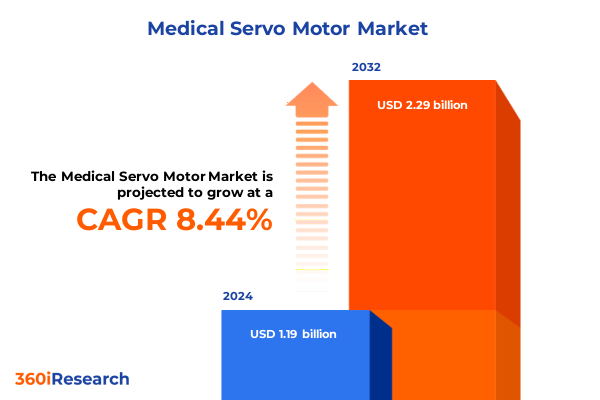

The Medical Servo Motor Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.41 billion in 2026, at a CAGR of 8.37% to reach USD 2.29 billion by 2032.

Exploring the Pivotal Role of Medical Servo Motors in Enhancing Precision and Reliability Across Advanced Healthcare Equipment Systems

Medical servo motors have become indispensable components in the design and operation of advanced medical devices, driving the precision, reliability, and responsiveness required in today’s healthcare environment. From robotic surgical platforms to automated diagnostic instruments, these motors deliver the controlled motion and torque consistency necessary for critical procedures, ensuring both patient safety and clinical efficiency. As treatment modalities evolve toward minimally invasive approaches and personalized therapies, the demand for servo motors capable of ultra-fine positioning and predictable performance under varying load conditions has surged.

This executive summary unveils the core dynamics shaping the medical servo motor market, providing industry leaders with a cohesive overview of key trends, technological breakthroughs, and strategic considerations. The analysis delves into the fundamental drivers influencing adoption across healthcare segments, explores the implications of recent policy developments, and highlights essential insights drawn from detailed segmentation studies. By framing the current landscape within the context of emerging challenges and opportunities, this introduction sets the stage for a nuanced understanding of how servo motor technologies will continue to transform patient care and operational workflows across the medical industry.

Unveiling the Significant Technological and Market Shifts Reshaping Medical Servo Motor Applications in Modern Healthcare Solutions

The medical servo motor sector is undergoing a profound transformation driven by both technological innovation and shifting end-user expectations. Recent advancements in motor miniaturization have enabled higher torque-to-size ratios, allowing for the integration of powerful actuators into compact form factors suitable for surgical robots and portable diagnostic platforms. Simultaneously, the fusion of digital motion control algorithms with embedded sensors and Internet of Things connectivity has introduced unprecedented levels of feedback precision and remote monitoring capabilities, ensuring seamless synchronization between hardware and software systems.

Beyond hardware upgrades, software-driven enhancements are redefining how service providers manage device performance and maintenance. Predictive analytics powered by machine learning engines now analyze operational data in real time, preemptively flagging potential failures and optimizing maintenance schedules to minimize unplanned downtime. Moreover, the convergence of artificial intelligence in motion trajectory planning has unlocked new avenues for autonomous robotic assistance, reducing procedure times and enhancing repeatability. Taken together, these transformative shifts underscore a rapidly evolving landscape in which adaptability, intelligence, and connectivity have become nonnegotiable requirements for next-generation medical servo applications.

Analyzing the Far-Reaching Consequences of the 2025 United States Tariff Measures on Medical Servo Motor Supply and Value Chains

The implementation of new tariff measures in the United States throughout 2025 has significantly impacted the procurement and distribution of medical servo motors by introducing additional cost pressures across the value chain. Components and subassemblies imported from key manufacturing hubs now face elevated duties, driving original equipment manufacturers to reassess their sourcing strategies. In response, many suppliers have accelerated their nearshoring initiatives, relocating production closer to final assembly sites in North America to mitigate the financial burden imposed by import tariffs.

Furthermore, the increased cost of imported raw materials and finished assemblies has catalyzed collaborative efforts between manufacturers and tier-one suppliers to redesign servo modules with greater domestic content. This transition not only alleviates tariff exposure but also strengthens supply chain resilience against future policy shifts. As a result, industry participants are placing renewed emphasis on strategic partnerships and long-term procurement agreements to stabilize pricing and ensure consistent access to critical motor components. These adaptations reflect the broader imperative for agility and localized manufacturing capability in the face of evolving trade policies.

