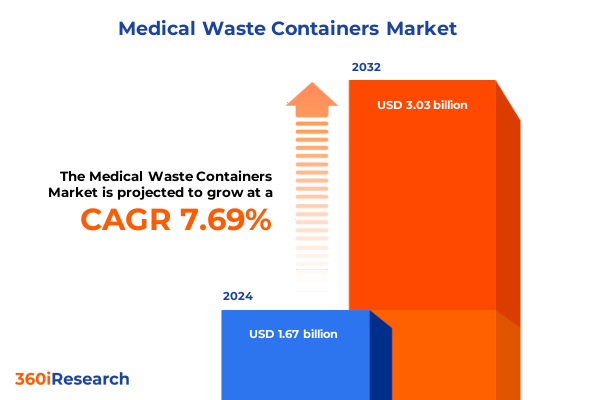

The Medical Waste Containers Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 1.88 billion in 2026, at a CAGR of 7.93% to reach USD 3.03 billion by 2032.

Setting the Stage for Understanding the Integral Role of Modern Medical Waste Containers in Healthcare Safety and Sustainability

With healthcare systems continually evolving under the pressures of regulatory mandates, environmental sustainability, and operational efficiency, understanding the medical waste containers market has never been more critical. This analysis unveils the integral role these containers play in maintaining public health safeguards and enabling healthcare providers to meet stringent disposal guidelines. From the anatomy of container design to the lifecycle considerations that influence procurement decisions, this introduction frames the report’s broader exploration of the intersection between safety, innovation, and compliance.

As healthcare institutions confront mounting volumes of biohazardous, pharmaceutical, and radioactive waste, container technologies have advanced beyond simple receptacles. Innovations in material sciences and containment mechanisms now offer enhanced durability, leak resistance, and traceability, helping organizations minimize contamination risks and optimize waste segregation workflows. By setting the stage with an examination of market drivers-ranging from infection control imperatives to sustainability ambitions-this section lays the groundwork for a deeper dive into the transformative shifts, tariff impacts, segmentation dynamics, and regional variances that define today’s market landscape. It also highlights the critical need for decision-makers to leverage data-driven strategies in container selection to achieve both safety objectives and cost efficiencies.

Unveiling the Intersection of Technological Innovation and Sustainability Driving Next Generation Medical Waste Container Solutions

Healthcare delivery is undergoing a profound transformation driven by technological breakthroughs and heightened environmental concerns. In recent years, container manufacturers have introduced smart systems incorporating IoT sensors and RFID tagging to provide real-time visibility into waste volumes and pick-up schedules, reducing overflows and elevating compliance reporting. Simultaneously, the shift toward more sustainable materials has spurred the development of containers utilizing biodegradable polymers and additive manufacturing techniques, reducing carbon footprints without compromising structural integrity.

These innovations are complemented by an industry-wide move toward circular economy principles, where reusable containment solutions-enabled by rigorous sterilization protocols-are gaining traction among high-volume generators such as hospitals and large laboratories. This has reshaped supplier-customer relationships, creating opportunities for service-oriented models that bundle container provision with maintenance, collection, and disposal services. Furthermore, digitization of regulatory documentation has streamlined audits and accelerated turnaround times for waste management approvals, underscoring how technological convergence and environmental stewardship together redefine competitive differentiation in this sector.

Examining the Multifaceted Consequences of 2025 Tariffs on Component Sourcing and Supply Chain Resilience for Medical Waste Containers

The introduction of new United States tariffs in early 2025 has imposed additional cost pressures on imported plastic and metal components critical to medical waste container production. These duties have translated into upward cost adjustments across the supply chain, prompting domestic manufacturers to reassess sourcing strategies and explore local supplier partnerships. While domestic capacity expansion offers a buffer against price volatility, it also necessitates capital investments in tooling, quality assurance systems, and regulatory certifications to meet FDA and EPA compliance requirements.

Conversely, the tariff environment has accelerated regional reshoring initiatives, encouraging manufacturers to establish production facilities closer to end-user markets. This proximity reduces lead times and mitigates currency exposure, albeit at the expense of initial capital expenditures and workforce training. In parallel, some international suppliers have responded by relocating operations to duty-friendly jurisdictions to maintain competitiveness. As a result, healthcare institutions must navigate a complex landscape of shifting lead times, evolving supplier capabilities, and cost implications, emphasizing the need for strategic procurement planning that anticipates regulatory adjustments and secures continuity of supply.

