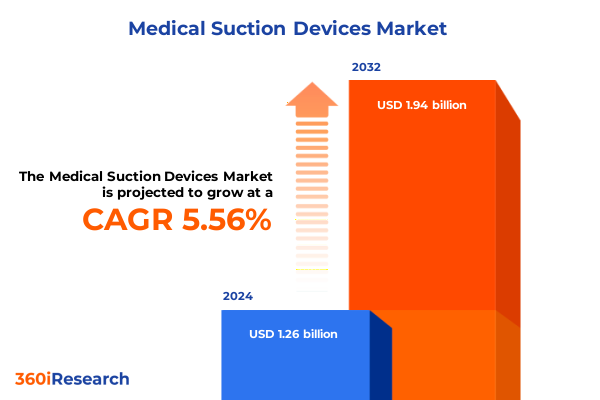

The Medical Suction Devices Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 5.59% to reach USD 1.94 billion by 2032.

Harnessing the Vital Role of Medical Suction Devices in Modern Healthcare Settings by Defining Their Market Positioning and Unveiling Critical Use Cases

Medical suction devices play an indispensable role across modern healthcare environments, providing the essential vacuum functions required to maintain airway patency, facilitate surgical site clearance, and support diagnostic procedures. From the emergency department to outpatient clinics and homecare settings, these devices underpin critical interventions by effectively removing fluids, tissues, and secretions. Their versatility-ranging from portable battery-powered units to wall-mounted systems-ensures adaptability for diverse clinical scenarios, while advancements in ergonomic design and noise reduction continue to enhance user experience and patient comfort.

Against this backdrop, understanding the competitive dynamics and technological trajectories within the medical suction device market has never been more crucial. As hospitals and care providers confront rising demands for minimally invasive procedures, stringent infection control protocols, and telehealth-enabled remote monitoring, the performance and reliability of suction equipment directly influence clinical outcomes. Consequently, stakeholders require robust insights into evolving product innovations, regulatory landscapes, and end-user preferences to inform procurement strategies and R&D investments. This report delves into these facets, setting the stage for deeper exploration into emerging trends and market drivers.

Exploring the Transformative Technological and Regulatory Shifts Reshaping the Medical Suction Device Landscape for Enhanced Efficiency and Patient Safety

Over the past decade, the medical suction device landscape has experienced profound transformations driven by both technological advances and shifting regulatory frameworks. On the innovation front, the integration of smart sensors and IoT connectivity has enabled real-time performance monitoring and predictive maintenance, ensuring uninterrupted functionality in high-acuity environments. Simultaneously, manufacturers have embraced modular architectures that streamline sterilization workflows and reduce cross-contamination risks, thereby aligning with stricter infection control mandates instituted by healthcare authorities.

Moreover, regulatory shifts have accelerated product development cycles by introducing harmonized standards across major regions. The adoption of risk-based classification criteria and comprehensive post-market surveillance has compelled vendors to prioritize design controls and robust clinical validation. In addition, the increasing emphasis on sustainability has spurred the introduction of energy-efficient vacuum systems and recyclable component materials. Together, these transformative shifts are reshaping expectations for performance, safety, and environmental stewardship, propelling the medical suction device sector toward new frontiers of innovation and operational excellence.

Analyzing the Cumulative Impact of United States Tariff Adjustments in 2025 on Medical Suction Device Supply Chains and Cost Structures

The United States’ tariff adjustments in 2025 have exerted a multifaceted impact on the medical suction device industry, influencing everything from component sourcing to final product pricing. With increased duties on key raw materials and imported subassemblies, manufacturers have faced elevated input costs, prompting a strategic reevaluation of supply chain partners. Many vendors have responded by diversifying procurement channels, forging alliances with domestic suppliers, and investing in local manufacturing capacities to mitigate exposure to tariff volatility.

In addition, the cascading effect of these tariff hikes has extended to end-users, as hospital procurement teams grapple with budget constraints and constrained reimbursement environments. To alleviate cost pressures, providers are increasingly adopting value-based purchasing models, leveraging total-cost-of-ownership analyses to justify capital investments. This shift underscores the importance of designing next-generation medical suction devices that balance performance with cost efficiency. Consequently, organizations that proactively adapt their procurement and production strategies stand to maintain competitive advantage despite the headwinds introduced by the 2025 tariff landscape.

