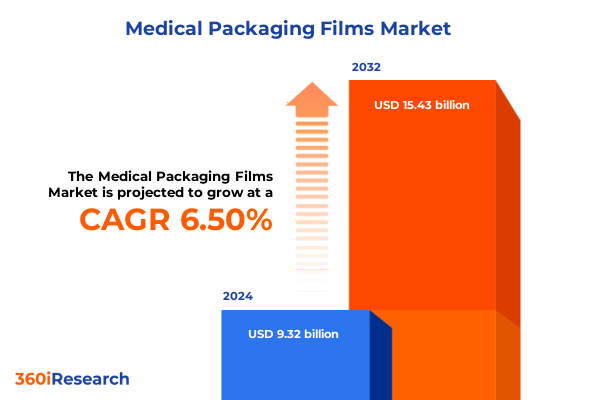

The Medical Packaging Films Market size was estimated at USD 9.69 billion in 2025 and expected to reach USD 10.08 billion in 2026, at a CAGR of 6.86% to reach USD 15.43 billion by 2032.

Understanding the Critical Role of Advanced Medical Packaging Films in Protecting Healthcare Products and Ensuring Patient Safety

Medical packaging films serve as the unseen guardians of critical healthcare products, offering essential protection against contaminants, moisture, and oxygen while maintaining sterility and integrity. These high-performance polymeric solutions encompass a range of film architectures designed to meet the exacting demands of medical, pharmaceutical, and diagnostic applications. From multi-layer co-extruded films delivering advanced barrier properties to blister and pouch formats engineered for rapid and reliable dispensing, the versatility of film-based packaging underpins product efficacy and patient safety.

In recent years, the convergence of regulatory stringency, sustainable materials innovation, and heightened supply chain scrutiny has propelled medical packaging films into the strategic spotlight for healthcare manufacturers and packaging converters alike. Advanced materials science has enabled thinner, lighter structures without compromising functional performance, while novel adhesives and laminates have improved seal reliability and process efficiency. As the need for traceability, serialization, and tamper-evident features intensifies, film substrates are increasingly integrated with digital and smart technologies to provide real-time monitoring and authentication.

Navigating the Paradigm Shift Driven by Sustainability, Technological Innovation, and Regulatory Evolution in the Medical Packaging Films Industry

The medical packaging film landscape is undergoing a paradigm shift driven by converging forces of sustainability, technological innovation, and evolving regulatory frameworks. Growing environmental concerns have accelerated development of recyclable, bio-based, and multi-material films that align with circular economy goals while maintaining the rigorous performance standards required for healthcare applications. Concurrently, next-generation coating and lamination technologies are enabling ultra-thin, high-barrier structures that reduce material usage and transportation weight without sacrificing functionality.

Against this backdrop, digital printing and intelligent packaging systems are transforming how stakeholders manage serialization, track-and-trace mandates, and patient-centric labeling. Regulatory agencies worldwide are mandating enhanced traceability controls to safeguard against counterfeiting and ensure product authenticity, incentivizing investment in RFID, QR code integration, and tamper-evident designs. As automation and Industry 4.0 tooling become more accessible, converters are adopting real-time process monitoring, predictive maintenance, and data-driven quality assurance to optimize throughput and reduce downtime.

Assessing the Comprehensive Economic and Operational Effects of 2025 United States Tariffs on Medical Packaging Film Supply Chains and Pricing Dynamics

The implementation of new United States tariffs in 2025 on imported polymer resins and film substrates has reverberated across the medical packaging films sector, reshaping cost structures and sourcing strategies. For converters reliant on polyethylene and polyethylene terephthalate imports, upward cost pressure has necessitated renegotiations with domestic resin suppliers and exploration of alternative polymer blends to manage margin compression. In response, many manufacturers increased inventory holdings ahead of tariff enactment to buffer against abrupt price escalations and supply chain disruptions.

This tariff environment has also catalyzed strategic shifts toward localized production and vertical integration. Converters are forging partnerships with resin producers to secure preferential pricing agreements and co-invest in new extrusion capacity closer to major healthcare manufacturing hubs. Meanwhile, the imperative to control material costs has spurred process innovation-ranging from high-speed extrusion lines that enable thinner gauge films to formulation tweaks that maintain barrier performance with lower-cost polymer blends. Looking ahead, the market is adapting through contract realignment, expanded domestic capacity, and agile sourcing protocols that balance cost, compliance, and continuity of supply.