Revealing Critical Differentiators across Product Types, Waste Categories, Container Models, End-User Demands, and Purchase Channels

The product landscape for medical waste containers spans from robust biohazard receptacles to specialized chemotherapy and pharmaceutical waste collectors, alongside containers designed to comply with Resource Conservation & Recovery Act mandates. Each category reflects distinct performance requirements-from chemical resistance to precise leak containment-requiring manufacturers to tailor material formulations and design features accordingly. When viewed through the lens of waste type, containers optimized for general medical waste diverge significantly from those engineered to isolate infectious or radioactive materials, demanding rigorous validation protocols and specific labeling conventions.

Considering category segmentation, the disposable segment dominates high-volume, low-duration use cases such as outpatient clinics, whereas reusable containment solutions are increasingly adopted by large hospitals and research institutes seeking to reduce operational costs over extended periods. End-user analysis further reveals that academic research institutes and diagnostic laboratories prioritize precision and traceability, while hospitals and private clinics emphasize ease of use and integration with existing waste management workflows. Pharmaceutical and biotechnology companies, by contrast, demand containers certified for high-purity applications often integrated into closed-loop waste disposal systems. Finally, the sales channel dynamic shows offline distributors retaining prominence among traditional buyers, even as online procurement platforms rapidly gain acceptance by offering streamlined ordering, volume pricing, and expedited logistics.

This comprehensive research report categorizes the Medical Waste Containers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Waste Type

- Category

- End User

- Sales Channel

Analyzing Regional Variations in Regulatory Drivers, Procurement Trends, and Technological Adoption across Major Global Markets

In the Americas, advanced regulatory frameworks and high per-capita healthcare expenditure have fostered adoption of cutting-edge container technologies, with major health systems investing in smart tracking and closed-loop waste programs. Conversely, emerging markets within Latin America show a growing appetite for cost-effective disposable solutions, driven by the need to comply with evolving environmental directives while managing budget constraints.

Across Europe, Middle East & Africa, stringent regulations such as the EU’s Waste Framework Directive have catalyzed demand for reusable containers and waste minimization initiatives, leading to partnerships between local governments and manufacturers to standardize best practices. Meanwhile, in the Middle East, rapid healthcare infrastructure expansion in hubs like the Gulf Cooperation Council region underpins a rising requirement for advanced containment solutions.

The Asia-Pacific region presents a dual landscape: in mature markets such as Japan and Australia, end-users emphasize automation and data integration, whereas in Southeast Asia and India, growth is anchored in scalable, cost-efficient disposables that meet baseline regulatory standards. Collectively, these regional variances underscore the need for market participants to calibrate offerings to local compliance regimes, economic environments, and healthcare delivery models.

This comprehensive research report examines key regions that drive the evolution of the Medical Waste Containers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying the Strategic Pillars of Market Leaders and Niche Innovators Driving Competitive Advantage in Medical Waste Containment

Leading container manufacturers have differentiated themselves through investments in research and development, expanding portfolios to include smart sensor-enabled systems and eco-friendly material formulations. Firms that have prioritized quality certifications-such as ISO 9001 for quality management and ISO 13485 for medical devices-enjoy elevated trust among healthcare providers navigating complex procurement vetting processes. Furthermore, companies with vertically integrated production capabilities, spanning resin compounding to final assembly, demonstrate stronger resilience against component shortages and tariff-driven cost fluctuations.

Strategic alliances between container producers and waste disposal service providers have emerged as a notable trend, enabling end-to-end solutions that bundle container supply with collection, treatment, and compliance reporting. This integrated model not only enhances customer convenience but also generates recurring revenue streams through service contracts. Additionally, nimble innovators focusing on niche segments-such as oncology centers requiring chemotherapy waste containment-are capturing market share by offering specialized designs that address unique safety and handling protocols. These diverse approaches illustrate how competitive positioning hinges on the intersection of product differentiation, service integration, and operational stability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Waste Containers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aesculap, Inc. by B. Braun company

- Alleva Medical Ltd.

- Becton, Dickinson, And Company

- Bemis Manufacturing Company

- Biosigma S.p.A.

- Bondtech Corporation

- Bright Technologies Ltd.

- Cardinal Health Inc.

- COMECER S.p.A. by ATS Company

- Daniels Sharpsmart, Inc.

- DDC Dolphin Ltd

- ELITE BAGS, S.L.

- EnviroTain, LLC

- FL MEDICAL s.r.l.

- GPC Medical Ltd.

- Génia

- Henry Schein, Inc.

