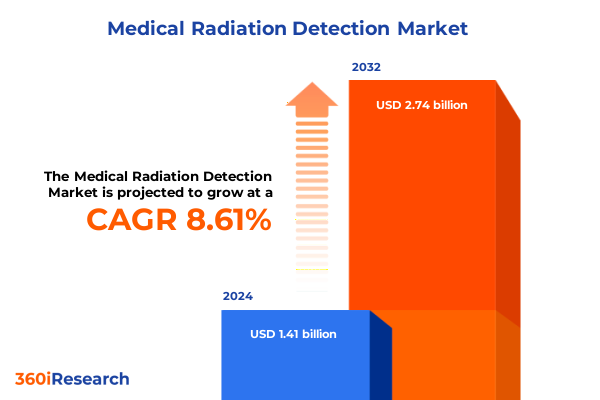

The Medical Radiation Detection Market size was estimated at USD 1.54 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 8.63% to reach USD 2.74 billion by 2032.

Unveiling the Critical Role of Advanced Radiation Detection Technologies in Safeguarding Public Health and Ensuring Regulatory Compliance

Effective medical radiation detection underpins patient safety, accurate diagnostics, and robust compliance with evolving regulatory standards across healthcare and related sectors. Over the past decade, the convergence of heightened awareness around radiation risks and the expansion of radiological procedures has driven institutions to prioritize sophisticated detection solutions. This imperative extends beyond clinical settings, permeating pharmaceutical manufacturing, research laboratories, and nuclear medicine centers where stringent oversight and precise monitoring remain non-negotiable.

Moreover, the landscape of medical radiation detection has evolved from standalone survey meters to integrated systems embedded within hospital networks and cloud platforms. This evolution reflects the need for real-time data visibility, predictive maintenance, and seamless interoperability with hospital information systems. As end users demand higher efficiency and reduced downtime, vendors have responded by developing modular platforms that support both fixed and portable applications. Ultimately, these advancements enable clinicians, health physicists, and safety officers to make faster, more informed decisions while maintaining rigorous quality control and regulatory adherence.

Exploring the Transformative Technological and Regulatory Shifts Reshaping the Global Medical Radiation Detection Landscape

The medical radiation detection ecosystem is undergoing transformative shifts driven by technological breakthroughs and stringent regulatory mandates. In particular, the integration of Internet of Things connectivity with survey meters and personal dosimeters has enabled continuous, remote monitoring of radiation levels, reducing the reliance on manual inspections and enhancing response times when anomalies arise. Concurrently, semiconductor detectors have gained prominence for their superior energy resolution and compact form factors, displacing legacy gas-filled detectors in critical applications where accuracy is paramount.

Furthermore, regulatory bodies across major markets have intensified their focus on radiological safety, issuing updated guidelines that tighten permissible exposure limits and require more frequent calibration of instruments. This regulatory tightening has spurred demand for fixed ionization chambers in nuclear medicine departments and prompted healthcare facilities to adopt automated calibration services. At the same time, strategic collaborations between detector manufacturers and medical device companies have accelerated the development of hybrid systems capable of simultaneously measuring multiple radiation types, such as gamma and neutron emissions. Consequently, these alliances are reshaping procurement strategies and compelling legacy providers to innovate rapidly in order to maintain market relevance.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Supply Chain Dynamics and Cost Structures in Radiation Detection

United States tariff policies implemented in early 2025 have introduced material disruptions to the procurement and distribution of radiation detection equipment. Many manufacturers of key components source printed circuit assemblies and scintillator materials overseas, and elevated duties on imports have increased landed costs across product lines. As a result, procurement teams within healthcare systems and nuclear facilities are reevaluating supplier portfolios and negotiating longer-term contracts to hedge against further tariff escalations.

