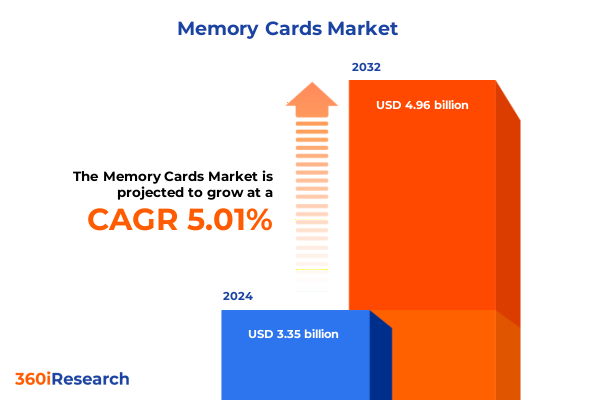

The Memory Cards Market size was estimated at USD 3.52 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 5.03% to reach USD 4.96 billion by 2032.

Mapping the Current Memory Card Ecosystem by Highlighting Technological Milestones, Consumer Adoption Trends, and Core Value Propositions for Stakeholders

The memory card sector stands at a pivotal juncture as advancements in digital imaging, mobile data demands, and emerging IoT applications converge to redefine storage requirements. Over recent years, memory cards have evolved from simple removable storage devices into integral enablers of high-resolution multimedia capture, edge computing, and data-intensive workflows. This introduction offers an essential orientation to the technological milestones, consumer adoption dynamics, and core value propositions shaping current industry discussions.

Driven by an unprecedented surge in smartphone functionality, professional photography, and connected automotive features, memory cards have become critical in delivering reliable, high-speed data transfers. Stakeholders across the value chain-from original equipment manufacturers to system integrators-recognize the necessity of aligning product development roadmaps with shifting user expectations for durability, capacity, and transfer rates. Moreover, increased emphasis on data security and encryption protocols is extending memory cards’ role beyond mere storage, positioning them as secure repositories within both consumer electronics and mission-critical enterprise environments.

As the ecosystem expands to include next-generation applications such as 8K video capture, real-time edge analytics, and wearable devices, the strategic importance of form factor diversity, cost-effective capacity scaling, and robust technology partnerships has never been greater. This introduction establishes the foundational context for the comprehensive insights that follow, ensuring that industry leaders, decision-makers, and technical specialists are primed to navigate the fast-paced developments in the memory card landscape.

Unveiling the Major Transformational Forces Reshaping Memory Card Technology Ranging from Capacity Expansion to Integration with Cutting-Edge IoT and AI Workflows

The memory card landscape is being reshaped by technological innovations that extend far beyond incremental capacity increases. We are witnessing a paradigm shift toward ultra-high-speed interfaces, such as UHS-III and PCIe-based formats, enabling seamless support for real-time 8K video recording and burst-mode photography. Meanwhile, integration with artificial intelligence workflows is propelling embedded analytical capabilities at the device edge, transforming memory cards into intelligent modules that can preprocess and encrypt data before it reaches central systems.

Simultaneously, demand for versatile form factors has intensified, as compact devices-driven by the proliferation of drones, wearable sensors, and IoT gateways-require storage solutions that blend minimal physical footprint with rugged durability. This has accelerated the rise of advanced microcontroller-based protection features for threat detection and secure boot environments. In parallel, consumer expectations for instant file access and lag-free performance have translated into growing appetite for next-generation NAND technologies, where 3D stacking and planar design coalesce to deliver unprecedented throughput and endurance.

Looking ahead, interoperability standards and cross-industry collaborations are primed to unlock new use cases across automotive infotainment, virtual reality, and industrial automation. These transformative shifts underscore the importance of proactive innovation strategies that anticipate both hardware evolutions and evolving software ecosystems. By staying attuned to these forces, industry participants can capitalize on emerging opportunities and forge partnerships that drive sustainable growth in an increasingly competitive domain.