- MarketLab, Inc.

- MAUSER Group

- Medtronic PLC

- Milian SA

- Sharps Medical Waste Services

- Snyder Industries, Inc.

- Staples Professional Inc.

- Terra Universal, Inc.

- Thermo Fisher Scientific, Inc.

Empowering Stakeholders with Targeted Strategies to Optimize Sustainability, Supply Chain Agility, and Digital Integration

Industry leaders should prioritize investments in circular containment solutions and digital monitoring platforms to reduce total cost of ownership and meet escalating sustainability mandates. By forging partnerships with local resin suppliers and precision molding specialists, manufacturers can mitigate tariff exposure while shortening lead times for critical components. At the same time, healthcare administrators are advised to adopt centralized procurement frameworks that leverage volume commitments to negotiate favorable contract terms encompassing container supply and disposal services.

To harness the benefits of data-driven waste management, organizations must integrate container tracking outputs into enterprise resource planning and environmental, health, and safety systems, enabling real-time analytics that inform operational adjustments. Collaborative pilot programs between providers and regulators can further refine best practices for sterilization protocols related to reusable containers, enhancing lifecycle performance. Finally, stakeholders across the ecosystem should convene in industry working groups to harmonize labeling standards and digital interface specifications, ensuring interoperability and streamlining audit processes.

Detailing a Rigorous Multi-Method Research Framework Anchored in Primary Interviews and Comprehensive Secondary Analysis

This report synthesizes insights derived from a multi-tiered research approach encompassing primary interviews with procurement executives, environmental health officers, and design engineers spanning healthcare institutions, container manufacturers, and regulatory bodies. Supplementing these qualitative inputs, secondary research involved a comprehensive review of publicly available technical standards, regulatory guidelines, patent filings, and academic publications to validate emerging technology trends and compliance frameworks.

Quantitative analysis was conducted through the aggregation of procurement data, shipment records, and import-export statistics, enabling the identification of supply chain shifts induced by tariff changes. To ensure robust triangulation, responses from primary interviews were cross-checked against secondary data, and any discrepancies were reconciled through follow-up inquiries. The research methodology also incorporated scenario-based modeling to assess the implications of regional regulatory variations on container selection criteria, ensuring that the findings reflect a holistic and objective evaluation of market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Waste Containers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Waste Containers Market, by Product

- Medical Waste Containers Market, by Waste Type

- Medical Waste Containers Market, by Category

- Medical Waste Containers Market, by End User

- Medical Waste Containers Market, by Sales Channel

- Medical Waste Containers Market, by Region

- Medical Waste Containers Market, by Group

- Medical Waste Containers Market, by Country

- United States Medical Waste Containers Market

- China Medical Waste Containers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Market Evolution Through the Lens of Innovation, Regulatory Dynamics, and Segmentation-Driven Strategies

The evolution of the medical waste containers market is characterized by a convergence of technological innovation, environmental stewardship, and regulatory complexity. Containers have transitioned from passive receptacles to active components within an integrated waste management ecosystem, driven by IoT advancements and sustainable material initiatives. At the same time, high-stakes procurement decisions are increasingly influenced by tariff environments and supply chain resilience considerations, underscoring the strategic importance of localized manufacturing and supplier diversification.

Segmentation analysis highlights the necessity for manufacturers and buyers to align container features with specific waste types and end-user requirements, while regional insights emphasize the diversity of compliance landscapes and infrastructure capabilities. Leading firms combine product differentiation with service integration to establish compelling value propositions, but the opportunity for collaboration remains vast, especially in harmonizing digital standards and sterilization best practices. Ultimately, organizations that proactively adapt to these market shifts-through data-driven decision-making and targeted partnerships-will secure sustainable advantages in this essential segment of healthcare operations.

Empower Your Strategic Vision with Expert Guidance from Ketan Rohom to Secure the Definitive Medical Waste Containers Market Report

Ready to elevate your organization’s waste management protocols with unparalleled insights into the medical waste containers landscape? Reach out today to secure your copy of the industry’s most comprehensive analysis and gain a competitive edge in regulatory compliance and operational efficiency. For immediate assistance and personalized guidance, contact Ketan Rohom, Associate Director, Sales & Marketing, to discuss tailored packages, volume discounts, and enterprise solutions that align with your strategic priorities. Don’t miss out on critical intelligence that will inform your strategic roadmap and drive measurable impact across your operations.

- How big is the Medical Waste Containers Market?

- What is the Medical Waste Containers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?