Unveiling Critical Segmentation Patterns That Define Product Types, Material Variations, End User Profiles, Application Niches, and Technological Approaches

Market segmentation foundationally reflects the diversity of product architectures and end-use requirements spanning co-extruded films, flexible films, laminates, and rigid films. Within co-extruded films, multi-layer, three-layer, and two-layer constructions each deliver tailored barrier and mechanical performance to meet specific sterility and moisture control needs. Flexible film formats encompass blister films, pouches, and roll stock, supporting diverse formats from unit-dose oral solids packaging to roll-fed wrap configurations in hospital settings. Laminates distinguished by solvent based adhesive versus solventless adhesive bonding approaches enable precision customization of functional layers for adhesion, barrier enhancement, and sealing integrity.

Beyond product typology, material-based segmentation across polyethylene, polyethylene terephthalate, polypropylene, and polyvinyl chloride underpins performance trade-offs in transparency, chemical resistance, and heat sealability. Application-driven analysis reveals distinct requirements for diagnostics packaging-further segmented into in vitro diagnostics and point of care testing-alongside dedicated medical device, pharmaceutical, and wound care packaging formats. Technological levers in blown film, cast film, coating-incorporating knife coating and slit coating methods-and thermoforming define process efficiency, quality consistency, and design flexibility. Finally, end user segmentation unearths varying priorities among clinics, diagnostic laboratories, hospitals, and pharmaceutical companies, shaping requirements for shelf life, traceability, and packaging ergonomics.

This comprehensive research report categorizes the Medical Packaging Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Technology

- End User

- Application

Highlighting Regional Dynamics Shaping Demand and Innovation Trends Across the Americas, Europe Middle East and Africa, and Asia-Pacific Medical Packaging Film

Regional market dynamics reveal nuanced drivers and adoption rates across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, robust demand is underpinned by a mature healthcare infrastructure, strong regulatory enforcement, and significant investment in sustainable packaging initiatives. North American converters are expanding capacity while Latin American markets show rising requirements for cost-effective, high-barrier films to support growing pharmaceutical and diagnostic sectors.

Across Europe Middle East and Africa, harmonized regulations around sterilization, serialization, and environmental directives are accelerating updates to film formulations and packaging processes. Emphasis on post-consumer recyclability and waste reduction has prompted collaborations between film producers and recycling consortia. In Asia-Pacific, the fastest-growing region, rising healthcare expenditure in China and India drives substantial capacity build-out and localized manufacturing. Government incentives for domestic polymer production and increasing export volumes of medical devices are fostering rapid adoption of advanced film technologies.

This comprehensive research report examines key regions that drive the evolution of the Medical Packaging Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives and Competitive Strengths of Leading Industry Players Driving Advancement in Medical Packaging Film Solutions

Key industry participants are advancing competitive differentiation through strategic initiatives in innovation, capacity investment, and sustainability commitments. Global film producers have launched specialized barrier and bio-based film platforms, with recent product rollouts demonstrating significant reductions in carbon footprint and material thickness. Partnerships between converters and resin suppliers are co-funding research on advanced polymer alloys and next-generation lamination adhesives to meet evolving functional requirements and environmental targets.

Leading companies are also deploying digital tools across manufacturing operations to enable end-to-end visibility and improve batch-to-batch consistency. Several firms have secured ISO 15378 and ISO 11607 certifications for medical device packaging, reinforcing quality management systems and regulatory compliance. Additionally, mergers and capacity expansions in strategic geographies are enhancing scale and enabling faster response times to localized demand. These collective actions underscore a competitive landscape where innovation, regulatory alignment, and operational agility dictate market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Packaging Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Amcor plc

- Berry Global Group, Inc.

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- Honeywell International Inc.

- Huhtamäki Oyj

- Klöckner Pentaplast Group

- Mondi plc

- Sealed Air Corporation

- Toppan Inc.

