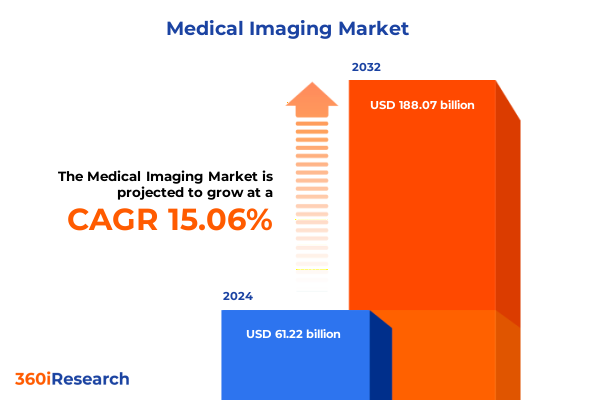

The Medical Imaging Market size was estimated at USD 70.46 billion in 2025 and expected to reach USD 79.63 billion in 2026, at a CAGR of 15.05% to reach USD 188.07 billion by 2032.

Revolutionizing Healthcare Through Advanced Medical Imaging Technologies Driving Unprecedented Insights and Transformational Clinical Applications

Medical imaging stands at the heart of modern healthcare by delivering critical diagnostic and treatment insights that fundamentally improve patient outcomes. Recent advancements in imaging hardware and software have accelerated the speed and precision with which clinicians detect, monitor, and manage a vast array of medical conditions. Moreover, the integration of intelligent algorithms is driving unprecedented capabilities such as automated lesion detection, volumetric analysis, and predictive modeling, thereby transforming traditional imaging workflows into powerful decision-support systems that enhance clinical confidence and efficiency.

In addition to technological breakthroughs, there is a growing emphasis on interoperability and data integration across care environments. Improved connectivity among imaging modalities enables seamless sharing of high-resolution images and analytic results between hospitals, outpatient centers, and specialty clinics. Consequently, multidisciplinary care teams can collaborate more effectively, leveraging unified imaging repositories and cloud-based platforms to make timely care decisions. As healthcare providers seek to balance quality, cost, and access, innovative imaging solutions are poised to play an increasingly strategic role in delivering scalable, patient-centered care experiences.

Navigating the Surge of Artificial Intelligence and Digital Diagnostics Shaping the Future of Medical Imaging Workflows Across Care Continuum

The medical imaging landscape is undergoing transformative shifts as artificial intelligence and advanced computational techniques converge with emerging digital modalities. Machine learning algorithms are being embedded directly into imaging systems to deliver real-time reconstruction, noise reduction, and anomaly detection, fundamentally altering the speed and accuracy of diagnostic reading. At the same time, digital diagnostics platforms are enabling remote interpretation and consultation, expanding specialist access in rural and underserved regions. Consequently, imaging providers are adopting hybrid on-premise and cloud-based architectures to accommodate advanced analytics while ensuring data security and regulatory compliance.

Furthermore, the proliferation of portable imaging devices, coupled with miniaturized ultrasound probes and compact computed tomography scanners, is redefining point-of-care diagnostics. These devices empower clinicians to perform bedside evaluations in ambulatory settings, surgical centers, and even patient homes. As a result, care pathways are becoming more patient-centric, with faster decision cycles, reduced hospital stays, and proactive monitoring strategies that support early intervention. The integration of telemedicine and connected imaging networks amplifies these benefits, accelerating the shift from reactive treatment models to continuous, data-driven patient management.

Assessing the Far-Reaching Impact of United States Trade Tariffs on Medical Imaging Supply Chains Equipment Service Economics and Strategic Procurement

Recent policy measures introduced by the United States in 2025 have imposed higher tariffs on a broad spectrum of medical imaging equipment and related components. These levies have introduced additional cost pressures that reverberate through every stage of the supply chain. Manufacturers dependent on imported semiconductors for advanced imaging modalities, for example, are experiencing extended lead times and inflated procurement expenses. In turn, system integrators and healthcare providers face the challenge of balancing capital budgets with the imperative to maintain access to cutting-edge diagnostic tools.

In response, stakeholders are exploring alternative sourcing strategies to mitigate risk and manage total cost of ownership. Regional assembly centers and local manufacturing partnerships are emerging as viable solutions to reduce dependency on tariff-impacted imports. Additionally, service agreements are being renegotiated to include flexible maintenance models and extended warranties that offset upfront equipment investments. As procurement teams navigate this new economic landscape, strategic planning around inventory buffering, collaborative vendor relationships, and dynamic pricing frameworks will be critical to preserving both operational continuity and high standards of patient care.

