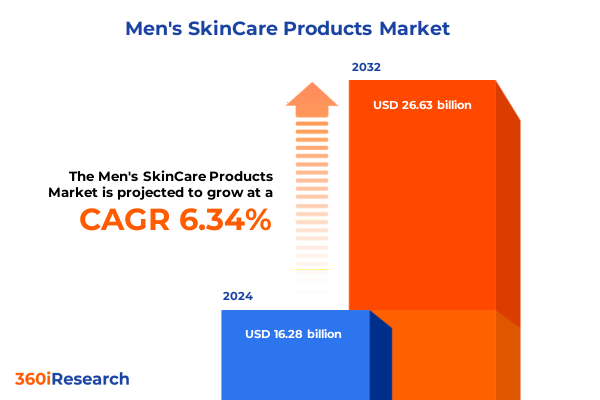

The Men's SkinCare Products Market size was estimated at USD 17.25 billion in 2025 and expected to reach USD 18.30 billion in 2026, at a CAGR of 6.39% to reach USD 26.63 billion by 2032.

A concise orientation to the contemporary men’s skincare sector explaining behavioral shifts, product evolution, channel dynamics, and competitive signals reshaping strategy

The men’s skincare landscape has evolved from a niche segment into a mainstream axis of consumer goods, driven by shifting cultural norms, digital-native behaviors, and expanded product functionality. Over recent years men’s daily routines have broadened beyond single-step solutions into multi-product regimens that address cleansing, hydration, targeted actives, sun protection, and shaving-related concerns. This evolution reflects a deeper socio-cultural acceptance of self-care and appearance management among diverse male cohorts, and it has prompted both heritage personal-care manufacturers and digitally native challengers to accelerate product development and communications tailored specifically to male skin physiology and lifestyle demands.

Consequently, brands are translating this behavioral change into product layer strategies: basics like cleansers and shaving products are being reformulated to reduce irritation and to pair with complementary moisturizers and serums, while sunscreens and masks are being reimagined for utility and daily wearability. As channels fragment, consumers are discovering new brands via social and e-commerce platforms, increasing the importance of omnichannel visibility and rapid content-driven acquisition. In short, the introduction frames a market defined by greater consumer sophistication, faster product velocity, and intensifying competition across price tiers and distribution pathways.

How cultural normalization, celebrity-backed brands, and digital personalization are remaking product credibility and consumer loyalty in men’s skincare

The landscape is being transformed by a confluence of cultural normalization, celebrity and athlete brand entry, and technological enablement, each amplifying the others in ways that reorder brand equity and product development priorities. Cultural normalization has reduced stigma around male grooming, encouraging broader usage of serums, moisturizers and even category-adjacent products such as face masks and targeted actives. This increased acceptance has opened receptive audiences for influencers and high-profile founders who translate athletic performance, personal lifestyle, or professional grooming cred into credible product assortments.

Notably, athlete-led and celebrity-backed labels have become important vectors of mainstreamization, bringing performance narratives and aspirational authenticity into product claims and storytelling. These entrants often design for performance and environmental considerations simultaneously, leaning on clean formulations and athlete-tested messaging to differentiate from legacy grooming brands. Simultaneously, advancements in personalization, AI-enabled product recommendation engines, and direct-to-consumer models are allowing brands to test formulations and tailor communication at pace. Taken together, these shifts are producing a marketplace where product credibility, narrative authenticity, and data-driven personalization define winners and influence long-term consumer loyalty.

Assessing cumulative trade, enforcement, and regulatory pressures on sunscreen formats, ingredient imports, and compliance risk for product development and supply chains

A crucial regulatory and trade dimension has emerged around sunscreen formats, active ingredient review, and import-sensitive inputs, producing new operational risks and commercial decisions for brands that rely on cross-border supply chains. Regulatory clarity on sunscreen dosage forms and active ingredients continues to evolve, with guidance that refines which formulations are recognized as compliant and what testing and labeling obligations manufacturers must satisfy. This regulatory scrutiny has tangible implications for product development timelines, labeling strategies, and consumer-facing claims, particularly for sunscreens and hybrid formulations marketed for daily wear rather than episodic use.

In addition to agency-driven refinement of sunscreen rules, enforcement actions and warning letters have focused attention on non-traditional dosage forms that deviate from established categories. Recent enforcement activity regarding mousse and foam sunscreen presentations triggered industry-wide reassessment of packaging, claims language, and the risk of misbranding in formats that could be deemed outside accepted dosage forms. These developments underscore the need for legal and regulatory teams to be integrated into early-stage formulation and packaging decisions to prevent costly recall or reformulation cycles. Further, import tariffs and scrutiny of certain raw materials may increase landed costs for ingredient- and packaging-intensive SKUs; sourcing decisions, supplier diversification, and nearshoring options therefore demand strategic evaluation to preserve margin, speed to shelf, and compliance continuity.

