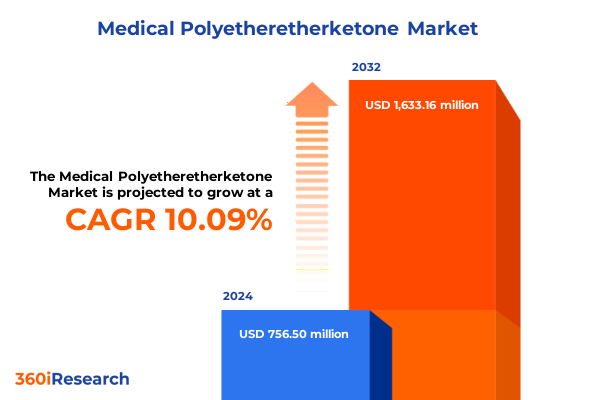

The Medical Polyetheretherketone Market size was estimated at USD 834.56 million in 2025 and expected to reach USD 926.90 million in 2026, at a CAGR of 11.00% to reach USD 1,733.16 million by 2032.

Discovering the Versatile Potential of Medical Polyetheretherketone as a High-Performance Biomaterial Driving Next-Generation Healthcare Solutions

Medical polyetheretherketone (PEEK) has emerged as a transformative high-performance thermoplastic in modern healthcare, redefining how surgeons, device manufacturers, and clinicians approach biomaterial selection. Its exceptional combination of mechanical strength, chemical resistance, and radiolucent properties positions PEEK as an ideal solution for applications requiring long-term biocompatibility and minimal imaging interference. In addition, its ability to withstand repeated sterilization processes without significant degradation ensures its suitability across a broad range of medical environments.

Driven by demographic shifts toward aging populations and rising rates of chronic orthopedic and cardiovascular conditions, demand for reliable implantable materials has surged. Simultaneously, the trend toward minimally invasive surgical techniques has heightened the need for materials that can be shaped into complex geometries via advanced manufacturing processes like 3D printing. As a result, PEEK’s adaptability and performance under diverse clinical conditions have catalyzed its rapid adoption in industries spanning from neurosurgery to trauma fixation. This introduction sets the stage for a deeper examination of the key factors shaping the PEEK landscape and underscores its strategic importance to stakeholders seeking sustainable innovation in the medical device sector.

Unveiling the Pivotal Technological Breakthroughs and Regulatory Reforms Reshaping the Medical Polyetheretherketone Market Landscape for Enhanced Patient Care

The medical PEEK landscape is witnessing a seismic shift propelled by breakthroughs in additive manufacturing and evolving regulatory frameworks that reward material innovation. Recent advancements in compounding techniques have enabled the integration of radiopaque fillers and antimicrobial agents into PEEK matrices, expanding its clinical utility and performance reliability. At the same time, certification bodies across North America, Europe, and Asia are streamlining approval pathways for novel PEEK-based components, incentivizing manufacturers to innovate with confidence and accelerate time-to-market.

Moreover, the maturation of digital surgical planning platforms and robotic-assisted procedures has heightened the demand for PEEK implants tailored through patient-specific design. Stakeholders are increasingly leveraging data-driven insights to optimize implant geometry and material properties, resulting in improved patient outcomes and reduced revision rates. Collectively, these technological and regulatory transformations are reshaping competitive dynamics and creating fertile ground for new entrants and established players alike to capture value through highly specialized PEEK solutions.

Analyzing the Comprehensive Impact of 2025 United States Tariffs on Imported Medical Polyetheretherketone Supplies and Industry Cost Structures

The introduction of elevated tariffs on imported medical polyetheretherketone in the United States, enacted in early 2025, has imposed significant cost pressures across the value chain. Suppliers relying on foreign-sourced PEEK resins face margin compression and are compelled to reevaluate procurement strategies. In response, several domestic producers have ramped up capacity investments to offset the impact of a tariff-driven price premium, while OEMs are negotiating longer-term contracts and exploring alternative sourcing partnerships to stabilize supply and cost structures.

These developments have also spurred innovation in polymer recycling and reclaiming processes, offering manufacturers a pathway to mitigate raw material cost inflation. Concurrently, end users such as hospitals and clinics are conducting more rigorous total cost of ownership analyses when selecting implant suppliers, weighing the implications of material costs against clinical benefits and lifecycle considerations. As the tariff environment continues to influence strategic sourcing decisions, stakeholders must remain agile in balancing cost optimization with adherence to stringent quality and compliance standards.

