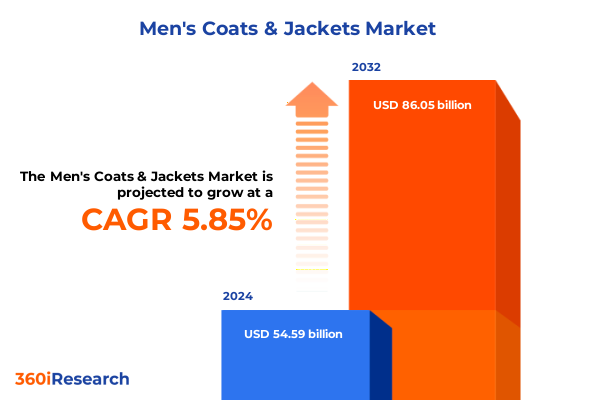

The Men's Coats & Jackets Market size was estimated at USD 57.82 billion in 2025 and expected to reach USD 61.36 billion in 2026, at a CAGR of 5.84% to reach USD 86.05 billion by 2032.

Unveiling the Dynamic Evolution of the Men’s Coats and Jackets Market as Consumer Preferences Shift Amid Global Economic, Environmental, and Technological Drivers

The men’s coats and jackets market stands at a pivotal juncture as shifting consumer expectations converge with evolving macroeconomic and technological forces. Recent years have witnessed a profound transformation in how buyers perceive outerwear, elevating functionality, sustainability, and style to equal measures. While traditional decision drivers such as warmth and craftsmanship remain essential, the rise of digitally native consumer segments demands seamless online shopping experiences and transparent, eco‐responsive supply chains. Simultaneously, apparel manufacturers and brand owners grapple with global trade complexities and efforts to de‐risk production by diversifying sourcing bases beyond established hubs. As a result, the competitive landscape is witnessing increased fragmentation, with established heritage brands facing agile new entrants that leverage data analytics, direct‐to‐consumer models, and innovative textile developments to gain an edge.

Looking ahead, the market’s trajectory will be shaped by an interplay of consumer demand for customizable, high‐performance garments and the imperative for industry players to adapt to regulatory shifts and geopolitical headwinds. Success will favor those companies that can integrate omni‐channel engagement strategies with sustainable material sourcing and resilient logistics networks. This introduction outlines the forces driving current and future growth in the men’s coats and jackets sector, underscoring the need for stakeholders to reassess traditional playbooks and embrace a more dynamic, customer‐centric approach.

Navigating the Transformative Shifts Redefining Design Innovation, Sustainability Practices, Digital Integration, and Supply Chain Resilience in the Men’s Coats and Jackets Industry

Innovations in textile engineering and digital technologies have catalyzed a series of transformative shifts across design, production, and retail within the men’s outerwear segment. Brands increasingly deploy advanced materials such as recycled polyester blends and next-generation biodegradable wools, which not only appeal to eco-conscious consumers but also align with stringent environmental standards across multiple jurisdictions. Concurrently, digital sampling and virtual prototyping have streamlined product development cycles, enabling rapid iteration of bomber jackets, trench coats, and parkas that better reflect nuanced regional tastes and functional requirements.

In parallel, omnichannel retail architectures are breaking down silos between brick-and-mortar showrooms and e-commerce platforms. Flagship brand stores now serve as experiential hubs where augmented-reality mirrors allow shoppers to visualize leather jackets in different colorways, while mobile apps deliver hyper-personalized recommendations based on prior purchase history. These technological integrations bolster customer loyalty and drive upconversion rates, especially when paired with innovative loyalty programs that reward sustainable purchasing behaviors.

Moreover, resilient supply chain strategies have emerged as a strategic imperative. After years of near-sole reliance on a handful of manufacturing markets, several industry leaders are diversifying into Southeast Asia and Latin America to mitigate tariff exposure and logistical bottlenecks. The redistribution of procurement is complemented by tighter inventory management techniques, where AI-driven forecasting tools assess seasonality trends across spring / fall, summer, and winter collections to optimize stock allocations and reduce markdown risk. Taken together, these transformative shifts are redefining what it means to succeed in the men’s coats and jackets industry, demanding agility, innovation, and a forward‐looking mindset.

Decoding the Cumulative Impact of 2025 United States Tariffs on Material Sourcing, Pricing Strategies, and Competitive Dynamics in the Men’s Coats and Jackets Market

The reinstatement and adjustment of tariffs on textile and apparel imports under Section 301 have continued to reverberate through the men’s coats and jackets market in 2025, altering the cost structures that underpin material sourcing and pricing strategies. Although duties imposed on key cotton, wool, and synthetic blends have fluctuated with successive administrative reviews, the net effect remains a persistent elevation in landed costs for outerwear finished goods. Brands that once relied heavily on single origins are compelled to reassess their supplier portfolios, often blending higher‐cost domestic production with lower‐duty imports from third-country locations to maintain margin stability.

