability, laying the groundwork for broader commercialization and diversified applications.

Uncovering the Fundamental Shifts Reshaping Medical Holography across Imaging Practices Training Protocols and Interdisciplinary Collaboration

The medical holography landscape is experiencing several transformative shifts that extend far beyond incremental upgrades in display resolution. Core imaging systems are integrating artificial intelligence–driven segmentation tools, allowing clinicians to interact with holograms in real time and manipulate volumetric data during diagnosis. Furthermore, the convergence of extended reality platforms with holographic displays is fostering new training paradigms, enhancing the fidelity of anatomical simulations and enabling remote education with lifelike interactivity.

Additionally, the market is witnessing an expansion of collaborative ecosystems, where device manufacturers, software developers, and service providers co-create end-to-end solutions tailored to specialized clinical workflows. In parallel, regulatory frameworks are adapting to recognize holographic outputs as valid adjuncts to traditional imaging modalities, streamlining clearance pathways and incentivizing investment. Beyond hospitals and academic research centers, patient education initiatives are embracing holographic storytelling to increase engagement and improve health literacy, symbolizing a paradigm shift in how information is communicated across the care continuum.

Analyzing the Far-Reaching Consequences of United States Tariff Policies on Medical Holography Supply Chains and Technology Adoption

The introduction of updated tariff measures by the United States government in early 2025 has had a cumulative impact on the medical holography industry, influencing component sourcing and cost structures. Import duties imposed on key hardware elements, including specialized sensors and advanced display panels, have prompted manufacturers to reevaluate supply chains and pursue alternative procurement strategies. Consequently, some suppliers have opted to localize production or diversify their vendor portfolios in order to mitigate the effects of elevated import expenses.

In response to increased input costs, software developers and service integrators have adapted pricing models to balance profitability with accessibility, leading to innovative bundled offerings and value-added maintenance agreements. Stakeholders have also intensified dialogue with policymakers to advocate for tariff exemptions on life-saving medical innovations, underscoring the potential downstream benefits of broader technology adoption. As a result, the industry is entering a new phase where strategic resilience and policy alignment play pivotal roles in shaping market trajectories and ensuring that holographic solutions remain both effective and cost-efficient.

Unveiling Critical Segmentation Insights Revealing How Diverse Application Components Technology and End Users Drive Medical Holography Value

A nuanced examination of segmentation reveals that the spectrum of holographic applications extends beyond core imaging into dynamic realms of medical training, patient education, and surgical planning. The interplay between hardware, software, and services forms the backbone of solution ecosystems, where high-performance displays, advanced processors, and sensitive sensors work in concert with image processing tools, integration frameworks, and sophisticated visualization platforms.

Product-type distinctions are equally critical, with head-mounted displays offering personal, surgeon-centric perspectives, projection displays providing shared visual experiences in conference rooms and operating theaters, and spatial light modulators enabling scalable, room-based immersion. Technological variations, including fog displays, laser plasma projections, and true volumetric renderings, cater to different clinical requirements and environmental constraints, showcasing how diverse capabilities address specific use cases. Moreover, end-user profiles-ranging from diagnostic centers focused on rapid throughput to hospitals requiring robust, high-fidelity solutions and research institutes driving experimental innovation-underscore the importance of customizing offerings to meet unique operational demands.

This comprehensive research report categorizes the Medical Holography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product Type

- Technology

- End User

- Application

Exploring Regional Dynamics Shaping the Growth of Medical Holography Solutions across the Americas Europe Middle East Africa and Asia Pacific

Regional analysis highlights that the Americas continue to lead in early adoption of medical holography, fueled by robust research funding, a supportive regulatory environment, and a concentration of innovative healthcare institutions. Providers in North America are deploying holographic imaging for complex surgical reconstruction, while Latin American markets are pioneering cost-effective solutions to address endemic resource constraints, illustrating varied regional strategies for leveraging holography.

In Europe, Middle East, and Africa, collaborative research consortia are actively exploring holographic-assisted interventions, and emerging policies are fostering cross-border trial programs. This region’s blend of established healthcare networks and nascent digital infrastructure creates a fertile ground for pilot projects, particularly in training and education. Meanwhile, the Asia-Pacific landscape demonstrates rapid commercial expansion, driven by high population density, government initiatives to digitize healthcare, and local technology champions producing competitive hardware and integration services. Each geography presents a distinct growth narrative, underscoring the need for tailored regional strategies that align with regulatory frameworks, funding ecosystems, and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Medical Holography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Competitive Landscape of Medical Holography through Strategic Partnerships and Technological Breakthroughs

Leading companies in the medical holography domain are converging traditional medical device expertise with cutting-edge visualization platforms. Hardware pioneers refine display technologies and sensor accuracy, while software innovators push the boundaries of real-time rendering and interoperable integration. At the same time, service providers are developing customized implementation frameworks and training curricula to accelerate time to value across diverse clinical environments.

