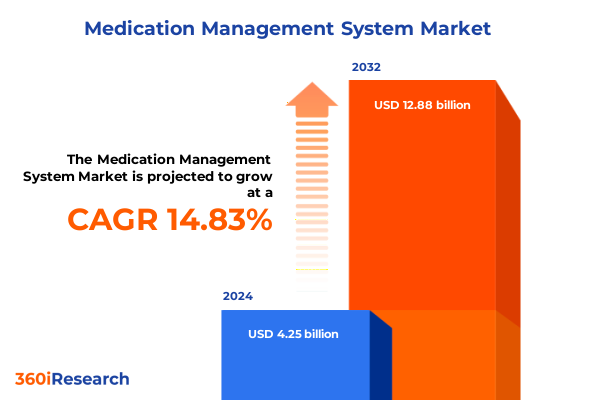

The Medication Management System Market size was estimated at USD 4.88 billion in 2025 and expected to reach USD 5.60 billion in 2026, at a CAGR of 14.85% to reach USD 12.88 billion by 2032.

Exploring the Evolution of Medication Management Systems as Pivotal Solutions for Enhancing Clinical Efficiency, Patient Safety, and Regulatory Compliance Across Care Settings

In an era defined by dynamic healthcare transformation, medication management systems have emerged as indispensable assets in optimizing patient care pathways and minimizing clinical risks. These solutions integrate cutting-edge automation, data analytics, and interoperability frameworks to ensure that medication is prescribed, dispensed, and administered with greater precision than ever before. Stakeholders across care settings now view comprehensive medication management platforms as central pillars in driving operational efficiency, elevating patient safety metrics, and achieving compliance with evolving regulatory mandates.

Against this backdrop, the introduction of advanced technologies such as artificial intelligence and cloud-native architectures has accelerated system performance, enabling real-time monitoring and predictive analytics. Healthcare organizations are actively seeking solutions that harmonize seamlessly with existing electronic health records and pharmacy management applications, fostering an ecosystem where data flows unimpeded across care teams. This shift underscores the imperative for decision-makers to understand both the technological underpinnings and the business imperatives that define the current landscape of medication management systems.

The purpose of this report is to deliver a nuanced, executive-level overview of the market’s foundational drivers, transformative shifts, and critical barriers. By examining deployment modalities, component specialization, application-specific use cases, and end-user dynamics, readers will gain a 360-degree perspective on the forces shaping technology adoption. This Introductory section sets the stage for a deep dive into tariff impacts, segmentation nuances, and actionable strategies designed to guide stakeholders in aligning technology investments with patient care objectives.

Examining the Converging Trends of Artificial Intelligence, Cloud Adoption, and Interoperable Platforms That Are Driving the Next Wave of Innovation in Medication Management Systems

Rapid technological convergence has triggered a wave of transformative shifts within the medication management system arena. First, the integration of machine learning algorithms has elevated clinical decision support, enabling systems to identify potential drug interactions and dosing errors before they reach the patient. As a result, healthcare providers can intervene proactively, reducing adverse medication events and improving overall treatment efficacy.

Simultaneously, cloud-based deployment models have gained traction, offering scalable infrastructure and cost efficiencies that on-premises solutions struggle to match. This transition empowers smaller clinics to adopt advanced functionality without extensive capital expenditure, thereby leveling the playing field and fostering broader access to state-of-the-art medication management capabilities.

Moreover, the demand for cross-platform interoperability has never been greater. Standards such as FHIR and HL7 facilitate comprehensive data exchange between pharmacy systems, electronic health records, and remote monitoring devices. This interoperability drives cohesive workflows, ensuring each stakeholder has a unified view of the medication lifecycle. Consequently, organizations that prioritize open architectures and API-driven integrations position themselves as leaders in delivering seamless patient experiences.

Finally, the rise of hybrid models-combining cloud flexibility with on-site data control-addresses lingering concerns around data privacy and regulatory compliance. By harnessing hybrid frameworks, healthcare systems can optimize latency-sensitive operations while adhering to stringent governance requirements. This balanced approach exemplifies the adaptive innovation that is reshaping the medication management market landscape.

Analyzing the Cumulative Repercussions of 2025 United States Tariff Policies on Import-Dependent Components of Medication Management Systems and Supply Chain Resilience

Recent tariff policies enacted by the United States in 2025 have introduced new headwinds for solution providers reliant on imported hardware and specialized components. Tariffs imposed under targeted trade measures affect robotics modules, barcode scanners, and server-grade processors sourced from key global suppliers. These additional duties elevate cost structures and challenge vendors to reassess sourcing strategies and supply chain resilience frameworks.