These additional levies have had palpable implications for consumer pricing, nudging retail tags upward in both premium department stores and fast-fashion outlets. While many high-end labels have absorbed a share of duty inflation to preserve brand equity, mid-tier brands find themselves at an inflection point where price‐value perceptions risk erosion. To confront this challenge, forward-looking companies have accelerated investments in cost‐saving production technologies, including automated cutting machines and lean manufacturing processes that reduce material waste.

Competitive dynamics have also shifted as regional players leverage preferential trade agreements to secure more favorable duty treatments. For example, manufacturers in Mexico and Vietnam have scaled production of quilted down jackets and leather parkas, capitalizing on lower tariffs under trade pacts to offer more compelling price points in North America. This realignment has intensified pressure on traditional apparel hubs and underscored the importance of agile tariff mitigation strategies for brands seeking to sustain growth in 2025 and beyond.

Unraveling Key Segmentation Insights That Illuminate Seasonal Demand, Price Sensitivity, Consumer Demographics, Distribution Channels, Materials, and Product Types

A nuanced understanding of market segmentation illuminates how distinct consumer cohorts interact with men’s coats and jackets offerings. Seasonality exerts a foundational influence, with winter and transitional spring / fall collections commanding the lion’s share of unit demand while summer pieces attract adventure-seeking buyers in cooler climates. Within each seasonal portfolio, the interplay between mass, mid, and premium price tiers reveals divergent purchase rationales: value-oriented shoppers gravitate toward accessible mass market designs that emphasize durability, while premium consumers seek artisanal craftsmanship paired with the latest performance fabrics.

Demographics further enrich this picture, as adult and young adult segments show an affinity for functional streetwear silhouettes such as bomber and puffer jackets, while seniors often prioritize classic overcoats and blend wool trench coats that marry tradition and comfort. Teen consumers, conversely, are drawn to trend-driven moto jackets and sherpa denim styles that enable bold self‐expression on social channels. Each age group’s distinct lifestyle priorities translates into SKU differentiation and targeted marketing approaches.

Distribution channels amplify these segmentation effects by offering tailored purchase experiences. Specialty stores featuring multi-brand boutiques curate limited-edition collections for discerning clientele, whereas department store chain outlets drive volume through seasonal promotions and loyalty events. Conversely, online retail channels subdivide into brand websites that deliver full catalog access, e-commerce marketplaces offering comparative shopping, and mobile apps with frictionless checkout. This granular channel diversification compels brands to optimize channel mix strategies that align assortment depth with consumer expectations.

Equally critical is an understanding of material preferences, where cotton canvas and denim maintain their status in casual jacket categories, while down insulation-sourced from duck or goose fill-dominates puffer segments. Leather remains a staple in biker and cafe racer jackets, yet mixed blends and synthetic alternatives have surged in popularity due to increasing animal welfare and sustainability considerations. The selection of shell and fill materials directly informs product engineering, pricing decisions, and go-to-market timing.

Finally, product typology underscores consumer priorities and design innovations. Classic bomber jackets coexist alongside zippered variants that emphasize utility, while double-breasted trench coats and single-breasted overcoats offer sartorial versatility for urban professionals. Parkas bifurcate into fur-trimmed and lightweight designs to address diverse climate conditions. This product taxonomy shapes the SKU architecture and underpins market competitiveness through continuous evolution of silhouettes and technical features.

This comprehensive research report categorizes the Men's Coats & Jackets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Season

- Price Tier

- Demographic

- Distribution Channel

- Material

- Product Type

Key Regional Insights Revealing Distinct Growth Drivers, Consumer Preferences, and Market Dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics are playing an increasingly decisive role in shaping the men’s coats and jackets landscape. In the Americas, North American markets continue to benefit from robust e-commerce penetration, with digital channels capturing a growing portion of transactional volume. Canadian consumers prioritize high-performance down parkas to endure subzero winters, while U.S. buyers demonstrate appetite for versatile trench coats and lightweight leather jackets suited for transitional seasons. Latin America, in turn, exhibits strong demand for mid-tier synthetic insulated jackets, reflecting both climate considerations and evolving aspirational trends.

