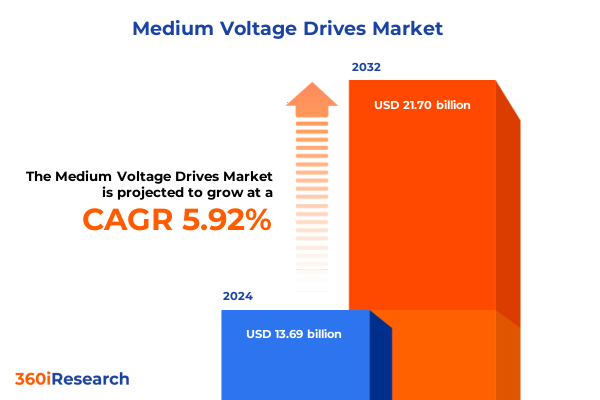

The Medium Voltage Drives Market size was estimated at USD 5.58 billion in 2025 and expected to reach USD 5.90 billion in 2026, at a CAGR of 5.92% to reach USD 8.35 billion by 2032.

Unlocking the Full Potential of Medium Voltage Drives to Revolutionize Industrial Processes through Precision Control, Operational Efficiency, and Seamless Automation Integration

Medium voltage drives have become indispensable components in modern industrial landscapes, offering unparalleled advantages in process control and energy optimization. By regulating motor speed and torque, these systems enable precise management of operational workflows, reducing wear and tear on equipment and extending the service life of critical assets. As industries worldwide pursue ambitious sustainability targets and seek to minimize energy waste, medium voltage drives stand at the forefront of innovation, delivering significant reductions in power consumption and supporting corporate environmental goals.

Moreover, the evolution of these drives has been characterized by continuous enhancements in power electronics, allowing for higher switching frequencies and more compact footprints. This technological advancement facilitates seamless integration with next-generation automation platforms and digital ecosystems. Consequently, facility managers and plant engineers can harness real-time monitoring capabilities, predictive maintenance algorithms, and advanced fault diagnostics. Taken together, these developments underscore why medium voltage drives are central to operational excellence and why an in-depth examination of this landscape is essential for forward-looking organizations.

Navigating the Convergence of Digital Transformation and Sustainability in Shaping the Next Generation of Medium Voltage Drive Technologies

The medium voltage drives sector has undergone transformative shifts driven by the convergence of digitalization and sustainability imperatives. Industry 4.0 frameworks have ushered in a new era of connectivity, enabling the deployment of smart drives equipped with embedded sensors and edge computing capabilities. These intelligent platforms provide real-time telemetry on factors such as temperature, vibration, and harmonic distortion, empowering maintenance teams to preemptively address emerging issues before they escalate into downtime events.

Simultaneously, the drive toward net-zero targets has spurred a heightened focus on energy usage analytics and demand response functionalities. By integrating with building management systems and grid operators, medium voltage drives can dynamically adjust load profiles, contributing to grid stability and optimizing utility costs. Additionally, the rise of modular and scalable architectures has allowed manufacturers to offer customizable configurations that cater to niche applications across diverse sectors. Collectively, these shifts underscore a landscape in which digital sophistication and environmental stewardship intersect to redefine the role of medium voltage drives across industrial ecosystems.

Adapting to Evolving Trade Policies As United States 2025 Tariffs Reshape Supply Chains and Strategic Sourcing in Medium Voltage Drive Markets

In 2025, the cumulative impact of newly implemented United States tariffs has reverberated across global supply chains and procurement strategies for medium voltage drives. Heightened duties on key electronic components have driven original equipment manufacturers to reassess sourcing models, with some electing to reposition critical production activities closer to domestic markets. This geographic realignment, while adding initial capital expenditures, offers long-term resilience against future trade policy fluctuations.

Furthermore, end-users have responded by extending operational lifecycles through more rigorous maintenance regimes and selective retrofit initiatives. Service providers report a surge in demand for component upgrades that circumvent tariff-impacted imports, often leveraging local repair and rewinding facilities to maintain performance standards without incurring prohibitive costs. Meanwhile, collaborative partnerships between drive suppliers and system integrators have intensified, focusing on co-innovation to develop tariff-exempt solutions and alternate architectures. Through these adaptive strategies, stakeholders are successfully navigating a period of elevated trade friction and securing continuity of supply.

