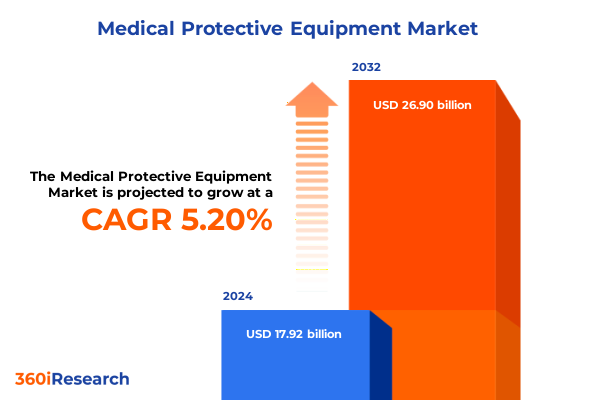

The Medical Protective Equipment Market size was estimated at USD 18.87 billion in 2025 and expected to reach USD 19.93 billion in 2026, at a CAGR of 5.19% to reach USD 26.90 billion by 2032.

Setting the Stage for Unparalleled Medical Protective Equipment Insights That Empower Decision-Makers to Navigate a Dynamic Healthcare Safety Environment

The medical protective equipment sector has never been more central to global healthcare resilience. As hospitals, clinics, and home care providers confront ongoing infectious threats and evolving regulatory mandates, the role of robust protective gear has expanded beyond simple safety protocols into a strategic imperative. This report opens by framing how stakeholders across the value chain - from manufacturers and distributors to procurement officers and clinical leaders - are navigating unprecedented complexity.

Against a backdrop of heightened biosafety concerns and accelerated innovation cycles, organizations must balance cost containment with uncompromising product performance. Recent breakthroughs in material science and ergonomic design have ushered in iterations of gloves, face shields, eyewear, and respirators that promise enhanced comfort without sacrificing barrier effectiveness. Yet these advances arrive alongside shifting trade policies and logistical hurdles that challenge traditional sourcing models.

In this context, decision-makers require a holistic understanding of market drivers, technological enablers, and competitive landscapes. The introduction sets the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, regional divergences, and key corporate strategies. Ultimately, it positions medical protective equipment not only as a frontline safeguard for healthcare professionals but as a critical component of organizational risk management and future readiness.

Unveiling the Profound Technological and Regulatory Transformations Redefining the Medical Protective Equipment Landscape for Future-Ready Healthcare Solutions

The landscape of medical protective equipment is being reshaped by a confluence of breakthroughs in materials engineering, digital integration, and regulatory reform. Advanced polymers and antimicrobial coatings have given rise to gloves that adapt to prolonged wear and face shields with self-sanitizing properties, marking a departure from traditional single-use designs. Simultaneously, connectivity solutions now enable real-time monitoring of supply levels, linking automated reordering mechanisms directly to healthcare facility inventories.

Regulatory frameworks have also undergone significant revision, with key markets streamlining approval pathways for innovative products while increasing quality oversight. These policy adjustments are fostering faster market entry for disruptive technologies, but they also place greater emphasis on rigorous clinical validation and post-market surveillance. As a result, companies are forging deeper collaborations with clinical research organizations and adopting more robust quality-management systems to ensure compliance and user safety.

Moreover, the COVID-19 pandemic experience has elevated preparedness to a strategic priority. Organizations are investing in flexible manufacturing capabilities that allow rapid scale-up or retooling in response to emergent pathogens. This operational agility is underpinned by a growing trend toward nearshoring production to reduce lead times and buffer supply chain volatility. Taken together, these technological and regulatory shifts are forging a transformed ecosystem in which innovation speed, quality assurance, and supply chain resilience are inseparable pillars of competitive advantage.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Medical Protective Equipment Supply Chains and Cost Structures

In 2025, a new wave of United States tariffs targeting imported medical protective equipment has introduced fresh cost pressures for buyers and manufacturers alike. These duties, applied across a range of labelling codes for gloves, masks, and gowns, have incrementally raised landed costs and prompted supply chain realignments. While designed to bolster domestic production, the tariffs have also increased the total cost of ownership for healthcare providers reliant on international suppliers.

To mitigate these financial impacts, several key players have accelerated investments in local manufacturing hubs, erecting or expanding facilities in states offering tax incentives and workforce grants. Nonetheless, building capacity to meet surges in demand requires time-consuming capital expenditure and workforce training, delaying the full realization of cost relief. Concurrently, distributors are renegotiating long-term contracts to incorporate tariff-adjustment clauses, ensuring price stability amidst policy flux.