Uncovering Key Segmentation Insights to Understand Product Variations Application Diversity and Sales Channel Preferences within the Medical Suction Device Ecosystem

The medical suction device ecosystem can be dissected through multiple lenses to reveal critical product and market variations. Examining devices by design reveals distinct user experiences between hand-handled models, prized for portability and rapid deployment, and wall-mounted systems, valued for durability and continuous power availability. Similarly, power configurations shape device capabilities, with alternating current models delivering high vacuum stability ideal for hospital settings, battery-powered units enabling untethered mobility in emergency care, dual-powered systems offering operational redundancy, and manually operated alternatives providing reliable performance in resource-limited environments.

Application diversity further underscores the market’s complexity, spanning airway clearance during respiratory emergencies, precise fluid management in surgical suites, and filtration requirements in research and diagnostics laboratories. Moreover, end-user segmentation highlights the nuanced demands of clinics seeking compact, user-friendly devices, homecare markets prioritizing ease of use and quiet operation, and hospitals demanding high throughput and integration with broader medical gas infrastructures. Finally, sales channel dynamics reveal a growing tilt toward online procurement platforms, driven by digital transformation initiatives, alongside enduring reliance on traditional offline distributors to support customized service and training offerings.

This comprehensive research report categorizes the Medical Suction Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Vacuum Systems

- Application

- End User

- Sales Channel

Delineating Key Regional Insights to Highlight Market Dynamics and Growth Opportunities across Americas Europe Middle East Africa and Asia Pacific Regions

Geographic perspectives offer valuable context for interpreting market dynamics, as regional healthcare infrastructures, reimbursement policies, and regulatory regimes shape device adoption patterns. In the Americas, investment in telehealth and homecare solutions has spurred demand for portable and battery-powered suction units, while robust hospital networks continue to drive procurement of advanced wall-mounted systems. Conversely, economic constraints in certain Latin American markets have elevated interest in cost-effective manually operated devices that require minimal maintenance.

In the Europe, Middle East & Africa region, stringent EU medical device regulations and a growing focus on hospital accreditation programs have elevated quality standards for suction equipment. Meanwhile, Middle Eastern healthcare modernization initiatives are catalyzing capital investments in smart, connected devices, and African markets are prioritizing ruggedized designs to withstand challenging environmental conditions. Across Asia-Pacific, rapid urbanization and expanding healthcare access are fueling uptake of dual-powered systems, alongside government incentives aimed at bolstering domestic manufacturing and reducing reliance on imported medical technologies.

This comprehensive research report examines key regions that drive the evolution of the Medical Suction Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Shaping the Competitive Landscape of Medical Suction Device Providers Globally

A handful of industry leaders dominate the medical suction device sphere, each leveraging distinctive competitive advantages to expand their market footprint. Established multinational corporations excel at large-scale manufacturing and global distribution, investing heavily in R&D to introduce next-generation vacuum technologies and digital connectivity features. Their expansive product portfolios cater to hospital chains requiring comprehensive service agreements and end-to-end support, reinforcing their stronghold in high-value segments.

In parallel, agile specialized players are gaining traction through targeted innovations and strategic partnerships. By focusing on portable and homecare applications, these companies differentiate themselves with user-centric design philosophies and rapid product development cycles. Their emphasis on direct-to-customer channels and value-added services such as remote device monitoring underscores a shift toward subscription-based models. Collectively, these strategic initiatives are intensifying competitive pressures, stimulating continuous innovation, and fostering a more dynamic market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Suction Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cardinal Health

- Delex Pharma International, Inc.

- Indoplas Philippines Inc.

- Medela AG

- Medtronic plc

- Nareena Lifesciences Private Limited

- Ohio Medical Corporation

- Olympus Corporation

- Panamed Philippines Inc.

- Philips Healthcare

- Siemens Healthineers

- Stryker Corporation

- The Getz Group of companies

- TRANSMEDIC PHILIPPINES INC

- Welch Allyn, Inc.

