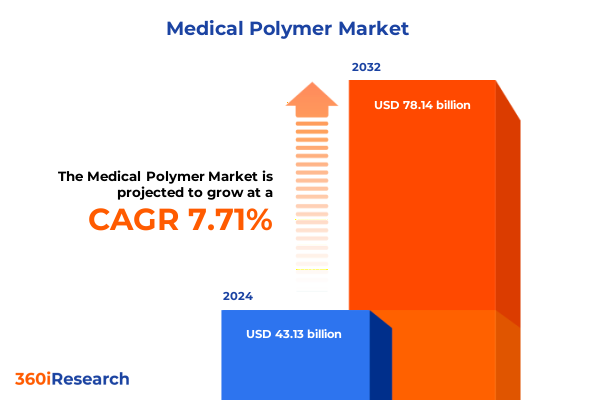

The Medical Polymer Market size was estimated at USD 46.26 billion in 2025 and expected to reach USD 49.68 billion in 2026, at a CAGR of 7.77% to reach USD 78.14 billion by 2032.

Exploring the critical convergence of high-performance material engineering and healthcare innovation driving modern medical polymer applications

The medical polymer market stands at the intersection of material science innovation and critical healthcare advancements, offering unparalleled potential to transform patient outcomes. These high-performance materials are engineered for biocompatibility, sterilization resilience, and mechanical strength, making them indispensable in applications ranging from implantable devices to disposable diagnostics. In response to mounting pressures for sustainability and regulatory compliance, companies are investing heavily in next-generation resins and additive manufacturing techniques that minimize environmental footprints while meeting stringent safety standards.

In recent years, breakthroughs in biodegradable polymers have catalyzed the development of resorbable scaffolds and drug delivery systems that degrade within the body, reducing the need for secondary surgical interventions. Simultaneously, advances in thermoplastic elastomers and polycarbonate blends have enabled more flexible, durable, and transparent components for minimally invasive surgical tools. Regulatory bodies across North America, Europe, and Asia-Pacific have harmonized testing protocols for medical grade polymers, accelerating product approvals and fostering cross-border market expansion.

Transitioning from legacy materials to innovative formulations has required collaboration across academia, healthcare providers, and manufacturers. This collaborative ecosystem fuels patented polymer chemistries that address emerging clinical requirements, such as radiopacity for image-guided procedures and antimicrobial surface modifications to mitigate hospital-acquired infections. Against this backdrop of rapid evolution, understanding the transformative trends and strategic drivers in the medical polymer sector is essential for stakeholders seeking to maintain competitive advantage and deliver next-generation medical solutions.

Uncovering the synergy of sustainability, digital manufacturing, and personalized medicine as catalysts for a new paradigm in medical polymers

The landscape of medical polymers is being reshaped by several transformative forces that extend beyond incremental material improvements. Emerging sustainability mandates are compelling manufacturers to integrate bio-based feedstocks and closed-loop recycling protocols, while circular economy principles drive innovation in polymer reprocessing and lifecycle management. As a result, legacy petrochemical-derived grades are being reengineered to incorporate renewable monomers, reducing the carbon footprint of single-use devices without sacrificing performance or regulatory compliance.

Digitalization and Industry 4.0 paradigms have also catalyzed a new era of precision manufacturing. Real-time data analytics and machine learning algorithms optimize extrusion and injection molding processes, enabling tighter tolerances and reduced scrap rates. This digital transformation extends to quality assurance, where vision systems and advanced sensors ensure traceability from raw material batch to finished medical device, enhancing patient safety and regulatory transparency.

In parallel, the advent of personalized medicine is driving demand for custom polymer solutions adapted to patient-specific anatomies. Additive manufacturing platforms powered by photopolymer resins are now routinely used to fabricate patient-matched surgical guides, prosthetic components, and tissue scaffolds. This convergence of digital design and material science exemplifies how technological, regulatory, and sustainability imperatives are collectively steering the medical polymer industry toward unprecedented levels of innovation and adaptability.