Strategic segmentation insights linking product type, ingredient choices, composition, formulation formats, and channel design to portfolio and go-to-market decisions

Segmentation insights reveal how product, ingredient, composition, formulation and channel decisions intersect to create differentiated value propositions across consumer cohorts and retailer contexts. When products are framed by type-ranging from cleansers, masks and moisturizers to serums, shaving products, and sunscreens-brands must balance foundational efficacy with sensory properties and application occasion to win trial and retention among men who prioritize speed and visible outcomes. For ingredient type, the tension between chemical actives and naturally derived materials plays out in positioning: chemical actives often provide rapid, measurable benefit statements, while natural ingredients support sustainability and transparency narratives that resonate with younger, value-driven consumers.

Composition choices between oil-based and water-based formulations determine both sensory perception and compatibility with other routine steps; lighter, water-based vehicles are preferred for daytime layering and sun protection, while richer oil-based formulas often target repair and barrier restoration. Formulation formats-cream, foam, gel, and lotion-drive user experience and suitability for application contexts, with foams and gels frequently favored for quick absorption and low residue, while creams and lotions deliver prolonged moisturization. Distribution decisions further condition commercial strategy: offline retail environments like convenience stores, pharmacies and supermarkets demand SKU rationalization, strong point-of-shelf messaging and predictable replenishment, whereas online platforms-brand sites and third-party e-commerce marketplaces-reward deeper SKU ranges, personalized bundles, and content-rich product pages that facilitate conversion. Taken together, each segmentation dimension informs portfolio architecture, R&D prioritization, and go-to-market design in ways that must be orchestrated rather than treated independently.

This comprehensive research report categorizes the Men's SkinCare Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Composition

- Formulation

- Distribution Channel

How regional regulatory standards, consumer priorities, and channel dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific demand differentiated commercial playbooks

Regional behavior and regulatory environments create differentiated imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific, each requiring bespoke commercial and compliance playbooks. In the Americas, consumers demonstrate high receptivity to simplicity-meets-performance propositions and value clear claims on sensitivity, sun protection, and shaving comfort; retail ecosystems favor both mass and specialty pharmacy placements alongside robust e-commerce penetration, making omnichannel execution critical.

In Europe, Middle East & Africa, regulatory standards and consumer preferences emphasize safety, provenance, and sustainability credentials, with many markets showing stronger demand for natural and ethically sourced ingredients and a premium on transparent supply chains. Brands entering EMEA must therefore align ingredient declarations and environmental messaging with local expectations and regulatory frameworks. Across Asia-Pacific, rapid digital adoption, high usage of targeted actives, and strong interest in lightweight, layering-friendly formulations characterize consumer behavior; this region also presents nuanced submarket differences in texture and scent preferences that require localized formulation nuance and region-specific marketing choreography. Understanding these regional vectors and harmonizing global product platforms with local compliance and cultural fit is essential for scaling with discipline and speed.

This comprehensive research report examines key regions that drive the evolution of the Men's SkinCare Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape analysis showing how legacy manufacturers, digital-first challengers, and niche performance brands create distinct advantages in formulation, channel, and storytelling

Competitive intelligence indicates a marketplace comprised of legacy personal-care companies, digitally native specialists, niche performance brands, and founder- or celebrity-backed entrants, each bringing different advantages to product, distribution, and narrative. Incumbent manufacturers leverage scale, distribution relationships, and formulation expertise to defend core grocery and pharmacy placements, while digital-first brands excel at rapid iteration, direct consumer feedback loops, and higher-margin channel mix enabled by direct-to-consumer commerce. Niche performance brands and celebrity founders often capture attention through storytelling that ties product function to lifestyle or athletic performance, using credibility to accelerate trial among targeted demographics.

Successful companies have distinct capabilities in ingredient sourcing, laboratory partnerships, and regulatory navigation that enable faster concept-to-shelf cycles and mitigate compliance risk. Moreover, firms that invest in robust content ecosystems-combining education, application guidance, and social proof-tend to extract higher lifetime value from early adopters. Across competitive sets, partnerships with dermatologists, barbershop networks, and sports professionals further increase product legitimacy and visibility in high-intent contexts. Ultimately, the competitive landscape rewards organizations that can blend formulation excellence with authentic storytelling and channel-specific executional strength.

This comprehensive research report delivers an in-depth overview of the principal market players in the Men's SkinCare Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Beiersdorf AG

- Berner Ltd.

- Brickell Brands LLC

- CLARINS SAS

- Colgate-Palmolive Company

- Coty Inc.

- Edgewell Personal Care

- Emami Ltd.

- Galderma SA

- Himalaya Wellness Co.

- Kao Corporation

- Kose Corp.

- L'Oréal S.A.

- Marico Limited

- Papatui LLC

- Rituals Cosmetics Enterprise B.V.

- Shiseido Co.,Ltd.