In addition, the ripple effects of these tariffs have catalyzed a shift toward localized manufacturing and assembly. Several leading providers have expanded North American production capacity to circumvent duty burdens and shorten delivery lead times. This trend has been particularly pronounced for high-precision instruments such as spectroscopy systems, which rely on specialized photomultiplier tubes and customized ASICs. Meanwhile, distributors have accrued larger safety stocks to buffer against price volatility, prompting a reevaluation of working capital deployment throughout the supply chain.

Consequently, organizations that proactively adjust sourcing strategies and pursue nearshoring initiatives are better positioned to mitigate cost pressures. By collaborating closely with manufacturers on demand forecasting and flexible production schedules, end users can maintain equipment uptime and ensure uninterrupted service while navigating an increasingly complex tariff environment.

Deriving Actionable Insights from Diverse Market Segmentation Criteria to Drive Strategic Decision Making in Radiation Detection

An overview of market segmentation reveals how divergent requirements across product categories influence procurement and innovation priorities. Monitors fixed within facilities demand rugged designs and automated alarm integration, whereas handheld instruments must balance sensitivity with ergonomic considerations. Electronic personal dosimeters have emerged as the predominant choice in clinical environments, yet film badges and thermoluminescent dosimeters retain relevance for periodic, archival dose verification. Similarly, survey meters differentiated by gamma, neutron, or x-ray detection cater to distinct use cases in nuclear medicine versus research labs.

Turning to technology, gas-filled detectors still serve as cost-effective options for basic area monitoring. However, the superior energy discrimination of CsI(Tl) and NaI(Tl) scintillation crystals has accelerated their adoption in spectroscopy systems. Plastic scintillators, prized for durability and low gamma sensitivity, address niche applications such as contamination surveys. Fixed ionization chambers remain indispensable in therapy suites where beam output consistency is critical, while portable ionization chambers support on-site quality assurance checks across multiple rooms.

On the application front, computed tomography, fluoroscopy, mammography, and x-ray radiography collectively drive the lion’s share of detection deployments in diagnostic imaging facilities. In contrast, PET and SPECT instruments underline nuclear medicine’s reliance on advanced detection and calibration workflows. Radiation therapy departments increasingly invest in brachytherapy and external beam radiotherapy solutions, reflecting the modality’s expanded clinical application. Finally, end-user environments ranging from hospital-affiliated and standalone diagnostic centers to private and public hospitals, pharmaceutical firms, and research institutes each impose unique performance, compliance, and service expectations on detection solutions, with portability-whether fixed, handheld, or mobile-introducing additional design and logistical considerations.

This comprehensive research report categorizes the Medical Radiation Detection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Portability

- Application

- End User

Uncovering Regional Dynamics and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific in Medical Radiation Detection

Regional dynamics within the Americas have been shaped by extensive regulatory frameworks and significant investments in nuclear power generation, leading to robust demand for high-precision monitoring platforms and personal dosimetry. Healthcare providers in North America, in particular, have accelerated upgrades to digital survey meters and networked portal monitors to comply with enhanced federal safety mandates and accreditation requirements. Meanwhile, Latin American countries are progressively aligning with global safety standards, fostering opportunities for turnkey detection solutions combined with training and maintenance services.

In Europe Middle East & Africa, the heterogeneity of regulatory environments presents both challenges and opportunities for technology providers. Established markets in Western Europe prioritize integration with hospital information systems and demand advanced analytics, whereas emerging economies in Eastern Europe and the Gulf region seek cost-effective yet reliable instruments to support expanding radiopharmaceutical production and nuclear research initiatives. Across Africa, nuclear security applications bolster the adoption of ruggedized portable detectors for border control and emergency response, underscoring the importance of tailored service models and local partnerships.

Asia Pacific continues to register dynamic growth as governments invest in healthcare infrastructure and expand radiotherapy capacity. Countries such as China, Japan, and South Korea lead in the adoption of semiconductor detectors for diagnostic imaging, while Southeast Asian nations are at the forefront of portable, mobile solutions for community health programs. Moreover, regional trade agreements and industrial policies aimed at bolstering domestic manufacturing have encouraged joint ventures, enabling international suppliers to establish localized production and service networks.

