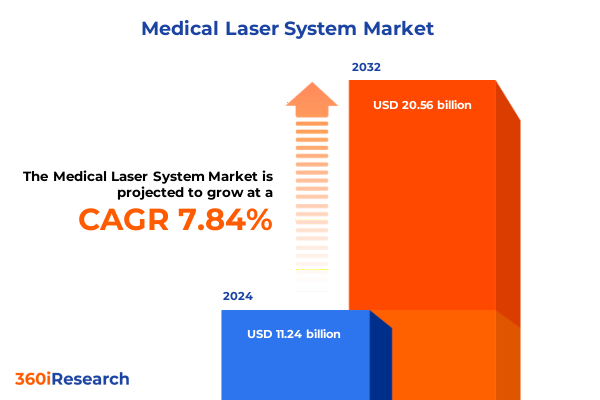

The Medical Laser System Market size was estimated at USD 12.05 billion in 2025 and expected to reach USD 12.92 billion in 2026, at a CAGR of 7.93% to reach USD 20.56 billion by 2032.

Setting the Stage for Medical Laser Systems by Unveiling Current Dynamics, Drivers, and Opportunity Pathways Across Healthcare Environments

The medical laser system arena has experienced a remarkable evolution, with advancements that are reshaping clinical practice and patient outcomes across multiple disciplines. From early CO2 platforms used in dermatology to today’s compact fiber lasers that enable precision procedures, the journey has been defined by relentless innovation and a commitment to expanding therapeutic possibilities. As these technologies mature, healthcare providers are gaining access to systems that deliver greater accuracy, reduced downtime, and enhanced safety, establishing laser modalities as a cornerstone of modern medicine.

Emerging technologies such as diode lasers, Erbium:YAG platforms, and Q-switched Nd:YAG devices are now complementing established Alexandrite and carbon dioxide configurations, broadening the scope of procedures that can be performed in dermatological, ophthalmic, dental, and surgical settings. Meanwhile, improvements in ergonomics, user interfaces, and energy delivery mechanisms have lowered the learning curve for clinicians, accelerating adoption across ambulatory surgical centers, hospitals, and specialized clinics. Consequently, the role of medical lasers has expanded beyond niche applications to become integral to therapeutic regimens addressing scar revision, tissue ablation, vision correction, and oncological interventions.

Transitional forces, including increased investment in R&D, strategic collaborations between device manufacturers and research institutions, and a heightened focus on minimally invasive treatments, continue to propel the market forward. Additionally, the convergence of digital tools-such as real-time imaging, AI-driven treatment planning, and cloud-based performance monitoring-augments the clinical utility of laser systems and bolsters procedural precision. This introductory overview establishes the context for understanding how technological breakthroughs, regulatory evolution, and shifting operational paradigms are collectively driving the next wave of growth and transformation in medical laser system applications across healthcare landscapes.

Unveiling the Pivotal Technological, Regulatory, and Clinical Innovations Redefining the Medical Laser Systems Landscape

Recent years have witnessed transformative shifts that are redefining the contours of the medical laser system market. One of the most consequential developments has been the integration of artificial intelligence and machine-learning algorithms into laser platforms, enabling adaptive energy modulation that responds to tissue characteristics in real time. This evolution from static parameter settings to dynamic, feedback-driven delivery is enhancing procedural safety, reducing collateral damage, and opening pathways for complex interventions that were previously constrained by manual adjustments.

Concurrently, there has been a marked transition toward hybrid devices that combine multiple laser wavelengths within a single console, offering clinicians versatile tools to address a spectrum of tissue interactions. Such modular configurations are enabling seamless switching between continuous wave, pulsed, and Q-switched operating modes, thereby streamlining clinical workflows and maximizing utilization rates. These hybrid innovations complement the trend toward miniaturization, with portable, cart-based, and handheld platforms facilitating point-of-care treatments in outpatient environments and remote care settings.

Another pivotal shift involves the evolution of fiber-delivered laser architectures, which have replaced rigid arm systems and optimized energy transmission over greater distances without significant power loss. This fiber-optic revolution not only enhances clinical reach but also simplifies maintenance and reduces operational downtime. Lastly, regulatory landscapes have adjusted to accommodate expedited pathways for breakthrough devices, incentivizing manufacturers to pursue novel applications such as photodynamic therapy, laser-guided drug delivery, and non-thermal laser modalities that harness optical coherence for enhanced diagnostics. Together, these developments underscore how technology and regulation interplay to accelerate innovation and elevate the standard of care across diverse medical disciplines.