Examining how the 2025 United States tariff framework is reshaping supply chain strategies and operational resilience in medical polymers

The introduction of United States tariffs in 2025 on key polymer intermediates and finished medical-grade materials has prompted a strategic reevaluation of global supply chains across the medical polymer industry. In response to increased duty rates on select acrylics, polycarbonate, and engineering resins, downstream manufacturers have accelerated efforts to diversify sourcing and qualify secondary suppliers in untapped markets. This shift has led to near-shore production agreements and collaborative joint ventures aimed at mitigating tariff-induced cost pressures while ensuring uninterrupted supply of critical materials.

Beyond reshaping procurement strategies, these cumulative tariff measures have spurred investment in domestic polymer compounding facilities equipped with state-of-the-art filtration and extrusion technologies. By onshoring key segments of the value chain, companies can more effectively manage inventory buffers, respond to regional regulatory changes, and maintain tighter control over quality assurance. At the same time, regional trade agreements and tariff exemption programs have been leveraged to secure relief for specialized high-value polymers used in implantable devices and advanced diagnostics.

Overall, the 2025 tariff framework has reinforced the imperative for robust scenario planning and agile risk management. Forward-looking organizations are reevaluating total landed cost models, expanding strategic stockholdings, and fostering partnerships with logistics providers to navigate customs complexities. These adaptive measures underscore how tariff dynamics have become a pivotal driver of operational resilience and competitive differentiation within the medical polymer ecosystem.

Decoding the multifaceted segmentation layers that drive performance differentiation and strategic decision-making in medical polymers

An in-depth assessment of market segmentation reveals that the medical polymer arena encompasses a diverse array of material classifications, manufacturing techniques, raw material sources, and end-use applications, each bearing unique implications for performance and regulatory compliance. Within polymer types, acrylics serve critical roles in transparent components, while acrylonitrile butadiene styrene underpins durable housings. Biodegradable polymers have emerged as transformative materials for resorbable implants, contrasted against polycarbonate’s ubiquity in durable, high-clarity devices. Polyethylene and polypropylene provide cost-effective options for disposables, whereas polyethylene terephthalate is prized for barrier packaging. Polystyrene remains prevalent in diagnostic devices, polyvinyl chloride offers versatility for tubing, and thermoplastic elastomers deliver flexible jointing solutions.

Regarding manufacturing processes, compression molding is often selected for high-strength components requiring uniform material density. Extrusion tubing dominates applications where continuous production of precision bore is essential, and injection molding delivers the versatility to produce complex geometries at scale. The choice of raw material-bio-based versus petrochemical-further nuances environmental footprint considerations and regulatory certifications. Bio-based polymers are gaining prominence in single-use and packaging, while petrochemical derivatives continue to serve high-performance implantable devices.

In terms of applications, dental care has bifurcated into orthodontics and prosthetics, each demanding tailored polymer properties to meet mechanical and aesthetic requirements. Medical devices span diagnostics, disposables, and implantable devices, all of which necessitate specific levels of sterility, biocompatibility, and mechanical resilience. Packaging solutions range from blister packaging for pre-filled diagnostic kits to vials and containers for parenteral formulations. Finally, tissue engineering applications leverage scaffoldable polymers to support cellular growth and tissue regeneration. These segmentation dimensions collectively inform strategic decision-making and product development roadmaps.

This comprehensive research report categorizes the Medical Polymer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Type

- Manufacturing Process

- Raw Material

- Application

Analyzing regional market dynamics and regulatory imperatives shaping medical polymer adoption across global corridors

Regional dynamics in the medical polymer industry exhibit distinct drivers, regulatory frameworks, and infrastructure capabilities across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, mature healthcare systems and well-established regulatory pathways have fostered high adoption rates of advanced polymer materials, particularly in minimally invasive devices and single-use diagnostic kits. North American manufacturers benefit from integrated domestic supply chains and proximity to leading research institutions, accelerating the path from material innovation to commercial deployment.

Within Europe Middle East Africa, regulatory harmonization under the Medical Device Regulation (MDR) has imposed rigorous safety and traceability requirements, prompting increased adoption of traceable polymer grades and digital tracking solutions. Regulatory scrutiny in key European markets has incentivized collaborative alliances between polymer producers and medical device OEMs to co-develop materials that meet MDR specifications while optimizing manufacturing throughput.

