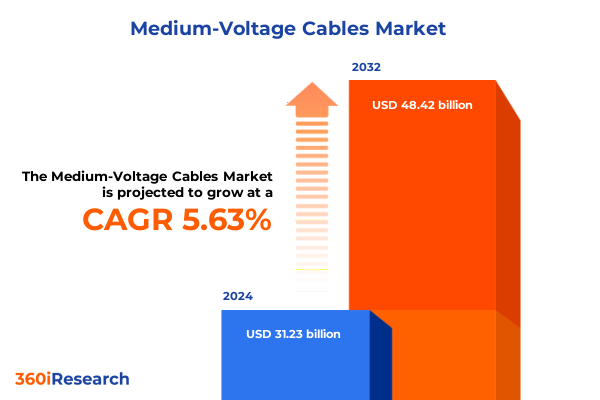

The Medium-Voltage Cables Market size was estimated at USD 32.91 billion in 2025 and expected to reach USD 34.69 billion in 2026, at a CAGR of 5.66% to reach USD 48.42 billion by 2032.

Unveiling the Evolving Medium-Voltage Cable Industry with Critical Distribution and Industrial Power Solutions Transforming Global Infrastructure

Medium-voltage cables are integral components of modern power distribution networks, operating within a voltage spectrum that bridges low-voltage and high-voltage systems. Industry standards typically classify medium voltage as 1 kV to 35 kV for alternating current systems, though definitions can extend to 45 kV in certain regions. These cables are engineered to ensure reliable and efficient transmission of electricity over moderate distances, serving as the workhorse for connecting substations, feeders, and critical industrial equipment.

The deployment of medium-voltage cabling underpins a wide array of applications, from substations in utilities to energy-intensive sectors such as mining, oil and gas, and manufacturing. As utility-scale power generation surpassed 3,287 billion kWh globally in 2024, the pressure to modernize aging infrastructure has intensified. Consequently, medium-voltage cables have become a focal point for initiatives aimed at enhancing grid resiliency, reducing transmission losses, and integrating renewable energy resources.

Charting the Transformative Shifts Shaping Medium-Voltage Cable Demand from Renewable Integration to Digital Grid Modernization Across the Globe

The rapid expansion of renewable energy infrastructures such as solar and wind farms has reshaped cable requirements, with medium-voltage cables now expected to transmit power over extended distances with minimal losses. In 2024, the UK added 18 GW of solar capacity, driving demand for MV cables that can handle fluctuating loads and harsh environmental conditions. Manufacturers are responding with advanced insulation materials and enhanced conductor designs to meet the rigorous demands of renewable integration.

Concurrently, utilities are embracing digitalization, leveraging IIoT, AI, and predictive analytics to optimize grid performance. Condition-based maintenance and edge computing strategies are ensuring that medium-voltage assets are monitored in real time, reducing downtime and maintenance costs. This digital convergence is facilitating faster decision-making at the grid edge, ultimately strengthening network resilience.

Moreover, the electrification of transportation and growth of data centers have intensified requirements for robust medium-voltage infrastructure. Energy storage systems are being integrated at substations to buffer intermittent renewable output, necessitating specialized MV cable configurations capable of bi-directional power flows. Together, these transformative trends are redefining expectations for performance, reliability, and sustainability in the medium-voltage cable landscape.

Assessing the Cumulative Impact of 2025 United States Tariff Policy on Medium-Voltage Cable Supply Chains and Manufacturers’ Competitiveness

In 2025, the United States implemented a series of tariff measures that have collectively reshaped the competitive landscape for medium-voltage cable manufacturers. A general reciprocal tariff of 10% was imposed on all inbound shipments effective April 5, 2025, with higher rates applied based on trade deficit considerations. Simultaneously, steel and aluminum imports faced a 25% levy under Section 232 tariffs, impacting pipeline and armored cable production components.

Chinese-origin cable imports experienced particularly punitive treatment, with cumulative tariffs-comprising MFN duties, Section 301 levies, and IEEPA IWF duties-reaching up to 145% at peak levels, although a temporary reprieve reduced reciprocal duties to 10% for 90 days commencing May 14, 2025. These measures have incentivized shifts toward alternate sourcing strategies, particularly from Indian and Southeast Asian producers, as evidenced by R R Kabel’s projected volume gains in the U.S. market.

Imported copper, a critical raw material for medium-voltage cable conductors, was subjected to a 50% tariff in early July 2025, further complicating cost structures for firms reliant on overseas metal procurement. Domestic players with vertically integrated sourcing capabilities, such as Prysmian’s U.S.-based copper rod mill, are positioned to mitigate these headwinds and preserve margin stability.

Overall, the cumulative tariff regime has accelerated the reconfiguration of global supply chains, encouraging onshore manufacturing investments and strategic partnerships with tariff-exempt jurisdictions. While these policy shifts have introduced short-term cost pressures, they also present opportunities for market realignment and resilience-building among medium-voltage cable stakeholders.