Examining How 2025 United States Tariff Reforms on Imported Medical Laser Systems Are Revamping Supply Chains and Manufacturing Strategies

The introduction of new tariff measures in the United States in early 2025 has exerted a notable influence on the medical laser system market, prompting stakeholders to reassess supply chain strategies and sourcing decisions. As import duties increased on key components and finished devices originating from select regions, manufacturers faced heightened input costs. This scenario has compelled many to explore near-shoring and local assembly initiatives to mitigate exposure to cross-border levies and maintain price competitiveness for end users.

Consequently, certain original equipment manufacturers have accelerated investments in domestic production capacities, forging partnerships with regional suppliers to ensure a stable flow of critical elements such as laser diodes, optical components, and control electronics. These realignments have reshaped distribution networks, with distributors diversifying their portfolios to include domestically produced platforms and aftermarket service offerings that prioritize agile maintenance support. Meanwhile, the cost implications have spurred innovation in component design, leading to optimized manufacturing processes that reduce material waste and improve yield rates.

Despite these challenges, the tariff environment has also catalyzed opportunities for companies positioned to capitalize on reshored operations and enhanced value propositions. By emphasizing shorter lead times, tightened quality controls, and responsive service models, domestic players are differentiating themselves in a landscape where reliability and operational continuity have become paramount. Ultimately, the cumulative impact of the 2025 tariff adjustments underscores the strategic necessity of supply chain resilience and the value of aligning production footprints with evolving trade policies.

Revealing How Laser Type, Operating Mode, Application Spectrum, and End User Profiles Shape Distinct Demand Patterns and Clinical Adoption Trends

In analyzing market segmentation through the lens of laser type, operating mode, application, and end user, distinct patterns of demand and technological fit emerge that inform strategic positioning. Among laser types, diode systems have garnered substantial attention for their efficiency and compact form factors, whereas CO2 platforms remain indispensable for dermatological resurfacing and otolaryngology procedures. Alexandrite lasers continue to serve as benchmarks for selective photothermolysis in pigment-related treatments, while Nd:YAG and Erbium devices occupy specialized niches within ophthalmology and dental surgery respectively, reflecting diverse wavelength requirements.

Operating modes also delineate the user experience and clinical suitability of laser interventions. Continuous wave systems deliver steady energy for sustained ablation, pulsed lasers facilitate controlled thermal impact with reduced collateral damage, and Q-switched platforms generate high-peak power pulses ideal for pigment fragmentation and tattoo removal. Each mode aligns with specific clinical objectives, driving practitioners to select systems that best balance procedural efficiency with patient comfort.

Application-based segmentation further highlights the heterogeneity of laser use cases. Dermatology professionals leverage hair removal and vascular lesion treatments through precise wavelength selection, while dental practitioners adopt laser-guided tissue surgery and tooth whitening for minimally invasive outcomes. In general surgery, tissue ablation and tumor removal protocols are benefiting from advancements in fiber transmission and beam shaping, whereas ophthalmologists exploit laser systems for cataract extraction, glaucoma management, and retina therapy under microscopic guidance. Gynecological and oncological applications are increasingly adopting laser technologies for targeted interventions, underscoring the modality’s expanding footprint across therapeutic domains.

Turning to end users, hospitals represent the primary environment for complex laser procedures supported by multidisciplinary teams, while clinics and ambulatory surgical centers capitalize on laser systems for high-throughput elective treatments. Academic and research institutions remain pivotal in driving next-generation innovations through clinical trials and translational studies, shaping the trajectory of technology adoption and helping to establish evidence-based protocols that guide practitioner decision-making.

This comprehensive research report categorizes the Medical Laser System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Operating Mode

- Application

- End User

Exploring Regional Dynamics Highlighting North American Leadership, EMEA Diversity, and Asia-Pacific Growth Trajectories in Medical Laser Adoption

Geographically, the Americas have emerged as a fertile ground for medical laser system innovation and uptake, underpinned by a robust network of academic research centers and a high concentration of private healthcare facilities. North American markets are characterized by early adoption of cutting-edge platforms, particularly in dermatological and ophthalmic applications, supported by favorable reimbursement frameworks and a culture of technology-driven care. Latin American regions, while facing varied economic constraints, are experiencing incremental growth as private clinics and specialty hospitals integrate laser treatments to differentiate their service offerings.

