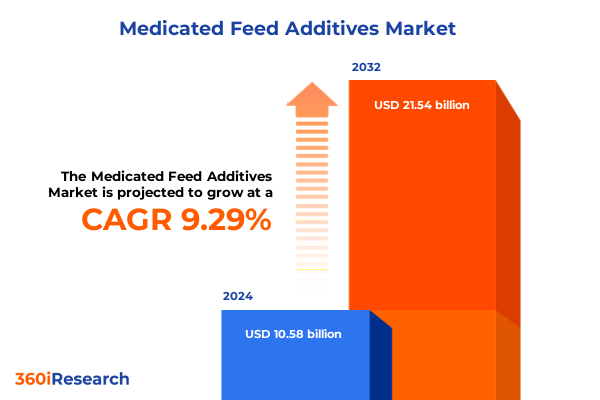

The Medicated Feed Additives Market size was estimated at USD 11.58 billion in 2025 and expected to reach USD 12.46 billion in 2026, at a CAGR of 9.26% to reach USD 21.54 billion by 2032.

Unveiling the Critical Role and Growing Significance of Medicated Feed Additives in Modern Animal Nutrition and Health Management

Medicated feed additives represent a cornerstone in modern livestock nutrition, combining therapeutic and nutritional functionalities to safeguard animal health and optimize production outcomes. These additives encompass an array of active ingredients-from antibiotics and antioxidants to coccidiostats, enzymes, minerals, and vitamins-formulated into animal diets to prevent disease, enhance growth performance, and supplement essential nutrients. By integrating these specialized compounds into feed, producers not only bolster herd health and productivity but also address emerging challenges such as pathogen resistance and nutrient absorption efficiency.

A robust regulatory framework governs the development, distribution, and use of medicated feeds across key markets. In the United States, the Veterinary Feed Directive (VFD) mandates that medically important antimicrobials in feed be authorized by a licensed veterinarian, thereby restricting use to therapeutic applications and eliminating growth-promotion claims as of January 1, 2017. In the European Union, stringent measures under the Veterinary Medicines Regulation have curtailed prophylactic antibiotic inclusion and spurred a 62% reduction in veterinary antibiotic usage since antibiotic growth promoter bans, reflecting heightened scrutiny over antimicrobial resistance.

Amid these regulatory pressures, the role of medicated feed additives has expanded beyond disease treatment to encompass precision nutrition and performance optimization. Enzyme inclusion, for instance, has seen global adoption rates climb by nearly 18% as producers seek to improve digestibility and feed conversion ratios. This dual focus on animal welfare and production efficiency underscores the strategic importance of medicated feed additives within integrated livestock operations.

Exploring Pivotal Transformative Shifts Reshaping the Medicated Feed Landscape Through Technology Innovation Regulation and Consumer Demand

The medicated feed additives landscape is undergoing a profound transformation propelled by regulatory shifts, technological innovation, and evolving consumer expectations. Regulatory constraints against antibiotic growth promoters have catalyzed a pivot toward natural antibacterial solutions, with plant-derived compounds like oregano oil and citrus extracts achieving 15–20% pathogen reduction rates on Dutch poultry farms, illustrating the efficacy of phytogenic blends under stringent EU export standards. In parallel, the global market has witnessed a surge in probiotic and prebiotic incorporation, leveraging beta-glucans and other immunomodulatory polysaccharides to enhance gut health and resilience in livestock.

Innovation in feed technology has also redefined the parameters of additive delivery. Automated dosing systems, now operational on over 2,300 large-scale farms, enable real-time monitoring and precision distribution of medicated feeds, thereby minimizing dosage variability and ensuring consistent therapeutic outcomes. Concurrently, advances in fermentation biotechnology have scaled single-cell protein production, offering a sustainable, high-quality protein alternative sourced from microbial substrates and agricultural by-products.