These dynamics are fueling greater consolidation among regional producers striving to achieve economies of scale. Smaller importers face heightened risk as they grapple with tighter margins and reduced bargaining power. Looking ahead, successful market participants will be those that combine diversified sourcing strategies with strategic partnerships and flexible logistics networks. Such approaches will be essential to offsetting the tariff-induced cost escalation and securing uninterrupted supply for critical protective equipment.

Dissecting Critical Product, Material, End User, Distribution Channel, and Sterility Segmentation to Illuminate Market Drivers and Customer Preferences

The market’s complexity becomes evident when examining how product, material, end user, distribution, and sterility segments interplay to shape demand patterns. On the product spectrum, face shields are differentiated by adjustable and non adjustable designs, offering users either custom fit or streamlined simplicity. Gloves divide into sterile and non sterile formats to support both operating room applications and general examinations, while goggles range from ventilated styles that reduce fogging to non ventilated variants emphasizing splash protection. Protective clothing choices span disposable suits for single-use scenarios and reusable options engineered for high-wear durability. Respirators bifurcate into FFP2 and N95 classifications, each meeting distinct filtration standards, and surgical masks further break down into Type I, Type II, and Type IIR tiers aligned with fluid resistance levels.

Material selection underscores additional performance trade-offs. Natural latex retains elastic conformity but can pose allergen concerns, driving a shift toward nitrile and polyethylene alternatives. Polypropylene remains a mainstay for cost-effective single-use pieces, while PVC finds niche application in specialized chemical-resistant garments. Among end-user groups, hospitals command a significant share through bulk purchasing frameworks, but clinics, dental practices, diagnostic laboratories, and home care providers drive incremental growth via decentralized procurement models. Channels of distribution reflect the omnichannel era, combining direct sales agreements and hospital procurement contracts with the agility of online retail, the ubiquity of retail pharmacies, and the scale advantages offered by wholesale distributors. Finally, the sterile versus non sterile dichotomy touches every product type, enforcing rigorous sterilization standards for critical care environments and allowing more flexible protocols in lower-risk settings.

This comprehensive research report categorizes the Medical Protective Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Sterility

- End User

- Distribution Channel

Comparing Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Identify Growth Hotspots and Strategic Priorities

Regional market dynamics reveal diverse growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, regulatory convergence and domestic stimulus programs have bolstered manufacturing capacity, yet the region wrestles with logistical bottlenecks in remote areas, prompting investment in decentralized warehousing. Healthcare facilities in this region are also pioneering telemedicine initiatives that feed demand for home care protective equipment.

Conversely, the Europe Middle East & Africa region presents a mosaic of regulatory regimes and purchasing consortia. The European Union’s harmonized standards have simplified cross-border trade, while Middle Eastern countries are leveraging sovereign wealth to establish high-tech production zones. In Africa, donor-driven procurement and public–private partnerships are critical to expanding access to PPE in underserved communities.

Meanwhile, Asia-Pacific maintains its position as a production powerhouse, with established supply chains for key materials and economies of scale that keep manufacturing costs competitive. Rising domestic consumption in emerging markets is fueling local OEM expansion, and governments across the region are exploring export controls to prioritize internal stockpiles. Each region’s distinct regulatory pressures, logistical strengths, and strategic priorities are shaping where and how protective equipment manufacturers direct their investments and operations.

This comprehensive research report examines key regions that drive the evolution of the Medical Protective Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Medical Protective Equipment Players to Showcase Competitive Strategies Innovation Pipelines and Market Positioning

Leading companies in the medical protective equipment arena are pursuing differentiated strategies to secure competitive advantage. One global manufacturer has prioritized vertical integration, acquiring polymer producers to stabilize raw material supply and reduce cost volatility. Another market leader has taken an open-innovation approach, collaborating with academic research centers to fast-track antimicrobial fabric development and translate prototypes into scalable production lines.

Mid-tier players are carving niches by specializing in ergonomic packaging solutions and just-in-time delivery services tailored to outpatient facilities. A prominent safety equipment provider has expanded its respirator portfolio by obtaining regulatory approval for novel valve technology that enhances breathability without compromising filtration efficiency. Similarly, family-owned regional distributors are investing in digital procurement platforms to streamline ordering processes and offer real-time inventory transparency to customers.

Across the board, corporate investment in sustainability practices is intensifying. Several firms have announced roadmaps to incorporate recycled materials into single-use protective gear and to divert production waste toward circular-economy initiatives. Through these varied approaches - from strategic M&A and collaborative R&D to customer-centric service enhancements - leading companies are reinforcing their market positions and laying the groundwork for long-term resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Protective Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alpha Pro Tech, Ltd.

- Ansell Limited

- Bullard, Inc.

- Cardinal Health, Inc.

- Delta Plus Group

- Drägerwerk AG & Co. KGaA

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Lakeland Industries, Inc.

