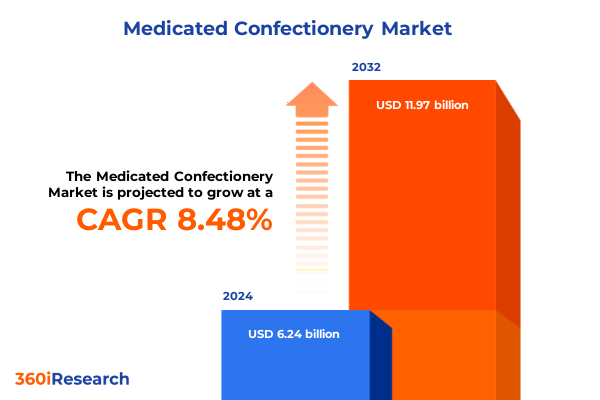

The Medicated Confectionery Market size was estimated at USD 6.73 billion in 2025 and expected to reach USD 7.28 billion in 2026, at a CAGR of 8.57% to reach USD 11.97 billion by 2032.

Navigating the Future of Medicated Confectionery: A Professional Overview of Opportunities, Health Trends, and Market Dynamics Shaping the Industry Landscape

The convergence of consumer wellness priorities and innovative confectionery formats has positioned medicated confections as a pivotal segment within the broader health and wellness industry. Modern consumers seek solutions that blend therapeutic efficacy with convenient, enjoyable consumption experiences. In response, manufacturers are reformulating traditional candy vehicles to incorporate active ingredients ranging from herbal extracts to pharmaceutical actives and essential vitamins. As these products transition from niche offerings to mainstream self-care options, they demand a rigorous analysis of evolving consumer expectations and industry capabilities.

This executive summary provides a professional orientation to the dynamic medicated confectionery space, highlighting critical trends, regulatory shifts, and stakeholder strategies. It underscores the imperative for industry participants to understand the intersection of formulation science, regulatory compliance, and consumer preferences. By examining the synergies between product innovation and market adoption, decision-makers can identify actionable pathways for product development, distribution optimization, and consumer engagement.

Revolutionary Shifts in Medicated Confectionery: How Innovation in Ingredients, Consumer Behavior, and Distribution Channels Is Redefining Patient Wellness

The medicated confectionery landscape is undergoing a profound transformation driven by breakthroughs in ingredient functionality, supply chain agility, and digital engagement. As personalization gains traction, manufacturers are leveraging data analytics to tailor formulations that address specific health needs such as cough relief, digestive support, and sleep enhancement. Concurrently, advances in encapsulation and time-release technologies enable more precise dosing and faster onset of action, elevating consumer confidence in efficacy.

At the same time, distribution channels have expanded beyond traditional pharmacies to include online direct-to-consumer platforms and subscription models, facilitating seamless replenishment and targeted marketing campaigns. Social media communities and influencer partnerships are amplifying product discovery and driving trial among health-conscious demographics. This shift underscores the importance of omnichannel strategies that integrate e-commerce, brick-and-mortar presence, and digital health platforms to maximize reach and enhance patient adherence.

Layered Trade Measures Shaping U.S. Medicated Confectionery Imports: Unpacking Section 301, IEEPA, and Reciprocal Adjustments Impacting 2025 Supply Chains

Medicated confectionery imports into the United States continue to navigate a complex trade environment characterized by multiple layers of duties and reciprocal adjustments. Products classified under Harmonized Tariff Schedule chapter 17, specifically HS code 1704 for sugar confectionery, face standard most-favored-nation duties; however, imports from China remain subject to additional Section 301 tariffs ranging from 7.5% to 25% in response to unfair trade practices. These measures, originally implemented to address intellectual property concerns, have persisted through 2025, significantly elevating landed costs for Chinese-origin candies and gummies.

In February 2025, the U.S. President invoked the International Emergency Economic Powers Act to impose a supplemental 10% ad valorem tariff on all goods from the People’s Republic of China, including medicated confectionery, citing public health and national emergency considerations related to synthetic opioid trafficking. This additional layer compounded existing Section 301 duties, intensifying cost pressures on importers and prompting many to reevaluate supply chain strategies.

Subsequently, a high-profile reciprocal tariff adjustment took effect on May 14, 2025, reducing the ad valorem rate on Chinese imports from 120% to 54% as part of a 90-day mutual agreement, though Section 301 and synthetic opioid-related levies remained unchanged. This interim concession provided temporary relief but underscored the volatility of the regulatory landscape and the need for ongoing policy monitoring.

Amid these developments, the Office of the U.S. Trade Representative announced a three-month extension of certain product exclusions from Section 301 tariffs, effective June 1 through August 31, 2025, allowing select medicated confectionery lines to enter the market without punitive duties. Despite these targeted relief measures, the cumulative tariff burden has driven many companies to diversify sourcing, seek supplier partnerships in tariff-free regions, and increase in-house manufacturing capacity to preserve margins and ensure consistent product availability.