Unveiling In-Depth Segmentation Insights Across Modality Deployment Component Application and Distribution Channel to Guide Targeted Strategies

A nuanced understanding of market segmentation reveals critical pathways for targeted product development and marketing strategies. Within modality classifications, the landscape extends from traditional X-ray and ultrasound technologies to sophisticated magnetic resonance imaging and computed tomography systems. Computed tomography itself encompasses cone beam CT for dental and orthopedic applications, PET-CT for oncology diagnostics, and spectral CT which delivers enhanced tissue characterization. Similarly, nuclear imaging divisions such as positron emission tomography and single photon emission computed tomography provide the foundation for advanced functional and metabolic studies.

Component segmentation further illuminates the balance between hardware investments, comprehensive software solutions, and essential services. Installation and integration services ensure systems are deployed seamlessly, while maintenance and support protocols safeguard long-term operational readiness. Training and education initiatives enhance clinical proficiency, driving adoption of advanced imaging features. Across applications, imaging solutions address core specialties including cardiology, gastroenterology, neurology, obstetrics and gynecology, oncology, orthopedics, and urology, each with unique performance and workflow requirements. End users range from ambulatory surgical centers and diagnostic imaging facilities to large hospital networks and outpatient clinics. Anatomy-focused segments cover abdominal, brain, breast, cardiovascular, musculoskeletal, pediatric, and spinal imaging. Finally, deployment mode choices between cloud and on-premise environments and distribution channels via direct sales or indirect dealers, distributors, and online retailers shape how solutions reach end markets.

This comprehensive research report categorizes the Medical Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Modality

- Component

- Application

- End User

- Anatomy

- Deployment Mode

Exploring the Distinct Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific for Tailored Market Penetration Strategies

Geographic nuances play a pivotal role in shaping adoption, regulatory, and reimbursement frameworks across the global medical imaging arena. In the Americas, robust healthcare infrastructure and progressive reimbursement models drive sustained investment in advanced modalities. However, market access pathways often require rigorous clinical validation and alignment with payer criteria. In contrast, Europe, the Middle East, and Africa exhibit a heterogeneous mix of public and private healthcare systems where regulatory harmonization under initiatives such as CE marking and Gulf Health Council approvals streamlines market entry for imaging innovators.

Meanwhile, the Asia-Pacific region is characterized by rapid digital transformation, with emerging economies leading growth in portable and cost-effective imaging platforms. Government initiatives supporting telehealth expansion and rural outreach have accelerated adoption of cloud-enabled imaging services. At the same time, established markets in Japan, South Korea, and Australia prioritize high-field MRI and hybrid PET-CT installations, backed by progressive research ecosystems. Collectively, these regional dynamics underscore the necessity of tailoring market strategies to local regulatory requirements, infrastructure capabilities, and clinical priorities.

This comprehensive research report examines key regions that drive the evolution of the Medical Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Research Roadmaps Strategic Alliances Intellectual Property Approaches and Competitive Advantages Driving the Evolution and Reinvention of Medical Imaging Solutions

Leading participants in the medical imaging ecosystem are executing multifaceted strategies to maintain competitive positioning and catalyze technological leadership. Global imaging equipment manufacturers are channeling resources into integrated hardware-software platforms, leveraging proprietary algorithms and deep learning frameworks to differentiate their offerings. Strategic collaborations with start-ups, academic centers, and cloud service providers are accelerating innovation cycles, enabling faster translation of research breakthroughs into commercial applications.

Moreover, intellectual property portfolios are being bolstered through targeted patent filings in areas such as spectral imaging, quantitative analytics, and workflow automation. At the same time, targeted acquisitions and joint ventures are expanding footprints into adjacent segments, such as interventional radiology and image-guided therapy. These consolidation efforts, combined with flexible subscription and service-based licensing models, demonstrate a shared industry commitment to balancing capital expenditures with scalable digital solutions. As a result, customers benefit from cohesive technology roadmaps, end-to-end support ecosystems, and continuous software enhancements that ensure maximal return on investment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert Group

- Analogic Corporation

- Bracco Imaging S.p.A.

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Carl Zeiss Meditec AG

- Esaote S.p.A.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- Hitachi, Ltd.

