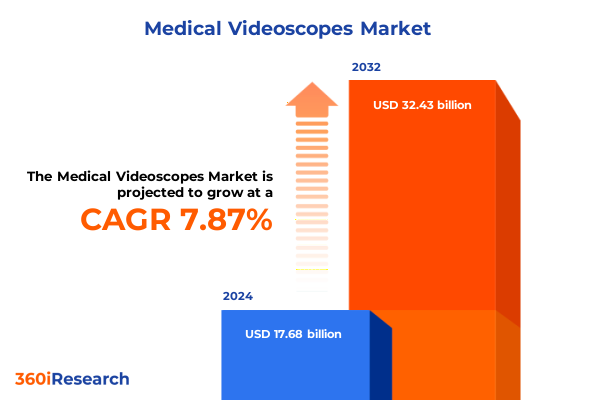

The Medical Videoscopes Market size was estimated at USD 18.99 billion in 2025 and expected to reach USD 20.40 billion in 2026, at a CAGR of 7.94% to reach USD 32.43 billion by 2032.

Groundbreaking innovations in medical videoscopes are reshaping minimally invasive care with AI, wireless systems, and enhanced imaging technologies

Medical videoscopes have become indispensable in today’s landscape of minimally invasive diagnostics and surgery, where precision and visibility directly influence patient outcomes. Advanced optics, coupled with high-definition and 4K imaging systems, deliver unparalleled clarity during endoscopic procedures, empowering clinicians to detect subtle tissue anomalies that traditional instruments might miss. At the same time, wireless data transmission and cloud-based platforms enable seamless integration of procedural footage into electronic medical records, fostering better collaboration among multidisciplinary teams and accelerating clinical decision-making. These breakthroughs mark a departure from earlier generations of scopes, positioning medical videoscopes at the forefront of transformative healthcare technologies.

Concurrently, evolving device configurations such as single-use versus reusable models reflect a broader shift toward safer, more cost-effective practices. Single-use videoscopes, which predominantly feature one working channel and leverage CMOS camera sensors, mitigate cross-contamination risks and eliminate the need for complex reprocessing protocols. Conversely, reusable designs often include dual-channel capabilities and sturdier optics, meeting the demands of high-volume centers that prioritize long-term value and reduced per-procedure expenses. As practitioners balance the trade-offs between disposability and durability, the industry continues to innovate, integrating features that optimize procedural efficiency while upholding the highest standards of patient safety.

Emerging technologies and shifting business models are redefining the medical videoscopes landscape through AI, disposables, and seamless data integration

The medical videoscopes landscape is experiencing transformative shifts driven by converging technological and operational imperatives. Artificial intelligence algorithms now assist in real-time image analysis, flagging potential lesions or anatomical landmarks that could escape the human eye. This AI-enabled guidance enhances diagnostic confidence and streamlines workflows, allowing clinicians to devote more attention to complex therapeutic decisions. Simultaneously, the proliferation of disposable, single-use scopes aligns with heightened regulatory focus on infection control, reducing reprocessing costs and eliminating sterilization bottlenecks that previously constrained procedure throughput. Together, these developments underscore a move toward smarter, safer devices that adapt to evolving clinical protocols.

In parallel, the integration of wireless connectivity and modular design has redefined the scope of medical videoscope use. Wireless video transmission untethers surgeons from fixed carts, fostering greater freedom of movement in operating rooms where sterility zones are critical. Modular camera heads and interchangeable insertion tubes support rapid customization, enabling practitioners to switch between rigid laparoscopes and flexible bronchoscopes using the same processing unit. These innovations reduce capital expenditures on multiple consoles and simplify maintenance, yielding a leaner equipment footprint without compromising imaging performance. As healthcare providers grapple with budgetary pressures and space constraints, these agile solutions are poised to become indispensable assets in modern procedural suites.

Widespread United States tariffs in 2025 are generating significant cost pressures and supply chain disruptions across the medical videoscope industry

United States tariffs introduced in early 2025 have introduced significant cost pressures across the medical videoscope industry. The new regime includes a baseline 10% duty on most imports, with elevated rates for specific trading partners such as China, Europe, Malaysia, and Vietnam. Industry associations including AdvaMed and the American Hospital Association have emphasized the disproportionate impact on medical technology, given the historically low‐tariff profile of humanitarian devices. As manufacturers brace for increased import costs, many have announced plans to diversify supply chains or absorb duties in the short term to shield healthcare providers from price hikes that could threaten patient access.

At a company level, GE Healthcare forecasts a $500 million tariff burden in 2025, driven primarily by bilateral levies on devices sourced from China. This mid-year spike, projected at nearly $200 million in the third and fourth quarters, has already prompted strategic shifts toward localized production and supplier diversification for 2026 and beyond. While analysts anticipate a one-time earnings adjustment, they also underscore the potential for restored growth once these mitigation plans take effect. In this environment, manufacturers must weigh near-term margin pressures against the long-term benefits of reshoring critical component assembly, a strategic pivot that could insulate the industry from future trade volatility.