Analyzing How United States Tariff Changes in 2025 Have Altered Supply Chains, Pricing Approaches, and Competitive Dynamics in the Memory Card Industry

In 2025, the United States implemented a series of tariff revisions that have exerted a pronounced influence on memory card supply chains. Previously reliant on international manufacturing hubs, several original equipment manufacturers have redirected portions of their sourcing to domestic partners or alternative regions offering tariff exemptions. This strategic pivot has mitigated exposure to additional import levies but has also introduced new challenges related to production lead times and materials procurement.

Price strategies have correspondingly adapted, with some vendors absorbing incremental costs to preserve end-user affordability, while others recalibrated premium segment pricing to reflect enhanced value propositions around security and performance. These divergent approaches have created a fragmented pricing landscape, compelling purchasers to weigh total cost of ownership against service levels and support arrangements. Simultaneously, smaller players have capitalized on niche opportunities by leveraging regional trade agreements and bilateral frameworks that grant preferential treatment for certain NAND configurations and form factor classifications.

Competitive dynamics have also shifted, as integrated device producers with in-house memory manufacturing capabilities gained a resilience advantage, enabling them to scale production without the constraints of external tariff burdens. This has heightened the imperative for collaborative ventures and technology licensing agreements as a means to distribute risk and maintain market presence across high-growth segments. As a result, the industry is witnessing a renaissance in partnership models, with a pronounced focus on joint development contracts, co-investment in assembly facilities, and strategic stockpiling to buffer against future trade policy volatility.

Interpreting Segmentation Insights Across Form Factor Classes, Capacity Ranges, NAND Technology Variants, End User Categories, and Diverse Application Scenarios

Segmentation analysis reveals the nuanced preferences and performance benchmarks that differentiate product categories. When examining form factor divisions, CompactFlash is evaluated across CF I and CF II platforms, MicroSD encompasses MicroSDHC, MicroSDUC, and MicroSDXC variants, and Secure Digital spans SDHC, SDUC, and SDXC types. Capacity segmentation highlights usage scenarios from ultra-compact storage up to 32 gigabytes, mainstream tiers between 32 and 64 gigabytes, mid-range thresholds from 65 to 128 gigabytes, high-capacity allocations between 129 and 256 gigabytes, and above 256 gigabytes for professional and enterprise-grade applications.

In the realm of NAND technology, development pathways diverge across MLC, QLC, SLC, and TLC architectures, each of which is explored in both three-dimensional stacking configurations and traditional planar designs. This variety enables tailored trade-offs between endurance, speed, and cost efficiency. Application segmentation encompasses DSLR, mirrorless, and point-and-shoot digital cameras, gaming consoles, personal computers, smartphones, and tablets, illustrating how specialized performance metrics drive product selection across consumer and prosumer communities. End-user profiles are categorized into automotive, consumer electronics, enterprise, and industrial environments, each of which imposes distinct reliability standards, data retention requirements, and lifecycle considerations.

This comprehensive research report categorizes the Memory Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form Factor

- Capacity Range

- Technology Type

- Speed Class

- Application

- Distribution Channel

Drawing Out Regional Nuances Influencing Memory Card Demand Across Americas Trends, Europe Middle East and Africa Drivers, and Asia Pacific Growth Dynamics

Regional market behaviors tend to reflect local infrastructure developments, regulatory frameworks, and consumer usage patterns. In the Americas, strong demand is fueled by expansive automotive electronics integration, content creation industries that rely on high-throughput data storage, and a growing trend toward remote work setups that necessitate portable yet secure memory solutions. Tax incentives and export facilitation programs have accelerated the establishment of regional assembly hubs, enabling faster time to market.