Consequently, many providers are exploring nearshoring options or forging strategic partnerships with domestic component manufacturers to mitigate exposure to fluctuating import levies. This strategic pivot not only cushions the financial impact of tariffs but also shortens delivery lead times, enhancing responsiveness to urgent client requirements. Organizations that anticipate and navigate these shifts successfully will safeguard their operational continuity and maintain competitive pricing.

Furthermore, service-oriented components of medication management solutions-such as deployment, training, and system maintenance-have become vital differentiators in an environment where hardware costs are rising. By bundling comprehensive services with software and hardware offerings, providers can deliver end-to-end value while insulating clients from direct tariff pass-throughs. Ultimately, a proactive approach to tariff-induced market adjustments will determine which vendors can sustain growth and maintain margin stability in the long term.

Dissecting Key Market Segments by Deployment Mode, Component, Application, and End User to Illuminate Strategic Opportunities for Medication Management Solutions

Understanding the nuanced segmentation of the medication management system market reveals where strategic investments and innovation opportunities reside. Deployment options range from fully cloud-based platforms that offer elastic scalability and reduced IT burden, to hybrid architectures that blend centralized data processing with on-premises control, and traditional on-premises installations favored by organizations with stringent data governance requirements. Each deployment mode demands unique IT competencies and impacts total cost of ownership considerations differently.

Within these frameworks, hardware components such as automated dispensing cabinets, barcode scanners, and robotics integrate seamlessly with sophisticated software modules that enable clinical decision support, prescription order entry, and error-reporting workflows. Meanwhile, services-including implementation consulting, training programs, and ongoing maintenance-serve as critical enablers that ensure optimal system uptime and user adoption. Software platforms themselves span modules for inventory tracking, replenishment alerts, and regulatory reporting, highlighting the layered architecture of modern medication management solutions.

Applications further segment into automated dispensing-covering bedside and pharmacy-based units-event reporting systems that manage both error reporting and regulatory submissions, real-time inventory management tools that deliver continuous stock visibility and alert triggers, and prescription management suites encompassing order entry and verification processes. End users encompass diverse care settings, from general and specialty clinics to private and public hospitals, as well as pharmacy environments including hospital and retail outlets. Recognizing these interlocking layers uncovers pathways for focused product development, targeted marketing strategies, and service differentiation.

This comprehensive research report categorizes the Medication Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- End User

Delving into Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Uncover Variations in Adoption, Regulatory Environments, and Growth Drivers

Regional dynamics play a pivotal role in shaping adoption patterns and regulatory requirements for medication management systems. In the Americas, institutions often prioritize rapid implementation cycles and integration with legacy electronic health record infrastructures. The United States, in particular, exhibits a high appetite for cloud deployments alongside stringent HIPAA compliance mandates, while Canada’s provincial regulatory frameworks introduce both alignment opportunities and jurisdictional variances that require localized strategies.

Across Europe, the Middle East, and Africa, diverse healthcare landscapes-from the mature NHS structures in the United Kingdom to emerging private networks in the Gulf-drive a spectrum of system requirements. Robust data privacy norms under GDPR elevate the importance of encryption and user-access controls, and regional interoperability initiatives aim to harmonize medication data exchange across national boundaries. Simultaneously, EMEA stakeholders increasingly view medication management as a lever for cost containment and quality assurance in both public and private sectors.

In the Asia-Pacific region, rapid healthcare digitization and growing investment in hospital infrastructure fuel demand for integrated medication management solutions. Nations such as Japan and Australia focus on advanced robotic dispensing and real-time analytics, while markets like India and Southeast Asia emphasize modular deployments that align with budget constraints and scaling considerations. These regional contrasts underscore the necessity for providers to tailor solutions and partnership models according to local regulatory landscapes, reimbursement frameworks, and clinical protocols.

This comprehensive research report examines key regions that drive the evolution of the Medication Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Medication Management System Providers to Highlight Strategic Initiatives, Technological Innovations, and Competitive Differentiators Driving Market Leadership

A select group of industry leaders continuously drives innovation and competitive differentiation within the medication management sector. These companies leverage extensive R&D capabilities to introduce advanced automation, predictive maintenance features, and integrated analytics dashboards. Their global footprints enable them to tailor solutions across diverse regulatory regimes and support multinational deployments.

Strategic partnerships with health systems and pharmacy chains amplify their market reach, while deep investments in cybersecurity and data privacy solidify client trust. These vendors have also demonstrated agility in navigating trade policy shifts by diversifying supplier networks and adopting modular product architectures. Equally important, their comprehensive service portfolios-from initial needs assessments to ongoing technical support-ensure seamless client onboarding and sustained user engagement.

As they continue to expand into adjacent segments, such as clinical decision support and population health management, these leading organizations set the bar for integration, scalability, and patient-centric design. Smaller, niche players complement this landscape by focusing on specialized applications-such as bedside dispensing robotics or AI-driven error-reporting algorithms-thus fostering a competitive ecosystem that benefits end users through continuous innovation and choice.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medication Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- ARxIUM Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Cerner Corporation

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Genoa Healthcare, LLC

- Hero Health, Inc.