Comprehensive segmentation analysis reveals distinct opportunities in videoscope product types, applications, operation modes, and end user requirements

A nuanced segmentation framework reveals how manufacturers can target specific market niches by aligning product features with clinical needs. Within the product type dimension, flexible videoscopes-offered in dual-channel and single-channel configurations-cater to specialties such as gastroenterology and pulmonology by delivering enhanced maneuverability and simultaneous therapeutic access. In contrast, rigid videoscopes designed for arthroscopy, laparoscopy, and otolaryngology provide robust imaging performance and structural integrity crucial for precision interventions in joint spaces and body cavities.

Beyond product types, distinctions in mode of operation underscore operational priorities: disposable scopes appeal to facilities prioritizing infection control and streamlined procedure turnover, whereas reusable devices serve high-volume centers seeking to optimize lifecycle costs. Application segmentation further refines targeting, as scopes specialized for ENT procedures leverage narrow-band imaging for mucosal visualization, while those designed for urology and gastrointestinal applications incorporate tailored illumination and angulation to navigate the genitourinary tract and digestive system, respectively. End-user considerations complete the matrix, with ambulatory surgery centers demanding compact, portable systems, diagnostic centers focusing on integrated reporting solutions, hospitals requiring scalable, networked platforms, and specialty clinics emphasizing device customization and service agreements. By intersecting these segmentation axes, industry players can prioritize R&D investments, marketing strategies, and distribution models to maximize alignment with evolving clinical workflows.

This comprehensive research report categorizes the Medical Videoscopes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mode Of Operation

- Application

- End User

Regional dynamics are driving divergent growth trajectories for medical videoscopes across the Americas, EMEA, and Asia-Pacific healthcare markets

Regional dynamics are shaping divergent growth pathways for medical videoscopes across the Americas, Europe, the Middle East & Africa, and Asia-Pacific. In the Americas, a robust network of ambulatory surgery centers and diagnostic facilities drives demand for portable, cost-effective solutions. At the same time, domestic manufacturers are accelerating near-shoring initiatives in response to tariffs, supported by government incentives designed to bolster onshore production of critical medical devices. This confluence of cost containment and policy support is fostering a competitive environment that rewards agility and supply chain resilience.

In Europe, the Middle East, and Africa, regulatory harmonization under the European Medical Device Regulation (MDR) is elevating quality standards and driving market consolidation among established players. Tariffs on EU exports, projected at up to 20% in certain scenarios, could disrupt the inflow of high-margin endoscopic technologies, compelling manufacturers to reevaluate pricing strategies and local partnership models. Meanwhile, Middle Eastern healthcare investments are expanding procurement volumes, presenting opportunities for product localization and extended service contracts. Across Africa, nascent healthcare infrastructure improvements are gradually increasing access to minimally invasive diagnostics, albeit from a smaller base.

Asia-Pacific represents a dual frontier of manufacturing leadership and growing clinical demand. China and India’s domestic production ecosystems continue to scale, offering lower‐cost alternatives that challenge incumbents in price-sensitive segments. At the same time, rising incidence of chronic diseases and expanding hospital networks in Southeast Asia and Australia are fueling greater adoption of advanced videoscope systems. Companies that navigate this complex landscape by balancing export capabilities with local market strategies stand to capture significant share in one of the world’s fastest-growing medtech regions.

This comprehensive research report examines key regions that drive the evolution of the Medical Videoscopes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry leadership in medical videoscopes is anchored by established giants and agile innovators advancing global endoscopy capabilities and supply chains

Industry leadership in medical videoscopes is anchored by established giants and agile innovators that continuously advance endoscopy capabilities and supply chain configurations. Olympus Corporation commands a dominant global position, holding roughly 70 percent of the world’s endoscope market and leveraging deep expertise in optics, image processing, and service networks. Its exclusively medical product portfolio benefits from high-definition and 3D endoscopic systems that set industry benchmarks for image clarity and procedural versatility.

Karl Storz SE & Co. KG stands out as a family-owned pioneer with a diverse portfolio spanning flexible and rigid scopes, accessories, and integrated operating room platforms. The company’s €2.18 billion revenue base and extensive global manufacturing footprint enable rapid supply chain responses and investments in emerging technologies such as fluorescence imaging and robotic endoscopy. Beyond these market leaders, a competitive cohort-featuring Stryker, Boston Scientific, Medtronic, Fujifilm, Smith & Nephew, Richard Wolf, Conmed, and Pentax Medical-drives innovation through targeted acquisitions, strategic alliances, and focused R&D. This dynamic ecosystem fosters ongoing technological breakthroughs while intensifying the race for value-based solutions across multiple geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Videoscopes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CONMED Corporation

- FUJIFILM Holdings Corporation

- HOYA Corporation

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Welch Allyn, Inc.

