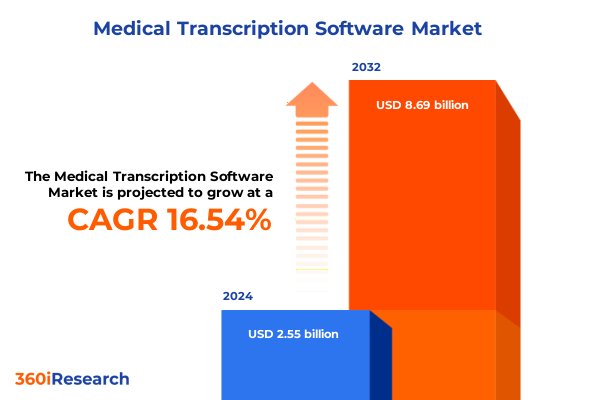

The Medical Transcription Software Market size was estimated at USD 2.95 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 16.65% to reach USD 8.69 billion by 2032.

How medical transcription software is transforming clinical documentation by driving accuracy, accelerating workflow efficiency, and strengthening data security

In today’s demanding healthcare environment, accurate and efficient clinical documentation sits at the core of patient care quality and organizational productivity. Medical transcription software has emerged as the keystone technology streamlining the arduous process of converting physician dictation and clinical notes into structured electronic records. By automating key steps that were traditionally manual and prone to error, these solutions free clinical staff to prioritize direct patient interaction and critical decision-making.

Beyond time savings, modern transcription platforms deliver advanced security measures and integration capabilities that reinforce data governance and interoperability. As electronic health record systems continue to proliferate, seamless data exchange between transcription tools and broader IT infrastructures has become a non-negotiable requirement. This convergence of workflow optimization, cybersecurity, and systems integration underscores why medical transcription software is rapidly shifting from a luxury to a strategic imperative for healthcare providers of all sizes.

Emergence of AI and cloud computing integration is redefining the medical transcription software landscape by enabling interoperability and efficiency

Over the past several years, the landscape of medical transcription has undergone a seismic transformation driven by breakthroughs in artificial intelligence and cloud computing. Speech recognition algorithms, once challenged by medical terminology and varied accents, now achieve near-human accuracy through machine learning models trained on expansive clinical datasets. Consequently, transcription engines that were once viewed as helpful assistants have evolved into core components capable of autonomously generating draft reports in real time.

Concurrently, the migration of transcription workloads to cloud environments has unlocked new levels of scalability and geographic accessibility. Providers no longer need to invest heavily in on-premise infrastructure; instead, they can deploy secure, centrally managed solutions that accommodate fluctuating demand and support remote workforces. Moreover, in the wake of telehealth expansion, the ability to capture patient encounters via integrated audio channels and route them seamlessly into transcription workflows has become a hallmark feature.

As a result of these technological shifts, the industry is witnessing a convergence of transcription and broader clinical documentation platforms. Vendors are embedding voice-enabled documentation within electronic health record systems, enabling clinicians to navigate between patient care and record generation without toggling disparate applications. This trend toward interoperability and real-time transcription marks a turning point in how medical narratives are captured, reviewed, and utilized across the continuum of care.

Escalating US tariffs on medical transcription software in 2025 are reshaping vendor pricing strategies and driving supply chain adaptations across the industry

In 2025, revised tariff schedules in the United States have begun to exert discernible pressure on the supply chains of vendors supplying medical transcription software. Components such as specialized microphones, digital audio capture devices, and imported coding modules now attract higher duties, prompting manufacturers to reassess their procurement strategies. These new cost burdens are frequently passed along the value chain, resulting in higher subscription rates or license fees for end users.

Aware of this development, leading solution providers have responded in two primary ways. First, they have intensified negotiations with domestic electronics fabricators to secure tariff-exempt alternatives. Second, some have accelerated the transition to cloud-native delivery models, which rely more heavily on homegrown data centers and software-as-a-service frameworks that mitigate exposure to hardware-related levies. As a consequence, healthcare organizations are weighing the trade-off between on-premise customization and the consistent cost profile offered by cloud subscriptions. Overall, the 2025 tariff changes have catalyzed a strategic pivot toward cloud deployments and local sourcing that will continue to shape vendor roadmaps and buyer decisions.

