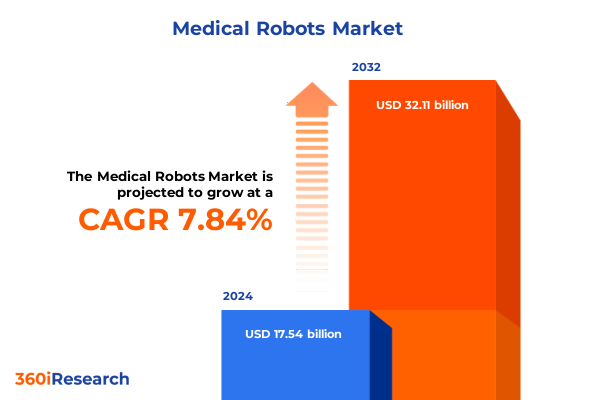

The Medical Robots Market size was estimated at USD 17.54 billion in 2024 and expected to reach USD 18.82 billion in 2025, at a CAGR of 7.84% to reach USD 32.11 billion by 2032.

Introducing the Emergence of Intelligent Robotic Systems Revolutionizing Medical Care Delivery and Patient Outcomes Across Diverse Healthcare Environments

The medical robotics sector is redefining the boundaries of modern healthcare by merging advanced automation with clinical expertise. As patient demands for minimally invasive procedures surge and healthcare systems confront labor shortages, robotic solutions are stepping into critical roles from disinfection and sterilization to rehabilitation and complex surgical interventions. Transitioning beyond niche applications, these intelligent platforms are now integral to everyday operations in hospitals, clinics, and research institutes, accelerating procedural consistency and enhancing safety.

In parallel with demographic shifts toward aging populations, the convergence of robotics with artificial intelligence and machine learning is enabling real-time decision support and adaptive control. Devices capable of analyzing sensor data and adjusting their actions dynamically are proving invaluable in environments characterized by unpredictability, such as emergency response scenarios or high-mix, low-volume clinical workflows. Furthermore, teleoperation technologies and telepresence systems are expanding the reach of specialized surgical expertise, allowing expert physicians to guide procedures across continents.

Equally transformative are the advancements in robotic components and subsystems-ranging from precision sensors and motion controllers to articulated arms and tracking systems-that underpin system reliability and dexterity. As investment in research and development intensifies, strategic collaborations between technology developers, healthcare providers, and regulatory bodies are fostering pathways for accelerated clinical adoption.

Exploring the Pivotal Shifts Reshaping the Medical Robotics Landscape Through Innovation in Technology, Integration Models, and Regulatory Evolution

The medical robotics industry is undergoing a profound metamorphosis, driven by breakthroughs in artificial intelligence, novel integration models, and evolving regulatory frameworks. Analytical AI is empowering robots to interpret vast datasets collected through embedded sensors, enabling predictive maintenance and real-time procedural optimization. Concurrently, physical AI techniques are allowing robotic platforms to learn through simulated environments, improving adaptability in unpredictable clinical settings. Generative AI, echoing the capabilities of large language models, is poised to create intuitive interfaces for programming and operating robotic assistants without extensive coding.

Moreover, swarm robotics is emerging as a disruptive approach for disinfection and delivery tasks, where coordinated fleets of mobile agents autonomously navigate complex hospital corridors. This shift towards collective intelligence enhances operational throughput and resilience to single-point failures. Teleoperation and telepresence technologies have matured to support bimanual control of humanoid and specialized task robots, extending the reach of expert practitioners into remote or underserved areas.

On the regulatory front, streamlined clearances for rehabilitation and training robots are aligning with growing clinical evidence of their therapeutic benefits, while surgical platforms are benefiting from refined approval pathways that balance patient safety with innovation. These transformative shifts underscore a new era in which medical robots evolve from supplemental tools to strategic assets, driving improved outcomes and operational efficiency.

Analyzing the Far-Reaching Consequences of 2025 United States Tariffs on Medical Robotics Components, Supply Chains, and Stakeholder Strategies

The imposition of new U.S. tariffs in 2025 has reverberated across the medical robotics supply chain, creating far-reaching consequences for component sourcing and cost structures. Duties enacted under Section 301 have elevated import rates on critical parts such as sensors, actuators, semiconductors, and precision bearings, generating cost escalations that challenge manufacturers and healthcare providers alike. In hallway discussions at leading industry conferences, stakeholders have expressed concern that steep tariffs could inflate the price of imported humanoids and specialized surgical instruments by as much as 100%, compelling many firms to reconsider established supply agreements and market entry strategies.