The Asia-Pacific region, characterized by rapid healthcare infrastructure expansion and cost-sensitive markets, has become a hotspot for contract manufacturing and polymer compounding investments. Strategic government initiatives aimed at bolstering domestic pharmaceutical and medical device capabilities have facilitated the establishment of polymer processing hubs in Southeast Asia and India. These developments reflect a broader trend of localized production networks designed to serve both regional demand and export markets, underscoring the importance of region-specific market entry strategies.

This comprehensive research report examines key regions that drive the evolution of the Medical Polymer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating competitive positioning and innovation strategies among leading, niche, and regional medical polymer players

Competitive dynamics in the medical polymer landscape are defined by a convergence of established global materials science firms, specialized medical device polymer innovators, and agile regional manufacturers. Leading enterprises have leveraged their extensive R&D capabilities to introduce proprietary polymer formulations with tailored biocompatibility and enhanced mechanical performance. These organizations often maintain vertically integrated operations, encompassing monomer synthesis, polymer compounding, and logistics networks that span multiple continents.

At the same time, niche players have gained traction by focusing on high-growth application segments such as bioresorbable scaffold materials and photopolymer resins for 3D printing. Their ability to rapidly iterate formulations and collaborate with medical device designers has allowed them to capture early market share in emerging personalized medicine use cases. Complementing these developments, regional polymer processors in Asia-Pacific and Eastern Europe have carved out competitive positions by offering cost-effective compound grades tailored to local regulatory requirements and healthcare provider preferences.

Shareholder value creation in this sector is increasingly driven by investments in sustainable materials, digital supply chain integration, and strategic partnerships with medical device OEMs. Forward-looking companies are also exploring circular economy initiatives, such as polymer recycling programs and take-back schemes for high-value devices. This confluence of capabilities and strategic initiatives underscores the complexity and dynamism of competitive positioning within the medical polymer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Polymer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema Group

- Aroa Biosurgery Limited

- Avient Corporation by PolyOne Corporation

- BASF SE

- Berkeley Advanced Biomaterials Inc.

- Bezwada Biomedical, LLC

- Biesterfeld AG

- Carpenter Technology Corporation

- Celanese Corporation

- CoorsTek, Inc.

- Corbion NV

- Covestro AG

- Dentsply Sirona Inc.

- DSM-Firmenich AG

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Exactech, Inc.

- Exxon Mobil Corporation

- GELITA AG

- Green Dot Bioplastics Inc.

- Heraeus Holding GmbH

- Huizhou Foryou Medical Devices Co., Ltd.

- Invibio Limited

- Invibio Ltd. by Victrex PLC

- ITV Denkendorf Product Service GmbH

- KRATON CORPORATION by KRATON CORPORATION

- Lubrizol Corporation

- Medtronic plc

- Merck KGaA

- Modern Meadow, Inc.

- MycoWorks, Inc.

- NatureWorks LLC by Cargill Inc.

- Noble Biomaterials, Inc.

- Rodenburg Biopolymers

- Smith & Nephew plc

- Solvay SA

- Stryker Corporation

- Thermo Fisher Scientific Inc.

- TissueForm, Inc.

- Toray Industries, Inc.

- Zeus Company LLC

Outlining strategic imperatives in collaboration, supply chain diversification, digital integration, and circularity to secure competitive advantage

To navigate the evolving complexities of the medical polymer industry and capture future growth opportunities, organizations should pursue several targeted strategic imperatives. First, investing in collaborative research ventures with academic institutions and contract research organizations will accelerate the development of advanced polymer chemistries-particularly in bioresorbable and antimicrobial formulations-that meet emerging clinical demands. This approach reduces time to market and strengthens intellectual property portfolios.

Second, diversifying supply chain networks through dual-sourcing strategies and regional compounding partnerships will mitigate tariff exposure and logistical disruptions. By establishing near-shore processing agreements and qualifying alternative raw material suppliers, companies can maintain continuous production while optimizing total landed costs. Concurrently, integrating digital supply chain platforms will provide real-time visibility into inventory levels and quality metrics, enhancing operational resilience.

Third, embracing Industry 4.0 technologies such as predictive analytics and additive manufacturing will facilitate rapid prototyping and iterative design processes. These digital tools not only improve yield and reduce scrap but also enable greater customization for patient-specific applications. Finally, adopting circular economy principles-through polymer recycling programs and design-for-recyclability initiatives-will address stakeholder demands for sustainability and regulatory compliance. Collectively, these actionable recommendations will empower industry leaders to maintain competitive differentiation and drive long-term value creation.

