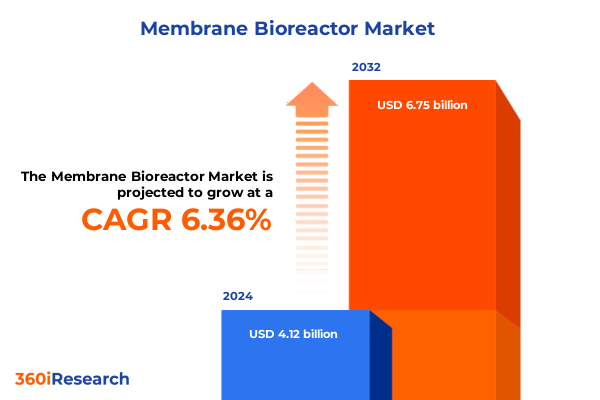

The Membrane Bioreactor Market size was estimated at USD 4.33 billion in 2025 and expected to reach USD 4.55 billion in 2026, at a CAGR of 6.53% to reach USD 6.75 billion by 2032.

Exploring the Transformational Role and Strategic Advantages of Membrane Bioreactors in Contemporary Wastewater Treatment and Reuse

The evolution of wastewater treatment technologies has ushered in a new era of sustainable and efficient resource management, with membrane bioreactors standing at the forefront of this transformation. As municipalities and industries grapple with stricter discharge regulations, escalating energy costs, and growing water scarcity challenges, membrane bioreactor systems have emerged as a pivotal solution that seamlessly integrates biological treatment with membrane filtration. This synergy not only enhances effluent quality but also reduces system footprints and energy consumption compared to conventional treatment methods. Consequently, decision makers across the water treatment ecosystem are turning to membrane bioreactors to meet compliance goals while advancing their circular economy and net-zero commitments.

In addition to regulatory drivers, rapid advancements in membrane materials, reactor designs, and process automation have amplified the appeal of membrane bioreactors. Innovations such as high-flux hollow fiber membranes and submerged reactor configurations have improved process stability and reduced operating costs. Furthermore, the integration of real-time monitoring and AI-driven control systems has optimized membrane cleaning cycles and performance diagnostics. As a result, organizations are realizing lower life-cycle costs and enhanced operational resilience, prompting widespread adoption across municipal and industrial sectors. This executive summary provides an in-depth overview of these developments, equipping stakeholders with the strategic context needed to capitalize on the membrane bioreactor opportunity.

Capturing the Momentous Technological Innovations Regulatory Overhauls and Environmental Pressures Reshaping the Membrane Bioreactor Landscape

Over the past few years, the landscape of membrane bioreactor technology has undergone transformative shifts driven by breakthroughs in membrane chemistry and reactor engineering. Next-generation ceramic and polymeric membranes now deliver greater fouling resistance, extended service lifetimes, and higher permeate fluxes. Moreover, hybrid reactor architectures-combining external and submerged configurations-have unlocked new levels of operational flexibility, enabling plants to swiftly adapt to fluctuating influent loads and diverse contaminant profiles. These technical innovations have not only bolstered performance metrics but also enhanced the financial viability of membrane bioreactor installations across a broader range of applications.

Furthermore, the regulatory environment has evolved to reinforce water reuse and nutrient recovery initiatives, imposing stricter effluent quality thresholds that conventional treatment systems struggle to meet. Incentive programs and funding mechanisms at federal, state, and local levels now increasingly favor advanced treatment solutions that demonstrate resource recovery potential. At the same time, mounting stakeholder pressure around environmental stewardship and corporate social responsibility has propelled end users to seek out membrane bioreactors for their ability to reclaim water for irrigation, industrial cooling, and process reuse. As these regulatory and market pressures converge, the membrane bioreactor sector is poised for accelerated adoption and heightened innovation.

Assessing the Far-Reaching Cumulative Impact of 2025 United States Tariffs on Membrane Bioreactor Supply Chains Operating Costs and Market Dynamics

The introduction of targeted tariffs by the United States in early 2025 has had a cumulative impact on membrane bioreactor supply chains and operating costs. Imposed on imported membranes-particularly ceramic variants-these measures aimed to fortify domestic manufacturing but inadvertently elevated material procurement costs by an estimated mid-single digit percentage. Consequently, project budgets faced upward pressure, prompting system integrators and end users to reassess vendor agreements, renegotiate long-term contracts, and explore alternative membrane suppliers. In tandem, the higher capital costs triggered extended payback periods for new installations and retrofits, reshaping project financing models and risk assessments.

In response to these tariff-induced dynamics, domestic membrane manufacturers have ramped up production capacity and accelerated innovation roadmaps to capture market share. Supply chain diversification has become a strategic imperative, with many stakeholders forging partnerships across North American and regional manufacturing hubs to mitigate exposure to trade fluctuations. Moreover, the tariff environment has fueled investments in research focused on polymeric membrane performance, as polymeric options often remain exempt from import levies. These shifts underscore the interplay between trade policy and technology adoption, demonstrating how macroeconomic factors can influence the trajectory of advanced water treatment solutions.