In-Depth Segmentation Insights Revealing How Active Ingredients, Product Types, Applications, End Users, and Distribution Channels Drive Market Dynamics

A nuanced understanding of market segmentation is essential for capitalizing on emerging consumer demands within medicated confectionery. In formulations anchored by active ingredients, herbal extracts such as eucalyptus and licorice are gaining prominence due to their perceived natural efficacy, while menthol remains a steadfast option for symptomatic relief. Pharmaceutical actives continue to underpin high-potency products, complemented by vitamin fortification to support daily wellness routines. This diversity in active compounds enables brands to target needs as varied as cough suppression, pain management, and immune support.

The diversity of product types-from chewing gum and gummies to hard candies and lollipops-drives differentiation in dosage form, sensory appeal, and convenience. Innovations in soft chew textures and sugar-free hard lozenges cater to both taste preferences and dietary restrictions. In practice, cough relief offerings are segmented to address adult and pediatric populations, ensuring age-appropriate dosing and flavor profiles that balance efficacy with palatability.

End users span adults seeking on-the-go wellness solutions, children who require safe and enjoyable dosage forms, and seniors prioritizing ease of chewing and functional support. Distribution channels are equally diverse, ranging from convenience stores and supermarkets to online retailers and pharmacies. Among pharmacy outlets, chain and independent operators play distinct roles in driving professional recommendations and building consumer trust. By weaving insights across these dimensions, industry stakeholders can refine product portfolios and channel strategies to meet segmented needs and maximize market penetration.

This comprehensive research report categorizes the Medicated Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor

- Application

- End User

- Distribution Channel

Critical Regional Perspectives on Medicated Confectionery Demand and Growth Patterns Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the evolution of medicated confectionery, as geographic preferences and regulatory environments shape product portfolios and distribution strategies. In the Americas, robust demand for immunity-boosting gummies and sugar-free lozenges reflects a broad wellness orientation, supported by strong retail networks and digital health initiatives. North American players are at the forefront of integrating botanical supplements and probiotic formulations to meet shifting consumer priorities.

Across Europe, the Middle East & Africa, regulatory stringency around health claims and ingredient approvals necessitates rigorous compliance frameworks and scientific substantiation. This has spurred the proliferation of clean-label certified products and clinical trial partnerships that underpin marketing credibility. Meanwhile, premium pricing models in Western Europe coexist with price-sensitive strategies in emerging EMEA markets, requiring tailored value propositions.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes are accelerating the adoption of medicated confectionery, particularly in markets such as Japan and South Korea where functional gummies are mainstream. The integration of traditional herbal remedies with modern dosage forms drives innovation pipelines, and regional e-commerce platforms facilitate swift market entry. As a result, Asia-Pacific serves both as an incubator for experimental formulations and a critical growth frontier for global brands.

This comprehensive research report examines key regions that drive the evolution of the Medicated Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles in Medicated Confectionery: Examining Key Players’ Innovations, Collaborations, and Competitive Positioning in 2025

Leading companies within the medicated confectionery segment are leveraging strategic partnerships and cross-functional expertise to accelerate innovation. Major global consumer goods firms are collaborating with pharmaceutical entities to co-develop novel formulations, while specialized contract manufacturers are scaling up soft chew and lozenge capabilities in response to surging OEM demand. This collaborative ecosystem enables faster product launches and diversified supply chain footprints.

Innovation leaders are differentiating through ingredient science, securing exclusive agreements for patented actives and exploring next-generation delivery systems such as fast-dissolve films embedded within lollipops. Companies are also investing in digital health platforms that integrate product usage data with telehealth services, fostering stronger brand engagement and patient adherence. These digital ventures not only enhance clinical outcomes but also generate first-party data to inform ongoing R&D.

On the competitive front, mid-size players are carving out niche positions by focusing on specialty applications, such as pediatric-friendly formulations and organic botanical chewables. These targeted approaches, supported by agile marketing and e-commerce strategies, allow smaller firms to capture market share in under-served segments. Collectively, the interplay of global giants, innovative startups, and CMO specialists drives a dynamic competitive landscape centered on consumer trust, regulatory compliance, and technological differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medicated Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.L.Simpkin & Co. Ltd.

- Baker Perkins Limited by Schenck Process Group

- Bartek Ingredients Inc.

- BCH (Rochdale) Ltd

- Cipla Limited

- Cloetta AB

- Creasy Foods Ltd.

- Dabur Ltd.

- Enorama Pharma AB

- Ernest Jackson Ltd.

- Ferrara Candy Company, Inc.

- G. R. Lane Health Products Ltd.

- Haleon plc

- Herbion International Inc. by Kehkashan Group

- Himalaya Wellness Company

- Lofthouse of Fleetwood Ltd.

- Lozen Pharma Pvt. Ltd.