Detailing the comprehensive multi-source research approach that ensures depth, validity, and strategic relevance of medical polymer insights

The research framework underpinning this analysis is anchored in a multi-source data collection and rigorous validation process. Primary research included in-depth interviews with industry experts across polymer manufacturing, medical device design, regulatory affairs, and supply chain management. These discussions provided qualitative insights into emerging technical challenges, regulatory shifts, and competitive strategies, ensuring the report’s relevance and accuracy.

Complementing primary inputs, secondary research comprised an exhaustive review of peer-reviewed journals, regulatory agency publications, patent filings, technical white papers, and corporate sustainability reports. Data triangulation techniques were employed to cross-verify critical information, minimizing bias and enhancing data integrity. Quantitative analyses of production capacity and trade flow data were conducted to map global supply networks and assess changes wrought by tariff measures.

An expert panel comprising material scientists, regulatory consultants, and manufacturing engineers conducted a thorough validation of key findings, ensuring internal consistency and methodological rigor. This systematic approach, which blends qualitative depth with quantitative precision, underpins the actionable insights presented throughout this report and affirms the credibility of its strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Polymer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Polymer Market, by Polymer Type

- Medical Polymer Market, by Manufacturing Process

- Medical Polymer Market, by Raw Material

- Medical Polymer Market, by Application

- Medical Polymer Market, by Region

- Medical Polymer Market, by Group

- Medical Polymer Market, by Country

- United States Medical Polymer Market

- China Medical Polymer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing critical trends, regional dynamics, and strategic takeaways to illuminate the future trajectory of medical polymer innovations

As the medical polymer industry continues its rapid evolution, stakeholders must remain attuned to the interplay of technological advancements, regulatory imperatives, and sustainability demands that define market dynamics. From biodegradable scaffolds to digital manufacturing platforms, innovation is accelerating at every segment of the value chain, driving enhanced patient outcomes and operational efficiencies. The 2025 tariff landscape has underscored the importance of supply chain agility and strategic risk management, compelling companies to rethink traditional sourcing models.

Segmentation analysis highlights the nuanced performance requirements across polymer types, manufacturing processes, raw materials, and applications, guiding targeted product development and strategic positioning. Regional insights reveal differentiated growth trajectories, with mature markets leveraging established regulatory pathways and emerging regions expanding capacities through supportive government initiatives. Competitive benchmarking underscores how integrated global leaders and agile niche players are shaping the sector’s innovation agenda.

Looking ahead, actionable recommendations around research collaboration, supply chain diversification, digital integration, and circular economy principles will be essential for maintaining competitive differentiation. By leveraging rigorous research methodologies and expert validation, industry decision-makers can confidently navigate uncertainties and unlock the full potential of medical polymers. This executive summary lays the groundwork for deeper exploration of the data-driven insights and strategic frameworks contained within the full report.

Empower your decision-making with personalized guidance from Ketan Rohom to secure the medical polymer market research report tailored to your strategic needs

To delve deeper into the detailed findings and gain unrestricted access to the complete medical polymer market research report, readers are encouraged to initiate a direct conversation with Ketan Rohom. As Associate Director of Sales & Marketing, Ketan Rohom brings an in-depth understanding of how these insights translate into strategic advantages. Engaging with him will provide immediate clarity on the report’s methodology, scope, and bespoke data sets tailored to your organization’s priorities. He can also outline available subscription options, value-added services, and potential partnership opportunities that align with your growth objectives.

Securing this market research report will equip your team with the intelligence to navigate evolving regulations, anticipate supply chain shifts, and capitalize on emerging material innovations. By contacting Ketan Rohom, you’ll ensure that your organization has timely access to the latest analysis across polymer types, manufacturing processes, raw material trends, applications, and regional dynamics. Don’t miss the opportunity to transform your strategic planning, fuel product development pipelines, and reinforce your competitive positioning with definitive data and expert guidance. Reach out today to purchase the comprehensive medical polymer report and unlock actionable insights designed to inform critical business decisions.

- How big is the Medical Polymer Market?

- What is the Medical Polymer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?