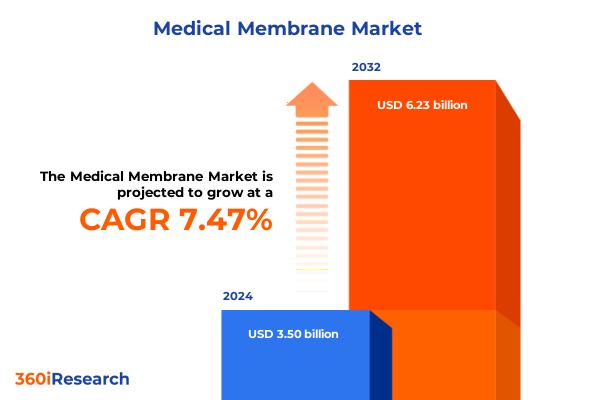

The Medical Membrane Market size was estimated at USD 3.75 billion in 2025 and expected to reach USD 4.02 billion in 2026, at a CAGR of 7.51% to reach USD 6.23 billion by 2032.

Exploring the Dynamic World of Medical Membranes Shaping the Future of Patient Care and Innovative Solutions in Critical Healthcare Applications Worldwide

The medical membrane sector has emerged as a cornerstone of modern healthcare, underpinning critical applications from purified dialysis solutions to advanced drug delivery systems. Over recent years, innovations in material science and membrane engineering have converged to address the growing demand for more efficient, biocompatible, and cost-effective membranes. As patient populations expand and regulatory scrutiny intensifies, stakeholders across hospitals, pharmaceutical companies, and research laboratories are seeking reliable solutions that deliver consistent performance under stringent operating conditions.

Against this backdrop, our executive summary offers a concise yet thorough exploration of the market forces shaping the trajectory of medical membranes. By examining transformative technological shifts, policy developments, segmentation insights, and key regional dynamics, this analysis equips decision makers with the context needed to align strategic priorities with emerging opportunities. Additionally, it highlights how evolving United States tariff policies in 2025 have redefined manufacturing economics and competitive positioning for both domestic and global suppliers.

Ultimately, this introduction sets the stage for a deep dive into market segmentation, competitive landscapes, and actionable recommendations designed to guide industry leaders in making informed investments. Through a balanced narrative that emphasizes clarity, authority, and factual accuracy, readers will gain immediate understanding of the multifaceted factors driving demand and innovation in medical membranes.

Navigating Transformative Shifts in Medical Membrane Innovation Driven by Advanced Materials Regulatory Evolution and Technological Breakthroughs Across the Healthcare Value Chain

The landscape of medical membranes is undergoing profound shifts as advanced materials converge with digital manufacturing techniques and evolving regulatory frameworks. Breakthroughs in polymer chemistry and composite formulations have enabled membranes with enhanced permeability, selectivity, and durability, expanding their applicability beyond traditional dialysis to areas such as gas separation in extracorporeal oxygenation systems. At the same time, additive manufacturing and modular production lines are streamlining scale-up processes, reducing lead times, and facilitating customization for specific clinical protocols.

Regulatory bodies have responded to these technological advancements by refining guidance on biocompatibility testing and sterilization standards, encouraging manufacturers to adopt more rigorous validation processes. This harmonization of standards across key markets has accelerated product approvals while raising the bar for demonstrating safety and efficacy. Concurrently, artificial intelligence and process analytics are being integrated into quality control workflows, enabling real-time monitoring and predictive maintenance, which collectively enhance batch-to-batch consistency and reduce risk of contamination.

Moreover, the emergence of novel materials-such as bioinspired ceramic-coated membranes and functionalized nanofiber meshes-promises to unlock new therapeutic possibilities, from targeted drug delivery to tissue engineering scaffolds. These materials are driving a shift toward multifunctional platforms that combine filtration, sensing, and controlled release capabilities. As a result, organizations that proactively invest in cross-disciplinary R&D and cultivate partnerships with academic institutions are positioning themselves at the vanguard of the industry. This section illuminates the transformative currents reshaping market dynamics and underscores the imperative for agility and innovation.

