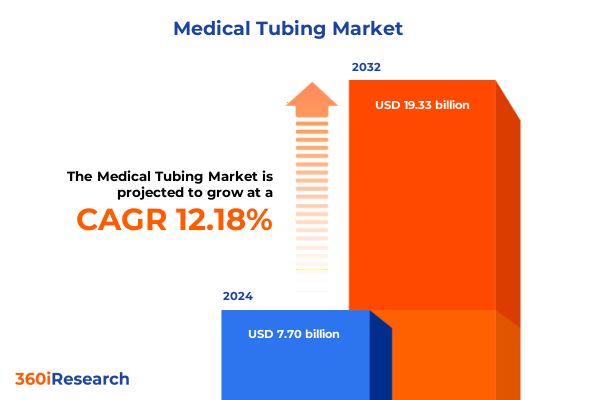

The Medical Tubing Market size was estimated at USD 8.63 billion in 2025 and expected to reach USD 9.68 billion in 2026, at a CAGR of 12.19% to reach USD 19.33 billion by 2032.

Introducing the Medical Tubing Market Dynamics Shaping Advanced Healthcare Delivery Pathways and Revolutionizing Clinical Treatment Modalities Worldwide

Introducing readers to the multifaceted world of medical tubing, this section sets the stage by illuminating the vital role of precision-engineered polymer channels across diverse clinical applications. From minimally invasive catheters that navigate complex vasculature to specialty infusion lines delivering life-sustaining therapies, tubing serves as a critical component bridging patient care with device functionality. The evolving complexity of therapeutic interventions and diagnostic procedures places heightened demands on tubing performance, driving an expanding need for enhanced biocompatibility, flexibility, and durability.

Medical tubing design has been influenced by broader shifts in healthcare, including the rising prevalence of chronic conditions, an aging population seeking outpatient services, and the adoption of advanced in-hospital treatments. These forces converge to propel innovation in materials science, regulatory compliance, and manufacturing processes. As the industry navigates cost pressures and quality imperatives, stakeholders are turning to next-generation polymers, smart manufacturing, and supply chain optimization to deliver tubing solutions that align with emerging clinical requirements and stringent safety standards.

By framing the context with clinical drivers and technological imperatives, this introduction underscores the strategic importance of understanding market dynamics. It paves the way for a deeper exploration of transformative shifts, regulatory influences, and competitive landscapes that shape the trajectory of medical tubing development and commercialization today.

Unveiling Transformative Shifts Driving Evolution in Medical Tubing Innovations Supply Chains and Clinical Adoption in Modern Healthcare Ecosystems

The medical tubing landscape is undergoing a transformation driven by converging advances in materials innovation, design engineering, and digital integration. Emerging polymers, including bioresorbable and antimicrobial formulations, are redefining performance benchmarks by offering enhanced patient safety and reduced risk of device-related complications. Alongside material breakthroughs, additive manufacturing techniques are enabling rapid prototyping and complex geometries that support personalized device configurations, accelerating time to market and improving clinical outcomes.

Simultaneously, sustainability imperatives are prompting industry leaders to reevaluate manufacturing footprints and embrace ecofriendly practices. From solvent-free extrusion methods to closed-loop recycling initiatives, companies are integrating life cycle assessments to minimize environmental impact without compromising biocompatibility or regulatory compliance. This shift toward resource efficiency is reshaping partnerships across the value chain, catalyzing collaboration between material suppliers, contract manufacturers, and end users to develop greener tubing solutions.

In addition, digital monitoring and data analytics are emerging as pivotal enablers of quality assurance and operational resilience. Real-time production data from smart extrusion lines informs predictive maintenance, reduces downtime, and ensures consistent precision in wall thickness and lumen integrity. These combined shifts in technology, sustainability, and digitalization are driving a new era of medical tubing that aligns with broader healthcare trends toward value-based care and patient-centric innovation.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Medical Tubing Supply Networks Manufacturing Costs and Sector Resilience

The introduction of elevated tariff measures by the United States in early 2025 has reverberated across the medical tubing supply chain, prompting manufacturers to reassess sourcing strategies and distribution networks. These duties, targeting a subset of imported polymer-based medical components, have amplified cost pressures and necessitated the exploration of alternative materials or domestic production capacities. As a result, companies are balancing short-term margin impacts with long-term investments in localized extrusion and molding capabilities, seeking to insulate operations from further geopolitical volatility.

Against this backdrop, stakeholder responses have varied. Some original equipment manufacturers accelerated pre-tariff procurement to hedge against price escalation, while contract manufacturers diversified supplier portfolios to include nonaffected regions. Concurrently, negotiations with raw material producers intensified, aiming to secure stable feedstock pricing through volume agreements and joint development partnerships. Such collaborative approaches have proved essential in maintaining continuity of supply for critical healthcare applications, even as regulatory landscapes continue to shift.

Moreover, the tariff-driven realignment has underscored the strategic importance of supply chain visibility and risk management. Enhanced traceability measures, encompassing full-lot tracking from polymer compounding to finished tubing extrusion, enable rapid adaptation to regulatory changes and ensure compliance with evolving import regulations. Ultimately, the cumulative impact of the 2025 tariff measures has catalyzed a more resilient, diversified, and transparent medical tubing ecosystem.