Deriving Actionable Insights from Comprehensive Segmentation Covering Types, Applications, End Use Industries, Control Configurations, and Mounting Options

Insight into market segmentation underscores the varied requirements and growth opportunities within the medical servo motor domain. When considered by type, alternating current and direct current servo motors each present unique advantages: alternating current variants typically deliver higher sustained torque for continuous operation in imaging systems, while direct current options excel in battery-powered applications such as portable infusion pumps where efficiency and compactness are paramount. Segmenting by application reveals distinct performance thresholds across computer numerical control machinery, packaging lines for pharmaceuticals, and the policing of intricate robotic modules-particularly as collaborative robotics demands ultra-smooth acceleration profiles in personnel-shared environments, whereas industrial robotic arms prioritize peak load handling and repeatability.

Further segmentation by end use industry highlights divergent prioritization between automotive-grade motors repurposed for medical assembly lines, manufacturing equipment requiring rapid motion cycles, and bespoke devices in medical technology where biocompatibility and sterilization resistance are critical. Control architectures also vary significantly; closed loop systems dominate precision assemblies due to their feedback-driven correction capability, whereas open loop configurations sustain simpler instrument movements under less stringent positional tolerance. Mounting considerations complete the picture, as flange-type installations support secure integration into robotic end effectors, foot-mounted options deliver structural stability in bench-top analyzers, and shaft-mounted variants enable direct coupling in microfluidic dispensing mechanisms.

This comprehensive research report categorizes the Medical Servo Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End Use Industry

- Control Type

- Mounting Type

Uncovering Distinct Regional Dynamics Driving Medical Servo Motor Demand across the Americas, EMEA, and Asia-Pacific Regions with Unique Market Drivers

Regional dynamics continue to shape the strategic priorities of medical servo motor suppliers worldwide. In the Americas, modernizing hospital infrastructure and an increasing focus on outpatient surgical centers have driven demand for motors that integrate seamlessly with image-guided robotic systems and teleoperation platforms. Regulatory incentives supporting domestic manufacturing have further encouraged OEMs to partner with local motor fabricators, enabling faster delivery times and closer quality assurance oversight.

Across Europe, the Middle East, and Africa, market activity is buoyed by investments in precision medicine and next-generation automated laboratories. Countries such as Germany, France, and the United Kingdom are at the forefront, leveraging robust compliance frameworks and funding for collaborative robotics initiatives. Meanwhile, regions within the Middle East are exploring applications in telemedicine and field-deployable diagnostic kits, where motor reliability under harsh environmental conditions is paramount.

In Asia-Pacific, growth trajectories remain the steepest as emerging economies in China, India, and Southeast Asia expand their domestic manufacturing bases. Localized production hubs benefit from government subsidies and technology transfer programs that accelerate the development of high-performance servo components. Simultaneously, established markets in Japan and South Korea continue to innovate around high-speed, low-vibration servo platforms, reinforcing the region’s reputation for engineering excellence and cost-effective scalability.

This comprehensive research report examines key regions that drive the evolution of the Medical Servo Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape through the Lens of Leading Medical Servo Motor Innovators and Their Strategic Market Positioning Tactics

The competitive landscape is marked by a handful of multinational corporations commanding significant engineering and distribution resources, alongside a diverse array of specialized motor fabricators catering to niche medical applications. Siemens and Rockwell Automation maintain robust portfolios of integrated motion control platforms, combining servo drives with software suites that facilitate seamless integration into hospital automation networks. In parallel, Yaskawa Electric and Mitsubishi Electric leverage their deep expertise in Mechatronics to offer modular motor units with optimized thermal management and backlash-free gearing systems.

