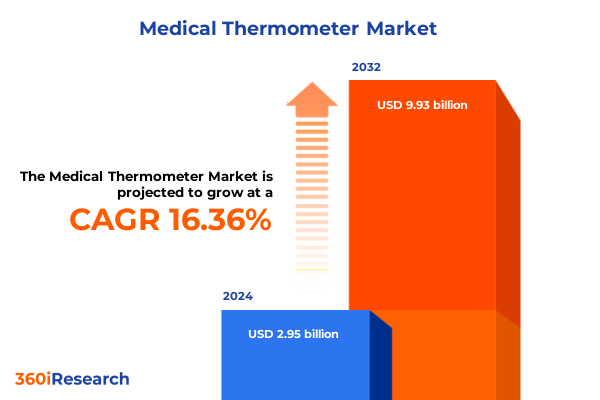

The Medical Thermometer Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 3.95 billion in 2026, at a CAGR of 16.45% to reach USD 9.93 billion by 2032.

Introducing the Evolving Dynamics of Medical Thermometry Unveiling Opportunities Shaping Healthcare Diagnostics and Consumer Wellness Trends

The medical thermometer landscape has undergone a remarkable evolution, driven by rapid advancements in sensor technologies and shifts in consumer behavior. What began as a basic clinical instrument has transformed into a multifaceted diagnostic tool, integral to both professional healthcare settings and everyday wellness monitoring. Increasing emphasis on remote patient care, coupled with heightened consumer awareness around personal health, has elevated the thermometer from an adjunctive tool to a first-line diagnostic resource. Consequently, manufacturers are under mounting pressure to deliver products that seamlessly blend accuracy, ease of use, and connectivity.

Furthermore, the post-pandemic era has accelerated digital integration within healthcare, catalyzing the adoption of non-invasive infrared and wearable devices for continuous monitoring. This transition underscores the imperative for portable, user-friendly thermometers capable of transmitting real-time data to mobile applications and electronic health records. As decision-makers chart their strategic roadmaps, understanding the converging trajectories of clinical requirements, regulatory frameworks, and consumer expectations will be paramount. This introduction sets the stage for an executive summary that unpacks these dynamics and distills actionable insights to navigate the shifting currents of medical thermometry.

Exploring Key Transformative Forces Revolutionizing Temperature Monitoring with Innovations in Sensor Technology and User-Centric Design

The medical thermometer domain is at the cusp of a transformative inflection point, fueled by heightened investment in novel sensor materials and digital ecosystems. Over recent years, gallium-based alternatives have resurfaced as safer substitutes for mercury, while digital sensors have undergone miniaturization, yielding handheld and wearable variants that cater to diverse use cases. Concurrently, infrared technology has advanced, enabling rapid, contactless temperature assessment via ear and forehead sensors with sub-second response times.

In parallel, the proliferation of telehealth platforms has intensified demand for devices that integrate seamlessly into remote monitoring frameworks. Manufacturers are now embedding Bluetooth and Wi-Fi modules into contact and non-contact thermometers, facilitating seamless data transmission for both oral, rectal, and underarm applications as well as forehead and tympanic measurements. This infusion of connectivity not only enhances clinical decision-making but also elevates patient engagement by delivering personalized health insights directly to end users. As a result, the landscape is shifting from standalone instruments to intelligent, networked ecosystems, redefining the benchmarks for accuracy, safety, and user experience.

Analyzing the Compound Effects of the 2025 United States Tariff Policies on Imported Thermometer Components and End Market Viability

The imposition of revised United States tariffs in 2025 has introduced a complex layer of cost considerations for thermometer manufacturers reliant on imported components. Critical subsystems such as infrared sensors, printed circuit boards, and specialized plastics have experienced incremental duty increases, prompting upstream suppliers and downstream assemblers to reassess their procurement strategies. These tariff adjustments have effectively redistributed cost burdens along the supply chain, compelling manufacturers to explore domestic sourcing alternatives or negotiate longer-term agreements with international partners to stabilize input prices.

Amid these pressures, some innovators have pursued strategic partnerships with North American component producers, leveraging local expertise to mitigate tariff exposure and shorten lead times. Others have invested in localized assembly operations, which has not only alleviated duty liabilities but also enhanced supply chain resilience. While certain cost escalations have been absorbed or offset through incremental price adjustments to end users, forward-looking organizations are reconfiguring their value propositions to emphasize product differentiation and service-based offerings. Ultimately, the cumulative impact of the 2025 tariffs transcends mere cost management, serving as a catalyst for operational agility and strategic collaboration.