Assessing the Cumulative Impact of 2025 United States Tariffs on Medical Membrane Supply Chains Manufacturing Economics and Industry Competitiveness

The United States introduced revised tariff measures in early 2025 targeting specific categories of medical membrane imports, compelling both domestic manufacturers and multinational suppliers to reassess cost structures and sourcing strategies. These duties, applied to raw polymeric sheets, composite precursors, and specialized membrane modules, have increased landed costs, prompting many firms to accelerate localization of manufacturing processes within the U.S. This realignment has fostered renewed investment in domestic production facilities, spurring modernization of extrusion and coating capabilities to offset the financial impact of import levies.

In response, vertically integrated manufacturers have explored strategic consolidation, acquiring upstream resin suppliers to secure raw material availability at more predictable price points. Meanwhile, procurement teams at pharmaceutical companies and hospital groups are renegotiating contracts to stabilize supply agreements, often incorporating cost-sharing mechanisms for tariffs. Transparency in total landed cost has become paramount, driving the adoption of digital supply chain platforms that provide end-to-end visibility from resin sourcing to membrane delivery.

Although the tariffs have introduced headwinds, they have also catalyzed innovation in alternative materials and manufacturing techniques that reduce dependence on imported feedstocks. Research partnerships are emerging between material scientists and membrane engineers to explore recyclable ceramics, metals, and novel polymer blends that offer comparable performance to traditional materials. As these efforts mature, the industry is likely to witness a gradual mitigation of tariff-driven cost pressures and a more resilient, diversified supply base. This section evaluates the collective influence of U.S. trade policies on production economics, supply chain resilience, and competitive differentiation within the medical membrane market.

Uncovering Key Segmentation Insights Revealing Diverse Opportunities Across Membrane Types Materials Applications and End User Dynamics in Healthcare

Market segmentation provides critical insight into how different membrane types are driving specialized applications and targeted investment. Membranes designed for dialysis continue to command significant attention as they enable ultrapure water treatment and selective removal of solutes, but emerging segments such as gas separation for extracorporeal oxygenation and high-precision microfiltration are gaining traction. Nanofiltration and reverse osmosis technologies are increasingly deployed in pharmaceutical filtration processes, underscoring the need for membranes that balance high throughput with stringent sterility requirements. Ultrafiltration’s role in biomolecule concentration and purification further emphasizes its strategic importance in both therapeutic manufacturing and point-of-care diagnostics.

Material classifications reveal nuanced performance trade-offs that influence product development roadmaps. Ceramic membranes, prized for chemical resistance and thermal stability, are finding new utility in harsh sterilization cycles, while composite and metallic membranes offer customizable porosity and mechanical robustness. Polymeric membranes remain the workhorse of the industry, with polypropylene, polysulfone, PTFE, and PVDF each delivering unique combinations of hydrophobicity, tensile strength, and biocompatibility. Ongoing research into polymer blends and surface modifications aims to enhance fouling resistance and prolong service life.

Diverse clinical and industrial applications underscore the expansive reach of medical membranes. Apheresis platforms are leveraging specialized membranes for selective plasma separation, and advancements in controlled release systems and transdermal patches are broadening the scope of drug delivery solutions. Within pharmaceutical filtration, the purification of biologics and sterile filtration processes demand rigorous membrane integrity testing, while tissue engineering scaffolds and wound care dressings integrate membrane components to support cell proliferation and fluid management.

End users such as hospitals, clinics, and research laboratories are shaping procurement strategies by prioritizing supplier reliability, regulatory compliance, and total cost of ownership. Pharmaceutical companies, driven by the imperative for high-purity processes, are partnering with membrane manufacturers on co-development initiatives. This segmentation lens illuminates where emerging opportunities lie and how value propositions must adapt to meet the distinct requirements of each market segment.

This comprehensive research report categorizes the Medical Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type of Membrane

- Material

- Application

- End-User

Examining Key Regional Insights Highlighting Growth Trajectories Market Drivers and Strategic Imperatives in the Americas EMEA and Asia Pacific Medical Membrane Markets

Regional dynamics exhibit distinct patterns of demand and innovation that influence investment and collaboration strategies. In the Americas, strong federal support for domestic manufacturing and incentives tied to reshoring have magnified capacity expansions in polymeric membrane production. The convergence of research institutions and private sector manufacturing hubs in North America has fostered an ecosystem where pilot-scale lines and rapid prototyping facilities accelerate time to market. Latin American markets, while still developing, present potential for growth in basic water purification and dialysis initiatives, underscoring the need for cost-optimized membrane solutions.

