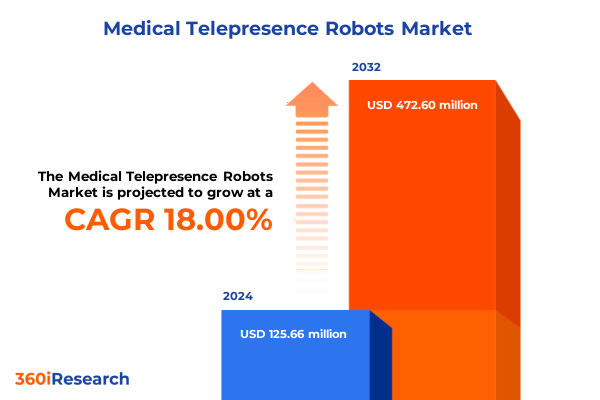

The Medical Telepresence Robots Market size was estimated at USD 147.16 million in 2025 and expected to reach USD 172.65 million in 2026, at a CAGR of 18.13% to reach USD 472.60 million by 2032.

Medical telepresence robots are ushering in a new era of healthcare by connecting providers and patients remotely, streamlining operations and improving clinical outcomes

In recent years, the convergence of robotics and telecommunication technologies has ushered in an era where medical telepresence robots play an increasingly central role in healthcare delivery. These advanced systems leverage integrated camera and audio modules to facilitate real-time remote interactions between healthcare professionals and patients, breaking down traditional geographical barriers. Furthermore, as digital transformation accelerates across hospitals, clinics, and home healthcare settings, stakeholders are recognizing the potential of these robotic solutions to streamline workflows, optimize resource allocation, and enhance clinical efficiency.

Moreover, growing demand for remote consultations and patient monitoring has been fueled by rising healthcare costs and evolving patient expectations. As a result, telepresence robotics are not only enabling virtual rounds and teleconsultations but are also redefining patient engagement strategies. In parallel, advances in user interface design and connectivity are simplifying deployment, allowing providers to adopt these systems more seamlessly into existing clinical workflows. Consequently, medical telepresence robots are shifting from niche applications toward mainstream acceptance.

In addition, the integration of AI-driven algorithms enhances the diagnostic and operational capabilities of these platforms. For instance, computerized vision modules can assist in preliminary assessments, while automated scheduling features reduce administrative burdens. Therefore, hospitals and ambulatory surgical centers are increasingly investing in end-to-end solutions that combine hardware robustness with intuitive software interfaces. Furthermore, as stakeholders pursue value-based care models, the focus on patient outcomes and cost-effectiveness further underscores the importance of telepresence robotics in shaping future healthcare ecosystems.

By examining the driving forces behind adoption, including regulatory catalysts and reimbursement structures, the report illuminates how healthcare organizations can leverage robotic telepresence to deliver high-quality care while containing costs. Overall, this report provides an in-depth exploration of the medical telepresence robotics market, highlighting transformative trends, regulatory impacts, segmentation insights, regional dynamics, and strategic imperatives for industry leaders to navigate this rapidly evolving landscape.

The integration of advanced AI, high-speed networks, and robotics in healthcare has triggered transformative shifts in remote care delivery models, enhancing precision and accessibility

Transitioning from the introduction, the landscape of medical telepresence robotics has undergone several transformative shifts driven by technological innovation and changing care paradigms. Initially, telepresence robots were confined to basic remote communication tools, yet recent advancements in artificial intelligence and edge computing have empowered these platforms to perform complex clinical functions. For example, automated navigation systems enable robots to traverse healthcare facilities autonomously, while machine learning algorithms support real-time imaging analysis during virtual consultations. Consequently, providers are now embracing telepresence as an integral component of daily operations rather than an auxiliary service.

Furthermore, the proliferation of high-bandwidth networks, including private 5G deployments, has catalyzed the expansion of remote surgery assistance, allowing specialist teams to guide procedures from offsite locations with unprecedented precision. This shift not only broadens access to specialized care in underserved regions but also optimizes the utilization of scarce surgical expertise. In addition, the convergence of telemedicine platforms with robotic interfaces fosters more immersive patient interactions, thereby enhancing trust and satisfaction during virtual encounters.

Moreover, the global response to recent public health challenges has accelerated investments in remote care infrastructure, propelling telepresence robotics into regulated care pathways. Consequently, interoperability and standardization have emerged as critical enablers, ensuring seamless integration with electronic health record systems. Taken together, these transformative shifts underscore how medical telepresence robots are redefining care delivery models, bridging gaps between providers and patients, and setting new benchmarks for clinical excellence and operational resilience.