Revealing Strategic Market Segmentation Insights Across Membrane Designs Reactor Setups Material Choices End-Use Verticals and Installation Paths

A detailed segmentation analysis highlights the multifaceted nature of the membrane bioreactor market and underscores emerging opportunities within each category. Examining membrane configuration reveals distinct performance profiles for flat sheet, hollow fiber, and tubular formats, where hollow fiber’s high packing density enhances footprint efficiency, and flat sheet systems offer ease of maintenance. Shifting focus to reactor configuration, submerged designs deliver lower aeration demands, whereas external setups provide easier module access for cleaning and replacement, catering to diverse operational priorities. Material selection further refines system capabilities, with ceramic membranes-available in alumina, titania, and zirconia-excelling in high-temperature and abrasive environments, while polymeric membranes composed of PES, PSF, and PVDF serve as cost-effective solutions for general applications.

Beyond membrane particulars, process mode delineation between aerobic and anaerobic operations drives decisions based on energy efficiency and sludge production targets. Capacity segmentation, spanning small, medium, and large-scale systems, tailors solutions for decentralized wastewater treatment in remote communities to high-volume industrial effluent processing. End-use classifications differentiate municipal needs-from potable reuse to stormwater management-from industrial requirements across chemical, food & beverage, oil & gas, pharmaceutical, and pulp & paper sectors, where brewery, dairy processing, and soft drink production segments demand bespoke purification standards. Finally, installation type insights distinguish the rapid growth in retrofit projects, driven by aging infrastructure, from new installations in greenfield sites, illuminating pathways for service providers to align offerings with client priorities.

This comprehensive research report categorizes the Membrane Bioreactor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Membrane Configuration

- Reactor Configuration

- Membrane Material

- Process Mode

- Capacity

- End-Use Industry

- Installation Type

Unearthing Regional Dynamics in the Membrane Bioreactor Sector Across the Americas Europe Middle East Africa and Asia Pacific Growth Trajectories

Regional dynamics play a pivotal role in shaping membrane bioreactor deployment strategies and investment decisions. In the Americas, robust public funding and municipal infrastructure programs are driving widespread adoption of submerged, polymeric membrane systems for municipal wastewater reuse initiatives. The emphasis on potable reuse in water-stressed regions such as California and the arid Southwest has created a fertile ground for innovators to pilot packaged MBR solutions that balance capital intensity and operational simplicity. Additionally, industrial end users in the region-particularly in the oil & gas and chemical sectors-are deploying external configurations to handle high-fouling wastewater streams, leveraging local manufacturing to buffer against tariff-related cost increases.

Meanwhile, Europe, the Middle East, and Africa exhibit a heterogeneous but growing appetite for membrane bioreactor technologies. In Western Europe, stringent municipal discharge standards and resource recovery mandates have spurred the retrofitting of gridded membrane installations in legacy treatment plants, complemented by ceramic membrane trials for high-pH industrial effluent treatment. Gulf Cooperation Council countries are prioritizing energy-efficient aerobic systems to desalinate brine and treat produced water, underpinned by government subsidies. Across Africa, decentralized anaerobic MBR solutions are emerging to support off-grid communities and bolster circular sanitation models, often funded through international development partnerships.

Asia-Pacific stands out as a high-growth frontier, where rapid urbanization and water scarcity concerns are accelerating new installation pipelines. China and India are investing heavily in large-scale MBR plants to meet rising clean water demands, while Southeast Asian markets are exploring small-scale, modular units for agro-industrial complexes. Japan continues to lead in ceramic membrane innovation, pushing the envelope on fouling reduction and lifetime extension, whereas Australia is pioneering the integration of solar-powered MBRs for remote mining operations. These varied regional trajectories underscore the need for tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Membrane Bioreactor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Competitive Dynamics and Strategic Collaborations That Shape the Global Membrane Bioreactor Market

Competitive intelligence reveals a landscape defined by both established conglomerates and agile technology disruptors. Major water treatment corporations are deepening their membrane portfolios through strategic partnerships, acquiring niche membrane manufacturers, and expanding pilot demonstration sites. They are prioritizing platform integration-combining advanced sensors, digital twins, and remote monitoring capabilities-to deliver turnkey solutions that reduce total cost of ownership. At the same time, regional pioneers and startup ventures are carving out specialized niches in ceramic membrane fabrication, 3D-printed module geometries, and proprietary fouling mitigation coatings.

Collaborations between membrane material innovators and biotechnology firms are also gaining traction, aiming to enhance bioprocess performance and streamline downstream separation. In concert with these partnerships, system integrators are refining service models, offering performance-based contracts and outcome-driven maintenance agreements. Collectively, these competitive dynamics are accelerating product differentiation, driving price competitiveness in key segments, and fostering a continuous cycle of incremental innovation that elevates overall market maturity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Membrane Bioreactor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- EnviroChemie GmbH

- General Electric Company

- HUBER SE

- Kovalus Separation Solutions, Inc.