Europe, the Middle East, and Africa collectively represent a complex landscape where regulatory harmonization across the European Union contrasts with market fragmentation in other subregions. EU directives on medical device classification and environmental compliance have heightened expectations for membrane recyclability and lifecycle management. Meanwhile, the Middle East has become a nexus for partnerships in gas separation technologies, driven by the oil and gas sector’s interest in membrane-based carbon capture. In Africa, demand for robust microfiltration and ultrafiltration systems in both healthcare and potable water projects is steadily rising, although challenges in logistics and infrastructure persist.

Asia-Pacific continues to lead in both manufacturing scale and end-use innovation. Major production hubs in China, India, and Southeast Asia benefit from cost-efficient labor and vertically integrated chemical supply chains. Rapid growth in hospital networks and pharmaceutical manufacturing capacity in these markets has fueled demand for advanced dialysis modules and pharmaceutical-grade filtration membranes. Additionally, collaborative research efforts between local universities and global membrane developers have produced next-generation membranes tailored for emerging markets, including portable and point-of-care devices geared toward decentralized healthcare delivery.

These regional insights underscore the importance of aligning market entry strategies with local regulatory and economic environments. Companies that navigate these dynamics effectively are leveraging joint ventures, technology transfers, and strategic alliances to capture growth opportunities while mitigating geopolitical and logistical risks.

This comprehensive research report examines key regions that drive the evolution of the Medical Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies Shaping the Competitive Landscape through Strategic Partnerships Product Innovation and Market Expansion in the Medical Membrane Industry

The medical membrane industry is marked by the presence of established global leaders and nimble innovators, each leveraging distinct competencies to differentiate their offerings. Several large-scale manufacturers with integrated polymer processing and membrane fabrication capabilities are deploying aggressive capacity expansions and technology upgrades to maintain cost leadership. In parallel, specialized firms focusing on high-value applications such as controlled release systems and biomedical scaffolds are securing niche positions through targeted R&D investments.

Strategic collaborations between membrane producers and end users have become increasingly common, enabling co-development of customized solutions. Pharmaceutical companies are entering long-term supply agreements that include joint validation protocols and performance guarantees, reinforcing mutual commitments to quality and continuity. At the same time, emerging entrants with expertise in nanofiber and 3D printing technologies are challenging incumbents by offering membranes with tunable pore architectures and integrated sensing functionalities.

Competitive pressures are also driving mergers and acquisitions as firms seek to enhance vertical integration and broaden their technology portfolios. Recent transactions have concentrated on acquiring upstream resin capabilities and downstream module assembly operations, creating synergies in supply chain management and reducing exposure to tariff volatility. This consolidation trend reflects a broader industry imperative to secure end-to-end control and foster agility in responding to shifting regulatory mandates and customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Agilent Technologies Inc.

- American Membrane Corporation

- AMS Technologies PVT LTD

- Applied Membrane Technology, Inc.

- Asahi Kasei Corporation

- Atlas Copco AB

- Cytiva

- Foxx Life Sciences

- Fresenius Medical Care AG & Co. KGaA

- GE HealthCare Technologies Inc.

- Global Filter by Filtration Group

- Graver Technologies LLC

- Hangzhou Cobetter Filtration Equipment Co. Ltd.

- International Polymer Solutions

- Koch Separation Solutions, Inc.

- Medtronic PLC

- Merck KGaA

- Micropore Technologies Limited

- Nikkiso Co., Ltd.

- Nipro Corporation

- Pall Corporation

- Pargreen Process Technologies

- PIL Membranes Ltd.

- Repligen Corporation

- Sartorius AG

- Sefar AG

- Solventum

- Syensqo

- Thermo Fisher Scientific Inc.

- Toray Industries, Inc.

- W. L. Gore & Associates, Inc.

