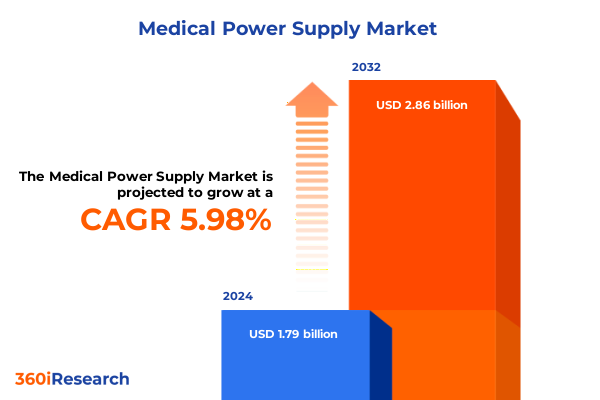

The Medical Power Supply Market size was estimated at USD 1.90 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 5.96% to reach USD 2.86 billion by 2032.

Exploring the Critical Role and Dynamic Evolution of Medical Power Supply Solutions in Modern Healthcare Infrastructure to Elevate Patient Outcomes

Introduction to the critical role of medical power supply solutions sets the stage for understanding how patient care outcomes are inextricably linked to reliable, efficient, and safe electrical power frameworks. In contemporary healthcare environments, from bustling hospitals to specialized diagnostic centers, uninterrupted and precise energy delivery ensures that complex equipment functions optimally. Whether it is sustaining life-saving ventilators in intensive care units or powering advanced imaging modalities, the stability and resilience of power supply architectures directly translate into clinical efficacy and operational continuity.

In addition, the trend toward miniaturized, portable, and point-of-care devices has elevated the importance of compact AC-DC and DC-DC power subsystems that balance size, weight, and power efficiency. Coupled with the rise of remote care and telemedicine solutions, power supply systems must now exhibit enhanced energy density and interoperability to support digital connectivity and battery backup capabilities. As healthcare institutions prioritize sustainability and total cost of ownership, cutting-edge power management technologies are increasingly adopted to reduce energy consumption and thermal footprints. This introduction outlines the significance of medical power supply innovations and provides context for the ensuing analysis of market developments, regulatory influences, and strategic imperatives.

Unveiling the Key Technological, Regulatory, and Market Catalysts Transforming the Medical Power Supply Landscape Across Global Healthcare Spectrum

The medical power supply landscape has undergone transformative shifts driven by technological breakthroughs, regulatory realignments, and evolving clinical requirements. Recent advances in switch-mode power architectures, including flyback and forward converter topologies, have enabled higher power densities while maintaining stringent safety standards. Simultaneously, the integration of advanced monitoring and digital telemetry features has empowered device manufacturers and facility managers to preemptively identify anomalies, thereby minimizing downtime and enhancing patient safety.

From a regulatory perspective, updated international standards for medical electrical equipment have mandated more rigorous electromagnetic compatibility testing and low leakage current thresholds, compelling suppliers to innovate around isolation techniques and redundant safety mechanisms. In tandem, the push toward greener healthcare facilities has incentivized investments in energy-efficient power conversion and adaptive cooling methods, such as liquid-cooled systems that optimize thermal management without compromising reliability. Moreover, increased adoption of lithium-ion battery backup systems has addressed critical needs for seamless operation during grid disturbances, further reshaping the competitive landscape. These converging trends underscore the depth and pace of change in the power supply sector, illuminating the imperative for stakeholders to adapt swiftly and strategically.

Assessing How Recent United States Tariff Adjustments in 2025 Are Reshaping Medical Power Supply Procurement Strategies and Manufacturing Footprints

The introduction of new tariff measures by the United States in 2025 targeting imported electronic components and finished power supply units has had a pronounced impact on sourcing strategies and cost structures. Manufacturers have been compelled to reassess vendor portfolios, leading to increased interest in regional production and the exploration of nearshore assembly hubs to mitigate added duties. As a result, supply chain configurations are becoming more diversified, with an emphasis on securing alternative component suppliers outside traditional import channels to maintain price competitiveness and delivery reliability.