These trade measures have intensified pressure on companies to diversify their component sourcing and invest in reshoring initiatives, catalyzing a wave of domestic production efforts. Government incentives and programs aimed at strengthening local manufacturing capabilities under the CHIPS and Science Act are now pivotal in sustaining semiconductor availability and mitigating geopolitical risks. However, small and medium enterprises face significant integration costs and logistical hurdles in reconfiguring their operations, a reality underscored by industry experts who note that high duties are deterring greenfield investments and slowing the adoption of next-generation automation technologies.

Despite these challenges, the tariff environment has also created strategic opportunities. Companies that succeed in localizing critical supply chain segments can achieve improved resilience, reduced lead times, and enhanced intellectual property protection. As a result, strategic alliances between robotics developers, component manufacturers, and policy makers are emerging to navigate this complex landscape and build more robust frameworks for innovation.

Uncovering Comprehensive Segmentation Insights That Illuminate Critical Market Dynamics Across Multiple Dimensions of the Medical Robotics Ecosystem

Delving into the diverse market segments reveals how different categories of medical robotics are evolving in response to clinical needs and technological advances. Platforms for disinfection are being adopted in post-COVID protocols, while pharmacy automation robots streamline medication dispensing in increasingly digitalized pharmacy settings. Rehabilitation robots are enhancing patient engagement and recovery trajectories, and robot-assisted training platforms are redefining medical education. At the pinnacle, surgical robots combine high-precision manipulators with advanced imaging, further supported by drives, motion controllers, and sophisticated sensors housed within robotic systems. Complementing these, precision arms and tracking mechanisms ensure accurate instrument delivery under the guidance of surgical instruments and accessories.

On the technology front, the integration of artificial intelligence and machine learning has unlocked self-learning and adaptive control capabilities, while swarm robotics offers an emerging paradigm for synchronized multi-robot operations. Teleoperation and telepresence are providing real-time remote connectivity, essential for extending specialist services to rural or resource-limited regions. Devices range from fixed units suited to operating theaters to portable platforms designed for point-of-care interventions, distinguished further by hybrid and fully powered modes of operation.

Clinical indications span cardiology, gynecology, neurosurgery, orthopedics, and urology, reflecting the growing confidence of specialists in leveraging robotic precision. In diagnostic and treatment applications, robots are transforming workflows from image-guided biopsies to automated drug delivery. These technologies find their way into academic and research institutes, ambulatory surgery centers, hospitals and clinics, and rehabilitation centers. Distribution channels likewise adapt, encompassing both traditional offline procurement and emerging online platforms, thereby broadening accessibility.

This comprehensive research report categorizes the Medical Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type Of Robot

- Component

- Mobility

- Mode of Operation

- Indication

- Application Area

- End User

- Distribution Channels

Revealing Key Regional Variations That Define Growth Trajectories and Adoption Patterns of Medical Robotics Solutions Across Global Markets

Regional dynamics play a critical role in shaping the trajectory of medical robotics adoption and innovation worldwide. In the Americas, mature healthcare systems and robust venture capital ecosystems have accelerated the integration of sophisticated surgical and rehabilitation robots. The U.S. not only leads in system installations but also hosts the largest cluster of service and medical robot manufacturers, leveraging clear regulatory pathways and reimbursement frameworks to drive early clinical adoption. Transitioning southward, Latin American markets exhibit growing interest in cost-efficient robotic solutions to address emerging healthcare access challenges.

Europe, Middle East & Africa demonstrate a mosaic of adoption patterns, influenced by heterogeneous payer systems and national reimbursement policies. In Western Europe, quality-driven volume rules and collaborative procurement models are fostering cluster approaches, while the Nordics focus on integrating robotic data with national outcome registries. In the Middle East, strategic investments in world-class medical infrastructure are accelerating robotics trials in advanced surgical centers, and African nations are piloting teleoperated systems to extend specialty care to remote regions.