Strategic actions can empower industry leaders to harness technological advances, mitigate trade risks, and capture emerging market potential in videoscopes

Industry leaders can seize competitive advantage by adopting a multi-pronged strategy that aligns technology investments with emerging regulatory and trade landscapes. Prioritizing AI-driven image analysis and modular system architectures will enhance clinical workflows, reduce cognitive load for practitioners, and support future software upgrades without full hardware replacements. Concurrently, expanding the range of disposable videoscopes will address infection control mandates and capture opportunities in outpatient settings where procedural throughput and turnaround times are critical.

To mitigate tariff-related disruptions, manufacturers should accelerate near-shoring initiatives and establish strategic alliances with local contract development and manufacturing organizations. This approach not only reduces exposure to trade volatility but also leverages regional incentives and shortens lead times for spare parts and consumables. Finally, fostering partnerships with healthcare providers to co-develop customized service bundles-spanning training, maintenance, and digital health integration-can differentiate offerings and build long-term loyalty in an increasingly outcomes-focused environment. By executing these recommendations, industry players can future-proof their portfolios and capitalize on the robust demand for minimally invasive diagnostic and therapeutic solutions.

Robust research methodology underpins the market insights through extensive secondary research, expert engagements, and rigorous data validation processes

This analysis integrates comprehensive secondary research and primary engagements to ensure robust and objective market insights. Secondary sources-including peer-reviewed publications, regulatory filings, and reputable industry news outlets-provided foundational data on technological trends, tariff impacts, and regional dynamics. In parallel, in-depth interviews were conducted with key opinion leaders, supply chain executives, and clinicians to validate assumptions, enrich contextual understanding, and uncover emerging use cases.

Data triangulation methods were applied to reconcile divergent estimates from public databases, corporate disclosures, and expert feedback. Segmentation frameworks were tested against real-world procurement data from healthcare facilities across multiple regions. Quality checks and peer review processes guaranteed consistency and accuracy, while sensitivity analyses assessed the potential effects of alternative tariff scenarios and adoption curves. Any identified limitations-such as evolving regulatory developments or unforeseen geopolitical events-are transparently documented, ensuring the study’s findings maintain clarity and applicability for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Videoscopes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Videoscopes Market, by Product Type

- Medical Videoscopes Market, by Mode Of Operation

- Medical Videoscopes Market, by Application

- Medical Videoscopes Market, by End User

- Medical Videoscopes Market, by Region

- Medical Videoscopes Market, by Group

- Medical Videoscopes Market, by Country

- United States Medical Videoscopes Market

- China Medical Videoscopes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding synthesis highlights critical takeaways and strategic imperatives for stakeholders navigating the evolving medical videoscopes ecosystem

By weaving together technological, regulatory, and market forces, this executive summary illuminates the current and future state of the medical videoscopes industry. Innovations in 4K imaging, AI integration, and wireless connectivity are propelling devices toward new frontiers of procedural precision and clinical efficiency. Meanwhile, tariff pressures and segmentation nuances underscore the importance of agile supply chain strategies and targeted product portfolios. Regional insights highlight distinct growth trajectories shaped by policy environments, local manufacturing capacities, and healthcare infrastructure imperatives.

Looking ahead, stakeholders who balance deep clinical understanding with strategic foresight-embracing digital health, expanding disposable offerings, and forging local partnerships-will be best positioned to capitalize on the rising demand for minimally invasive diagnostics and therapeutics. These core takeaways serve as guideposts for manufacturers, healthcare providers, and investors seeking to navigate the evolving videoscope ecosystem, driving improved patient outcomes and sustained business success.

Engage with Ketan Rohom to access comprehensive market insights and drive informed decision-making in the medical videoscope domain today

We invite you to explore our comprehensive report and unlock a deeper understanding of the medical videoscopes market by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights that address your unique business challenges, ensuring you can leverage the report’s findings to enhance competitive positioning and operational efficiency. By initiating a conversation, you’ll gain access to supplementary data, personalized consultations, and exclusive previews of key analysis sections that align with your strategic priorities.

Take the next step toward informed decision-making and sustained growth by contacting Ketan today. His team stands ready to facilitate your purchase, provide immediate responses to your inquiries, and deliver the actionable intelligence you need to stay at the forefront of medical videoscope innovation. Elevate your market strategy now by partnering with Ketan Rohom and securing this indispensable resource for your organization

- How big is the Medical Videoscopes Market?

- What is the Medical Videoscopes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?