Revealing Strategic Market Segmentation Insights Spanning Material Composition End Use Manufacturing Processes Product Types and End User Profiles

Dissecting the market through multiple lenses reveals nuanced insights into material selection, end use applications, manufacturing methodologies, product typologies, and user segments. Polymers form the foundational axis of differentiation, with high density and low density polyethylene offering distinct profiles in terms of chemical resistance and mechanical flexibility. Polyurethane emerges in thermoplastic and thermoset variants, delivering optimized abrasion resistance and kink control. Rigid and soft grades of polyvinyl chloride cater to contrasting requirements for structural rigidity or lumen pliability, while high consistency and liquid silicone facilitate critical temperature stability and biocompatibility. Thermoplastic elastomers, including olefinic and styrenic formulations, bridge the gap between rubber-like elasticity and thermoplastic processability.

End use segmentation further refines value chains, spanning delivery devices such as catheter systems for interventional cardiology, dental instruments for precision oral applications, infusion lines for enteral and intravenous therapies, and ophthalmic tubing tailored to microsurgical procedures. The subdivision into angioplasty and stent delivery under interventional categories accentuates the role of tubing in high-stakes, minimally invasive contexts. Manufacturing processes bifurcate into extrusion for continuous, uniform cross-sections and molding for complex component geometries, each demanding specialized tooling and process control.

Product typologies delineate catheter tubing from extruded variants, which encompass single and multi-lumen designs, to laser welded assemblies that integrate precise joint integrity. Finally, end user segmentation highlights ambulatory care centers embracing outpatient therapies, clinics focusing on specialized procedures, home care applications emphasizing ease of use, and hospitals requiring comprehensive, regulatory-compliant solutions. This holistic segmentation framework provides stakeholders with a clear blueprint for targeting investments, innovation, and go-to-market strategies.

This comprehensive research report categorizes the Medical Tubing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- Manufacturing Process

- End Use

- End User

Exploring and Highlighting Expanding Regional Market Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Healthcare

An exploration of regional market dynamics uncovers distinct growth drivers and strategic imperatives across major geographies. In the Americas, stable reimbursement models and an established network of leading healthcare providers support the adoption of advanced tubing solutions, with domestic manufacturing hubs in North America enabling rapid product iteration and strong regulatory support. Latin American markets are experiencing incremental growth, driven by expanding private healthcare facilities and rising public investment in minimally invasive procedures.

Europe, the Middle East, and Africa exhibit a tapestry of regulatory diversity and emerging opportunities. Western European countries maintain rigorous quality standards and incentivize innovation through government-led initiatives, while Middle Eastern markets prioritize rapid infrastructure development and strategic partnerships to localize production. In Africa, rising disease burdens and improving healthcare access inspire government-led procurement programs, even as logistical and regulatory hurdles persist.

Asia-Pacific stands out as a dynamic growth frontier, propelled by expanding medical device manufacturing in China, India, and South Korea. Government-backed innovation clusters and favorable foreign investment policies attract leading polymer compounders and contract manufacturers. Simultaneously, rising healthcare spending in Southeast Asia and Australia fosters demand for premium, high-performance tubing solutions. Together, these regional narratives frame a globally interconnected yet locally nuanced market environment.

This comprehensive research report examines key regions that drive the evolution of the Medical Tubing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiled Leading Innovators Revolutionizing Medical Tubing With Strategic Alliances Cutting-Edge Technologies and Expanding Global Market Footprint

The competitive landscape is defined by leading medical device corporations and specialized contract manufacturers driving innovation in polymer science and precision extrusion technologies. One prominent player leverages a robust portfolio of catheter and infusion solutions, underpinned by proprietary polymer blends that deliver enhanced material consistency and biocompatibility. Another innovator focuses on advanced extrusion platforms, offering modular production lines capable of producing multi-lumen designs and laser welded assemblies with micron-level tolerances.

Specialty suppliers of silicone and thermoplastic elastomer compounds have emerged as critical partners, co-developing next-generation formulations that balance flexibility, chemical resistance, and sterilization compatibility. These collaborations often culminate in integrated manufacturing models, where raw material expertise dovetails with in-house extrusion or molding capabilities to accelerate product development cycles. Meanwhile, global contract manufacturers are expanding capacity in strategic regions to offer end-to-end solutions, blending quality certifications with scalable throughput for both premium and economy-tier devices.

This network of differentiated competencies spans advanced materials, precision engineering, and geographic reach, enabling stakeholders to align with partners that best suit their clinical application requirements and commercialization timelines. As competitive dynamics continue to evolve, organizations that integrate technological strength with global operational agility will command the most significant influence in the medical tubing sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Tubing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Compagnie de Saint-Gobain S.A.