- McKesson Corporation

- Omnicell, Inc.

- Optum, Inc.

- Swisslog Healthcare AG

- Talyst, LLC

Outlining Actionable Strategies for Industry Leaders to Capitalize on Emerging Technologies, Strengthen Supply Chains, and Elevate Patient Outcomes Through Integrated Medication Management

To capitalize on evolving market dynamics and secure long-term growth, industry leaders must pursue a series of targeted strategies. First, prioritizing robust interoperability frameworks will enable seamless integration with electronic health records and adjacent clinical systems, thus driving user adoption and reducing workflow friction. Service differentiation through customized training programs and value-based maintenance contracts will further strengthen client relationships and create recurring revenue streams.

Furthermore, companies should advance cloud-first roadmaps while maintaining hybrid options to address varying data sovereignty and performance requirements. This dual approach ensures broad accessibility for small and midsized care settings while preserving the control larger health systems demand. In parallel, investing in artificial intelligence capabilities-particularly in predictive analytics and natural language processing-can elevate safety features by proactively identifying potential medication errors and optimizing inventory management workflows.

In light of tariff-induced cost pressures, diversifying the component supply chain through regional partnerships and nearshoring initiatives will mitigate risk and stabilize pricing. Lastly, fostering a consultative sales model that emphasizes outcomes, patient safety, and return on investment will resonate with decision-makers seeking concrete value. By enacting these recommendations, organizations can navigate regulatory complexities, accelerate digital transformation, and enhance patient care outcomes.

Detailing the Comprehensive, Multi-Method Research Methodology Incorporating Primary Interviews and Secondary Literature to Ensure Robust Insights and Data Triangulation

This study employs a rigorous, multi-faceted research methodology designed to deliver both depth and reliability. Primary research involved structured interviews with senior executives, pharmacy directors, and IT leaders across healthcare providers and solution vendors to capture firsthand insights on adoption drivers, pain points, and investment priorities. These qualitative engagements were complemented by surveys targeting end users to quantify satisfaction levels, feature preferences, and deployment experiences.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory filings, industry white papers, and government trade documents relating to tariff measures and compliance standards. Data from public health agencies and interoperability consortiums provided additional context on regional regulatory trends and integration benchmarks. Triangulation between primary and secondary sources ensured consistency and mitigated potential bias, while expert validation sessions with subject matter advisors refined assumptions and interpretations.

This blended approach guarantees that the findings reflect real-world practice, incorporate the latest policy developments, and uncover emerging opportunities in the medication management system landscape. It also enables a balanced perspective that resonates with both technical stakeholders and executive decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medication Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medication Management System Market, by Component

- Medication Management System Market, by Deployment Mode

- Medication Management System Market, by Application

- Medication Management System Market, by End User

- Medication Management System Market, by Region

- Medication Management System Market, by Group

- Medication Management System Market, by Country

- United States Medication Management System Market

- China Medication Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Summarizing Core Findings and Strategic Imperatives to Guide Stakeholders in Making Informed Decisions Within the Evolving Medication Management System Ecosystem

This report has distilled critical insights across technological trends, regulatory dynamics, and market segmentation to present a holistic view of the medication management system landscape. Key takeaways underscore the transformative impact of AI-driven decision support, the strategic value of hybrid and cloud deployment models, and the necessity of supply chain resilience in the face of tariff fluctuations.

The analysis reveals how nuanced segmentation-ranging from bedside dispensing to order verification-uncovers targeted innovation pathways, while regional considerations highlight the imperative for localized compliance and adaptation. By synthesizing these facets, stakeholders can craft informed strategies that align with clinical objectives, regulatory mandates, and financial imperatives.

In conclusion, the evolving medication management market warrants proactive engagement with emerging technologies and collaborative partnerships to drive patient safety and operational excellence. Organizations that harness the insights provided herein will be well-positioned to navigate complexity, capitalize on growth opportunities, and deliver superior care experiences.

Engage with Ketan Rohom Today to Unlock In-Depth Intelligence and Tailored Insights from Our Definitive Medication Management System Market Research Report

To discover the complete findings, connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the comprehensive medication management system market research report. Establish a tailored engagement that aligns with your organization’s strategic goals and gain exclusive access to in-depth analysis, competitor benchmarking, and actionable insights designed to inform your next move. This bespoke consultation will clarify how emerging innovations, regulatory dynamics, and region-specific drivers converge to shape future growth trajectories. Don’t miss the opportunity to harness expert guidance and data-driven recommendations that can accelerate decision-making and empower your team to seize competitive advantages in this fast-evolving market.

- How big is the Medication Management System Market?

- What is the Medication Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?