Across Europe, Middle East & Africa, consumer preferences display marked heterogeneity. Western European markets, led by the United Kingdom, France, and Germany, emphasize sustainability credentials and artisanal craftsmanship. In these regions, premium wool blend overcoats and eco-certified wool trench coats have gained prominence. Meanwhile, Middle Eastern preference for luxury and bespoke tailoring fuels demand for leather moto jackets and double-breasted trench cuts, often sourced from neighboring European ateliers. African markets, particularly in South Africa, are witnessing nascent interest in technical parkas and rain-ready trench coats driven by growing urbanization and climatic volatility.

In the Asia Pacific region, rapid digital adoption and rising disposable incomes underpin strong growth trajectories. East Asian consumers in Japan and South Korea favor minimalist design aesthetics, manifesting in sleek single-breasted coats and lightweight parkas with functional layering. Greater China’s market exhibits dynamic layering trends, where young adults integrate bomber jackets over hoodies for a distinct streetwear edge. Southeast Asian consumers display appetite for breathable synthetic garments tuned to humid conditions, prompting brands to innovate with moisture-wicking fabrics and mesh-lined parkas. Meanwhile, India is emerging as both a manufacturing hub and a burgeoning consumer base, with affordable mass-market denim jackets and mid-tier leather jackets capturing widespread appeal.

Taken together, these regional insights underscore the imperative for tailored market entry strategies. Brands that can calibrate their assortments, marketing narratives, and distribution approaches to local climatic conditions, cultural preferences, and digital maturity will be best positioned to capture cross-border growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Men's Coats & Jackets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Company Strategies, Innovations, Collaborations, and Competitive Positioning That Shape the Men’s Coats and Jackets Sector

Leading companies in the men’s coats and jackets sector are leveraging a mix of heritage brand equity, technological prowess, and strategic partnerships to fortify their market positions. A number of premium players differentiate through vertically integrated supply chains that uphold rigorous quality standards and sustainability commitments, ensuring consistent delivery of high-end down and wool outerwear. At the same time, global fast-fashion conglomerates harness rapid response manufacturing to introduce trend-inspired bomber and denim jackets at aggressive price points, securing market share among price-conscious consumers.

Collaboration between sportswear giants and luxury houses has become commonplace, enabling limited-edition leather jackets and technical parkas that marry performance credentials with aspirational branding. Such alliances not only boost brand visibility but also catalyze innovation by merging functional textile technologies with premium finishes. Parallel to these co-branding efforts, digitally native labels are adopting direct-to-consumer models and deploying advanced analytics to optimize assortment planning, personalized promotions, and inventory replenishment.

Investment in flagship retail environments continues to be a focal point for brands seeking to deepen emotional engagement. Cutting-edge store formats feature integrated interactive displays, RFID-enabled garments, and seamless mobile payment options, transforming outlets into brand immersion spaces. On the manufacturing front, key players have accelerated pilots of Industry 4.0 technologies, leveraging robotics and augmented reality to enhance throughput and reduce time to market for new outerwear lines.

Finally, companies are increasingly branching into circular business models, offering take-back programs and upcycling initiatives that extend the useful life of leather, wool, and down jackets. This circularity not only resonates with environmentally conscious buyers but also strengthens corporate sustainability narratives. Collectively, these strategic imperatives underscore the competitive priorities that will define success for leading brands in the men’s coats and jackets market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Men's Coats & Jackets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Arc’teryx Equipment Inc.

- Burberry Group plc

- Calvin Klein, Inc.

- Canada Goose Holdings Inc.

- Columbia Sportswear Company

- H&M Hennes & Mauritz AB

- J. Barbour & Sons Ltd.

- J. Crew Group, Inc.

- Levi Strauss & Co.

- Lululemon Athletica Inc.

- Moncler S.p.A.

- Nike, Inc.

- Patagonia, Inc.

- Puma SE

- Ralph Lauren Corporation

- Tommy Hilfiger Licensing LLC

- Under Armour, Inc.

- VF Corporation

- Zara

Strategic Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends, Enhance Resilience, and Drive Sustainable Growth in the Men’s Coats and Jackets Market

Industry leaders should prioritize the integration of sustainability at every stage of design and production, embedding recycled and renewable fibers without sacrificing performance or style. By forging partnerships with certified suppliers and investing in traceability platforms, brands can substantiate eco-claims and foster deeper consumer trust. In parallel, accelerating digital transformation across the value chain will enable more accurate demand forecasting and improved inventory turnover, reducing markdown exposure and enhancing profitability.

Furthermore, firms must refine their channel strategies by crafting differentiated experiences across flagship stores, online marketplaces, and mobile-first platforms. Deploying immersive in-store technologies alongside frictionless e-commerce journeys will create a cohesive brand narrative that resonates from discovery to purchase. To counteract tariff pressures, executives should explore nearshoring opportunities and tariff engineering techniques that optimize product classification codes while maintaining compliance.