Highlighting the Multidimensional Segmentation Landscape of Medical Polyetheretherketone Based on Form, Process, Application, Grade, End-User, and Distribution Channels

An intricate segmentation framework underpins the medical PEEK market, revealing nuanced opportunities across form factors, manufacturing processes, clinical applications, material grades, end-user groups, and distribution channels. In terms of physical form, the market spans granules and powders valued for injectable molding applications, rods and tubes which encompass both solid rods for spinal implants and hollow tubes for cardiovascular catheters, as well as sheets and films that include thin films utilized in barrier membranes and thicker sheets for bespoke surgical guides.

From a process standpoint, advanced additive manufacturing via 3D printing is gaining traction alongside traditional extrusion, injection molding, compression molding, and precision machining techniques. Each method offers distinct advantages: 3D printing affords complex geometries and customization, whereas injection molding and extrusion enable high-volume production with consistent mechanical properties. The spectrum of clinical applications is equally diverse, ranging from cardiovascular devices such as stents and heart valves, to dental implants including bridges and crowns, joint replacement procedures covering hip and knee components, neurosurgical applications, spinal implants like artificial discs and fusion cages, and trauma fixation hardware including pins, plates, and screws.

Material grade segmentation distinguishes between medical-grade PEEK, subjected to rigorous biocompatibility evaluations, and standard-grade variants predominantly used in non-implantable devices or instrumentation. End users span research institutes pioneering new biomaterial formulations, OEMs integrating PEEK into next-generation implants, hospitals demanding in-house sterilizable devices, and clinics focusing on outpatient procedures. Finally, distribution pathways range from direct sales agreements providing manufacturers with close customer engagement, to broad-reach distributor networks and emerging online platforms that facilitate rapid product identification and ordering.

This comprehensive research report categorizes the Medical Polyetheretherketone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Manufacturing Process

- Grade

- Application

- End User

- Distribution Channel

Key Geographic Dynamics Shaping the Medical Polyetheretherketone Market across the Americas, Europe Middle East and Africa, and the Asia-Pacific Region

Regional market dynamics for medical PEEK reflect varying degrees of clinical adoption, regulatory maturity, and manufacturing capabilities. In the Americas, North America leads in R&D intensity, supported by robust reimbursement frameworks and extensive hospital infrastructures that foster early adoption of PEEK-based innovations. Latin American markets, while nascent, are demonstrating growing interest in cost-efficient implant solutions, prompting select OEMs to establish local partnerships to address affordability and supply chain logistics.

Across Europe, Middle East, and Africa, Western Europe continues to dominate with stringent material standards and a focus on minimally invasive device approvals, while emerging markets in the Middle East are investing in healthcare infrastructure modernization, thus expanding the use of advanced biomaterials. In Africa, pilot programs leveraging PEEK for complex reconstructive surgeries signal a potential growth corridor, contingent on further regulatory harmonization. Meanwhile, the Asia-Pacific region exhibits a dual-track dynamic: mature markets such as Japan and Australia are technologically advanced with high per-capita implant utilization, whereas rapidly industrializing economies including China and India are escalating local polymer production and pursuing collaborative manufacturing ventures to serve both domestic and export markets.

This comprehensive research report examines key regions that drive the evolution of the Medical Polyetheretherketone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Differentiation in the Medical Polyetheretherketone Sector Worldwide

Leading players in the medical PEEK domain are differentiating through strategic partnerships, proprietary formulation advancements, and targeted capacity expansions. Evonik has accelerated its material science initiatives, focusing on customized PEEK compounds that integrate antimicrobial properties and enhanced radiopacity. Victrex continues to leverage its global footprint, securing long-term supply contracts with major implant OEMs and investing in regional manufacturing hubs to circumvent tariff barriers.

Invibio, renowned for its PEEK-OPTIMA portfolio, has expanded its application scope by collaborating with research institutions to validate PEEK in cutting-edge neurosurgical devices. Solvay has entered joint ventures to scale up extrusion capabilities in Asia, aiming to meet emerging regional demand, while Arkema is pioneering ultrahigh-performance PEEK blends tailored for next-generation spinal fusion cages. These companies, among others, are actively consolidating their positions through M&A activity, co-development agreements, and investments in digital manufacturing technologies that promise to streamline production workflows and enhance supply chain transparency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Polyetheretherketone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. Schulman Inc.

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Covestro AG

- Dyneon GmbH

- Ensinger GmbH

- Evonik Industries AG

- Jilin Joinature Polymer Co., Ltd.

- LATI Industria Termoplastici S.p.A.

- Lehvoss Group

- Lucent Polymers

- Mitsubishi Chemical Advanced Materials AG

- Panjin Zhongrun High Performance Polymers Co., Ltd.

- Quadrant AG

- RTP Company

- Röchling SE & Co. KG

- SABIC

- Solvay S.A.