Uncovering Core Segmentation Perspectives Highlighting Product, Technology, End User, and Distribution Variations in Thermometer Demand

In dissecting the market through the lens of product type, it becomes evident that digital thermometers-encompassing both handheld and wearable formats-continue to dominate innovation pipelines, driven by consumer preference for ease of use and integration with wellness apps. Gallium-based options have gained traction as hospitals and home users seek safer alternatives to mercury, while infrared devices, segmented into ear and forehead applications, have captured demand for rapid, non-contact readings. Within technology-based segmentation, contact modalities-spanning oral, rectal, and underarm measurement-remain foundational in clinical settings, whereas non-contact designs, particularly in forehead and tympanic configurations, have surged in popularity for their hygienic benefits and operational efficiency.

End user segmentation reveals that hospital settings, divided between general ward and intensive care units, maintain rigorous validation requirements for accuracy and durability, while clinics, including ambulatory and outpatient centers, prioritize portability and cost-effectiveness as they navigate high patient volumes. At the same time, the home segment has witnessed exponential growth as consumers embrace self-monitoring, favoring devices that offer intuitive interfaces and long-term data tracking. Distribution channel analysis highlights the symbiotic relationship between offline channels-covering pharmacy stores and supermarkets-and burgeoning online marketplaces, driven by subscription models and direct-to-consumer platforms. Together, these segmentation insights paint a comprehensive portrait of diverse market needs across multiple dimensions.

This comprehensive research report categorizes the Medical Thermometer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Distribution Channel

Revealing Regional Growth Patterns and Demand Drivers across the Americas, Europe Middle East Africa, and Asia Pacific Thermometer Markets

Regional patterns underscore the interconnected nature of demand drivers and regulatory landscapes across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, robust investment in telehealth infrastructure and well-established reimbursement pathways have catalyzed the uptake of connected thermometers in clinical and home care. Cross-border supply chain integration within North America has further optimized component availability, reinforcing the region’s position as an innovation hub.

Meanwhile, the Europe Middle East Africa region presents a heterogeneous tapestry of regulatory requirements and healthcare priorities. Western European markets demonstrate a pronounced focus on product safety and environmental sustainability, propelling gallium and digital variants, whereas emerging markets in the Middle East and Africa are characterized by price sensitivity and a preference for versatile, durable devices suited to diverse healthcare settings. In Asia Pacific, rapid urbanization and expanding middle-class cohorts have fueled demand for consumer-oriented, non-contact thermometers, with leading national manufacturers competing on features such as rapid response, battery longevity, and localized service networks. The nuanced interplay of economic, regulatory, and demographic factors across these regions informs tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Medical Thermometer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Industry Leading Organizations and Their Strategic Innovations Driving Competitive Advantage in Medical Thermometer Development

Leading organizations in the medical thermometer arena are differentiating through targeted R&D investments and strategic alliances. Key industry players are channeling resources into sensor innovation, exploring new materials and designs to enhance measurement precision and device robustness. Simultaneously, partnerships with software and data analytics firms are yielding advanced health monitoring platforms, enabling real-time alerts and predictive analytics that transcend traditional temperature logging.

In addition, several market frontrunners have established vertically integrated production facilities in strategic locations to streamline manufacturing and distribution. These integrated models facilitate just-in-time assembly, reducing inventory holding costs and enabling rapid customization for varying end user segments. The adoption of quality management systems compliant with international standards has further bolstered brand credibility and market trust, particularly within hospital and clinic applications. By combining technological differentiation with operational excellence, these prominent companies are carving sustainable competitive advantages and setting the bar for product performance and customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Thermometer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A&D Company, Limited

- American Diagnostic Corporation

- Beurer GmbH

- Braun GmbH

- Briggs Corporation

- Cardinal Health, Inc.

- Citizen Systems Japan Co., Ltd.

- Exergen Corporation

- Fairhaven Health, LLC

- Geratherm Medical AG

- Helen of Troy Limited

- Hicks Thermometers India Pvt. Ltd.

- Hill-Rom Holdings, Inc.

- Lumiscope Company, Inc.

- Mabis Healthcare, Inc.

- McKesson Corporation

- Medline Industries, LP

- Microlife Corporation

- Omron Healthcare, Inc.

- Rossmax International Ltd.

- Tecnimed srl

- Terumo Corporation

- Welch Allyn, Inc.