Deriving Key Insights from Product, Voltage, Insulation, Conductor, Installation, Core, End-Use, Deployment, Application and Service Segmentations

Insights drawn from product segmentation reveal that XLPE cables maintain supremacy due to superior thermal performance and ease of installation compared to joints and termination accessories, which are experiencing rising demand as grid interconnection complexities intensify. Under voltage-level segmentation, configurations rated below 35 kV dominate distribution networks, while high-capacity applications greater than 35 kV require specialized solutions. Insulation materials have evolved with cross-linked polyethylene leading in market preference for its combination of durability and dielectric strength, whereas alternatives such as EPR, PVC, and rubber maintain niches based on application requirements. Conductor materials illustrate a trade-off between copper’s conductivity and aluminum’s cost advantages, driving a balanced portfolio of offerings. Indoor installations rely on compact single-core designs, whereas multi-core constructions are more prevalent in outdoor feeder and intertie applications. These trends underscore a market that is converging on high-performance materials and hybrid conductor structures to meet diverse performance specifications.

Complex segmentation by end-use and deployment reveals utilities and renewable energy sectors as primary demand drivers, owing to large-scale distribution projects and decarbonization mandates. Underground cabling is increasingly adopted in urban centers for enhanced reliability and safety, while overhead lines continue to serve rural and industrial applications. Submarine medium-voltage cables are gaining prominence in offshore interconnection projects to transmit renewable power across regions. In the service category, aftermarket components and maintenance offerings are growing in importance as aging infrastructure requires retrofits and condition-based maintenance services, complementing original equipment manufacturer channels that focus on new installations and system expansions.

This comprehensive research report categorizes the Medium-Voltage Cables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Products

- Voltage Level

- Insulation Material

- Conductor Material

- Installation Type

- Core Structure

- Industry End-Use

- Deployment

- Application

- Service Category

Synthesizing Regional Dynamics in Medium-Voltage Cable Markets Spanning Americas, Europe, Middle East & Africa, and Asia-Pacific Infrastructure Growth

In the Americas, medium-voltage cable demand is propelled by significant federal and state-level investments in grid modernization under initiatives such as the Inflation Reduction Act, which has spurred renewable energy deployments and grid resilience projects. The region’s focus on decarbonization and electrification of transportation has catalyzed upgrades to distribution networks. The United States market has witnessed a surge in acquisitions and expansions, exemplified by Prysmian’s strategic purchase of Encore Wire to strengthen its North American footprint.

Across Europe, the Middle East & Africa, ambitious energy transition goals and stringent regulatory frameworks are driving underground medium-voltage cable installations, particularly in dense urban areas and cross-border interconnector projects. Countries such as Germany, France, and the United Kingdom are expanding renewable energy capacity, necessitating robust cable systems for offshore wind and smart grid integration. In the Middle East, utility-scale developments and water desalination plants rely on high-specification MV cabling designed to withstand extreme environmental conditions.

Asia-Pacific leads global growth, underpinned by government commitments to double wind and solar power capacity-China’s goal of 1,200 GW by 2025 exemplifies this trend-and expansive rural electrification programs in India. The region’s rapid urbanization and industrialization further fuel demand for medium-voltage cables across infrastructure, manufacturing, and mining sectors. Offshore renewable projects in coastal markets are also boosting submarine cable requirements, reinforcing Asia-Pacific’s dominance in the global medium-voltage market.

This comprehensive research report examines key regions that drive the evolution of the Medium-Voltage Cables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Medium-Voltage Cable Manufacturers and Innovators Steering Technological Advances and Competitive Strategies in Global Power Distribution

The competitive landscape in the medium-voltage cable sector is characterized by a blend of global incumbents and regional specialists. World leader Prysmian Group, with over 30,000 employees and a strong presence in Europe, North America, and Asia, maintains a diversified portfolio covering submarine, power, and telecom cables. Nexans, the second-largest global player, commands a significant share in high-voltage projects and data cable markets, with revenues exceeding €8.5 billion in 2024.

NKT has carved out a niche in offshore high-voltage DC interconnectors while supporting onshore medium-voltage rollouts across Europe, backed by €3.3 billion in revenue for 2024 and dedicated manufacturing in 10 European countries. Southwire, a leading North American producer, leverages its integrated manufacturing footprint to serve utilities and industrial clients, supported by revenues of approximately $5.5 billion in 2020.

Regional champions such as Sumitomo Electric, Leoni, and LS Cable & System bolster the market with specialized product lines and localized R&D hubs. Sumitomo Electric’s medium-voltage offerings include XLPE-insulated cables for up to 36 kV applications, underpinned by advanced conductor and monitoring systems. Chinese and Indian firms are also expanding their export capabilities in response to shifting tariff landscapes, emerging as competitive alternatives in certain material and service segments.