- Hologic, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Planmeca Oy

- RadNet, Inc.

- Samsung Medison Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers AG

- Varex Imaging Corporation

Delivering Practical Strategic Recommendations to Guide Industry Leaders in Seizing Opportunities Overcoming Challenges and Fuelling Growth in Medical Imaging

Industry leaders should prioritize integration of artificial intelligence capabilities at the core of their product and service portfolios. By embedding AI-driven analytics directly into imaging workflows, organizations can elevate diagnostic accuracy, accelerate time to diagnosis, and streamline radiologist throughput. Concurrently, diversifying supplier networks and establishing secondary procurement channels will mitigate exposure to supply-chain disruptions and tariff pressures.

In addition, forging strategic alliances across the health IT ecosystem can catalyze value-added services such as cloud-based storage, enterprise imaging platforms, and remote collaboration tools. Emphasizing cybersecurity protocols and regulatory compliance will safeguard patient data and build institutional trust. Furthermore, tailoring solutions to meet the distinct needs of regional markets-whether that involves cost-effective portable systems for emerging economies or high-field imaging suites for tertiary care centers-will unlock new revenue streams and drive sustainable growth. Ultimately, a balanced focus on technological innovation, operational resilience, and customer-centric service models will enable industry stakeholders to capitalize on evolving clinical and economic landscapes.

Illuminating the Robust Research Methodology Integrating Primary Expert Consultations Secondary Source Analysis and Rigorous Data Validation to Ensure Insights Credibility

This research employed a rigorous methodology that integrates primary discussions with key opinion leaders, senior imaging specialists, and procurement executives to capture firsthand perspectives on technology adoption, clinical requirements, and purchasing criteria. Complementary secondary analysis drew upon peer-reviewed publications, regulatory filings, company documents, and digital health databases to contextualize primary findings within broader market trends.

Data validation was conducted through cross-referencing multiple independent sources, enabling triangulation of qualitative insights and quantitative indicators. Expert panels reviewed preliminary conclusions to ensure accuracy, relevance, and applicability. A structured multi-tier quality control process, including editorial oversight and statistical consistency checks, underpins the reliability of the findings. By combining deep domain expertise with comprehensive data analysis, this study offers robust guidance that aligns with the evolving demands of the medical imaging community and supports informed strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Imaging Market, by Modality

- Medical Imaging Market, by Component

- Medical Imaging Market, by Application

- Medical Imaging Market, by End User

- Medical Imaging Market, by Anatomy

- Medical Imaging Market, by Deployment Mode

- Medical Imaging Market, by Region

- Medical Imaging Market, by Group

- Medical Imaging Market, by Country

- United States Medical Imaging Market

- China Medical Imaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Outlook Reflections to Reinforce Strategic Imperatives and Inspire Future Innovations Across the Medical Imaging Landscape

In conclusion, the medical imaging market is entering a phase of profound transformation driven by technological innovation, regulatory evolution, and shifting economic forces. Key findings highlight the central role of artificial intelligence, cloud-based architectures, and interoperable platforms in shaping next-generation imaging solutions. Supply chain considerations, amplified by recent trade policies, underscore the importance of strategic procurement practices and regional manufacturing partnerships.

Segmentation and regional insights reveal opportunities for tailored offerings that address the unique clinical and operational needs of diverse end users. Meanwhile, competitive dynamics among leading companies demonstrate the value of collaborative alliances and intellectual property strategies in accelerating innovation. By synthesizing these insights, industry stakeholders are equipped with a clear roadmap to navigate challenges, capitalize on emerging trends, and drive sustainable growth across the global medical imaging ecosystem.

Act Now to Partner with Ketan Rohom and Acquire the Definitive Market Research Report Empowering Your Strategic Decisions in the Medical Imaging Domain

Harness actionable insights by engaging directly with Ketan Rohom, whose expertise in market dynamics and sales strategy will empower your organization to leverage this comprehensive study.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this market research report can be tailored to your specific decision-making needs and drive tangible business outcomes.

Secure your copy today to stay ahead of emerging trends, optimize procurement of imaging technologies, and refine strategic initiatives that align with evolving clinical and regulatory demands.

Initiate a conversation with Ketan to discover exclusive data modules, customized analysis options, and priority access to future updates that will enhance your competitive positioning in the medical imaging field.

- How big is the Medical Imaging Market?

- What is the Medical Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?