Asia-Pacific has emerged as the fastest-growing region, accounting for nearly 80% of global service robot sales, propelled by government-backed funding, demographic pressures, and rapid hospital modernization initiatives. China’s tier-3 hospital networks are major adopters of oncology robots, Japan’s insurance-supported exoskeleton programs are expanding rehabilitative care, and India’s multispecialty hospital chains are leveraging robotics to capture medical tourism demand. These regional insights highlight the need for tailored engagement strategies that align with local healthcare delivery models and funding environments.

This comprehensive research report examines key regions that drive the evolution of the Medical Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players and Innovative Partnerships Driving Competitive Advantage in the Medical Robotics Industry

Leading companies in the medical robotics domain are shaping the competitive landscape through cutting-edge innovations, strategic partnerships, and expanding global footprints. Intuitive Surgical continues to reinforce its market leadership with its flagship da Vinci series, which saw over 2,500 installations of its next-generation da Vinci 5 platform in the first half of 2025 and sustained procedure growth despite broader market headwinds. Stryker has solidified its position in robotics-assisted orthopedic surgery, leveraging its Mako system’s precision joint replacement capabilities and branching into spine applications, while Medtronic is poised to challenge established leaders with its modular Hugo RAS system, secured through key regulatory submissions and clinical trials.

Johnson & Johnson’s Ethicon division is making significant strides with its Ottava platform, integrating advanced analytics and flexible multiarm configurations to serve general surgery indications. Zimmer Biomet’s ROSA portfolio and miniaturized TMINI offering exemplify expansion into neurosurgery and orthopedic joint procedures. Emerging specialty players such as CMR Surgical are capitalizing on portability and workflow versatility with their Versius system, while Asensus Surgical and Renishaw are targeting high-precision laparoscopic and stereotactic neurosurgery domains, respectively.

Additionally, collaborative models between device manufacturers, software developers, and healthcare institutions are accelerating market penetration. Partnerships to integrate cloud-based analytics, robotic process automation, and augmented reality guidance are redefining value propositions by enabling more efficient training, predictive maintenance, and outcome benchmarking. These alliances underscore a dynamic ecosystem in which shared expertise and interoperable platforms become key differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accuray Incorporated

- Aethon, Inc. by ST Engineering

- Aldebaran SAS

- ARxIUM

- CMR Surgical Limited

- DENSO Corporation

- Diligent Robotics, Inc.

- Freehand Ltd.

- Globus Medical, Inc.

- Guangdong Huayan Robotics Co.,Ltd.

- Harmonic Drive SE

- Intuitive Surgical, Inc.

- Johnson & Johnson Services, Inc.

- Kawasaki Heavy Industries, Ltd.

- Kinova Inc.

- Medtronic PLC

- Meril Group

- Midea Group

- Momentis Innovative Surgery Ltd.

- Noah Medical

- PROCEPT BioRobotics

- Siemens Healthineers

- Smith & Nephew PLC

- Stryker Corporation

- Stäubli International AG

- Think Surgical Inc.

- Triton Medical Robotics

- Vicarious Surgical Inc.

- XACT Robotics

- ZIMMER BIOMET HOLDINGS, INC.

Formulating Actionable Strategies That Empower Industry Leaders to Capitalize on Emerging Opportunities Within the Medical Robotics Sector

To navigate the evolving medical robotics landscape, industry leaders should prioritize forging agile partnerships that facilitate shared innovation and risk mitigation. Establishing collaborative alliances with component suppliers and academic research centers can expedite the integration of advanced sensors, motion controllers, and AI algorithms, accelerating time to clinical adoption. Simultaneously, companies should invest in scalable teleoperation and telepresence platforms, enabling remote procedure support and training that address the global shortage of specialized practitioners.

Leaders must also evaluate the long-term benefits of regional manufacturing diversification to buffer against tariff volatility and supply disruptions. Engaging with government initiatives, such as semiconductor localization programs, will be crucial for securing prioritized access to critical subsystems. Embedding predictive analytics within robotics portfolios can enhance service offerings by providing proactive maintenance and reducing system downtime, thereby strengthening customer value propositions.