- ZOLL Medical Corporation

Providing Actionable Recommendations for Industry Leaders to Navigate Market Disruptions Drive Innovation and Enhance Competitive Advantage in Medical Suction Devices

To navigate ongoing disruption and secure sustainable growth, industry leaders should prioritize a multifaceted approach that balances innovation, cost management, and strategic alliances. First, implementing modular device architectures can accelerate time to market and facilitate easier compliance with evolving regulatory standards. In tandem, investing in digital platforms that enable remote diagnostics and preventive maintenance will improve customer satisfaction, reduce downtime, and generate recurring service revenues.

Furthermore, cultivating partnerships with domestic component suppliers can counter tariff-driven cost pressures, while exploring joint ventures in emerging markets will unlock new distribution channels. Equally important is the development of sustainable manufacturing practices, which not only meet environmental objectives but also resonate with healthcare providers striving for greener procurement portfolios. By embracing these actionable strategies, companies can enhance operational resilience, differentiate their offerings, and capitalize on emerging opportunities in the medical suction device domain.

Detailing a Rigorous Research Methodology to Ensure Comprehensive Data Collection Analysis and Validation for the Medical Suction Device Market Study

This study employs a rigorous multi-tiered research framework combining primary and secondary data sources to ensure comprehensive market coverage and analytical depth. Initially, a detailed literature review of scientific publications, regulatory guidelines, and clinical white papers established the foundational understanding of medical suction device applications, design principles, and compliance requirements. Subsequently, expert interviews with clinical practitioners, biomedical engineers, and product managers were conducted to capture firsthand insights into user needs, performance benchmarks, and emerging challenges.

Complementing these qualitative inputs, a systematic analysis of patent filings, industry consortium reports, and publicly disclosed corporate filings provided visibility into competitive strategies, technological roadmaps, and investment trends. Data triangulation methods were then applied, cross-verifying information across sources to enhance validity and mitigate bias. Finally, thematic synthesis and scenario analysis techniques were utilized to articulate forward-looking perspectives and strategic imperatives, ensuring that stakeholders receive actionable intelligence grounded in empirical evidence and stakeholder consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Suction Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Suction Devices Market, by Product

- Medical Suction Devices Market, by Vacuum Systems

- Medical Suction Devices Market, by Application

- Medical Suction Devices Market, by End User

- Medical Suction Devices Market, by Sales Channel

- Medical Suction Devices Market, by Region

- Medical Suction Devices Market, by Group

- Medical Suction Devices Market, by Country

- United States Medical Suction Devices Market

- China Medical Suction Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Strategic Perspectives on Emerging Trends Critical Challenges and Long Term Outlook for the Evolving Medical Suction Device Market

In summary, the medical suction device market is undergoing a period of rapid evolution characterized by technological breakthroughs, regulatory realignments, and global supply chain reconfigurations. Growing demand for portable, connected, and eco-friendly devices is redefining competitive benchmarks, while tariff pressures and regional policy variations are reshaping procurement imperatives. As market entry barriers diversify and established players fortify their positions, the balance between cost efficiency and performance excellence will dictate future success.

Looking ahead, stakeholders that embrace digitalization, foster supply chain resilience, and align product development with emerging clinical protocols are best positioned to capitalize on growth trajectories. By synthesizing market dynamics with actionable strategies, this report equips decision-makers with the clarity required to navigate complexity and drive value creation. Continual monitoring of policy shifts, technological adoption rates, and end-user feedback will remain imperative to sustaining momentum in an increasingly competitive landscape.

Engage with Ketan Rohom to Access In Depth Market Intelligence on Medical Suction Devices and Propel Your Strategic Decision Making Efforts Forward Today

Engaging with Ketan Rohom offers an invaluable opportunity for healthcare executives and procurement professionals to secure unparalleled market insights tailored to the dynamic medical suction device sector. By partnering directly with the Associate Director of Sales & Marketing, organizations gain privileged access to comprehensive intelligence highlighting the latest technological breakthroughs, regulatory updates, and competitive strategies shaping the industry. This bespoke advisory experience empowers stakeholders to benchmark their innovation roadmaps, optimize supply chain resilience, and elevate patient care standards through evidence-based decision making.

Take the decisive step toward transforming your strategic initiatives today by reaching out to Ketan Rohom for a personalized consultation and report purchase. Seize this chance to enhance your market positioning, uncover untapped growth avenues, and stay ahead of emergent disruptions in the medical suction device landscape. Your organization's next competitive leap starts with this critical engagement.

- How big is the Medical Suction Devices Market?

- What is the Medical Suction Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?