- Lozy's Pharmaceuticals, S.L.

- Mastix Medica, LLC by GelStat Corporation

- Mondelez International, Inc.

- Nestlé S.A.

- Nutrafol by Unilever PLC

- Perrigo Company PLC

- Prestige Consumer Healthcare Inc.

- PRINCE SUPPLICO

- Reckitt Benckiser Group PLC

- Ricola Group AG

- Syntegon Technology GmbH

- Tereos S.A.

- The Procter & Gamble Company

- UHA Mikakuto Co.Ltd.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Supply Chains, and Enhance Consumer Engagement in Medicated Confectionery

To harness the burgeoning potential of medicated confectionery, industry leaders should prioritize a triad of strategic levers focused on innovation, supply chain resilience, and consumer engagement. First, investing in advanced formulation platforms that support time-release technologies and low-temperature extrusion will enable the development of differentiated products with demonstrable efficacy. Coupled with rigorous clinical validation, these innovations can substantiate health claims and streamline regulatory approvals.

Second, diversifying manufacturing and sourcing footprints is essential to mitigate tariff-driven cost escalations and global supply disruptions. Establishing co-manufacturing partnerships in tariff-exempt regions while retaining critical active ingredient synthesis in regulated jurisdictions will balance cost efficiency with quality assurance. Real-time trade compliance monitoring systems should be deployed to adapt swiftly to evolving tariff regimes.

Third, enhancing omnichannel consumer experiences through integrated digital platforms will drive brand loyalty and elevate patient adherence. Personalized loyalty programs, AI-powered recommendation engines, and telehealth integration can transform one-off purchases into ongoing therapeutic engagements. By aligning product innovation with seamless customer journeys, companies can unlock recurring revenue streams and reinforce their leadership positions in this fast-evolving market.

Rigorous Multimethod Research Methodology Underpinning the Medicated Confectionery Market Analysis: Ensuring Data Integrity, Reliability, and Comprehensive Insight

This report adopts a multimethod research methodology, integrating primary qualitative interviews with industry executives, formulation scientists, and regulatory experts to capture real-time insights into innovation trajectories and compliance imperatives. Secondary data sources include regulatory filings, patent databases, and trade policy announcements, which were systematically analyzed to map tariff implications and identify supply chain vulnerabilities.

Quantitative analysis draws upon proprietary transactional data from retail and e-commerce platforms, augmented by consumer survey data collected via online panels to assess purchase drivers and brand sentiment. A micro-segmentation approach was applied to evaluate active ingredient preferences, dosage form adoption, and distribution channel performance across demographic cohorts. Triangulation of these data streams ensures robust validation of market patterns and emerging trajectories.

All data points underwent rigorous quality checks, including outlier detection and consistency verification against historical industry benchmarks. Insights were peer-reviewed by an advisory council comprising pharmaceutical consultants and market intelligence experts to affirm methodological integrity and strategic relevance. This comprehensive approach underpins the credibility of the findings and the actionable guidance provided herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medicated Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medicated Confectionery Market, by Product Type

- Medicated Confectionery Market, by Flavor

- Medicated Confectionery Market, by Application

- Medicated Confectionery Market, by End User

- Medicated Confectionery Market, by Distribution Channel

- Medicated Confectionery Market, by Region

- Medicated Confectionery Market, by Group

- Medicated Confectionery Market, by Country

- United States Medicated Confectionery Market

- China Medicated Confectionery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Synthesis of Medicated Confectionery Market Evolution: Integrating Strategic Insights to Illuminate Future Opportunities and Challenges for Stakeholders

The medicated confectionery segment stands at a critical inflection point, propelled by the convergence of consumer wellness priorities, disruptive formulation technologies, and dynamic trade policies. The analysis herein reveals a market that is both resilient and adaptive, with stakeholders poised to deliver differentiated products that meet ever-evolving health needs. The interplay of segmented insights, regional nuances, and competitive strategies provides a cohesive foundation for informed decision-making.

Looking ahead, sustained success will depend on the capacity to innovate responsibly, navigate complex regulatory landscapes, and foster meaningful consumer relationships. Companies that integrate advanced scientific approaches with agile supply chain frameworks and digital engagement platforms will be best positioned to capture emerging growth opportunities. This report offers a strategic compass for market participants aiming to lead in the medicated confectionery domain, translating deep analysis into practical actions that drive value and enhance patient outcomes.

Empower Your Strategic Decisions Today: Contact Ketan Rohom, Associate Director of Sales & Marketing, to Secure the Definitive Medicated Confectionery Market Intelligence Report

Ready to elevate your strategic planning with unparalleled market intelligence? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how the comprehensive medicated confectionery report can drive your business forward. Secure your copy today to gain immediate access to the insights that will inform your next strategic move and deliver a competitive edge in the evolving market landscape.

- How big is the Medicated Confectionery Market?

- What is the Medicated Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?