The Europe, Middle East, and Africa region presents a diverse tapestry of regulatory environments and healthcare infrastructures. Western Europe maintains steady investment in next-generation laser therapies, bolstered by well-established clinical guidelines and public funding mechanisms. Meanwhile, emerging markets in Eastern Europe and the Middle East are increasingly equipping new hospitals and surgical centers with laser platforms to cater to growing demand for minimally invasive procedures. In Africa, constrained infrastructure has posed challenges, yet partnerships with international organizations and targeted government initiatives are gradually expanding access to laser-assisted treatments in tertiary care settings.

In Asia-Pacific, dynamic economic growth and supportive health policy reforms are accelerating the deployment of medical laser solutions across China, Japan, South Korea, and India. High patient volumes and a rising middle class are driving demand for cosmetic dermatology and dental laser applications, while government investments in cancer care infrastructure are facilitating the adoption of laser-based oncology protocols. Additionally, local manufacturers are gaining traction by offering cost-competitive alternatives and forging strategic collaborations with global technology providers to enhance service networks and after-sales support.

This comprehensive research report examines key regions that drive the evolution of the Medical Laser System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering How Leading Innovators and Agile Entrants Are Deploying Strategic Alliances, Aftermarket Excellence, and Modular Technologies to Drive Market Leadership

Leading companies in the medical laser system domain are demonstrating their competitive edge through a combination of technological differentiation, strategic alliances, and targeted service extensions. Key players are investing heavily in R&D to integrate features such as real-time tissue feedback, automated calibration routines, and interoperable software ecosystems. Collaborations with academic institutions and start-ups are fostering rapid prototyping of laser modules that address emerging clinical needs, while licensing agreements facilitate access to patented beam-shaping technologies that enhance treatment precision.

Several incumbent manufacturers are reinforcing their market positions by expanding aftermarket services, offering comprehensive maintenance packages, remote diagnostics, and training programs that help end users maximize system uptime and procedural efficacy. Partnerships with distribution networks and clinical societies have enabled these companies to broaden their reach into underserved regions, tailoring financing models and service offerings to local market conditions. Moreover, a subset of agile entrants is leveraging modular platform architectures to deliver customizable laser suites, allowing practitioners to scale capabilities by adding wavelengths or operating modes as practice demands evolve.

In parallel, forward-thinking firms are exploring adjacencies such as laser-assisted drug delivery, photobiomodulation therapies, and combined laser-imaging diagnostics, aiming to capture value beyond single-function devices. By forging cross-industry partnerships with pharmaceutical companies, imaging providers, and digital health platforms, these organizations are laying the groundwork for ecosystems that integrate laser technologies into comprehensive care pathways, reinforcing long-term customer relationships and opening avenues for recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Laser System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon, Inc.

- Bausch Health Companies Inc.

- Biolase, Inc.

- Boston Scientific Corporation

- Candela Corporation

- Carl Zeiss Meditec AG

- Cutera, Inc.

- Cynosure, LLC

- El.En. S.p.A.

- Fotona d.o.o.

- IPG Photonics Corporation

- IRIDEX Corporation

- Koninklijke Philips N.V.

- Lumenis Be Ltd.

- Sisram Medical Ltd

Empowering Organizations to Elevate Clinical Outcomes and Supply Chain Resilience Through AI Integration and Strategic Ecosystem Partnerships

Industry leaders should prioritize investments in artificial intelligence-enabled control systems that optimize energy delivery based on patient-specific tissue profiles. By integrating machine-learning algorithms into laser consoles, manufacturers and healthcare providers can elevate treatment reproducibility, reduce complication rates, and differentiate service offerings. This technological edge not only drives clinical confidence but also generates valuable procedural data that can inform future product enhancements and create new revenue models through data analytics services.

Another strategic imperative involves strengthening regional manufacturing and service footprints to mitigate trade policy risks and bolster supply chain resilience. Establishing localized assembly hubs and certified service centers ensures that stakeholders can respond rapidly to market fluctuations and regulatory shifts, while also demonstrating a commitment to customer support excellence. Collaborative ventures with local component suppliers and training institutions can further enhance operational agility and reinforce brand loyalty among end users seeking reliable, regionally grounded partners.