United States tariffs enacted in 2025 have reshaped medical telepresence robotics supply chains, driving cost realignments, spurring domestic innovation, and redefining procurement strategies

Building on macro trends, the imposition of United States tariffs in 2025 has exerted significant influence on the medical telepresence robotics supply chain. Initially introduced to safeguard domestic manufacturing and encourage local production, these duties have driven up the landed costs of key hardware components such as camera modules, control units, and advanced sensors. Consequently, original equipment manufacturers have had to reevaluate sourcing strategies to mitigate cost pressures. As a result, strategic shifts toward nearshoring and onshore assembly have gained traction, enabling greater supply security and reduced lead times.

At the same time, healthcare providers are facing the ripple effects of these tariff-driven cost adjustments. While some organizations have absorbed incremental expenses through capital planning allowances, others have sought bundled service contracts that include installation, maintenance, and training support to offset higher upfront investments. Moreover, robotics vendors are collaborating more closely with component suppliers to redesign modules for tariff compliance and optimized performance. In addition, partnerships between industry stakeholders and government agencies are emerging to secure incentives for domestic manufacturing expansions.

Furthermore, this tariff environment has stimulated innovation within the US ecosystem. By fostering a more robust local manufacturing base, there is now increased capacity for customization, quality control, and faster iteration cycles. Ultimately, the cumulative impact of these 2025 tariffs has catalyzed a more resilient telepresence robotics industry while reshaping procurement paradigms and encouraging deeper collaboration across the value chain.

Market segmentation analysis indicates nuanced adoption drivers and tailored value propositions across diverse robot types, components, applications, end users, and sales channels

Delving deeper into market composition reveals that segmentation analysis illuminates distinct adoption patterns and value creation opportunities. Considering robot type, mobile telepresence robots are favored for dynamic environments such as hospitals and ambulatory surgical centers, where unobtrusive navigation and rapid redeployment support diverse clinical workflows. In contrast, stationary telepresence units find prominence in dedicated teleconsultation suites and outpatient clinics, where fixed install points enable optimized camera angles and secure data connectivity.

Turning to component segmentation, the hardware layer remains foundational, with integrated camera systems, control systems, microphones, screens, and speakers forming the core building blocks. As telepresence platforms evolve, service offerings such as installation and maintenance, along with training and support, have become critical differentiators in vendor selection. Furthermore, software advancements encompassing remote session management, AI-enhanced diagnostics, and interoperability modules increasingly drive platform stickiness and long-term customer satisfaction.

Within application-focused segmentation, patient interaction scenarios dominate early adoption, while telemonitoring for chronic disease management and postoperative care is gaining momentum due to its ability to deliver continuous care outside traditional settings. Meanwhile, remote surgery assistance, spanning general surgery, neurosurgery, and orthopedic surgery, demonstrates the transformative potential of robotics to extend specialty care reach. Teleconsultation and broader telemedicine use cases complement these trends by enabling rapid, secure virtual engagements.

Lastly, examining end-user segmentation, hospitals and clinics represent core markets with robust budgets and infrastructural support, while ambulatory surgical centers and home healthcare environments are emerging as high-growth segments. Across sales channels, offline sales through established medical equipment distributors coexist with online procurement models, reflecting evolving buyer preferences for digital transaction capabilities and on-demand service activation.

This comprehensive research report categorizes the Medical Telepresence Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Component

- Application

- End User

- Sales Channel

Regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific underscore distinct regulatory landscapes, infrastructure maturity, and cultural factors shaping telepresence robotics adoption

Examining regional dynamics highlights unique market forces across the Americas, Europe Middle East & Africa, and Asia-Pacific that shape medical telepresence robotics adoption and deployment strategies. In the Americas, a strong innovation ecosystem driven by leading technology hubs and major healthcare networks accelerates the uptake of advanced telepresence solutions. The existence of comprehensive regulatory frameworks and reimbursement pathways further supports investment in these platforms. Additionally, a growing focus on value-based care models is fostering collaborative pilots between robotics vendors and large hospital systems.

Conversely, in the Europe Middle East & Africa region, regulatory harmonization across European Union member states facilitates cross-border market entry, yet diverse reimbursement policies require targeted market access strategies. Nations within the Middle East are investing heavily in smart healthcare infrastructure as part of broader economic diversification initiatives, creating greenfield opportunities for telepresence robotics. Meanwhile, gaps in infrastructure and funding constraints in certain African markets necessitate cost-effective, scalable models tailored to local contexts.