Europe, the Middle East, and Africa collectively exhibit a duality of advanced adoption in Western Europe-with stringent certification standards for industrial automation and broadcast media-alongside emerging opportunities in the Middle East and Africa, where infrastructure buildout for telecommunications and digital services is creating fresh end-user segments. Incentivized by government digital transformation initiatives, these regions present fertile ground for entry-level and mid-range product portfolios.

Asia-Pacific remains a powerhouse for both manufacturing and consumption. East Asian economies continue to drive innovation through aggressive R&D investment, while Southeast Asia and South Asia demonstrate rapidly escalating adoption rates as smartphone and consumer electronics penetration deepens. Supply chain resilience strategies have prompted expanded facility capacities across multiple Asia-Pacific locales, ensuring that production nodes remain agile in response to geopolitical shifts and evolving tariff landscapes.

This comprehensive research report examines key regions that drive the evolution of the Memory Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Initiatives, R&D Endeavors, and Alliances Redefining Competitive Dynamics within the Memory Card Sector

Industry leaders have adopted varied strategies to secure technological differentiation and operational excellence. Sandisk has intensified its focus on high-endurance industrial modules and advanced security protocols, leveraging its extensive patent portfolio to offer value-added features. Samsung continues to expand its vertically integrated manufacturing footprint, investing in next-generation 3D NAND facilities and forging strategic partnerships to accelerate product validation cycles.

Kingston has diversified its channel strategy by enhancing direct-to-consumer platforms and cultivating relationships with gaming ecosystem developers to tailor performance-optimized solutions for consoles and high-refresh-rate PCs. Transcend and Lexar have emphasized co-development initiatives with camera manufacturers, co-engineering firmware enhancements to unlock superior write speed consistency and energy efficiency. Meanwhile, PNY has reinforced its presence in data center operations through collaborations with hyperscale cloud providers, adapting memory card formats for specialized edge storage tasks under stringent reliability mandates.

These concerted efforts highlight the importance of combining targeted R&D programs with flexible production strategies. Cross-company alliances-such as joint ventures to explore novel error correction algorithms and co-invested pilot lines for emerging form factors-illustrate how coalition-building is becoming a critical determinant of competitive positioning in an industry where both scale and specialization are essential.

This comprehensive research report delivers an in-depth overview of the principal market players in the Memory Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- ATP Electronics, Inc.

- Delkin Devices, Inc.

- Innodisk Corporation

- Integral Memory PLC

- KINGMAX Technology Inc.

- Kingston Technology Corporation

- Kioxia Holdings Corporation

- Lexar Co., Ltd.

- Micron Technology, Inc.

- Nextorage Corporation by Phison Electronics Corp.

- Panasonic Holdings Corporation

- Patriot Memory, Inc.

- PNY Technologies, Inc.

- ProGrade Digital, Inc.

- Samsung Electronics Co., Ltd.

- Sandisk Corporation

- Shenzhen Longsys Electronics Co., Ltd.

- Silicon Power Computer & Communications Inc.

- Simms International plc

- Sony Group Corporation

- Strontium Technology Pte Ltd.

- Super Talent Technology Corp.

- Swissbit AG

- Team Group Inc.

- Toshiba Corporation

- Transcend Information, Inc.

- Unirex Technologies

- Verbatim Americas LLC

Delivering Strategic Guidance for Stakeholders to Enhance Product Positioning, Streamline Supply Operations, and Leverage Technological Advancements

To thrive in the evolving memory card landscape, stakeholders should prioritize diversification of their supply networks, identifying secondary fabrication sites in tariff-exempt zones and cultivating relationships with regional component suppliers to mitigate geopolitical risks. Equally important is the acceleration of technology roadmaps; companies should establish dedicated innovation cells tasked with exploring next-generation NAND architectures, advanced interface protocols, and embedded security features that align with emerging edge computing requirements.

Product positioning strategies must also evolve. By developing tiered offerings that combine premium performance with cost-effective basic packages, organizations can address both high-end professional applications and mass-market consumer segments without diluting brand value. This layered model should be reinforced through integrated marketing campaigns that underscore safety certifications, durability benchmarks, and seamless interoperability with leading device ecosystems.