Finally, forging interdisciplinary partnerships that bridge laser technology with emerging therapeutic modalities will unlock novel applications and expand market addressability. Engaging with pharmaceutical companies on laser-assisted drug delivery trials, collaborating with imaging firms to develop integrated diagnostic-therapeutic suites, and participating in interdisciplinary research consortia can position organizations at the vanguard of next-generation healthcare solutions. Embracing this holistic vision fosters ecosystem synergies, drives innovation pipelines, and establishes a durable competitive moat in an increasingly convergent medical technology landscape.

Describing the Rigorous Multi-Tiered Research Approach Combining Secondary Analysis, Expert Interviews, and Quantitative Validation

The research methodology underpinning this analysis combines a structured multi-tiered approach to ensure both breadth and depth of insights. Initially, comprehensive secondary research was conducted, incorporating peer-reviewed journals, technical white papers, regulatory filings, and policy documents to map technological advancements, regulatory trajectories, and application paradigms. This foundational phase provided a rigorous knowledge base to frame subsequent inquiry.

Following the secondary phase, qualitative primary research was undertaken through in-depth interviews with device manufacturers, clinical practitioners, logistics experts, and regulatory officials. These conversations elicited nuanced perspectives on technology adoption barriers, evolving patient needs, and the practical implications of policy changes. By triangulating viewpoints across stakeholders, the research team was able to validate assumptions, identify consensus areas, and uncover divergent views that enrich the strategic narrative.

Quantitative validation was achieved by analyzing proprietary datasets from service providers and industry consortia, focusing on procurement cycles, equipment utilization patterns, and component lead-time metrics. Statistical rigor was applied to ensure data reliability, with cross-checks against publicly available benchmarks and audit trails maintained for transparency. Finally, iterative review sessions with internal experts facilitated critical refinement, ensuring that the final report reflects a balanced synthesis of empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Laser System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Laser System Market, by Laser Type

- Medical Laser System Market, by Operating Mode

- Medical Laser System Market, by Application

- Medical Laser System Market, by End User

- Medical Laser System Market, by Region

- Medical Laser System Market, by Group

- Medical Laser System Market, by Country

- United States Medical Laser System Market

- China Medical Laser System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing How Innovation, Policy Evolution, and Strategic Alignment Are Shaping the Future of Medical Laser System Applications Across Healthcare Domains

This executive summary has explored the dynamic interplay of innovation, policy, and market forces that define the medical laser system ecosystem. From the foundational evolution of laser wavelengths and operating modes to the strategic implications of tariffs and regional growth differentials, the analysis has highlighted critical trends shaping industry trajectories. Key segmentation insights revealed how laser type, application domains, and end-user contexts drive distinctive adoption patterns, while company profiles demonstrated the strategic maneuvers that underpin competitive positioning.

The discourse underscores the necessity for stakeholders to embrace technological integration, supply chain agility, and ecosystem collaboration as pillars of sustainable growth. With tariffs influencing cost structures and regional markets exhibiting unique drivers, organizations must employ a holistic lens to align product portfolios and service strategies with shifting market demands. Moreover, the emergent role of AI in clinical laser systems portends a future where smart platforms will redefine procedural standards and data-driven care pathways.

Ultimately, the medical laser landscape is characterized by a convergence of cross-disciplinary innovation and regulatory evolution, offering abundant opportunities for those who can synchronize technological capability with strategic foresight. By leveraging the insights and recommendations outlined throughout this summary, industry participants can navigate complexity, capitalize on emerging growth avenues, and contribute to improved patient outcomes across global healthcare settings.

Take decisive action now to harness expert insights and gain competitive advantage by engaging with Ketan Rohom to acquire the comprehensive medical laser systems report

Elevate your strategic vision and empower your organization to navigate the rapidly evolving medical laser system market landscape. Partner with Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive report that will arm you with in-depth analysis, actionable insights, and the clarity needed to make informed decisions. Reach out today to transform opportunity into competitive advantage and drive sustainable growth with tailored intelligence that resonates with your objectives.

- How big is the Medical Laser System Market?

- What is the Medical Laser System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?