- Mitsubishi Corporation

- Newterra Corporation

- Nijhuis Industries Holding B.V. by Saur

- Premier Tech Ltd.

- Salher, S.L.

- Siemens AG

- Smith & Loveless Inc.

- Veolia Environnement SA

Formulating Strategic Imperatives and Actionable Roadmaps to Establish Industry Leadership Drive Innovation and Optimize Membrane Bioreactor Deployment

To maintain a competitive edge, industry leaders should prioritize collaboration with membrane material specialists to co-develop next-generation modules tailored to their unique effluent profiles, thereby reducing fouling frequency and extending membrane lifespan. Additionally, diversifying the supplier base-incorporating both domestic and international membrane producers-will help mitigate risks associated with tariff fluctuations and supply chain disruptions. Equally important is the integration of advanced process control platforms equipped with predictive analytics, which can optimize air scour, backwash routines, and chemical dosing to achieve stable permeate quality and energy savings.

Moreover, embracing reactor retrofits as a service offering can unlock growth opportunities in markets with aging treatment infrastructure. By designing modular upgrade packages that retrofit existing activated sludge plants with membrane units, providers can lower entry barriers for municipal and industrial clients. Finally, investing in workforce training programs-covering MBR operation best practices and digital maintenance tools-will ensure consistent system performance and cultivate long-term client partnerships. These strategic imperatives, when executed cohesively, will position organizations to lead in a rapidly evolving water treatment arena.

Outlining a Robust Research Methodology Integrating Primary Data Collection Secondary Analysis and Expert Validation to Ensure Rigorous Market Insights

Our research methodology combines rigorous secondary data analysis with primary qualitative insights, ensuring a comprehensive appraisal of market dynamics. We began by aggregating technical papers, patent filings, trade association reports, and publicly available regulatory documents to contextualize technology trends and policy drivers. These foundational insights were then enriched by in-depth interviews with membrane scientists, system integrators, project developers, and end-user facility managers. Through these discussions, we validated emerging use cases, identified bottlenecks in scale-up, and assessed the competitive strategies of key players.

To further reinforce accuracy, we triangulated quantitative process performance data-such as permeate flux rates, fouling indices, and lifecycle maintenance metrics-against case study outcomes. Expert validation rounds ensured that our interpretations reflected real-world operational constraints and investment criteria. The resulting intelligence provides stakeholders with a robust, data-driven foundation for strategic planning, technology selection, and market positioning in the evolving membrane bioreactor space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Membrane Bioreactor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Membrane Bioreactor Market, by Membrane Configuration

- Membrane Bioreactor Market, by Reactor Configuration

- Membrane Bioreactor Market, by Membrane Material

- Membrane Bioreactor Market, by Process Mode

- Membrane Bioreactor Market, by Capacity

- Membrane Bioreactor Market, by End-Use Industry

- Membrane Bioreactor Market, by Installation Type

- Membrane Bioreactor Market, by Region

- Membrane Bioreactor Market, by Group

- Membrane Bioreactor Market, by Country

- United States Membrane Bioreactor Market

- China Membrane Bioreactor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights Strategic Findings and Practical Implications to Guide Stakeholder Decision Making in Membrane Bioreactor Adoption and Optimization

In conclusion, membrane bioreactor technology stands at a pivotal juncture, driven by technological breakthroughs, evolving regulatory frameworks, and shifting economic forces such as the 2025 United States tariffs. Decision makers across municipal and industrial sectors must navigate a complex matrix of configuration choices, material options, and regional market dynamics to optimize treatment performance and total cost of ownership. By leveraging segmentation insights-from membrane formats and reactor setups to end-use verticals and installation approaches-stakeholders can tailor solutions that align with operational requirements, sustainability targets, and financial parameters.

Looking ahead, success in the membrane bioreactor domain will hinge on the ability to integrate advanced material science, digital process controls, and strategic partnerships while maintaining agile supply chains. Organizations that embrace retrofit opportunities, invest in workforce capabilities, and proactively address tariff and trade considerations will be best positioned to unlock value. This body of research equips leaders with the critical intelligence needed to make informed investments, forge impactful collaborations, and chart a course toward resilient, resource-efficient water treatment infrastructures.

Empower Your Organization with Expert Guidance from Ketan Rohom to Secure Comprehensive Membrane Bioreactor Market Research Insights and Drive Strategic Growth

Empower your strategic decision making and operational planning by securing the full membrane bioreactor market research report. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, grants you tailored insights that align with your organization’s specific challenges and growth ambitions. By partnering with this dedicated expert, you will gain access to comprehensive data, in-depth analyses, and scenario planning tools designed to inform capital investments, coordinate product development roadmaps, and optimize procurement strategies. Reach out now to transform uncertainty into actionable intelligence and position your team to seize emerging opportunities in the membrane bioreactor landscape.

- How big is the Membrane Bioreactor Market?

- What is the Membrane Bioreactor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?