Finally, collaboration remains a keystone recommendation. Forming strategic alliances with software providers, device OEMs, and standards consortia will facilitate the rapid integration of memory cards into new application realms such as autonomous vehicles, wearable health monitors, and immersive multimedia platforms. By proactively engaging in co-development partnerships and tapping into shared intellectual property resources, industry leaders can accelerate time to revenue and seize first-mover advantage in nascent technology sectors.

Outlining the Comprehensive Methodological Framework Incorporating Primary Interviews, Secondary Data Analysis, and Validation for Memory Card Industry Insights

This research employed a rigorous methodological framework combining primary and secondary sources for a holistic view of the memory card domain. Primary insights were obtained through in-depth interviews with senior executives at leading component suppliers, device manufacturers, and end-user organizations, ensuring diverse perspectives on emerging trends and technical roadblocks. Concurrently, secondary data analysis drew upon publicly available technical journals, industry whitepapers, and government publications to corroborate supply chain developments and policy shifts.

To further validate findings, data triangulation techniques were applied across multiple input channels, including proprietary patent databases and competitive intelligence repositories. This approach allowed for the cross-referencing of R&D investment patterns with manufacturing capacity expansions, providing confidence in the accuracy of technology uptake trajectories. Additionally, expert advisory panels comprising former industry analysts and technical specialists convened at key project milestones to review preliminary conclusions and refine thematic emphasis.

The integration of quantitative indicators-such as production volume reports and tariff schedules-with qualitative narratives ensures that this analysis presents a balanced, actionable perspective. Careful documentation of research assumptions and limitations also facilitates transparent interpretation, enabling readers to contextualize insights within their specific strategic contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Memory Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Memory Cards Market, by Form Factor

- Memory Cards Market, by Capacity Range

- Memory Cards Market, by Technology Type

- Memory Cards Market, by Speed Class

- Memory Cards Market, by Application

- Memory Cards Market, by Distribution Channel

- Memory Cards Market, by Region

- Memory Cards Market, by Group

- Memory Cards Market, by Country

- United States Memory Cards Market

- China Memory Cards Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Findings on Technological Evolution, Market Dynamics, and Strategic Imperatives Shaping the Future Memory Card Landscape

The collective analysis underscores a memory card industry characterized by rapid technological evolution, shifting geopolitical parameters, and increasingly complex user demands. Key takeaways include the growing prominence of next-generation interfaces and intelligent embedded features, the necessity of supply chain diversification in light of recent tariff measures, and the vital role of strategic segmentation in addressing distinct application and end-user requirements.

Collaboration between technology developers, OEM partners, and standards bodies emerges as an indispensable element of sustainable competitive differentiation. At the same time, regional dynamics reveal both mature and emerging growth corridors, each presenting unique entry considerations for new market entrants and established incumbents. The interplay between capacity, form factor, and NAND architecture will continue to drive product innovation, while adaptive pricing strategies will determine the accessibility of high-performance solutions.

As stakeholders chart their strategic pathways, agility in research and development, supply network optimization, and partnership formation will be the primary levers for capturing value. This cohesive overview offers a grounded basis from which organizations can anticipate future trajectories and align their initiatives to the evolving demands of data-centric applications.

Engage with Ketan Rohom to Access the Comprehensive Memory Card Market Analysis Report and Uncover Strategic Insights to Propel Your Business Growth

For personalized guidance and in-depth discussion on how to harness the full potential of the memory card industry’s latest developments, you are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with him, you can explore tailored strategies, exclusive insights, and customized solutions that align with your organization’s objectives. Reach out to schedule a one-on-one consultation and take the next step toward accelerating innovation and reinforcing your competitive positioning within this fast-evolving technology sector.

- How big is the Memory Cards Market?

- What is the Memory Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?