Segmentation analysis uncovers the influence of product offerings, technology types, end user profiles, and application areas on adoption trends

Segmenting the medical transcription software market by product offering reveals distinct adoption patterns between integrated systems and standalone software. Integrated systems, which bundle transcription tools with broader clinical documentation suites, often appeal to large hospital networks seeking streamlined procurement and unified data governance. Conversely, standalone software retains popularity among smaller practices and outsourcing firms that prioritize flexibility and selective functionality investments.

When examining technology, solutions based on speech recognition are rapidly gaining traction due to continuous improvements in voice-to-text accuracy, whereas template-based approaches maintain a foothold in highly regulated environments that demand rigid report structures and consistency. In terms of functionality, modules such as audit trails and logging have become essential for compliance, while real-time transcription features drive operational efficiency by delivering near-instant draft documents. Batch transcription remains relevant for retrospective record processing, and capabilities such as data encryption and voice file management round out the secure handling of sensitive health information.

End-user segments underscore the diverse buyer landscape. Healthcare providers and hospitals leverage these tools to alleviate administrative burden, insurance providers use them to expedite claims review, and medical education institutions apply them in research and training settings. Outsourcing companies, meanwhile, integrate multiple solutions to serve enterprise clients. Regarding deployment models, cloud-based offerings attract clients with limited IT resources by minimizing upfront investment, whereas on-premise solutions continue to serve organizations with stringent data residency requirements.

With respect to application, administrative use cases-such as appointment scheduling and billing-benefit from automated transcription of front-desk interactions, while medical documentation scenarios-encompassing clinical notes and patient records-demand precision and EHR integration to maintain continuity of care. Collectively, these segmentation insights inform targeted strategies for both vendors and buyers as they navigate feature sets, deployment preferences, and specialized needs.

This comprehensive research report categorizes the Medical Transcription Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Offering

- Technology

- Functionality

- End User

- Deployment Model

- Application

Regional analysis highlights how market drivers and adoption rates for medical transcription software vary across the Americas, EMEA, and Asia-Pacific landscapes

Across the Americas, market adoption has been propelled by large hospital networks in North America prioritizing EHR integration and regulatory compliance. Providers in the United States and Canada have invested heavily in speech-enabled transcription to improve clinician productivity and accelerate billing cycles, with an emphasis on cloud deployments that align with digital transformation initiatives.

In Europe, the Middle East, and Africa, heterogeneity in healthcare infrastructure has led to a split between well-funded markets-such as the United Kingdom and the Gulf Cooperation Council countries-that readily adopt integrated transcription platforms, and emerging economies where budget constraints favor standalone or template-based solutions. Rigorous data protection laws in Europe also elevate the demand for advanced encryption and audit trail capabilities.

The Asia-Pacific region exhibits robust growth driven by government-sponsored digital health programs, particularly in Australia, Japan, and select Southeast Asian nations. Here, real-time transcription and batch processing services are increasingly outsourced to specialized firms, while regional developers invest in localized language models to address multilingual requirements. Across all regions, cross-border partnerships and cloud-native architectures underscore the growing internationalization of the medical transcription software market.

This comprehensive research report examines key regions that drive the evolution of the Medical Transcription Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape overview reveals market positioning, innovation initiatives, and growth strategies of leading medical transcription software providers

The competitive fabric of the medical transcription software market is woven by established technology stalwarts and innovative newcomers alike. Leading providers distinguish themselves with deep expertise in speech recognition, proprietary language models, and extensive integrations with major electronic health record vendors. Their market positioning benefits from global footprints, strategic partnerships with healthcare systems, and comprehensive technical support frameworks.

Meanwhile, specialized innovators carve out niches by offering highly configurable solutions that address vertical-specific needs such as radiology, pathology, and mental health documentation. Their differentiation strategies frequently center around modular architectures that allow end users to activate only the features required for particular clinical settings. Innovation roadmaps for these players often emphasize mobile-first interfaces, voice biometrics, and AI-powered quality assurance tools to maintain accuracy standards.

Across the competitive spectrum, companies are racing to secure intellectual property around domain-specific speech models and workflow automation capabilities. Mergers and acquisitions remain commonplace as firms seek to bolster their portfolios with complementary assets-whether that be data encryption technologies, interoperability middleware, or advanced analytics dashboards. This dynamic environment compels all players to continuously refine their value propositions and accelerate time to market for new features.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Transcription Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Athreon, LLC

- DeepScribe

- Dolbey System, Inc.

- Eleos Health, Inc.

- Freed Inc.

- Google LLC by Alphabet Inc.

- Hyland Software, Inc.

