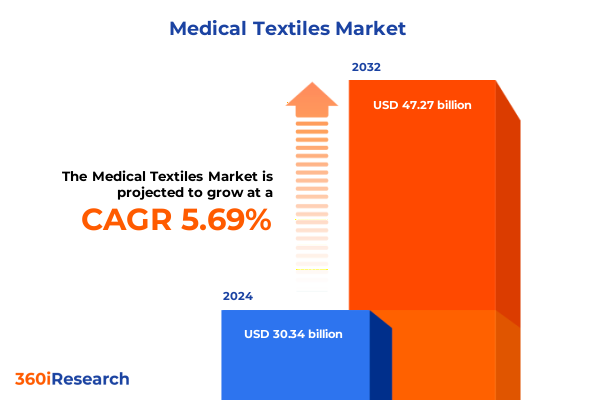

The Medical Textiles Market size was estimated at USD 32.05 billion in 2025 and expected to reach USD 33.76 billion in 2026, at a CAGR of 5.70% to reach USD 47.27 billion by 2032.

Exploring the Crucial Role of Medical Textiles in Advancing Healthcare Outcomes and Addressing Emerging Clinical Demands Across Treatment Areas

Medical textiles represent a critical convergence of advanced material science and clinical application, laying the groundwork for enhanced patient safety, improved therapeutic efficacy, and cost-effective healthcare delivery. Emerging from a heritage of traditional surgical gauzes and bandages, this dynamic field now leverages breakthroughs in fibers, coatings, and fabric structures to address complex challenges ranging from infection control to tissue regeneration. The adaptability of these specialized materials enables healthcare professionals to respond to evolving clinical demands across an ever-expanding spectrum of treatment areas.

In recent years, several transformative forces have underscored the importance of medical textiles. An aging global population and rising prevalence of chronic diseases have intensified demand for wound care solutions that accelerate healing while minimizing complications. Simultaneously, heightened awareness of hospital-acquired infections has propelled the uptake of advanced barrier fabrics and single-use nonwoven systems. Patient-centric care models, moreover, are driving a shift toward personalized and wearable textile devices that seamlessly integrate diagnostics and monitoring, reflecting a broader trend toward minimally invasive interventions.

Building on these industry dynamics, this executive summary collates critical insights into the current landscape of medical textiles. It contextualizes the technological innovations driving next-generation products, examines the regulatory and trade frameworks reshaping supply chains, and offers segmentation-based perspectives across product types, applications, raw materials, and end users. Together, these elements establish a foundation for strategic decision-making and a clear understanding of the opportunities and complexities inherent in the medical textile domain.

Uncovering the Technological Innovations and Regulatory Transformations Redefining the Medical Textiles Landscape in Patient Care Delivery

Over the past decade, the medical textile sector has undergone a profound metamorphosis fueled by converging technological advances and evolving regulatory paradigms. At the forefront of this evolution lies the advent of nanofiber and electrospun materials, which deliver unprecedented levels of surface area, porosity, and controlled release functionalities. These fine-fiber architectures support innovative drug-eluting dressings and bioactive scaffolds, heralding a new era of therapeutic textiles that actively contribute to patient healing trajectories.

Beyond materials innovation, digital integration has catalyzed the emergence of “smart” textile systems. Embedded sensors and conductive threads now enable real-time monitoring of physiological parameters such as temperature, pressure, and fluid exudation, facilitating data-driven clinical interventions. As interoperability with hospital information systems improves, care providers can leverage these insights to optimize treatment regimens and proactively detect complications. Concurrently, additive manufacturing and 3D printing are revolutionizing customized textile implants and grafts, offering bespoke geometries and porosities tailored to specific patient anatomies.