Sustainability imperatives have further driven exploration of alternative protein sources. Insect-based feeds and micro-algae formulations are gaining traction, with insect farming demonstrating minimal land and water requirements while delivering essential amino acids and omega-3 fatty acids for aquaculture and livestock applications. These transformative shifts underscore a broader industry realignment toward integrated solutions that balance regulatory compliance, environmental stewardship, and performance-driven nutrition.

Comprehensively Assessing the Cumulative Impact of United States Tariffs on Medicated Feed Additives and Supply Chains Through 2025

United States trade policies have imposed enduring tariffs on imported feed additives, significantly influencing supply chain dynamics and cost structures through 2025. The Section 301 tariffs on Chinese imports, initiated between 2018 and 2019, continue to apply at rates up to 25% on categories including industrial feed materials, thus elevating input costs for U.S. producers reliant on imported intermediates. Moreover, a 20% levy introduced under the International Emergency Economic Powers Act (IEEPA) on March 4, 2025 further intensified trade barriers for key feed components sourced from China, compelling ingredient diversification and domestic substitution strategies.

Despite the overarching tariff framework, selective exclusions have buffered certain feed imports. China’s extension through February 2025 of Section 301 exclusions for whey and fishmeal designated for feed applications temporarily alleviated duties on those lines, underscoring the volatility of trade reprieves and the imperative for supply chain agility. Nonetheless, the cumulative burden of tariffs on intermediate goods reached 54.5% of total additional costs incurred under Section 301 provisions, underscoring the disproportionate impact on production inputs versus finished goods.

These trade measures have driven strategic shifts across the value chain: manufacturers are reevaluating sourcing from diversified geographies, investing in domestic ingredient capacity, and recalibrating cost models to preserve margin integrity. This evolution underscores the dual challenge of navigating policy-driven cost pressures while sustaining supply reliability and operational resilience.

Revealing Key Segmentation Insights to Illuminate How Product Type Form Animal and Application-Based Divisions Drive Medicated Feed Additive Strategies

Segmentation analysis of the medicated feed additives market reveals nuanced insights into product category imperatives and end-user preferences. By type, the market encompasses a spectrum of functional ingredients, from broad-spectrum antibiotics-subdivided into ionophores, macrolides, and tetracyclines-to performance enhancers such as antioxidants, coccidiostats, enzymes, minerals, and vitamins. Each type addresses distinct physiological targets, whether controlling coccidiosis, optimizing oxidative balance, or supplementing essential micronutrients to fortify animal health and growth.

Beyond composition, form factor influences application versatility and handling efficiencies, with granules, liquids, and powders offering differentiated benefits in terms of feed mixing, stability, and administration. Animal type further stratifies demand, as aquaculture operations increasingly prioritize water-soluble additives for uniform dispersion, cattle producers invest in mineral fortification to support rumen function, poultry integrators leverage coccidiostat blends for avian disease control, and swine facilities rely on tailored antibiotic and enzyme regimens to enhance gut health.

Application-centric segmentation underscores the multifunctional role of medicated feeds: formulations targeting disease prevention integrate therapeutic agents and immune stimulants to mitigate morbidity risks, growth promotion blends combine nutrient-dense carriers with metabolic enhancers to accelerate weight gain, and nutrient supplementation packages deliver concentrated vitamins and minerals to address physiological deficits. This multifaceted segmentation framework informs product development strategies, enabling suppliers to fine-tune formulations that align with specific operational goals and regulatory mandates.

This comprehensive research report categorizes the Medicated Feed Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Animal Type

- Application

Uncovering How Americas Europe Middle East and Africa and Asia Pacific Regional Dynamics Shape the Medicated Feed Additive Market

Regional dynamics shape the trajectory of medicated feed additive utilization, reflecting divergent regulatory frameworks, production systems, and growth catalysts across major global markets. In the Americas, stringent residue monitoring and antimicrobial stewardship initiatives coexist with a robust expansion of non-antibiotic alternatives, driven by both federal guidelines and retailer commitments to antibiotic-free meat. Producers in North and South America are rapidly adopting phytogenic and probiotic blends to meet consumer expectations while ensuring compliance with evolving feed mill licensing requirements under U.S. and Canadian jurisdictions.