Strategic collaborations between equipment manufacturers and academic healthcare centers are establishing centers of excellence that validate clinical efficacy and support iterative product refinement. Alliances with telecommunications firms are also expanding remote consultation capabilities, enabling clinicians to leverage holographic projections in telemedicine applications. Concurrently, some forward-thinking organizations are securing intellectual property through targeted patent filings, positioning themselves as critical enablers of future standard-setting protocols. Together, these company-level dynamics underscore an ecosystem where complementary strengths drive holistic growth of medical holography solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Holography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- EchoPixel, Inc.

- EON Reality, Inc.

- Holoeyes Inc.

- Holoxica Ltd.

- Koninklijke Philips N.V.

- Microsoft Corporation

- Realfiction A/S

- RealView Imaging Ltd.

- Siemens Healthineers AG

- UltraLeap Ltd.

- Voxon Photonics Pty Ltd.

- zSpace, Inc.

Delivering Recommendations Guiding Industry Leaders to Accelerate Adoption Optimize Operations and Enhance Patient Outcomes with Advanced Holographic Solutions

Industry leaders seeking to capitalize on holographic technologies should prioritize investments in scalable software architectures that support seamless integration with existing electronic health records and imaging modalities. By focusing on interoperability and open standards, organizations can reduce implementation friction and foster ecosystem-wide collaboration. In parallel, executives are advised to forge partnerships with clinical research institutions to conduct joint validation studies, thereby strengthening evidentiary support for efficacy and reimbursement advocacy.

Operationally, manufacturers should evaluate opportunities to localize component assembly or diversify supply networks to mitigate geopolitical risks associated with import tariffs. At the product development level, teams must emphasize user-centric design, ensuring that holographic interfaces and workflows align with clinician needs and patient safety standards. Finally, decision-makers are encouraged to engage proactively with regulatory bodies to shape policy frameworks that recognize holography as a legitimate diagnostic and educational modality, thereby accelerating market access and adoption.

Detailing the Comprehensive Research Methodology Employed to Analyze Technological Advancements and Stakeholder Perspectives within Medical Holography

The research approach combines primary interviews with leading radiologists, surgeons, and biomedical engineers to capture firsthand insights into clinical requirements and operational challenges. Complementing these discussions, a structured survey of procurement officers and technology managers across multiple regions quantifies adoption drivers and friction points, creating a robust framework for comparative analysis.

Secondary research entailed a deep dive into technical literature, patent filings, and regulatory submissions, enabling a thorough mapping of innovation trajectories and compliance considerations. This qualitative and quantitative synthesis was further enriched by case study evaluations of early adopter institutions, which provided empirical evidence of workflow improvements and patient engagement outcomes. Data triangulation techniques ensured consistency and validity, while expert peer reviews offered critical feedback on methodology rigor. Together, these elements form a comprehensive blueprint for understanding the dynamic medical holography marketplace.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Holography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Holography Market, by Component

- Medical Holography Market, by Product Type

- Medical Holography Market, by Technology

- Medical Holography Market, by End User

- Medical Holography Market, by Application

- Medical Holography Market, by Region

- Medical Holography Market, by Group

- Medical Holography Market, by Country

- United States Medical Holography Market

- China Medical Holography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights Highlighting How Innovations in Medical Holography are Poised to Transform Patient Care Training and Collaborative Clinical Workflows

The convergence of advanced optics, high-speed processing, and intuitive software has positioned holography at the forefront of next-generation medical innovation. As demonstrated by progressive clinical applications ranging from preoperative planning to immersive patient education, these technologies promise to enhance diagnostic accuracy, reduce procedural risks, and foster more meaningful patient-provider interactions.

Looking forward, continued collaboration among technology developers, healthcare practitioners, and regulatory authorities will be essential to sustain momentum and translate experimental capabilities into mainstream practice. By embracing interoperable standards, robust evidence generation, and adaptive supply-chain strategies, stakeholders can ensure that holographic solutions deliver tangible benefits at scale. Ultimately, the true measure of success will be the improved health outcomes and operational efficiencies achieved through thoughtful integration of holography within the healthcare ecosystem.

Seize the Opportunity to Elevate Your Strategic Planning with Expert Insights by Contacting Ketan Rohom for the Definitive Medical Holography Report

Are you prepared to transform your strategic initiatives with unparalleled expertise in medical holography market insights? Contact Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report and gain access to critical data along with actionable analysis tailored to your objectives. Take the next step in advancing your organization’s competitive edge and innovation roadmap by partnering with an experienced industry leader who can guide you through the complexities of this rapidly evolving field. Reach out today to elevate your decision-making, optimize investment strategies, and unlock the full potential of holographic applications in healthcare.

- How big is the Medical Holography Market?

- What is the Medical Holography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?