In the Asia-Pacific region, robust economic growth and expansive healthcare coverage reforms in countries such as China, Japan, and Australia underpin a rapidly expanding demand for telepresence platforms. Urban density challenges, coupled with the need to extend specialist care into rural areas, drive interest in both mobile and stationary robot deployments. Furthermore, government-led initiatives supporting indigenous manufacturing and digital health integration are catalyzing partnerships between local OEMs and international technology providers.

Taken together, these regional insights underscore that tailored strategies accounting for regulatory nuances, infrastructure maturity, and cultural acceptance remain critical for realizing the full potential of medical telepresence robotics across global markets.

This comprehensive research report examines key regions that drive the evolution of the Medical Telepresence Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading industry players are differentiating through strategic alliances, targeted acquisitions, and continuous R&D investments to deliver innovative telepresence robotic solutions that address evolving clinical needs

A survey of key industry players reveals a competitive landscape characterized by strategic differentiation, collaborative ecosystems, and targeted innovation portfolios. Established robotics manufacturers are expanding their footprints by forging partnerships with clinical institutions to co-develop application-specific platforms. In parallel, emerging technology firms are focusing on modular architectures and open APIs to enhance interoperability with hospital IT systems, thereby unlocking new revenue streams through software licensing and data analytics services.

Moreover, certain companies are leveraging acquisitions to acquire complementary capabilities such as advanced imaging modules or AI-driven diagnostic engines, integrating these assets to build more comprehensive telepresence solutions. For instance, alliances between robotics vendors and telehealth software providers have accelerated the introduction of intuitive user interfaces and secure communication channels. This collaborative approach not only streamlines implementation but also bolsters overall user satisfaction by offering end-to-end service packages encompassing hardware, software, and support services.

Additionally, innovators are investing heavily in localized manufacturing and assembly operations to mitigate tariff impacts and improve supply chain resilience. Simultaneously, dedicated R&D centers focusing on user experience, autonomous navigation, and edge computing are emerging as critical assets in sustaining long-term competitive advantage. As a result, companies that maintain balanced portfolios spanning hardware robustness, service excellence, and software intelligence are best positioned to capture growing market opportunities across diverse healthcare settings.

Overall, the convergence of strategic partnerships, targeted acquisitions, and relentless R&D underscores how leading companies are shaping the future of telepresence robotics to meet evolving clinical demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Telepresence Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADIBOT

- Ava Robotics, Inc.

- Awabot SAS

- AXYN Robotics

- Brainlab AG

- Cisco Systems, Inc.

- Diligent Robotics, Inc.

- GOBE ROBOTS by Blue Ocean Robotics ApS

- Intuitive Surgical, Inc.

- Kubi by Xandex, Inc.

- Medtronic plc

- OhmniLabs, Inc.

- Teladoc Health, Inc.

- Telepresence Robotics Corporation

- Vecna Technologies, Inc.

- Zimmer Biomet Holdings, Inc.

Industry leaders can capitalize on emerging opportunities by prioritizing interoperability standards, localizing supply chains, forging clinical partnerships, and enhancing training frameworks for sustainable growth

To capitalize on the momentum of medical telepresence robotics, industry leaders should adopt a series of strategic and operational initiatives designed to drive sustainable growth. First, prioritizing interoperability standards through active engagement in industry consortiums will facilitate seamless integration of telepresence platforms with existing health IT infrastructures. By investing in open API frameworks and collaborating on data exchange protocols, vendors can reduce implementation friction and accelerate adoption across diverse care environments.

In addition, localizing supply chain operations through nearshoring or domestic partnerships can mitigate the effects of tariff fluctuations while reducing lead times. Organizations that strategically align with component suppliers for co engineering and joint quality assurance will gain greater control over cost structures and customization capacities. Simultaneously, forging clinical partnerships with leading healthcare institutions can provide valuable pilot environments for testing new features, validating clinical efficacy, and generating compelling evidence for broader market deployment.

Furthermore, enhancing training and support frameworks is essential to ensure provider confidence and proficiency in operating telepresence systems. Comprehensive programs encompassing simulation labs, virtual training modules, and dedicated field support can significantly improve user satisfaction and reduce downtime. From a commercial perspective, exploring flexible service models such as outcome-based contracts or subscription financing can lower adoption barriers for cost-sensitive segments.

Lastly, engaging proactively with regulatory bodies to shape policy frameworks for telepresence robotics will safeguard market access and ensure compliance. By contributing to standards development and advocating for favorable reimbursement pathways, industry leaders can foster a more predictable investment climate, ultimately benefiting all stakeholders in the healthcare ecosystem.