The Europe, Middle East, and Africa region presents a mosaic of regulatory rigor and market adaptation. European markets, guided by the Veterinary Medicines Regulation, have phased out antibiotic growth promoters, catalyzing innovation in mycotoxin management, enzyme dosing precision, and novel coccidiostat chemistries. Meanwhile, Middle Eastern feed integrators focus on enhancing livestock resilience under arid conditions through mineral and vitamin fortification, and African operations explore cost-effective enzyme and probiotic solutions to bolster productivity amid resource constraints.

In the Asia-Pacific, rapid growth in aquaculture and poultry consumption drives surging demand for medicated feed additives tailored to high-density production. Vitamin enrichment programs in Southeast Asian shrimp farms address disease susceptibility, while enzyme-assisted formulations optimize feed conversion in intensive poultry operations across China and India. These regional distinctions underscore the importance of localized product strategies and distribution networks attuned to regulatory, environmental, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Medicated Feed Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Strategies and Innovations Steering Competitive Momentum in the Global Medicated Feed Additives Sector

Leading industry participants are deploying targeted strategies to sustain competitive differentiation and capture emerging opportunities in the medicated feed additives sector. Companies such as DSM and BASF are intensifying R&D investments in phytogenic and enzyme technologies, partnering with academic institutions to accelerate proof-of-concept studies and secure proprietary delivery systems. Concurrently, Novus International and Elanco are advancing precision nutrition platforms that integrate digital monitoring with tailored additive dosing, enhancing transparency and traceability across the feed supply chain.

Strategic collaborations and acquisitions are reshaping the competitive landscape. Zoetis has expanded its portfolio through alliances with biotechnology start-ups specializing in alternative proteins, while Cargill has integrated targeted coccidiostat solutions into its animal nutrition portfolio, leveraging global distribution capabilities to accelerate market penetration. These moves illustrate a broader trend of consolidation and value chain integration, as companies seek to offer end-to-end nutrition and health solutions that transcend traditional additive formulations.

Moreover, emerging players are capitalizing on niche segments, introducing tailored offerings for minor species and specialty livestock. By focusing on under-served applications-ranging from aquaculture-specific immunostimulants to ruminant trace mineral blends-these entrants are challenging incumbents and driving incremental innovation, underscoring the sector’s dynamic competitive intensity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medicated Feed Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo

- Ajinomoto Co. Inc.

- Alltech, Inc.

- Archer Daniels Midland Company

- BASF SE

- Boehringer Ingelheim Animal Health GmbH

- Cargill, Incorporated

- Ceva Santé Animale S.A.

- Chr. Hansen Holding A/S

- Elanco Animal Health Incorporated

- Evonik Industries AG

- Huvepharma EOOD

- International Flavors & Fragrances Inc.

- Jubilant Ingrevia Limited

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Land O'Lakes, Inc.

- Merck & Co., Inc.

- Novonesis Group

- Novus International, Inc.

- Nutreco N.V.

- Phibro Animal Health Corporation

- Virbac SA

- Zagro Group

- Zoetis Inc.

Delivering Actionable Recommendations to Empower Industry Leaders to Navigate Regulatory Technology and Market Evolution in Medicated Feed Additives

To navigate the complex intersection of regulatory change, supply chain volatility, and evolving customer demands, industry leaders should prioritize investment in alternative additive research, particularly in non-antibiotic modalities such as phytogenics, probiotics, and single-cell proteins. By channeling resources into pilot trials and efficacy studies, organizations can validate novel formulations, secure regulatory approvals, and position themselves ahead of enforcement trends that discourage prophylactic antibiotic use.

Simultaneously, companies must deepen engagement with digitalization initiatives, deploying real-time monitoring systems and predictive analytics to optimize dosage accuracy, minimize waste, and enhance compliance reporting. Integrating these capabilities with comprehensive traceability frameworks not only improves operational efficiency but also reinforces brand credibility among healthcare authorities and end consumers expecting transparency in animal production.