- Medline Industries, LP

- Moldex-Metric AG & Co.

- MSA Safety, Inc.

- Mölnlycke Health Care AB

- Owens & Minor, Inc.

- Protective Industrial Products, Inc.

- STERIS plc

- UVEX Safety Group

Delivering Tactical Recommendations for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Drive Sustainable Growth

To capitalize on emerging opportunities and counteract persistent supply chain disruptions, industry leaders should adopt a multifaceted strategy. First, deepening partnerships with raw material suppliers through long-term offtake agreements will mitigate exposure to input price swings. Coupled with investments in predictive analytics for demand forecasting, these agreements will enhance procurement agility.

Second, companies should accelerate development of modular production lines capable of switching between product types in response to sudden demand spikes. By integrating lean manufacturing principles and cross-trained workforces, organizations can optimize output without significant capital outlay.

Third, expanding digital sales channels and leveraging e-commerce analytics will enable firms to capture decentralized purchasing patterns from clinics, dental practices, and home care markets. Tailored digital portals can simplify ordering workflows and foster direct engagement with end users.

Finally, establishing a transparent sustainability reporting framework that tracks material sourcing, waste reduction, and carbon footprint will resonate with stakeholders and support long-term brand equity. Collectively, these actions will drive operational resilience, customer loyalty, and strategic differentiation in a rapidly evolving market landscape.

Presenting a Rigorous Multi Source Research Framework Integrating Primary and Secondary Data for Comprehensive Market Coverage

This research employs a rigorous methodology combining primary interviews, secondary data aggregation, and triangulation to ensure comprehensive market coverage. Primary insights derive from structured interviews with procurement officers at leading hospitals, purchasing managers at distribution firms, and R&D directors at manufacturing enterprises. These discussions are supplemented by vendor presentations and conference proceedings to capture the latest product innovations and regulatory updates.

Secondary sources include government publications on tariff regulations, industry association reports, and peer-reviewed journals exploring material performance and safety standards. Public financial filings and corporate press releases provide additional context on strategic investments and capacity expansions. Quantitative data undergo top-down and bottom-up validation, reconciling national trade statistics with shipment records and company-reported volumes to ensure consistency.

Throughout the process, a multi-tiered quality assurance framework subjects all findings to editorial review and data triangulation checks. Statistical analyses identify outliers and trend anomalies, while subject matter experts audit key assumptions. This robust approach underpins the reliability of insights presented, offering stakeholders a trusted foundation for strategic planning in the medical protective equipment domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Protective Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Protective Equipment Market, by Product Type

- Medical Protective Equipment Market, by Material

- Medical Protective Equipment Market, by Sterility

- Medical Protective Equipment Market, by End User

- Medical Protective Equipment Market, by Distribution Channel

- Medical Protective Equipment Market, by Region

- Medical Protective Equipment Market, by Group

- Medical Protective Equipment Market, by Country

- United States Medical Protective Equipment Market

- China Medical Protective Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Strategic Takeaways from Market Dynamics Segmentation Insights and Regional Analysis to Guide Executive Level Decision Making

Drawing together the report’s analytical threads, the medical protective equipment market emerges as a dynamic ecosystem shaped by rapid technological evolution, evolving regulatory landscapes, and shifting global trade policies. Segmentation analysis reveals that nuanced product and material preferences, from breathable respirators to allergen-free gloves, are driving differentiated growth pockets across end-user categories.

Regionally, production hubs in Asia-Pacific continue to dominate supply chains, even as the Americas and Europe Middle East & Africa regions invest heavily in localized capacity and regulatory harmonization. Meanwhile, the 2025 tariff regime in the United States has catalyzed both short-term price pressures and long-term strategic realignment toward domestic manufacturing.

Competitive dynamics underscore the importance of innovation partnerships, vertical integration, and sustainability commitments in defining market leadership. Companies that excel in agile production, digital engagement, and responsible sourcing are best positioned to navigate ongoing uncertainty. With these insights in hand, decision-makers can align resource allocation, partnership strategies, and investment priorities to secure resilience and growth in an increasingly complex landscape.

Connect with Ketan Rohom to Unlock Our Detailed Medical Protective Equipment Market Research Report and Elevate Your Strategic Planning

For customized access to the full executive summary and comprehensive data on medical protective equipment market dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the detailed findings, discuss tailored subscription options, and facilitate a seamless report purchase. By connecting with Ketan, you will unlock strategic insights designed to strengthen your positioning and accelerate growth in an evolving healthcare safety environment. Begin your journey toward informed decision-making and competitive advantage today by securing your copy of the market research report through Ketan Rohom.

- How big is the Medical Protective Equipment Market?

- What is the Medical Protective Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?