- International Business Machines Corporation

- iScribes, Inc.

- Lingo solution pvt. ltd.

- Microsoft Corporation

- NextGen Healthcare, Inc.

- Nuance Communications, Inc.

- OpenText Corporation

- Oracle Corporation

- SmartMD, LLC

- Speechmatics Ltd.

- Tencent Holdings Limited

- Veradigm Inc

- Verint Systems Inc.

Strategic recommendations equip industry leaders with a roadmap for driving innovation to capitalize on emerging opportunities in medical transcription software

To maintain a competitive edge, industry leaders should prioritize investments in AI-driven transcription engines that reduce manual review workloads and support expanding terminology libraries. Embracing open APIs and certification-grade interoperability protocols will facilitate seamless integration with next-generation clinical systems and telehealth platforms, ensuring that transcription workflows remain embedded within end-to-end care pathways.

Concurrently, companies should accelerate cloud migration strategies to offer flexible subscription tiers aligned with diverse customer requirements. By standardizing on secure, multi-tenant architectures and transparent pricing models, vendors can attract organizations seeking predictable cost structures without sacrificing scalability. Simultaneously, partnership ecosystems must be cultivated with EHR providers, cybersecurity specialists, and language-model innovators to extend platform capabilities and support global market reach.

Finally, industry leaders must reinforce trust through compliance-focused enhancements such as immutable audit logs, end-to-end encryption, and role-based access controls. Clear documentation, proactive regulatory monitoring, and dedicated account-level support will differentiate providers in an increasingly security-conscious landscape. Together, these strategic actions will empower solution vendors and healthcare organizations to navigate evolving market demands and unlock the full potential of medical transcription software.

Research methodology details data collection processes, expert validation, and analytical frameworks that support our medical transcription software analysis

This analysis is built upon a rigorous methodology that combines multiple data collection approaches. Comprehensive secondary research involved reviewing publicly available filings, regulatory documentation, and corporate reports to establish a foundational understanding of market dynamics and vendor offerings. These findings were further validated through in-depth interviews with industry experts, including IT leaders at healthcare systems, transcription specialists, and solution architects.

Quantitative data were triangulated using a blend of vendor disclosures, technology usage statistics, and macroeconomic indicators to ensure consistency and reliability. Primary research insights were synthesized with qualitative assessments of emerging trends, product roadmaps, and customer feedback. This multi-pronged approach underpins the credibility of the segmentation analysis, regional perspectives, and competitive insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Transcription Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Transcription Software Market, by Product Offering

- Medical Transcription Software Market, by Technology

- Medical Transcription Software Market, by Functionality

- Medical Transcription Software Market, by End User

- Medical Transcription Software Market, by Deployment Model

- Medical Transcription Software Market, by Application

- Medical Transcription Software Market, by Region

- Medical Transcription Software Market, by Group

- Medical Transcription Software Market, by Country

- United States Medical Transcription Software Market

- China Medical Transcription Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding insights emphasize how technological advances and regulatory trends will continue to shape the future of medical transcription software

Through this executive summary, it becomes evident that medical transcription software is undergoing a period of profound transformation. Advancements in speech recognition accuracy, cloud adoption, and interoperability standards are converging to elevate transcription from a back-office task to a strategic enabler of clinical efficiency and data integrity.

The impact of regulatory shifts and supply chain recalibrations further accentuates the need for adaptable deployment models and robust security measures. Segmentation insights reveal a mosaic of user requirements that range from administrative scheduling to specialized clinical documentation, while regional dynamics highlight the varying adoption contours across global markets. Ultimately, providers that align their innovation roadmaps with these multifaceted demands, backed by a clear strategic vision and rigorous execution, will shape the future trajectory of the industry.

Partner with Ketan Rohom to access comprehensive market intelligence and empower strategic decisions in the evolving medical transcription software landscape

If you are ready to leverage the most comprehensive insights into the medical transcription software market, reach out today to discuss how you can secure the full market research report. Ketan Rohom, with extensive expertise in guiding sales and marketing strategies, is available to walk you through the report’s depth, tailored deliverables, and how our findings can directly support your strategic planning, competitive analysis, and go-to-market initiatives.

Contact Ketan Rohom to learn more about pricing, customization options, and to arrange a personalized briefing that will equip your team with the data-driven intelligence required to navigate market complexities and capitalize on the most promising growth opportunities.

- How big is the Medical Transcription Software Market?

- What is the Medical Transcription Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?