- DUKE Extrusion

- Fresenius SE & Co. KGaA

- Freudenberg SE

- Inter Primo A/S

- LVD Biotech

- Mistubishi Chemical Corporation

- Nipro Corporation

- Nordson Corporation

- Smiths Group plc

- Teleflex Incorporated

- Terumo Corporation

Delivering Actionable Recommendations to Industry Leaders for Capturing Growth Opportunities in Medical Tubing Through Innovation and Operational Excellence

To capitalize on emerging opportunities and navigate evolving industry dynamics, leaders should prioritize the development of advanced polymer formulations that address the dual imperatives of performance and regulatory compliance. Investing in research collaborations with material scientists and academic institutions can accelerate the creation of bioresorbable or antimicrobial tubing, differentiating product portfolios in fiercely competitive markets. Concurrently, implementing digital quality controls and predictive maintenance systems in extrusion and molding lines will enhance process reliability and reduce time to market.

Supply chain resilience must remain a strategic focus, with organizations diversifying raw material sourcing across low-risk geographies and strengthening partnerships with logistics providers to ensure uninterrupted delivery of critical components. Collaborative frameworks, such as joint innovation agreements with key suppliers and end users, will foster long-term alignment and shared risk mitigation. Moreover, expanding presence in high-growth regional markets through local manufacturing footprints or strategic alliances can capture new revenue streams and adhere to evolving import regulations.

Finally, stakeholders should adopt sustainability as a core tenet of product development, integrating closed-loop recycling for polymer waste and leveraging life cycle assessments to communicate environmental credentials to customers and regulators. By combining material innovation, operational excellence, and strategic partnerships, industry leaders will secure a competitive edge and build enduring value in the medical tubing domain.

Illustrating Rigorous Research Methodology Employed in Medical Tubing Analysis Through Comprehensive Primary Interviews and Secondary Data Triangulation

This analysis is grounded in a rigorous research framework that synthesizes qualitative and quantitative insights to ensure a comprehensive understanding of the medical tubing landscape. Primary research consisted of structured interviews with senior executives from polymer suppliers, contract manufacturers, original equipment manufacturers, and healthcare providers, uncovering decision criteria, innovation pipelines, and procurement strategies. Feedback from clinical experts and regulatory consultants enriched the perspective on compliance trends and material performance in real-world applications.

Secondary research encompassed a detailed review of industry publications, patent filings, regulatory databases, and company filings to validate primary insights and map competitive activity. Data triangulation techniques were employed to reconcile information from diverse sources, ensuring consistency and accuracy across material compositions, application trends, and supply chain dynamics. This cross-referencing process was complemented by process benchmarking and site visits to leading manufacturing facilities.

The combined methodology offers stakeholders a robust, transparent foundation for strategic decision-making, delivering actionable intelligence on technological advancements, regulatory influences, competitive positioning, and regional market nuances. By adhering to best practices in research rigor and validation, this report provides a trusted resource for guiding investments and innovation trajectories in the medical tubing sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Tubing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Tubing Market, by Material

- Medical Tubing Market, by Product Type

- Medical Tubing Market, by Manufacturing Process

- Medical Tubing Market, by End Use

- Medical Tubing Market, by End User

- Medical Tubing Market, by Region

- Medical Tubing Market, by Group

- Medical Tubing Market, by Country

- United States Medical Tubing Market

- China Medical Tubing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing Key Takeaways and Strategic Imperatives for Stakeholders to Navigate Growth in the Evolving Medical Tubing Market Landscape

In conclusion, the medical tubing domain stands at a pivotal juncture, shaped by material innovations, digitalization, regulatory shifts, and geopolitical influences. Strategically crafted polymer solutions, underpinned by advanced manufacturing processes and sustainability initiatives, are redefining performance thresholds and opening new clinical frontiers. The 2025 tariff landscape has illuminated the importance of supply chain resilience, while segmentation insights and regional dynamics underscore the need for tailored approaches in targeting applications and geographies.

Leading enterprises that integrate robust research partnerships, agile operations, and forward-looking material development will position themselves as catalysts for transformative change across healthcare delivery. By embracing the actionable recommendations outlined herein-ranging from innovation in polymer science to diversification of sourcing and heightened process automation-stakeholders can secure long-term value and maintain a competitive advantage. The insights distilled in this executive summary form a strategic blueprint for navigating complexity and capturing growth in an ever-evolving sector.

Ultimately, the convergence of technology, regulation, and clinical demand presents an unparalleled opportunity for industry leaders to drive improved patient outcomes, optimize supply networks, and deliver sustainable, high-performance tubing solutions on a global scale.

Engage with Ketan Rohom Associate Director Sales Marketing to Unlock Comprehensive Medical Tubing Market Insights and Secure Your Customized Research Report

To access unparalleled depth and precision in medical tubing insights tailored to your strategic objectives, we invite you to engage with Ketan Rohom Associate Director Sales Marketing. Ketan brings a wealth of industry acumen and will guide you through a customized journey of market intelligence, ensuring your organization harnesses the full potential of this evolving sector. Reach out today to secure complete access to the comprehensive research report and position your team at the forefront of innovation and competitive differentiation in the medical tubing landscape.

- How big is the Medical Tubing Market?

- What is the Medical Tubing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?