A rigorous methodology combining primary stakeholder interviews, comprehensive secondary research, expert validation, and quantitative data analysis underpins the credibility and depth of this telepresence robotics study

This study employs a rigorous research methodology designed to ensure comprehensive market understanding and robust insights. Initially, primary research was conducted through interviews with a diverse array of stakeholders, including healthcare executives, clinical end users, robotics engineers, and policy experts. These qualitative engagements provided firsthand perspectives on adoption drivers, operational challenges, and emerging use cases across varied care settings. In parallel, secondary research involved the systematic review of industry publications, peer-reviewed journals, government regulations, and technology white papers to contextualize primary findings and identify macroeconomic influences.

Furthermore, a quantitative data analysis framework was applied to synthesize information collected from proprietary databases, publicly available financial reports, and market intelligence portals. Data triangulation techniques were employed to validate estimates and reconcile discrepancies across multiple data sources. Additionally, an expert validation phase convened an advisory panel comprising clinicians, technical specialists, and market analysts to refine key insights and ensure methodological rigor.

Moreover, sensitivity analyses were performed to assess the impact of variables such as regulatory changes, tariff adjustments, and technology adoption rates on the overall market landscape. This iterative approach not only strengthens the credibility of the findings but also enhances the study’s ability to anticipate future trends. Throughout the research process, adherence to ethical guidelines and data privacy standards was maintained to preserve confidentiality and integrity.

In sum, the multi-method research design combining primary interviews, secondary data review, quantitative analysis, and expert validation underpins the depth and reliability of the telepresence robotics market report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Telepresence Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Telepresence Robots Market, by Robot Type

- Medical Telepresence Robots Market, by Component

- Medical Telepresence Robots Market, by Application

- Medical Telepresence Robots Market, by End User

- Medical Telepresence Robots Market, by Sales Channel

- Medical Telepresence Robots Market, by Region

- Medical Telepresence Robots Market, by Group

- Medical Telepresence Robots Market, by Country

- United States Medical Telepresence Robots Market

- China Medical Telepresence Robots Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

In conclusion, medical telepresence robotics stand poised to revolutionize healthcare delivery by converging technological advances, policy shifts, and patient-centric care models for future resilience

In summary, medical telepresence robotics represents a pivotal convergence of technology and healthcare, poised to transform patient care, operational efficiency, and clinical collaboration across multiple settings. The integration of AI, advanced connectivity, and modular hardware has expanded the potential applications from virtual patient rounds to remote surgery assistance and chronic disease monitoring. Moreover, regional dynamics, evolving tariff landscapes, and strategic industry partnerships are collectively shaping a more resilient and innovative ecosystem.

As healthcare organizations strive to deliver value-based care, telepresence robots offer a compelling avenue for extending access, enhancing patient engagement, and optimizing resource utilization. The segmentation analysis underscores the importance of aligning solutions with specific clinical workflows and end-user requirements, while regional insights highlight the need for tailored market entry strategies that account for regulatory and infrastructural nuances. Furthermore, the research methodology’s comprehensive design ensures that these findings rest on a foundation of robust data and expert validation.

Ultimately, the future trajectory of medical telepresence robotics will be defined by collaboration among technology vendors, healthcare providers, and policymakers. By embracing interoperability, localizing supply chains, and fostering innovation through targeted R&D, stakeholders can unlock the full potential of these platforms. This report’s insights serve as a roadmap for decision-makers seeking to navigate the evolving telepresence landscape and realize the benefits of remote healthcare delivery.

Unlock critical insights and strategic guidance on medical telepresence robotics by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to access the full comprehensive market research report

For healthcare executives, technology leaders, and strategic decision-makers seeking to gain a competitive edge in the medical telepresence robotics space, accessing comprehensive market intelligence is essential. Partner with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full depth of this report, uncover actionable insights, and receive tailored guidance on navigating the complex landscape of telepresence solutions. Whether you aim to optimize procurement strategies, align product roadmaps with emerging clinical needs, or understand the ramifications of regulatory developments, this report offers the clarity and expertise required to make informed strategic choices.

Engage directly with Ketan Rohom to discuss customized research packages, schedule a detailed briefing, and secure the critical information that will drive your organization’s success. Take this opportunity to position your organization at the forefront of medical telepresence innovation and ensure that you are equipped to capitalize on the growth opportunities emerging in this dynamic market.

- How big is the Medical Telepresence Robots Market?

- What is the Medical Telepresence Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?