Strategic M&A and joint ventures remain key to maintaining competitive positions. Prysmian’s acquisition of Encore Wire and Nexans’ targeted investments in emerging markets underscore a broader trend of consolidation and portfolio diversification, aimed at securing end-to-end supply chain resilience and technological leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medium-Voltage Cables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- alfanar Group

- Belden Inc.

- Borealis AG

- Brugg Kabel AG

- Dynamic Cables Limited

- Eland Cables Ltd.

- Elmeridge Cables Limited

- Furukawa Electric Co., Ltd.

- HELUKABEL GmbH

- Houston Wire & Cable Co.

- Nexans S.A.

- NKT A/S

- Pran-RFL Group

- Prysmian S.p.A.

- Riyadh Cables Group Company

- Schneider Electric SE

- Siemens AG

- Southwire Company, LLC

- SSG Cable

- Synergy Cables

- The Okonite Company

- TPC Wire & Cable

- Tratos Cavi SpA

- Universal Cables Limited

- ZTT International Limited

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Tariff Challenges, Technological Adoption, and Market Diversification in Medium-Voltage Cables

Industry leaders should prioritize digital integration across the cable value chain, adopting IIoT-enabled condition monitoring solutions to optimize maintenance schedules and extend asset life, leveraging proven frameworks in digital substations that have accelerated reliability gains.

In anticipation of continued tariff volatility, firms must diversify their raw material sourcing and consider nearshoring critical manufacturing processes to mitigate supply-chain disruptions, as evidenced by Prysmian’s success in leveraging domestic copper production to offset import levies.

Strategic collaborations with renewable energy developers and utilities can secure long-term offtake agreements, positioning cable manufacturers to capitalize on large-scale projects driven by decarbonization policies, such as China’s 1,200 GW renewable target and U.S. grid modernization funding.

R&D investments should focus on next-generation insulation materials, conductor alloys, and superconducting technologies to meet evolving performance requirements, while expanding aftermarket service portfolios to capture value from existing infrastructure across mature markets.

Outlining a Robust Research Methodology Integrating Primary Interviews, Comprehensive Secondary Analysis, and Data Triangulation for Market Insight Accuracy

The research underpinning this report commenced with extensive secondary data collection, leveraging reputable industry publications, regulatory filings, and tariff databases. Primary insights were obtained through structured interviews with sector executives, supply chain specialists, and regulatory authorities to validate assumptions and capture emerging trends. Data triangulation ensured consistency across quantitative inputs, while a bottom-up approach was utilized to reconcile company-level performance metrics with regional market dynamics. Rigorous data validation protocols, including cross-referencing multiple sources and statistical consistency checks, underpin the robustness and reliability of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medium-Voltage Cables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medium-Voltage Cables Market, by Products

- Medium-Voltage Cables Market, by Voltage Level

- Medium-Voltage Cables Market, by Insulation Material

- Medium-Voltage Cables Market, by Conductor Material

- Medium-Voltage Cables Market, by Installation Type

- Medium-Voltage Cables Market, by Core Structure

- Medium-Voltage Cables Market, by Industry End-Use

- Medium-Voltage Cables Market, by Deployment

- Medium-Voltage Cables Market, by Application

- Medium-Voltage Cables Market, by Service Category

- Medium-Voltage Cables Market, by Region

- Medium-Voltage Cables Market, by Group

- Medium-Voltage Cables Market, by Country

- United States Medium-Voltage Cables Market

- China Medium-Voltage Cables Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 1749 ]

Concluding Perspectives on Market Evolution Emphasizing Innovation, Resilience, and Strategic Positioning in the Medium-Voltage Cable Sector

The medium-voltage cable industry is navigating a pivotal juncture, shaped by accelerated grid modernization, the surge of renewable energy integration, and complex trade policies. As tariff regimes evolve and technological innovations proliferate, supply chain resiliency and strategic agility will distinguish leading firms in this competitive arena.

Emerging digital capabilities, from advanced monitoring systems to AI-driven analytics, are transforming the way utilities and industrial end-users manage network assets, driving new service paradigms that extend beyond traditional product offerings. Meanwhile, regional demand patterns underscore the importance of localized solutions and regulatory alignment.

Looking ahead, sustained investment in material science, automated manufacturing, and collaborative ecosystem partnerships will be essential for addressing global electrification imperatives, ensuring that medium-voltage cables continue to serve as a bedrock of reliable, efficient, and sustainable power distribution networks.

Take the Next Step: Connect with Ketan Rohom to Secure Comprehensive Insights and Leverage Our Medium-Voltage Cable Market Research Report Investment

To leverage these insights and gain a competitive edge in the evolving medium-voltage cable market, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engage today to secure your comprehensive report and unlock tailored strategic guidance for your organization.

Contact Ketan to discuss how our market intelligence can support your strategic planning, investment decisions, and partnership opportunities. Act now to ensure your organization is positioned to capitalize on the growth trajectories within the medium-voltage cable sector.

- How big is the Medium-Voltage Cables Market?

- What is the Medium-Voltage Cables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?