These tariff shifts have also prompted equipment OEMs to conduct comprehensive cost-benefit analyses, balancing the financial implications of higher import costs against potential efficiency gains from domestically produced or tariff-exempt components. In several cases, firms have accelerated investments in automated production lines to curtail labor costs and offset the duty burden, thereby preserving margin integrity. Additionally, healthcare providers evaluating capital expenditures for critical power infrastructure are now factoring in total landed costs and possible tariff fluctuations over the equipment lifecycle. This recalibration underscores how regulatory instruments, such as tariffs, play a pivotal role in shaping manufacturing footprints, procurement decisions, and broader market dynamics for medical power supplies.

Insightful Breakdown of Product Types, Applications, End Users, Technologies, Output Power Ranges, and Cooling Methods Shaping Medical Power Supply Dynamics

A deep dive into market segmentation reveals the nuanced interplay between product variations, application requirements, end-user environments, technological differentiation, output power specifications, and cooling approaches. When examining product types, AC-DC power supplies, available in desktop and wall-mount configurations, serve a broad range of diagnostic and monitoring equipment where compactness and safety are paramount. Battery backup systems, differentiated by lead-acid and lithium-ion chemistries, deliver critical holdover power for life-sustaining devices and mobile platforms. DC-DC converters, whether isolated for enhanced safety or non-isolated for efficiency, underpin modules that require precise voltage regulation in integrated systems. Uninterruptible power supplies, in the line-interactive and online double-conversion variants, ensure zero interruption during grid disturbances.

Turning to applications, diagnostic tools such as blood analyzers and endoscopy platforms rely on stable power for precision sensing, while laboratory centrifuges and refrigeration units demand continuous energy to maintain experimental integrity. Medical imaging devices including CT scanners, MRI systems, ultrasound probes, and X-ray machines integrate high-power supply modules to facilitate accurate imaging, whereas patient monitoring solutions-spanning cardiac, fetal, and vital signs monitors-require low-noise power streams to preserve signal fidelity. Surgical equipment, from electrosurgical units to advanced robotic systems, necessitates robust surge protection and real-time voltage management. Lastly, therapeutic devices like dialysis machines and infusion pumps depend on uninterrupted energy flow to uphold treatment efficacy.

Within end-user contexts, ambulatory surgical centers, clinics, diagnostic facilities, hospitals, and laboratories each impose unique power reliability, footprint, and certification demands. Technological choices between linear regulators, such as low dropout and series pass types, and switch-mode converters, including buck, flyback, and forward topologies, influence efficiency, noise levels, and thermal design. Output ranges spanning under 100 watts to beyond 1000 watts address diverse operational scales, while air-cooled versus liquid-cooled approaches determine maintenance profiles and acoustic signatures. Together, these segmentation dimensions shape competitive dynamics and guide product development roadmaps in the ever-evolving medical power supply arena.

This comprehensive research report categorizes the Medical Power Supply market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Output Power Range

- Cooling Method

- Application

- End User

Examining Regional Opportunities and Challenges across Americas, Europe, Middle East, Africa, and Asia-Pacific Influencing Medical Power Supply Ecosystem Growth

Regional dynamics exert profound influence over the adoption and evolution of medical power supply solutions, reflecting the interplay of healthcare infrastructure maturity, regulatory frameworks, economic conditions, and localization imperatives. In the Americas, robust investment in hospital modernization and ambulatory care expansion drives demand for advanced AC-DC and DC-DC power modules that adhere to stringent safety regulations and integrate seamlessly with legacy systems. Cost containment pressures in certain markets have also spurred interest in battery backup systems featuring lithium-ion chemistries, which offer extended lifecycle benefits and reduced total operating expenses.

Turning to Europe, the Middle East, and Africa region, regulatory harmonization efforts and cross-border healthcare collaborations shape procurement patterns. Countries with established reimbursement systems prioritize energy-efficient switch-mode supplies and uninterruptible power solutions that support critical care units and diagnostic hubs. Meanwhile, emerging markets within this region are investing in basic power infrastructure and capacity building, creating opportunities for modular, scalable UPS offerings that can quickly adapt to grid reliability challenges. In the Asia-Pacific region, rapid expansion of diagnostic centers and growing medical tourism fuel the integration of high-power imaging equipment, necessitating reliable, liquid-cooled solutions for thermal management and scalability. Moreover, domestic manufacturing incentives in several nations are attracting multinational suppliers to establish localized assembly lines, thus reducing lead times and tariff exposure.