A relentless focus on product innovation is also essential. Investing in R&D to develop high-performance coatings, sustainable leather alternatives, and adaptable modular designs will cater to a broader spectrum of end-use scenarios and reinforce brand leadership. Concurrently, embedding circular economy principles-through garment recycling, repair services, and resale marketplaces-will unlock new revenue streams and enhance customer lifetime value.

Ultimately, cross-functional collaboration between product development, supply chain, and marketing teams will be critical for executing these recommendations. By fostering a culture of continuous improvement and data-driven decision-making, industry leaders can navigate external headwinds and capitalize on the emergent opportunities within the men’s coats and jackets realm.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Advanced Triangulation Techniques for Market Insights

This research combines primary interviews with senior executives, product designers, and supply chain specialists to capture first-hand perspectives on market dynamics and innovation pipelines. Supplementing these insights, secondary research draws on publicly available trade data, regulatory filings, and peer-reviewed publications to contextualize tariff developments and consumer trends. The study employs rigorous data triangulation techniques, cross-verifying quantitative shipment volumes against qualitative feedback from retail buyers and end customers.

Market validation workshops were conducted across key regions to ensure the robustness of segmentation frameworks, with industry participants evaluating the practical relevance of seasonality, pricing tiers, demographic cohorts, distribution channels, and material categories. In addition, technology scouts and sustainability experts were engaged to assess breakthrough textile innovations and circular business models, enriching the analysis of emerging growth drivers.

Data synthesis was facilitated by advanced analytics platforms, enabling thematic clustering of consumer sentiment and detection of leading patterns in design preferences. The methodology adheres to high standards of transparency and replicability, ensuring that findings are grounded in verifiable evidence and reflect the most current industry realities. This comprehensive approach guarantees that stakeholders receive a holistic view of both macro trends and granular market nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Men's Coats & Jackets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Men's Coats & Jackets Market, by Season

- Men's Coats & Jackets Market, by Price Tier

- Men's Coats & Jackets Market, by Demographic

- Men's Coats & Jackets Market, by Distribution Channel

- Men's Coats & Jackets Market, by Material

- Men's Coats & Jackets Market, by Product Type

- Men's Coats & Jackets Market, by Region

- Men's Coats & Jackets Market, by Group

- Men's Coats & Jackets Market, by Country

- United States Men's Coats & Jackets Market

- China Men's Coats & Jackets Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Concluding Perspectives on Future Trajectory, Critical Imperatives, and Strategic Outlook for Stakeholders in the Men’s Coats and Jackets Market

The men’s coats and jackets market is poised for continued evolution as consumer expectations, regulatory frameworks, and technological possibilities converge. Brands that have embraced sustainability, digital innovation, and tariff-adaptive supply chain strategies have laid the groundwork for resilience, but the competitive environment will intensify as emerging players leverage nimble business models. Navigating this future landscape will require a balanced approach that integrates design creativity, operational excellence, and strategic foresight.

Looking ahead, the intersection of circular economy initiatives, localized manufacturing, and AI-driven personalization will define the next generation of market leaders. Organizations that can harmonize these elements while maintaining brand distinctiveness will capture value across price tiers and regions. Moreover, the ability to anticipate regulatory shifts, particularly in trade policy, will remain critical for preserving cost competitiveness and safeguarding margin profiles.

In summary, success in the men’s coats and jackets sector hinges on an unwavering commitment to innovation and collaboration. By aligning product portfolios with shifting consumer lifestyles and environmental imperatives, stakeholders can secure a sustainable growth trajectory. This conclusion underscores the strategic imperatives that will underpin the market’s future direction and offers a roadmap for those seeking to thrive in an increasingly dynamic fashion ecosystem.

Connect Directly with Ketan Rohom, Associate Director of Sales and Marketing, to Secure Comprehensive Market Research Insights and Elevate Your Strategic Decisions

To unlock the full depth of insights into evolving consumer behaviors, tariff impacts, and competitive strategies shaping the men’s coats and jackets market, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. Engaging with Ketan will provide you with tailored guidance on how to leverage this comprehensive research to optimize product roadmaps, enhance supply chain resilience, and craft compelling marketing narratives that resonate with today’s discerning buyers. By securing the complete market research report, you will access exclusive data on segmentation performance, regional dynamics, and cutting-edge innovations that empower your organization to stay at the forefront of an increasingly competitive landscape. Contact Ketan Rohom today to discuss your strategic priorities and receive a customized proposal that ensures you make informed decisions with confidence and precision

- How big is the Men's Coats & Jackets Market?

- What is the Men's Coats & Jackets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?