Emerging players such as Schneider Electric and Parker Hannifin have responded with targeted acquisitions to bolster their servo capabilities, injecting new life into traditional control catalogs. These firms emphasize digital twin simulations and cloud-enabled maintenance services, promoting a service-oriented business model that extends beyond pure hardware sales. Collectively, these competitive maneuvers underscore a broader industry shift toward full-system lifecycle engagement, where after-sales support, software updates, and firmware security patches form an integral component of market differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Servo Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- CHANGZHOU JKONGMOTOR CO.,LTD

- Dr. Fritz Faulhaber GmbH & Co. KG

- Maxon Motor AG

- Moog Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Parker-Hannifin Corporation

- Portescap SA

- Regal Rexnord Corporation

- Siemens AG

- Yaskawa Electric Corporation

Offering Strategic and Operational Recommendations to Optimize Medical Servo Motor Adoption and Sustain Competitive Edge in Evolving Healthcare Markets

Industry leaders can capitalize on emerging opportunities by prioritizing the development of modular servo platforms that accommodate rapid customization for diverse medical procedures. By investing in advanced control algorithms and standardized communication protocols, manufacturers will streamline integration with hospital information systems and robotic middleware. Additionally, establishing strategic partnerships with component suppliers and system integrators will fortify supply chain resilience, enabling swift responses to policy changes and component shortages.

In parallel, embracing predictive maintenance frameworks will distinguish market offerings, allowing end users to schedule service intervals proactively and reduce unplanned downtime in critical care environments. Companies should also develop comprehensive training programs and digital support portals, fostering deeper client engagement and accelerating the adoption of next-generation motion solutions. Sustainability considerations-such as designing motors with lower carbon footprints, recyclable materials, and energy recovery features-will further enhance brand reputation and align with global healthcare sustainability initiatives.

Detailing the Rigorous Research Process and Analytical Framework Underpinning Insights into the Medical Servo Motor Sector with Transparent Methodology

The insights presented in this report are grounded in a robust research methodology that blends qualitative and quantitative analysis. Primary research included confidential interviews with C-level executives at medical device manufacturers, engineering directors at contract development organizations, and technical procurement managers in hospital systems. These interactions provided firsthand perspectives on emerging requirements for motion control and the impact of policy changes on sourcing strategies.

Secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, regulatory databases, and technical white papers published by standards bodies. Data from these sources was systematically triangulated with industry event proceedings and global trade data to validate trends and identify potential inflection points. The analytical framework incorporated a detailed segmentation model covering motor type, application domain, end use vertical, control architecture, and mounting configuration, ensuring that findings are both comprehensive and aligned with real-world engineering practices. Throughout the process, proprietary validation workshops with domain experts ensured accuracy, relevance, and clarity of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Servo Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Servo Motor Market, by Type

- Medical Servo Motor Market, by Application

- Medical Servo Motor Market, by End Use Industry

- Medical Servo Motor Market, by Control Type

- Medical Servo Motor Market, by Mounting Type

- Medical Servo Motor Market, by Region

- Medical Servo Motor Market, by Group

- Medical Servo Motor Market, by Country

- United States Medical Servo Motor Market

- China Medical Servo Motor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synopsizing Key Findings and Concluding Perspectives on the Future Trajectory of Medical Servo Motor Applications in Healthcare Innovation

This report synthesizes the evolution of medical servo motors against a backdrop of technological leaps, shifting trade policies, and dynamic regional demands. Precision, connectivity, and adaptability have emerged as the cornerstone attributes shaping future motor designs, while the cumulative impact of tariff measures has prompted a decisive pivot toward localized manufacturing and resilient supply chains. Segmentation analysis reveals that application-specific requirements-from high-torque imaging systems to dexterous collaborative robots-will continue to drive product differentiation and specialized engineering solutions.

Looking forward, the integration of artificial intelligence, digital twins, and energy-efficient topologies promises to unlock new frontiers in device performance and operational economy. As healthcare providers pursue more efficient workflows and personalized treatment pathways, servo motor manufacturers that align R&D investments with these shifting priorities will be best positioned to capture growth. Ultimately, the convergence of advanced motion control with intelligent diagnostics and automated platforms will redefine surgical, diagnostic, and therapeutic modalities, cementing servo motors as vital enablers of next-generation healthcare innovation

Engage Directly with Ketan Rohom to Secure the Comprehensive Medical Servo Motor Market Research Report That Fuels Informed Strategic Decisions

To discuss how this in-depth analysis can empower your organization with actionable intelligence and strategic clarity, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. By engaging with Ketan, you will secure access to the full medical servo motor market research report, equipping your team with the insights needed to drive precision innovation, streamline procurement strategies, and achieve sustainable competitive advantage. Start a conversation today to unlock tailored guidance on integrating advanced servo solutions into your product roadmaps and operational workflows

- How big is the Medical Servo Motor Market?

- What is the Medical Servo Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?