Regulatory shifts are likewise reshaping the landscape. Agencies across major markets have introduced more stringent classification criteria and post-market surveillance requirements, ensuring that performance claims are substantiated by rigorous clinical data. This heightened oversight promotes patient safety but also demands robust quality management and documentation protocols from manufacturers. Taken together, these technological and regulatory transformations underscore the dynamic nature of the medical textile arena and highlight the strategic imperatives for stakeholders aiming to lead in innovation, compliance, and patient-centric solutions.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Medical Textile Import Dynamics and Supply Chain Resilience

In 2025, the United States implemented revised tariff structures affecting key input materials for medical textile manufacturing, most notably polyester, polyethylene, and polypropylene fibers. These measures, part of a broader trade policy update targeting specialty polymer imports, have reverberated across global supply chains. Importers are facing increased cost pressures, prompting many to explore alternative sourcing strategies or consider reshoring elements of production to maintain competitive margins.

As tariffs elevated the price of outsourced materials, manufacturers have accelerated efforts to localize supply networks. This has triggered a wave of partnerships between domestic fiber producers and textile converters, aimed at securing price stability and reducing lead times. At the same time, the heightened import costs have spurred investment in material efficiency, driving adoption of thinner or hybrid fabric constructions that balance performance with lower raw material usage. Through iterative design optimization, firms are mitigating the impact of higher duties while meeting stringent clinical performance benchmarks.

Despite these adjustments, the tariff-induced margin constraints remain a critical concern for smaller and mid-sized innovators whose procurement volumes lack sufficient scale to negotiate preferential terms. To counteract these challenges, industry consortia have emerged to promote pooled purchasing agreements, enhancing collective bargaining power. Furthermore, continuous dialogue with regulatory authorities is fostering temporary waivers and tariff exemptions for essential medical supplies during public health emergencies. As a result, the interplay of fiscal policy and strategic response is redefining resilience standards within the medical textile ecosystem.

Delving into Product Type Application Raw Material and End User Segmentation to Reveal Critical Insights Shaping Market Dynamics

An in-depth examination of market segmentation reveals how product types, from knitted to nonwoven to woven fabrics, drive differentiated performance outcomes. Knitted structures, encompassing seamless knit, warp knit, and weft knit variants, deliver elasticity and comfort well-suited for compression garments and implantable meshes. Nonwoven techniques-spanning airlaid, meltblown, spunbond, and spunlace processes-underpin critical barrier functions in face masks, drapes, and sterile gowns by providing consistent filtration and single-use convenience. Woven constructions, including cotton, nylon, and polyester weaves, maintain durable strength and breathability for garments and reusable hospital textiles that demand repeated sterilization cycles.

Application-based segmentation further illuminates clinical focus areas. Devices designed for implantable use such as hernia meshes, scaffolds, and vascular grafts capitalize on biocompatible and bioresorbable polymers to support tissue integration. Protective apparel modalities comprise face masks, gloves, and shoe covers that rely on robust nonwoven layers to shield against pathogens. In surgical environments, drapes, gowns, meshes, and sutures must adhere to strict sterility and tensile requirements, while wound care solutions leverage adhesives, bandages, and advanced dressings to optimize healing conditions and minimize scarring.

Raw material preferences shape performance benchmarks and cost structures. Polyester, polyethylene-with high- and low-density grades-and polypropylene-available as copolymer and homopolymer-offer a spectrum of attributes, from tensile strength to hydrophobicity. End-user distinctions, meanwhile, underscore the importance of context: ambulatory centers such as diagnostic clinics and surgical centers prioritize rapid turnover and convenience, home care scenarios focus on patient comfort and ease of use, and hospital settings, whether private or public, demand scalable consistency and comprehensive compliance protocols.

This comprehensive research report categorizes the Medical Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Application

- End User

Mapping Regional Divergences and Growth Drivers Across Americas EMEA and Asia-Pacific to Inform Strategic Market Priorities

Regional dynamics in the medical textile sector illustrate how disparate drivers shape adoption patterns and competitive strategies. In the Americas, technological leadership and expansive healthcare infrastructure underpin robust demand for advanced nonwoven disposables and customized implantable solutions. This region’s emphasis on stringent regulatory approval and reimbursement mechanisms fosters a fertile environment for premium, high-performance addresses of clinical needs. Meanwhile, collaborations between research institutions and manufacturers accelerate product development cycles and reinforce a focus on patient-centric innovation.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts, particularly under the European Union’s medical device regulations, have elevated quality standards and post-market vigilance. Market participants here navigate complex multilayered approval pathways, prompting investments in comprehensive clinical validation. In parallel, shifting reimbursement landscapes and increasing focus on cost containment have stimulated demand for sustainable and reusable fabric systems that balance environmental considerations with lifecycle economics.