- SISLEY

- Tatcha LLC

- The Estée Lauder Companies, Inc.

- The Procter & Gamble Company

- Unilever PLC

High-impact recommendations that unite regulatory foresight, portfolio architecture, ingredient transparency, channel differentiation, and supply chain resilience

Actionable recommendations for industry leaders focus on aligning product development, regulatory preparedness, channel strategy, and consumer communication to capture durable advantage. First, integrate regulatory review and trade-impact assessment into the earliest stages of formulation and packaging design, especially for sunscreens and novel dosage forms, to avoid costly reformulations and to speed compliant commercialization. Second, prioritize portfolio rationalization by tying product type and formulation format decisions to clear consumer use-cases and channel expectations: build lightweight, water-based daytime offerings for daily layering and oil-based treatments for targeted repair and barrier support.

Third, invest in ingredient transparency and provenance storytelling to capture value among consumers who equate natural sourcing with trust, while maintaining a clear science-backed narrative for chemical actives that deliver measurable performance. Fourth, create channel-specific assortments and content playbooks that recognize the distinct purchase journeys in convenience and pharmacy settings versus brand sites and e-commerce marketplaces. Finally, pursue supply chain resilience through supplier diversification, selective nearshoring of critical inputs, and contingency planning for tariff or enforcement shocks to preserve speed to shelf and margin integrity. These steps provide a practical blueprint for balancing short-term agility with medium-term resilience.

Methodology overview describing primary interviews, stakeholder consultations, secondary-source validation, and subject-matter quality assurance processes that underpin the analysis

The research methodology combines qualitative expert interviews, primary stakeholder consultations, and secondary-source triangulation to ensure comprehensive coverage of consumer behavior, product innovation, regulatory developments, and channel dynamics. Primary inputs include structured interviews with formulators, regulatory counsel, retail buyers, and consumer-facing marketing leaders, which provide real-world context on formulation constraints, compliance exposure, and retail assortment logic. These interviews were complemented by structured observation of online storefronts, packaging disclosures, and social listening to map consumer sentiment and to identify emerging product narratives.

Secondary research drew on regulatory agency publications, reputable industry commentary, and trade reporting to validate enforcement actions, labeling guidance, and channel shifts. A cross-functional quality assurance process ensured that interpretation of legal and regulatory materials was reviewed by subject-matter experts to avoid misstatement and to maintain actionable clarity. Throughout the research, iterative validation with industry practitioners refined conclusions and ensured that recommendations remained practical, targeted, and aligned to the operational realities of modern personal-care businesses.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Men's SkinCare Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Men's SkinCare Products Market, by Product Type

- Men's SkinCare Products Market, by Ingredient Type

- Men's SkinCare Products Market, by Composition

- Men's SkinCare Products Market, by Formulation

- Men's SkinCare Products Market, by Distribution Channel

- Men's SkinCare Products Market, by Region

- Men's SkinCare Products Market, by Group

- Men's SkinCare Products Market, by Country

- United States Men's SkinCare Products Market

- China Men's SkinCare Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

A forward-looking synthesis underscoring the necessity of integrated formulation, compliance, and channel strategies to capture sustainable advantage in men’s skincare

In conclusion, the men’s skincare sector is at an inflection point where cultural acceptance, product innovation, regulatory complexity, and channel evolution intersect to create both opportunity and operational risk. Brands that succeed will not only deliver efficacious, sensorially appropriate products across cleansers, moisturizers, serums, shaving aids and sunscreens, but will also embed regulatory foresight, transparent ingredient narratives, and channel-specific execution into their core commercial playbooks. Near-term pressures-such as evolving sunscreen guidance and enforcement attention to unconventional dosage forms-heighten the value of cross-functional alignment between R&D, legal, and commercial teams, while longer-term shifts in consumer expectations emphasize sustainability, personalization, and authenticity.

By adopting disciplined portfolio design, investing in supply chain resilience, and tailoring stories to both everyday use and performance occasions, market participants can pragmatically capture share of attention and long-term loyalty. The key message is straightforward: treat formulation, regulatory compliance, and channel strategy as integrated levers rather than separate tasks, and the organization will be better positioned to convert current trends into sustainable growth and differentiated brand equity.

Contact Ketan Rohom, Associate Director of Sales and Marketing, to secure a tailored briefing and purchase access to the complete men’s skincare market research report

For an immediate, tailored discussion about how these insights translate to your commercial priorities and to secure a full copy of the in-depth market research report, please connect directly with Ketan Rohom (Associate Director, Sales & Marketing). Ketan can arrange a briefing to walk through the research scope, methodology, and how the findings apply to product strategy, regulatory readiness, and channel optimization. Reach out to schedule a consultative walkthrough that includes a sample of the report's executive dashboards and a bespoke recommendation brief aligned to your portfolio objectives.

- How big is the Men's SkinCare Products Market?

- What is the Men's SkinCare Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?