Understanding the Nuanced Dynamics across Industry Verticals, Power Classes, and Drive Architectures in the Medium Voltage Drive Ecosystem

Insights derived from end-user industries reveal that sectors such as power generation and water and wastewater treatment have emerged as primary adopters, driven by stringent regulatory requirements for process reliability and energy efficiency. The mining and metals vertical, along with cement and chemicals, is increasingly favoring medium voltage drives for their ability to stabilize heavy-load operations and curtail energy consumption peaks. Meanwhile, oil and gas operators are leveraging advanced control features to optimize extraction and refining processes, achieving tighter regulatory compliance and improved operational uptime.

When examining output power classifications, applications requiring capacities above four megawatts gravitate toward robust drive configurations designed for continuous, high-demand environments. Conversely, solutions below one megawatt and those in the one-to-two megawatt range cater to modular installations where compactness and cost efficiency are paramount. On the technology front, voltage source inverter architectures-both insulated gate bipolar transistor based and integrated gate-commutated thyristor based-dominate due to their superior switching characteristics and harmonic performance. Active front end systems are preferred in facilities with bidirectional power flow requirements. Additionally, new installations increasingly specify drives built for retrofit compatibility, accommodating existing busbar systems without extensive infrastructure overhauls, and voltage levels spanning from 3.3 kilovolts up to 15 kilovolts are selected based on utility interconnection standards and distribution network specifications.

This comprehensive research report categorizes the Medium Voltage Drives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Rating

- Drive Type

- Voltage Range

- Installation Type

- Cooling Method

- Application

- End User Industry

- Sales Channel

Exploring Regional Variations in Medium Voltage Drive Adoption Driven by Infrastructure Renewal, Regulatory Mandates, and Industrial Growth Trajectories

The Americas region continues to lead in the adoption of medium voltage drives, propelled by modernization initiatives in North American petrochemical facilities and the expansion of South American water treatment infrastructures. These investments are supported by government incentives aimed at enhancing grid resilience and reducing greenhouse gas emissions. In EMEA, infrastructure renewal programs in power generation and mining are driving a steady uptick in drive deployment, with regulatory frameworks in Europe placing particular emphasis on decarbonization and cross-border energy trading.

Asia-Pacific remains the fastest-growing market, underpinned by rapid industrialization in Southeast Asia and significant capital projects across Australia’s mining sector. China’s ambitious urbanization plans are accelerating demand for medium voltage drives in public utilities and manufacturing clusters, while Japan’s focus on disaster-resilient energy systems has led to investments in high-reliability drive solutions. Each region presents distinct regulatory drivers, infrastructure maturity levels, and partner ecosystems, offering tailored opportunities for suppliers and integrators seeking to expand their geographic footprint.

This comprehensive research report examines key regions that drive the evolution of the Medium Voltage Drives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing How Leading Medium Voltage Drive Providers Are Leveraging Partnerships, Acquisitions, and Digital Platforms to Drive Growth

Leading companies in the medium voltage drives sector have concentrated on diversifying product portfolios through modular designs and digital service offerings. Strategic collaborations between drive manufacturers and automation software providers have resulted in seamless connectivity layers that simplify integration and accelerate time to value for end-users. Several prominent suppliers have also pursued targeted acquisitions to strengthen in-house capabilities in advanced power electronics and service networks.

Moreover, innovation centers and pilot facilities established by key industry players are serving as testbeds for next-generation drive functionalities, including integrated cybersecurity protocols and artificial intelligence–driven performance optimization. Aftermarket services have become a critical revenue stream, with firms offering subscription-based maintenance agreements and remote diagnostics packages. By reinforcing their global service footprints and emphasizing lifecycle management, these organizations are positioning themselves as full-solution partners capable of supporting customers from initial design through long-term operation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medium Voltage Drives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Siemens AG

- Hitachi, Ltd.

- Schneider Electric SE

- Danfoss A/S

- General Electric Company

- Honeywell International Inc.

- WEG S.A.

- Eaton Corporation plc

- Yaskawa Electric Corporation

- Amtech Electronics India Ltd.

- Beijing Hiconics Eco-energy Technology Co., Ltd.

- Bharat Heavy Electricals Limited

- CG Power & Industrial Solutions Ltd.

- Delta Electronics, Inc.

- Emerson Electric Co.

- ESTUN AUTOMATION CO.,LTD

- Fgi Science And Technology Co., Ltd.

- Fuji Electric Co., Ltd.

- Hope Senlan Science And Technology Holding Corp., Ltd.

- INGETEAM, S.A.