This comprehensive research report examines key regions that drive the evolution of the Medical Radiation Detection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Landscape and Strategic Movements of Leading Firms Shaping the Medical Radiation Detection Market Dynamics

The competitive arena in medical radiation detection is dominated by a handful of established firms that have built expansive product portfolios and global service networks. These market leaders consistently invest in research and development to introduce next-generation detectors that combine higher sensitivity with digital connectivity. Their strategic focus on mergers and acquisitions has broadened technological capabilities, enabling the integration of advanced spectroscopy and imaging modalities within single platforms.

Mid-tier companies have carved out niches by specializing in customized solutions for specific end-user segments such as radiopharmacy and nuclear facilities. By offering turnkey packages that include instrumentation, software analytics, and training services, they differentiate themselves through consultative sales models and regional support hubs. At the same time, agile startups are attracting attention by leveraging cutting-edge semiconductor innovations and machine learning-powered analytics to deliver predictive maintenance and remote diagnostics, presenting a competitive challenge to traditional players.

Across all tiers, strategic partnerships remain a crucial mechanism for speeding time to market. Collaborations with medical device OEMs, research institutions, and software providers enable expansive ecosystems that support interoperability and data integration. Ultimately, firms that balance broad geographic reach with deep vertical expertise in medical, industrial, and defense applications will secure the most resilient market positions moving forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Radiation Detection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AADCO Medical, Inc.

- AliMed, Inc.

- Amray Group

- Arrow-Tech, Inc.

- ATOMTEX

- Bertin Technologies SAS

- Burlington Medical, LLC

- Fluke Biomedical LLC by fortive

- Fuji Electric Co., Ltd.

- GE HealthCare Technologies Inc.

- Infab Corporation

- Ludlum Measurements, Inc.

- Mirion Technologies, Inc.

- Nanjing Jusha Commercial &Trading Co,Ltd

- PL Medical Co., LLC

- Polimaster Europe UAB

- PTW Freiburg GmbH

- Radiation Detection Company

- SIMAD s.r.l.

- Thermo Fisher Scientific Inc.

- Tracerco Limited

- Trivitron Healthcare

- X-Z LAB, Inc. by Raycan Technology Corporation

Providing Forward-Thinking Recommendations to Drive Innovation, Optimize Operations, and Strengthen Market Position in Radiation Detection

Industry leaders seeking to drive sustainable growth must prioritize investment in digital transformation and system integration. By embedding IoT sensors into area monitors and portal systems, organizations can transition from reactive maintenance to predictive service models that reduce downtime and extend equipment lifecycles. Furthermore, aligning product roadmaps with evolving international standards and regulatory milestones will ensure seamless market entry and foster trust among health physicists and accreditation bodies.

Companies should also strengthen supply chain resilience by diversifying sourcing strategies and exploring nearshoring or localized assembly for critical components. Engaging with key suppliers on collaborative inventory management and demand forecasting will mitigate the impact of tariff volatility and logistics disruptions. Simultaneously, forging strategic alliances with device manufacturers and analytics providers can accelerate innovation in hybrid detection systems capable of multi-modal radiation measurement.

Finally, to unlock new market opportunities, organizations must deepen their focus on value-added services such as calibration, training, and lifecycle management. By offering comprehensive support packages and leveraging remote connectivity for proactive maintenance, vendors can foster long-term customer relationships, increase recurring revenue streams, and differentiate their offerings in an increasingly competitive landscape.