- Solvay Specialty Polymers USA, LLC

- Teknor Apex Company

- Toray Industries, Inc.

- Victrex plc

Strategic Actionable Recommendations for Industry Leaders to Navigate Tariff Pressures, Accelerate Innovation, and Maximize Opportunities in Medical Polyetheretherketone

To thrive in a complex environment marked by tariff fluctuations and accelerating innovation cycles, industry leaders must adopt a multipronged strategy. First, diversifying supply chains by establishing regional production hubs can mitigate the impact of trade barriers and reduce lead times. Integrating recycled PEEK streams into manufacturing workflows will further buffer against resin cost volatility while supporting sustainability goals.

Concurrently, investing in collaborations with clinical research centers and technology incubators will accelerate validation of PEEK in novel therapeutic areas, such as bioresorbable scaffolds and hybrid polymer-metal interfaces. Embracing digital twins and predictive modeling can optimize implant designs for patient-specific anatomy, driving differentiation through performance and personalized outcomes. Finally, cultivating direct engagement with procurement teams in hospitals and clinics will facilitate the articulation of total cost of ownership advantages, strengthening long-term partnerships and fostering value-based purchasing models.

An In-Depth Overview of the Comprehensive Research Methodology Employed to Ensure Accuracy, Rigor, and Relevance in the Medical Polyetheretherketone Analysis

The research underpinning this analysis employed a rigorous multi-stage methodology to ensure comprehensive coverage and robust validation. Initially, extensive secondary research was conducted, drawing on scientific journals, patent filings, regulatory databases, and white papers from leading material science institutions to map the material properties and emerging application trends of medical PEEK.

Subsequently, primary insights were gathered through structured interviews with key opinion leaders, including biomaterial scientists, device engineers, and procurement executives across major healthcare systems. Quantitative data was triangulated by cross-referencing commercial and trade statistics, while qualitative assessments were refined through peer workshops and expert panels to gauge clinical adoption barriers and innovation drivers. This blended approach ensured the findings are grounded in empirical evidence, industry expertise, and real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Polyetheretherketone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Polyetheretherketone Market, by Form

- Medical Polyetheretherketone Market, by Manufacturing Process

- Medical Polyetheretherketone Market, by Grade

- Medical Polyetheretherketone Market, by Application

- Medical Polyetheretherketone Market, by End User

- Medical Polyetheretherketone Market, by Distribution Channel

- Medical Polyetheretherketone Market, by Region

- Medical Polyetheretherketone Market, by Group

- Medical Polyetheretherketone Market, by Country

- United States Medical Polyetheretherketone Market

- China Medical Polyetheretherketone Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of Critical Findings and Strategic Insights Underscoring the Future Trajectory of Medical Polyetheretherketone in Global Healthcare Applications

Medical polyetheretherketone has cemented its status as a cornerstone biomaterial, driven by unmatched performance characteristics and a versatile application spectrum. The confluence of additive manufacturing advancements, streamlined regulatory approvals, and increasing demand for personalized implants underscores a vibrant innovation trajectory. However, external factors such as evolving tariff regimes and heightened cost scrutiny necessitate strategic agility among material suppliers and device manufacturers.

By dissecting segmentation dynamics, regional growth patterns, and competitive landscapes, stakeholders can pinpoint high-impact opportunities and anticipate potential headwinds. Organizations that harness data-driven design optimization, forge collaborative research alliances, and diversify their operational footprints will be best positioned to capture value. Ultimately, this synthesis of insights offers a roadmap for navigating market complexities and driving sustained advancements in patient care through next-generation PEEK-based solutions.

Connect with Ketan Rohom to Secure Expert-Driven Medical Polyetheretherketone Market Research Insights and Propel Your Strategic Decision-Making Today

To explore the full spectrum of strategic insights and leverage unparalleled expertise in the medical polyetheretherketone market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He brings a deep understanding of biomaterials innovation and a track record of connecting decision makers with tailored intelligence. Engaging with Ketan enables you to navigate evolving regulatory landscapes, evaluate tariff impacts, and align your product pipeline with emerging clinical demands. His consultative approach and proprietary methodologies ensure you receive actionable data that drives growth and competitive advantage.

Whether you are evaluating new market entry, optimizing your supply chain in light of 2025 United States tariffs, or seeking detailed segmentation analysis for form, process, application, grade, end user, and distribution channels, Ketan can guide you to the precise sections of the report that address your requirements. Contact him today to secure your copy of the in-depth market research report and accelerate your strategic decision-making process.

- How big is the Medical Polyetheretherketone Market?

- What is the Medical Polyetheretherketone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?