Furthermore, it is imperative to develop robust value-based care models with payers and providers. Demonstrating clinical and economic outcomes through real-world evidence studies will support favorable reimbursement policies for robotic applications beyond traditional surgical settings, such as rehabilitation and pharmacy automation. By aligning product road maps with payer expectations and patient-centered workflows, companies can unlock broader market opportunities and sustain competitive advantage.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Ensure Robust Insights and Unbiased Understanding of Market Trends

This report synthesizes insights through a comprehensive research methodology grounded in both primary and secondary data collection. Initially, a broad set of secondary sources, including regulatory filings, peer-reviewed journals, and technical white papers, was reviewed to establish foundational market understanding. Concurrently, global trade data and clinical registry information were analyzed to contextualize adoption trajectories and supply chain influences.

Primary research involved structured interviews and roundtable discussions with over 40 key stakeholders, encompassing robotics developers, healthcare executives, clinical practitioners, and policy makers. These engagements provided nuanced perspectives on technology preferences, integration challenges, and economic considerations across different care settings.

A rigorous triangulation framework was applied to validate findings, cross-checking quantitative trade and installation metrics against qualitative expert opinions. The market segmentation schema was derived from an iterative process that mapped product categories, component architectures, technological platforms, mobility modalities, operation modes, clinical indications, application areas, end-user environments, and distribution pathways. Regional analyses leveraged sales databases to identify growth patterns in the Americas, Europe, the Middle East & Africa, and Asia-Pacific.

Finally, scenario planning and sensitivity analyses were conducted to assess the impact of potential regulatory shifts and tariff fluctuations on deployment strategies. This robust methodological approach ensures that the insights presented are both comprehensive and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Robots Market, by Type Of Robot

- Medical Robots Market, by Component

- Medical Robots Market, by Mobility

- Medical Robots Market, by Mode of Operation

- Medical Robots Market, by Indication

- Medical Robots Market, by Application Area

- Medical Robots Market, by End User

- Medical Robots Market, by Distribution Channels

- Medical Robots Market, by Region

- Medical Robots Market, by Group

- Medical Robots Market, by Country

- United States Medical Robots Market

- China Medical Robots Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Summarizing the Transformative Promise and Future Outlook of Medical Robotics Innovations in Revolutionizing Patient Care Worldwide

The convergence of robotics, artificial intelligence, and advanced sensing is rapidly transforming healthcare delivery, heralding a new era of precision medicine. As robots evolve from supplementary aids to integral components of clinical workflows, they promise to enhance surgical accuracy, streamline operational tasks, and extend the reach of specialized expertise. Navigating the complex interplay of tariffs, regulatory changes, and regional adoption nuances remains a critical imperative for stakeholders seeking to harness these innovations effectively.

Robust segmentation analyses illuminate where targeted investments in technology development and market expansion are most likely to yield substantial returns. Regional insights reveal that while mature markets in the Americas and EMEA continue to push the envelope of surgical and rehabilitative robotics, the Asia-Pacific region stands as the epicenter of emerging growth, driven by supportive policies and infrastructure modernization.

Leading companies are consolidating competitive advantage through integrated solutions, strategic partnerships, and a relentless focus on clinical outcomes, setting the stage for broader adoption across diverse care settings. By embracing data-driven decision making and agile supply chain strategies, industry participants are well positioned to navigate evolving external pressures and unlock the full potential of medical robots to improve patient care worldwide.

Engage Directly with the Report Author to Unlock Customized Insights and Drive Strategic Success in Medical Robotics

For tailored insights and strategic guidance on leveraging the latest medical robotics advancements to drive growth and operational excellence within your organization, engage directly with the report author, Ketan Rohom, Associate Director of Sales & Marketing. Drawing on extensive expertise and deep knowledge of the market’s nuances, he can provide a personalized consultation to align the research findings with your unique objectives and investment priorities. Through this dialogue, you can explore detailed analyses, address specific queries, and clarify how emerging technologies and evolving regulatory frameworks may impact your business model. Don’t miss the opportunity to transform these actionable insights into competitive advantage. Reach out today to schedule a one-on-one briefing and discover how these compelling trends and forecasts can shape your strategic roadmap in the dynamic field of medical robotics.

- How big is the Medical Robots Market?

- What is the Medical Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?