The Asia-Pacific region remains a pivotal production hub, leveraging competitive labor costs and mature manufacturing ecosystems. Countries across East and Southeast Asia have ramped capacity for high-volume nonwoven production, supplying global demand for disposable protection and wound care materials. At the same time, rapid urbanization and expanding healthcare access in markets such as China and India are fueling local consumption of both standard and advanced medical textile products, thereby reinforcing the region’s dual role as supplier and growth market.

This comprehensive research report examines key regions that drive the evolution of the Medical Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies Innovative Collaborations and Market Positioning of Leading Medical Textile Manufacturers Globally

A review of leading industry players highlights a spectrum of strategic approaches that underscore innovation, scale, and collaboration. Established chemical and textile conglomerates have deepened their portfolios through targeted acquisitions of specialized nonwoven manufacturers and fiber innovators. These acquisitions expand capabilities in areas such as drug-loaded fiber technologies and biodegradable scaffolds, while reinforcing global footprint and distribution channels.

Innovation partnerships between manufacturers and research universities have accelerated the translation of emerging materials into regulatory-approved products. Collaborative research centers focus on next-generation functionalities, including antimicrobial coatings, integrated sensor fabrics, and environmentally friendly resorbable polymers. In parallel, industry alliances facilitate shared investments in production excellence, developing best practices for lean manufacturing and sterile processing that enhance cost efficiency and quality consistency.

Digital transformation is another common theme among top contenders. Advanced automation, data analytics, and traceability platforms enable real-time monitoring of production lines and supply chains, ensuring compliance with evolving regulatory standards and rapid responsiveness to disruptions. Such investments not only optimize operational performance but also support new business models centered on service-driven maintenance, extended warranties, and outcome-oriented contracts that align long-term value with client success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom-Munksjö Oyj

- Asahi Kasei Corporation

- Atex Technologies, Inc.

- Avgol Nonwovens Ltd.

- B. Braun Melsungen AG

- Bally Ribbon Mills, Inc.

- Berry Global, Inc.

- Cardinal Health, Inc.

- DuPont de Nemours, Inc.

- Fitesa S.A.

- Freudenberg SE

- Kimberly-Clark Corporation

- Lohmann & Rauscher GmbH & Co. KG

- Medline Industries, L.P.

- Mölnlycke Health Care AB

- Precision Fabrics Group, Inc.

- Smith & Nephew plc

- Suominen Corporation

- Toray Industries, Inc.

Formulating Strategic Imperatives and Operational Tactics for Industry Leaders to Capitalize on Emerging Opportunities in Medical Textiles

Industry leaders seeking to harness the full potential of medical textiles must pursue a multifaceted growth strategy that integrates technological, operational, and commercial pillars. First, prioritizing research partnerships and targeted ventures with academic centers accelerates product innovation while sharing development risk. By co-developing advanced fiber systems and smart textile prototypes, organizations can position themselves at the vanguard of next-generation therapeutic solutions.

Operationally, firms should invest in flexible manufacturing platforms capable of switching between monofilament extrusion, nonwoven production, and weaving processes with minimal changeover. This agility not only mitigates tariff and supply-chain volatility but also enables rapid fulfillment of both standard catalog and customized orders. Embedding digital twin simulations and real-time analytics within these platforms further enhances yield, reduces waste, and ensures consistent compliance with regulatory requirements.

On the commercial front, aligning product portfolios with evolving healthcare models-such as value-based care and home-based therapies-expands market reach and differentiates offerings. Strategic alliances with distributors and clinical networks can facilitate direct feedback loops, ensuring rapid validation of product performance in real-world settings. Additionally, embracing sustainability credentials by integrating recycled fibers and biodegradable polymers strengthens brand reputation and meets rising demand for eco-responsible solutions.