These regional nuances underscore the importance of crafting strategies that align with local regulations, infrastructure requirements, and market maturation. Stakeholders that can tailor product portfolios and delivery models to regional idiosyncrasies will be best positioned to capture growth and drive sustainable adoption of next-generation medical power solutions.

This comprehensive research report examines key regions that drive the evolution of the Medical Power Supply market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Manufacturers Driving Technological Advancements and Strategic Partnerships in the Medical Power Supply Sector

Industry leaders in the medical power supply sector are defined by their commitment to technological innovation, quality assurance, and strategic partnerships. Leading manufacturers have invested heavily in research and development, pioneering converter topologies that enhance efficiency and reduce electromagnetic interference. Collaborations with semiconductor and component suppliers have expedited the integration of GaN and SiC technologies, which deliver superior performance in compact form factors. Such alliances also facilitate co-development of custom modules that address client-specific requirements, from high-voltage imaging applications to compact battery backup units for mobile diagnostic carts.

Additionally, top-tier companies differentiate themselves through rigorous adherence to international certification standards and proactive engagement with regulatory bodies. By maintaining transparent quality management systems and real-time supply chain traceability, these organizations minimize risk and bolster customer confidence. Strategic partnerships extend to healthcare providers and system integrators, enabling pilot program deployments and iterative feedback loops that refine product features and service offerings. Mergers and acquisitions have further consolidated capabilities, combining niche innovators with established multinationals to offer end-to-end power management solutions under unified service portfolios. Collectively, these concerted efforts embody the evolving competitive landscape, where agility, collaboration, and a relentless focus on reliability define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Power Supply market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adapter Technology Co., Ltd.

- Advanced Energy Industries, Inc.

- Astrodyne Corporation

- Avnet, Inc.

- Bel Fuse Inc.

- Cincon Electronics Co., Ltd.

- COSEL Co., Ltd.

- CUI Inc.

- Delta Electronics, Inc.

- Emerson Electric Co.

- FRIWO Geratebau GmbH

- GlobTek, Inc.

- Inventus Power, Inc.

- Mean Well Enterprises Co., Ltd.

- Mornsun Guangzhou Science & Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Powerbox International AB

- RECOM Power GmbH

- Sinpro Electronics Co., Ltd.

- SL Power Electronics Corp.

- Synqor Inc.

- TDK Corporation

- Texas Instruments Incorporated

- Traco Electronic AG

- TRC Electronics, Inc.

- Wall industries Inc.

- XP Power Ltd.

Providing Expert-Driven Action Plans and Strategic Imperatives to Enable Industry Leaders to Capitalize on Emerging Trends in Medical Power Supply Domain

To thrive amid accelerating technological advances and shifting regulatory dynamics, industry leaders must implement actionable strategies that prioritize innovation, resilience, and customer-centric agility. First, investing in modular converter platforms and standardized interfaces will reduce development cycles and enable rapid customization for a diverse array of medical devices. By leveraging scalable architectures and configurable power modules, firms can address varied application needs while controlling production costs and inventory complexity.

Second, cultivating collaborative ecosystems with semiconductor specialists, healthcare systems, and academic institutions will unlock new avenues for product differentiation and expedite time to market. Engaging in co-development projects and pilot integrations offers firsthand insights into real-world performance requirements, guiding iterative enhancements that bolster device reliability and patient safety. Third, establishing geographically distributed manufacturing footprints-either through joint ventures or localized contract manufacturers-will mitigate tariff risks and strengthen supply chain resilience. Such an approach should be complemented by digital supply chain monitoring tools that provide end-to-end visibility and predictive analytics to preempt disruptions.

Finally, adopting circular economy principles in product design and end-of-life management can create competitive advantage while aligning with healthcare sustainability mandates. Implementing take-back programs, recycling initiatives, and end-user training on energy-efficient operation will reinforce brand reputation and support long-term partnerships. These strategic imperatives, when coordinated under a cohesive innovation roadmap, will empower companies to capture emerging opportunities and navigate the complexities of the evolving medical power supply domain.