Delivering Actionable Recommendations for Industry Leaders to Drive Growth Enhance Resilience and Capitalize on Emerging Opportunities in Medical Membrane Manufacturing and Distribution

Industry leaders should consider adopting a modular manufacturing approach that allows for rapid scaling of production volumes and swift adaptation to material or design changes. By deploying flexible pilot lines and leveraging digital twins for process simulation, manufacturers can shorten innovation cycles and reduce time to market. Investing in adaptive automation and quality analytics platforms will further ensure consistent output and minimize batch failures.

Diversification of material sourcing is another strategic imperative. Establishing multiple supply agreements for key polymeric feedstocks and developing alternative material pathways-such as ceramic composites or recyclable metal-backed membranes-will enhance supply chain resilience and mitigate risks associated with trade policy shifts. Collaborative research agreements with chemical suppliers and academic centers can accelerate the introduction of next-generation materials with superior performance characteristics.

Finally, companies should prioritize emerging application areas by forging alliances with medical device OEMs and healthcare providers. Co-creation of integrated systems, such as point-of-care diagnostic cartridges or hybrid oxygenation-filtration platforms, will unlock new revenue streams and elevate membrane-based solutions beyond commodity roles. Cultivating cross-functional teams that bridge R&D, regulatory, and business development functions will be essential to capture these complex, high-value opportunities.

Detailing Robust Research Methodology Combining Primary Stakeholder Engagement Secondary Data Analysis and Rigorous Validation Techniques for Comprehensive Market Insights

This research draws upon a robust methodology designed to ensure validity, relevance, and comprehensive market coverage. Secondary data sources include peer-reviewed journals, patent databases, and regulatory filings, which provide foundational insights into material innovations, approval pathways, and historical market developments. These sources are complemented by technology white papers and industry association reports to capture the latest advancements in membrane engineering and process automation.

Primary research entailed in-depth interviews with key opinion leaders, including membrane technologists, procurement executives, and R&D heads at leading healthcare institutions. Insights from these stakeholders elucidated critical pain points, performance benchmarks, and real-world application outcomes. Additionally, structured surveys were conducted with supply chain managers and end-user procurement teams to quantify purchasing criteria, price sensitivity, and forecasted demand for various membrane categories.

Data triangulation techniques were employed to reconcile findings across diverse inputs and validate trends observed in the marketplace. Quantitative analyses of supply chain metrics, combined with qualitative narratives from expert interviews, underpin the strategic recommendations presented in this report. This methodology ensures that the conclusions reflect both empirical data and practitioner expertise, offering a multidimensional view of the medical membrane market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Membrane Market, by Type of Membrane

- Medical Membrane Market, by Material

- Medical Membrane Market, by Application

- Medical Membrane Market, by End-User

- Medical Membrane Market, by Region

- Medical Membrane Market, by Group

- Medical Membrane Market, by Country

- United States Medical Membrane Market

- China Medical Membrane Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Strategic Conclusions to Empower Decision Makers with Cohesive Insights on Market Dynamics Technological Trends and Regulatory Influences in Medical Membranes

Through a methodical evaluation of technological advances, tariff impacts, segmentation dynamics, regional variances, and competitive strategies, this analysis presents a coherent portrait of the medical membrane market as it stands in 2025. The convergence of material science breakthroughs, regulatory realignments, and supply chain restructuring has created both challenges and opportunities for market participants at every level of the value chain.

As stakeholders chart their paths forward, it will be imperative to balance investments in innovation with pragmatic measures that enhance operational resilience. The segmentation insights indicate clear areas for targeted growth, while regional analyses reveal the necessity of tailoring approaches to local market conditions. Companies that implement the actionable recommendations herein-modular manufacturing, material diversification, and strategic co-development-will be well positioned to capture emerging opportunities and reinforce their competitive edge in this dynamic landscape.

Act Now to Access the Exclusive Medical Membrane Market Research and Connect with Ketan Rohom for Tailored Strategic Guidance and Partnership Opportunities

We invite you to elevate your strategic vision by securing the full market research report on medical membranes. Gain exclusive access to in-depth analyses, proprietary insights, and comprehensive data that will empower you to navigate the evolving landscape with precision and confidence. Engage directly with Ketan Rohom to explore tailored solutions, roadmap next steps for product development, and strengthen partnerships that will accelerate your growth trajectory. Don’t miss this opportunity to make data-driven decisions and unlock new avenues for innovation and market leadership

- How big is the Medical Membrane Market?

- What is the Medical Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?