Detailing a Rigorous and Transparent Research Methodology for Robust Data Collection, Analysis, and Validation in Medical Radiation Detection Studies

Our research methodology combines rigorous secondary research with extensive primary validation to ensure both breadth and depth of market coverage. Initially, industry standards, regulatory guidelines, patent databases, technical white papers, and published academic journals were analyzed to construct a comprehensive baseline of technological capabilities and compliance requirements. Concurrently, proprietary databases and company filings were reviewed to map corporate strategies, product pipelines, and partnership networks.

Primary research involved structured interviews with key stakeholders, including medical physicists, safety officers, procurement managers, and R&D leaders at hospitals, pharmaceutical companies, and nuclear facilities. These one-on-one discussions provided qualitative insights into adoption drivers, pain points, and emerging use cases. In parallel, quantitative surveys were administered to engineers and technicians responsible for equipment validation and maintenance, supplying statistical validation of critical performance criteria.

Finally, data triangulation techniques cross-verified findings from multiple sources, and validation workshops with external experts were conducted to refine assumptions. Quality control protocols were applied at each stage to ensure accuracy, consistency, and unbiased interpretation. This multi-pillar approach underpins the credibility of our analysis and empowers stakeholders to make data-driven decisions in the dynamic medical radiation detection landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Radiation Detection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Radiation Detection Market, by Product Type

- Medical Radiation Detection Market, by Technology

- Medical Radiation Detection Market, by Portability

- Medical Radiation Detection Market, by Application

- Medical Radiation Detection Market, by End User

- Medical Radiation Detection Market, by Region

- Medical Radiation Detection Market, by Group

- Medical Radiation Detection Market, by Country

- United States Medical Radiation Detection Market

- China Medical Radiation Detection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings to Illuminate Strategic Imperatives and Future Pathways in the Evolving Radiation Detection Ecosystem

This executive summary has highlighted the intricate interplay between technological innovation, regulatory pressures, and market segmentation that defines modern medical radiation detection. Across product types-from fixed area monitors to portable handheld survey meters-evolving user needs demand solutions that seamlessly integrate advanced detector technologies with digital platforms. The impact of recent United States tariffs has underscored the importance of supply chain agility and local manufacturing resiliency, reshaping procurement and production strategies.

Regional analyses reveal diverse growth drivers, with the Americas emphasizing compliance and retrofit projects, Europe Middle East & Africa pursuing integrated analytics and service models, and Asia Pacific accelerating capacity expansion through joint ventures and semiconductor adoption. The competitive landscape continues to evolve as leading firms reinforce their positions through acquisitions and partnerships, while specialized providers and startups inject fresh innovation into niche segments.

Collectively, these findings illuminate strategic imperatives: invest in IoT-enabled detection systems, optimize sourcing frameworks, expand service portfolios, and align product roadmaps with emerging regulatory frameworks. As the medical radiation detection market transitions toward greater digitalization and interoperability, stakeholders equipped with nuanced insights and proactive strategies will emerge as frontrunners in safeguarding health and advancing diagnostic and therapeutic excellence.

Engaging with Ketan Rohom to Secure Comprehensive Market Insights through Customized Medical Radiation Detection Market Research Reports

To explore tailored insights and gain a competitive edge in medical radiation detection, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan offers the opportunity to secure a bespoke research package that aligns precisely with your organization’s strategic objectives and technical requirements. Through a collaborative dialogue, you can determine which aspects of the market landscape-whether regulatory developments, technology innovations, or regional dynamics-require deeper scrutiny.

By partnering with Ketan, you will gain privileged access to granular data, expert interviews, and actionable recommendations crafted for decision-makers who demand precision and practical guidance. His extensive experience in guiding healthcare and defense clients ensures that the deliverables will facilitate informed investment, product development, and partnership strategies. Don’t miss the chance to leverage comprehensive market intelligence designed to accelerate growth, minimize risk, and illuminate new opportunities in the evolving world of medical radiation detection. Contact Ketan Rohom today to initiate a customized research engagement that drives your next strategic move.

- How big is the Medical Radiation Detection Market?

- What is the Medical Radiation Detection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?