Detailing Rigorous Research Methodology Data Collection and Analysis Approaches Underpinning Comprehensive Medical Textile Insights

The analysis underpinning these insights combines multiple layers of primary and secondary research to ensure robust and reliable conclusions. Primary data were gathered through in-depth interviews with senior executives, R&D experts, and procurement leaders across major healthcare providers, textile manufacturers, and regulatory agencies. These conversations provided nuanced perspectives on material performance, cost pressures, and adoption barriers within clinical environments.

Secondary research encompassed a systematic review of industry publications, regulatory filings, patent databases, and peer-reviewed journals to track advancements in fiber technologies, textile processing methods, and policy developments. Market intelligence reports and company disclosures supplemented this knowledge base, supplying evidence of strategic investments, product launches, and operational footprints. Complementary data sources included trade association statistics, customs records, and academic conference proceedings to triangulate trends in capacity expansion and material flows.

To ensure analytical rigor, data points were evaluated through cross-validation protocols and synthesized into thematic frameworks encompassing segmentation, regional dynamics, and competitive positioning. Consistency checks were performed at each stage to identify anomalies and verify accuracy, while sensitivity analyses gauged the influence of tariff scenarios and regulatory changes. The resulting methodology delivers a comprehensive and transparent foundation for strategic decision-making in the medical textile domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Textiles Market, by Product Type

- Medical Textiles Market, by Raw Material

- Medical Textiles Market, by Application

- Medical Textiles Market, by End User

- Medical Textiles Market, by Region

- Medical Textiles Market, by Group

- Medical Textiles Market, by Country

- United States Medical Textiles Market

- China Medical Textiles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Core Analytical Findings and Strategic Imperatives to Guide Decision Makers Through the Rapidly Evolving Medical Textile Ecosystem

At the core of this study lies the recognition that medical textiles represent both a technical frontier and a strategic linchpin for modern healthcare delivery. Advanced material platforms, enabled by nanofiber and smart textile innovations, are redefining standards for infection control, patient monitoring, and tissue regeneration. Regulatory evolutions and 2025 tariff adjustments have introduced new complexities, underscoring the need for agile supply-chain strategies and localized partnerships.

Segmentation analysis reveals distinct profiles for knitted, nonwoven, and woven solutions, each aligned with specific clinical applications ranging from implantable meshes to single-use protective apparel and wound-care systems. Raw material selection-from polyester to high-density polyethylene and copro-/homopolymers-drives both functional performance and cost dynamics. Regional assessments highlight the Americas’ innovation leadership, EMEA’s regulatory-driven quality focus, and Asia-Pacific’s manufacturing scale and market expansion potential.

Leading companies are consolidating their positions through strategic M&A, research alliances, and digital investments, setting new benchmarks for performance, compliance, and value delivery. Actionable recommendations emphasize the integration of advanced manufacturing flexibility, collaborative innovation ecosystems, and sustainability imperatives. Altogether, these findings chart a clear pathway for stakeholders aiming to navigate the evolving medical textile ecosystem with precision and foresight.

Empowering Your Strategic Growth Journey Contact Ketan Rohom to Unlock In-Depth Market Insights and Advance Your Competitive Edge in Medical Textiles

To explore how these in-depth medical textile insights can directly inform your strategic roadmap, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Collaborating with Ketan provides a tailored conversation around your unique organizational goals and challenges, ensuring that every dimension of the report aligns with your decision-making priorities. By engaging with him, you gain not only access to comprehensive data and analysis but also strategic guidance on integrating findings into product development, supply chain optimization, and market entry strategies. Don’t miss the opportunity to empower your initiatives with actionable intelligence-contact Ketan Rohom today to secure your copy of the complete medical textile market research report and unlock the competitive advantage your team needs to thrive.

- How big is the Medical Textiles Market?

- What is the Medical Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?