Finally, establishing strategic partnerships across the value chain-from upstream raw material suppliers to downstream integrators and end users-will foster resilient, regionally attuned supply networks. Collaborative frameworks can streamline product localization, share regulatory intelligence, and co-develop targeted marketing approaches, ensuring that medicated feed solutions are aligned with both global performance benchmarks and local market nuances.

Detailing a Rigorous Research Methodology Underpinning Insights into Medicated Feed Additive Market Dynamics and Strategic Analysis

This analysis draws upon a structured research methodology combining extensive secondary research with targeted primary inputs and rigorous validation protocols. Secondary research encompassed global regulatory repositories, industry publications, and peer-reviewed studies to map regulatory trends, tariff developments, and technological advancements. These inputs were synthesized to develop a comprehensive understanding of market drivers, competitive dynamics, and innovation trajectories.

Primary research included in-depth interviews with feed mill executives, veterinary nutritionists, and regulatory experts across key regions. These qualitative engagements provided firsthand perspectives on application challenges, adoption barriers, and emerging solution priorities. Data triangulation methods cross-referenced interview findings with publicly available data, ensuring consistency and mitigating bias.

Quantitative analysis incorporated tariff schedules, trade flow statistics, and functional additive usage rates to model cost impacts and segmentation performance. All metrics were validated through multiple sources to confirm reliability. The final insights were reviewed by an advisory panel of industry veterans to ensure robustness, relevance, and actionable applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medicated Feed Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medicated Feed Additives Market, by Type

- Medicated Feed Additives Market, by Form

- Medicated Feed Additives Market, by Animal Type

- Medicated Feed Additives Market, by Application

- Medicated Feed Additives Market, by Region

- Medicated Feed Additives Market, by Group

- Medicated Feed Additives Market, by Country

- United States Medicated Feed Additives Market

- China Medicated Feed Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusions on Medicated Feed Additive Trends Industry Challenges and Strategic Imperatives for Future Growth and Sustainability

The medicated feed additives market stands at a strategic inflection point, shaped by intensified regulatory scrutiny, the imperative for sustainable alternatives, and the accelerating pace of technological innovation. Key segments-from antibiotics and coccidiostats to enzymes and vitamins-are being recalibrated to meet stringent global standards and shifting consumer preferences. Meanwhile, trade policies and tariff frameworks continue to influence supply chain configurations and cost structures, driving supply diversification and domestic capacity building.

Regional dynamics underscore the critical need for market-specific strategies, as producers in the Americas, Europe, Middle East, Africa, and Asia-Pacific navigate distinct regulatory and environmental contexts. Industry leaders are responding through enhanced R&D collaborations, digitalization investments, and strategic alliances that foster resilient, localized solutions. These strategic imperatives highlight the importance of integrated approaches that balance compliance, performance, and sustainability.

As the sector evolves, organizations that proactively embrace innovation in non-antibiotic alternatives, optimize additive delivery through advanced technologies, and engage collaboratively across the value chain will secure a competitive edge. This comprehensive overview offers a foundation for stakeholders to align their strategies with emerging trends and regulatory expectations, ensuring sustainable growth and operational excellence in the medicated feed additives industry.

Engage Directly with Ketan Rohom to Secure Your Comprehensive Medicated Feed Additives Market Research Report and Elevate Strategic Decision Making

Engage with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, to gain immediate access to a detailed market research report that provides unparalleled insights, comprehensive data, and actionable strategies tailored for the medicated feed additives industry. This report offers a deep dive into the latest regulatory developments, competitive dynamics, and emerging opportunities, equipping you with the intelligence needed to make informed decisions and secure a competitive edge. Reach out directly to discuss customized licensing options, gain a tailored briefing, and ensure your organization is positioned at the forefront of innovation and growth within this critical sector.

- How big is the Medicated Feed Additives Market?

- What is the Medicated Feed Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?