- Uflex Limited

Delivering Actionable Strategies for Industry Leaders to Enhance Sustainability, Supply Chain Resilience, and Innovation in Medical Packaging Film Applications

Industry leaders are advised to proactively integrate sustainable materials into existing product lines while fostering collaborative innovation with polymer suppliers and healthcare OEMs. By diversifying raw material sourcing and establishing regional extrusion and converting hubs, organizations can mitigate the impact of trade policy shifts and enhance supply chain resilience. Investing in digital serialization, track-and-trace platforms, and real-time quality monitoring will streamline regulatory compliance and fortify product authentication processes.

Operational excellence can be further advanced through adoption of Industry 4.0 methodologies-leveraging predictive maintenance, process analytics, and adaptive control systems to minimize downtime and optimize resource utilization. To capture emerging applications, companies should tailor film formulations and packaging formats to the unique requirements of in vitro diagnostics, point of care devices, and wound care therapies. Regularly engaging with regulatory stakeholders and standards bodies will ensure readiness for evolving requirements, enabling swift product launches and sustained market access.

Detailing Rigorous Research Methodologies Combining Primary Interviews, Secondary Data Analysis, and Data Triangulation for Market Insights

This research employs a rigorous methodology combining in-depth primary interviews with industry executives, packaging engineers, and procurement specialists alongside comprehensive secondary data analysis of regulatory filings, patent landscapes, and industry publications. Primary insights were gathered through structured interviews and expert consultations across key markets, enabling validation of emerging trends and strategic priorities. Secondary research incorporated a review of peer-reviewed journals, technical whitepapers, and conference proceedings to contextualize innovation trajectories and regulatory developments.

Data triangulation was applied to reconcile findings across sources and ensure consistency, employing cross-verification techniques that align interview inputs with documented market evidence. A multi-axis segmentation framework was utilized to categorize the market by product type, material type, application, technology, and end user, enabling granular analysis of functional requirements and growth drivers. Quality assurance protocols, including peer review and data integrity audits, underpin the reliability and credibility of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Packaging Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Packaging Films Market, by Product Type

- Medical Packaging Films Market, by Material Type

- Medical Packaging Films Market, by Technology

- Medical Packaging Films Market, by End User

- Medical Packaging Films Market, by Application

- Medical Packaging Films Market, by Region

- Medical Packaging Films Market, by Group

- Medical Packaging Films Market, by Country

- United States Medical Packaging Films Market

- China Medical Packaging Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Dynamic Market Forces, Regulatory Shifts, and Technological Trends into Holistic Conclusions for Medical Packaging Film Stakeholders

The medical packaging films market stands at an inflection point where sustainable innovation, regulatory imperatives, and supply chain dynamics converge to shape future trajectories. Evolving material science advances allow for thinner, bio-based and recyclable films without sacrificing performance, aligning with global environmental mandates. Regulatory shifts toward comprehensive serialization and recyclability requirements continue to drive investment in smart packaging solutions and eco-friendly materials.

Concurrently, regional market forces underscore the need for localized manufacturing strategies that balance cost, compliance, and responsiveness to healthcare trends. Tariff-induced cost pressures have accelerated moves toward domestic capacity expansion, while strategic partnerships are unlocking co-development pathways with resin suppliers and end users. As competitive intensity intensifies, leaders who harness data-driven decision-making, proactive innovation pipelines, and agile operational models will be best positioned to capture growth opportunities and sustain market advantage.

Engage with Our Expert to Secure Comprehensive Medical Packaging Film Insights and Drive Informed Strategic Decisions

Contact Ketan Rohom, Associate Director, Sales & Marketing, to secure comprehensive insights and unlock the full potential of the medical packaging films market research report. By partnering directly with an experienced industry specialist, you gain expedited access to deep-dive analysis, proprietary data sets, and actionable intelligence crafted to inform critical strategic decisions. Whether you aim to optimize supply chains, accelerate innovation in sustainable materials, or refine your go-to-market approach in key regional markets, direct engagement ensures tailored recommendations and implementation support. Don’t miss the opportunity to leverage expert guidance and accelerate your competitive advantage-reach out today and take the first step toward informed, data-driven growth in the evolving medical packaging films landscape.

- How big is the Medical Packaging Films Market?

- What is the Medical Packaging Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?