- Johnson Controls International plc

- LS ELECTRIC Co., Ltd.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Parker Hannifin Corp

- POWER ELECTRONICS ESPAÑA, S.L.U.

- Rockwell Automation, Inc.

- Shanghai STEP Electric Corporation

- Shenzhen Hopewind Electric Co., Ltd.

- Shenzhen INVT Electric Co., Ltd

- Sumitomo Heavy Industries, Ltd

- TECO Corporation

- TMEIC Corporation

- Toshiba International Corporation

- Wolong Electric Group

Strategic Imperatives for Suppliers to Embed Digital Services, Diversify Supply Chains, and Cultivate Retrofit Opportunities in Medium Voltage Drives

Industry leaders can enhance resilience by prioritizing the integration of smart sensor arrays and condition-monitoring software into their medium voltage drive offerings. By doing so, they will not only address customer demands for predictive maintenance but also foster new revenue streams through data-driven service models. In parallel, executives should evaluate supply chain diversification strategies that balance near-shore sourcing with strategic partnerships in low-cost regions to mitigate tariff exposures and lead-time uncertainties.

Additionally, it is critical to develop comprehensive retrofit pathways that simplify upgrades for existing installations, thereby unlocking incremental opportunities within installed bases. Collaborating with standards bodies and grid operators to pioneer compatibility frameworks will further differentiate product portfolios. Finally, investment in workforce training programs-focusing on digital twin simulations, cybersecurity best practices, and functional safety-will equip teams to navigate evolving technological and regulatory landscapes effectively.

Employing a Triangulated Research Framework Combining Executive Interviews, Secondary Literature, and Expert Validation to Inform Findings

This research leverages a structured methodology combining primary and secondary approaches to ensure robust and triangulated intelligence. Primary insights were gathered through in-depth interviews with senior executives across key end-user industries, validation workshops with system integrators, and consultations with regulatory experts. Secondary data was compiled from industry journals, technology white papers, and proprietary patent analysis to capture emerging innovation trajectories.

To enhance data credibility, findings were subjected to a rigorous triangulation process, comparing qualitative inputs with publicly available infrastructure investment records and standards documentation. A multi-stage review was conducted by an advisory panel comprising power electronics specialists and energy policy analysts, ensuring that all interpretations reflect current operational realities and future regulatory directions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medium Voltage Drives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medium Voltage Drives Market, by Power Rating

- Medium Voltage Drives Market, by Drive Type

- Medium Voltage Drives Market, by Voltage Range

- Medium Voltage Drives Market, by Installation Type

- Medium Voltage Drives Market, by Cooling Method

- Medium Voltage Drives Market, by Application

- Medium Voltage Drives Market, by End User Industry

- Medium Voltage Drives Market, by Sales Channel

- Medium Voltage Drives Market, by Region

- Medium Voltage Drives Market, by Group

- Medium Voltage Drives Market, by Country

- United States Medium Voltage Drives Market

- China Medium Voltage Drives Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Synthesizing Technological, Operational, and Regulatory Insights to Illuminate the Path Forward in Medium Voltage Drives

The overview of medium voltage drives underscores their pivotal role in advancing industrial efficiency, operational reliability, and sustainability objectives across diverse sectors. Key transformative trends include the fusion of digitalization with energy management, the realignment of supply chains in response to tariff landscapes, and the evolution of modular, retrofit-ready architectures. Regional analyses highlight differentiated growth patterns, while competitive insights reveal that innovation in product design and aftermarket services will be critical differentiators.

By synthesizing segmentation perspectives and tracking emerging regulatory mandates, stakeholders can identify tailored strategies to optimize asset performance and maintain a competitive edge. The research confirms that a holistic approach-encompassing technological, operational, and fiscal dimensions-will be essential for organizations seeking long-term value from their medium voltage drive investments.

Empower Your Strategic Decisions with Exclusive Access to Advanced Medium Voltage Drives Market Insights Through Personalized Engagement

We invite industry professionals and decision-makers seeking to gain a competitive edge to secure comprehensive insights by purchasing the full research report. By partnering directly with Ketan Rohom, Associate Director for Sales & Marketing, you will gain access to in-depth analysis, tailored executive discussions, and dedicated post-purchase support to drive strategic initiatives more effectively. Reach out to Ketan Rohom to explore customized options, secure preferred pricing, and ensure your organization is positioned to leverage the latest developments shaping the medium voltage drives market.

- How big is the Medium Voltage Drives Market?

- What is the Medium Voltage Drives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?