Outlining Rigorous Multi-Stage Research Processes Including Primary and Secondary Data Collection Techniques for Medical Power Supply Market Study

The research underpinning this comprehensive report integrates a multi-stage methodology designed to ensure accuracy, depth, and relevance. Initially, secondary data sources, including regulatory filings, industry whitepapers, and academic publications, were systematically reviewed to establish foundational context on technological standards, tariff developments, and clinical equipment requirements. This desk-based research provided a chronological framework of market evolution and highlighted critical inflection points.

Following the secondary phase, primary interviews were conducted with key stakeholders across the value chain, including power supply engineers, equipment OEMs, healthcare procurement specialists, and regulatory experts. These interviews were structured to extract nuanced perspectives on emerging converter topologies, certification challenges, and procurement decision drivers. Responses were synthesized through thematic analysis, enabling the identification of consensus viewpoints and divergent opinions that inform strategic guidance.

Quantitative data points, such as average duty impact assessments and product configuration breakdowns, were derived by triangulating multiple data sets and validating against expert feedback. Technical feasibility evaluations were performed in collaboration with engineering specialists to assess the performance metrics of various power architectures under real-world operating scenarios. Finally, all findings underwent rigorous quality checks, ensuring alignment with the latest industry developments and regulatory updates as of mid-2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Power Supply market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Power Supply Market, by Product Type

- Medical Power Supply Market, by Technology

- Medical Power Supply Market, by Output Power Range

- Medical Power Supply Market, by Cooling Method

- Medical Power Supply Market, by Application

- Medical Power Supply Market, by End User

- Medical Power Supply Market, by Region

- Medical Power Supply Market, by Group

- Medical Power Supply Market, by Country

- United States Medical Power Supply Market

- China Medical Power Supply Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Summarizing Key Findings and Strategic Implications to Provide a Comprehensive Perspective on the Evolution and Future of Medical Power Supply Solutions

This executive summary distills key insights into the evolving dynamics of the medical power supply sector, emphasizing the intersection of technological innovation, regulatory influence, and strategic maneuvering. Technological breakthroughs in converter topologies and battery chemistries are expanding design possibilities and driving efficiency gains, while updated international standards are elevating safety and electromagnetic compatibility benchmarks. Concurrently, the imposition of new tariffs in 2025 has prompted a strategic realignment of manufacturing and procurement practices, underscoring the importance of adaptable supply chain architectures.

Segmentation analysis reveals distinct considerations across product types, applications, end-user settings, technologies, output power ranges, and cooling methods, each contributing to a granular understanding of market opportunities. Regional assessments highlight the need for tailored strategies that address the unique regulatory regimes and infrastructure maturity levels across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Insights into leading companies illustrate how innovation, quality management, and strategic collaborations are driving competitive differentiation. Actionable recommendations provide a clear roadmap for organizations to build modular, resilient, and sustainable power architectures that align with evolving clinical and operational demands.

As the market continues to shift, stakeholders equipped with this strategic perspective will be positioned to anticipate emerging trends, mitigate risks, and harness opportunities for growth. The comprehensive approach outlined herein offers a robust foundation for informed decision-making and long-term value creation in the medical power supply domain.

Connect with Ketan Rohom to Secure Your Essential Market Research Report on Medical Power Supply and Gain a Competitive Edge in Strategic Decision Making

For organizations seeking to navigate the intricate dynamics of the medical power supply market, securing the comprehensive intelligence provided by Ketan Rohom is the first step toward outpacing competitors and informing critical investments. As Associate Director of Sales & Marketing, Ketan Rohom brings unparalleled industry insight and a deep understanding of technological advancements, regulatory shifts, and tariff implications that directly influence equipment procurement and supply chain management. Engaging with Ketan ensures direct access to expert guidance on customizing the report to align with specific organizational goals, whether it involves optimizing product portfolios, aligning production footprints, or exploring emerging regional opportunities.

Reaching out to Ketan Rohom will enable you to obtain tailored market analysis, segmented insights, and strategic recommendations that are vital for informed decision-making. His expertise will also facilitate introductions to key industry players, and his consultative approach ensures that your questions about methodology, data sources, and future projections are addressed comprehensively. By securing this report, your leadership team will gain the clarity and foresight needed to refine competitive strategies, drive innovation in power supply design, and capitalize on evolving market trends and regulatory landscapes.

- How big is the Medical Power Supply Market?

- What is the Medical Power Supply Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?