Proposing Actionable Strategic Initiatives to Enhance Market Positioning and Foster Sustainable Growth for Thermometer Manufacturers

To capitalize on emerging market opportunities, industry leaders should prioritize the development of modular platforms that can support both contact and non-contact measurement modes. Embedding flexible hardware architectures with upgradeable firmware will enable swift adaptation to evolving regulatory standards and feature demands. Moreover, forging alliances with logistics and distribution specialists can optimize the balance between offline and online channel penetration, ensuring rapid market access and superior after-sales support.

Furthermore, cultivating strategic partnerships with healthcare IT providers will enrich product ecosystems with value-added services such as cloud-based data analytics and remote monitoring dashboards. Such integrative solutions not only enhance patient engagement but also unlock recurring revenue streams through subscription-based models. To address tariff-induced cost pressures, manufacturers can evaluate nearshoring opportunities and co-invest in regional assembly hubs, reducing reliance on volatile import channels. Finally, a concerted emphasis on user-centered design, backed by rigorous clinical validation, will reinforce product differentiation and drive sustainable growth across diverse end user segments.

Outlining Comprehensive Methodological Approaches Ensuring Data Validity Reliability and Depth in Medical Thermometer Market Analysis

Our methodological framework combines primary and secondary research techniques to ensure robust and unbiased insights. We initiated a comprehensive literature review encompassing peer-reviewed journals, regulatory filings, and industry whitepapers, which provided foundational perspectives on technological trends and regulatory shifts. In parallel, we conducted in-depth interviews with key opinion leaders, including clinicians, procurement specialists, and technical experts, to validate market assumptions and uncover latent needs.

Quantitative data collection involved rigorous surveys distributed across hospital procurement teams, clinic managers, and consumer panels to capture usage patterns and purchase drivers. We complemented these efforts with a detailed analysis of import-export records and customs databases to quantify tariff impacts on component sourcing. To enhance data validity, we triangulated findings by cross-referencing multiple sources and applying statistical consistency checks. This multi-pronged approach, reinforced by strict adherence to industry-standard research protocols, underpins the credibility of our analysis and equips decision-makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Thermometer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Thermometer Market, by Product Type

- Medical Thermometer Market, by Technology

- Medical Thermometer Market, by End User

- Medical Thermometer Market, by Distribution Channel

- Medical Thermometer Market, by Region

- Medical Thermometer Market, by Group

- Medical Thermometer Market, by Country

- United States Medical Thermometer Market

- China Medical Thermometer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways on Market Evolution Technological Advances and Emerging Opportunities in the Broader Thermometer Landscape

The confluence of technological innovation, evolving user expectations, and regulatory dynamics has propelled the medical thermometer landscape into a new era of opportunity. Digital and non-contact infrared devices have redefined convenience and hygiene standards, while tariff-driven supply chain adaptations are prompting fresh operational models. Segment-level insights illuminate varied priorities, from high-precision requirements in hospital ICUs to intuitive designs for home monitoring, underscoring the necessity for tailored product strategies. Regionally, the maturity of Western markets contrasts with rapid adoption curves in Asia Pacific, highlighting fertile grounds for targeted expansion.

Looking ahead, the integration of artificial intelligence and predictive analytics within thermometer platforms promises to extend their utility beyond rudimentary temperature checks, enabling early detection of systemic health anomalies. As organizations navigate this dynamic environment, the alignment of innovation roadmaps with shifting end user demands and regulatory contours will be critical. Armed with a holistic understanding of these trends, stakeholders can orchestrate strategic initiatives that not only mitigate risks but also unlock new avenues for growth across the ever-evolving thermometry ecosystem.

Connecting Industry Stakeholders with Expert Insights and Tailored Research Support from Our Associate Director to Catalyze Informed Decision-Making

To secure an in-depth understanding of how evolving consumer demands and emerging technological capabilities shape the medical thermometer market, stakeholders are invited to engage directly with Ketan Rohom, our Associate Director, Sales & Marketing. By leveraging his comprehensive expertise and strategic acumen, you can obtain tailored insights that align precisely with your organization’s objectives. Partnering with Ketan guarantees access to exclusive briefings on regulatory updates, tariff analyses, and competitive benchmarking, thereby empowering your team to make informed, data-driven decisions. Reach out today to explore a full suite of deliverables, including custom market intelligence, in-depth case studies, and scenario-based forecasting models. Position your enterprise ahead of market shifts and capitalize on emerging growth pathways by initiating a dedicated consultation with Ketan Rohom now

- How big is the Medical Thermometer Market?

- What is the Medical Thermometer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?